Micron: Fiscal 2Q18 Financial Results

Record revenue and profitability, sales of trade NAND down 3% Q/Q and up 28% Y/Y

This is a Press Release edited by StorageNewsletter.com on March 26, 2018 at 2:35 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 4,648 | 7,351 | 8,618 | 14,154 |

| Growth | 58% | 64% | ||

| Net income (loss) | 894 | 3,309 | 1,074 | 5,987 |

Micron Technology, Inc. announced results of operations for its second quarter of fiscal 2018, which ended March 1, 2018.

Fiscal Q2 2018 Highlights

• Revenues of $7.35 billion, up 58% compared with the same period last year

• GAAP net income of $3.31 billion, or $2.67 per diluted share

• Non-GAAP net income of $3.50 billion, or $2.82 per diluted share

• Operating cash flow of $4.35 billion, compared with $1.77 billion for the same period last year (adjusted for the Inotera acquisition)

“Micron executed exceptionally well in the second quarter, delivering record results and strong free cash flow driven by broad-based demand for our memory and storage solutions. Our performance was accentuated by an ongoing shift to high-value solutions as we grew sales to our cloud, mobile and automotive customers and set new records for SSDs and graphics memory,” said president and CEO Sanjay Mehrotra. “Secular technology trends are driving robust demand for memory and storage, and Micron is well-positioned to address these growing opportunities.”

Revenues for the second quarter of 2018 were 8% higher compared to the first quarter of 2018, reflecting increased demand broadly across our products and end markets. Our overall consolidated gross margin of 58.1% for the second quarter of 2018 was higher compared to 55.1% for the first quarter of 2018 primarily due to execution across our product portfolio.

Investments in capital expenditures, net of amounts funded by partners, were $2.11 billion, which resulted in adjusted free cash flows of $2.2 billion for the second quarter of 2018. The company ended the second quarter with cash, marketable investments, and restricted cash of $8.68 billion.

Comments

Micron continues to grow globally but at a lower pace. For this most recent quarter, revenue grew 58% Y/Y compared to 71% for the former quarter. But next one it is expected to be sequentially only -2% to+3%

It's really bad for the storage business unit declining 9% quarterly.

Execution in 2FQ18

. Delivered record revenue, gross profit, EPS and cash generation

. Robust mobile growth driven by managed NAND and low-power DDR4

. Total SSD sales up 80% Y/Y

. Qualified 1X nm DRAM at three of largest hyperscale customers

. Achieved record automotive design wins in 1HFY18

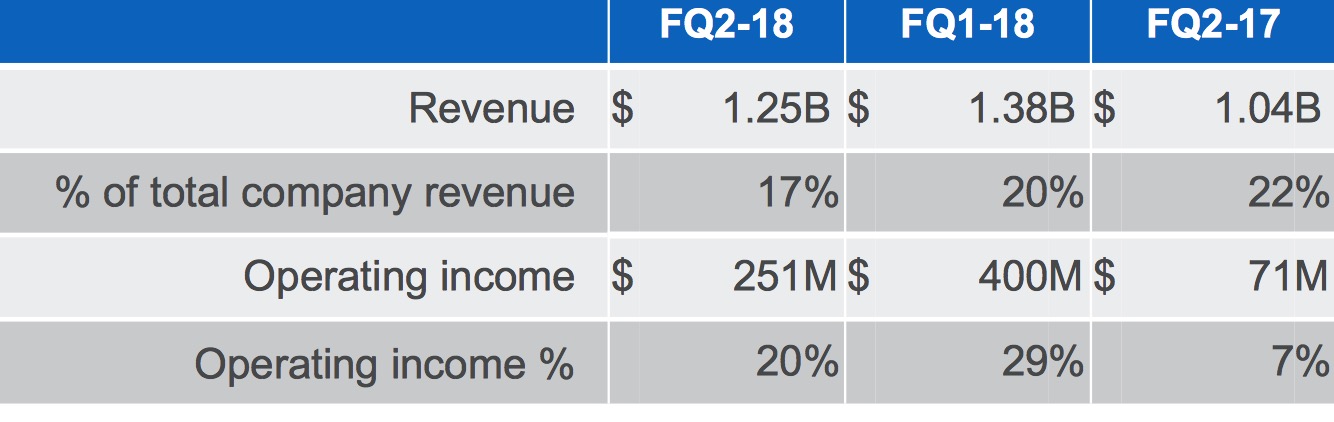

Storage Business Unit

For this business unit, revenue was $1.3 billion, up 20% Y/Y, supported by record revenue in SSDs. On a sequential basis, sales declined by 9% with the strong growth in SSDs offset by a reduction in components revenue. The sequential revenue comparison was impacted by mix shift within NAND component sales. The growth is most pronounced in the enterprise and cloud SSD portion of the market. Sales for these end markets were up 30% Q/Q and 230% Y/Y.

NAND

. Industry bit output growth to be somewhat higher than 45% in CY2018

. More balanced industry dynamic in CY18

. CY18 industry bit output growth higher than 45%

. CY18 Micron bit output growth above industry

. On track to achieve 64L 3D NAND bit crossover in 2HFY18

. Expect to deliver samples of 3rd gen 3D NAND by end of FY18

. With the support of the Singapore Economic Development Board, finalized plans to build additional shell space in Singapore, adjacent to company's existing NAND Center of Excellence to transition existing wafer capacity to future 3D NAND nodes; first phase of this cleanroom expected to be completed by the summer of 2019, with initial wafer output from the facility expected in 4CQ19.

Trade NAND

. 25% of overall company revenue in 2FQ18

. Revenue down 3% Q/Q and up 28% Y/Y

. Shipment quantities up low double-digit percent range Q/Q

. ASPs down mid-teens percent Q/Q; sequential ASP decline in NAND increased in part due to a meaningful last-time purchase of higher-priced MLC NAND in the 1FQ18 quarter.

. Non-GAAP gross margin of 47% in 2FQ18 vs 49% in 1FQ18, 31% in 2FQ17

3Q18 guidance for revenue is expected to be between $7.20 billion to $7.60 billion.

To read the earnings call transcript

Read also:

Micron: Fiscal 1Q18 Financial Results

SSD revenue to cloud/enterprise customer up 50% Q/Q

2017.12.20 | Press Release | [with our comments]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter