Growth Persists in 4Q17 EMEA External Storage Market, Fueled by Flash – IDC

Value increased by 12% Y/Y at $2.1 billion

This is a Press Release edited by StorageNewsletter.com on March 13, 2018 at 2:35 pmTotal EMEA external storage systems value increased by 11.7% in dollars in the 4Q17 (+2.4% in euros), according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker, 4Q17.

The all-flash-array (AFA) market value recorded high-double-digit growth in dollars (35.8%), accounting for almost 31% of overall external storage sales in the region, albeit with a marginally slower growth rate as it becomes increasingly sizeable. Hybrid arrays also grew (19.5%), but their share of total external sales remained stable compared with the previous quarter. HDD-only systems continued to contract (-18.9%).

“IT departments in key EMEA countries have resumed investments while progressing into their digital transformation plans, or modernizing or refreshing their datacenter in an effort to get ready for key workloads such as big data. As IT buyers are increasingly opting for new technologies such as AFA and HCI [hyperconverged infrastructure], competition in those areas is getting more intense, with some vendors quick to exploit the temporary weakness of legacy competitors busy carrying out their own transformation to remain relevant in a rapidly changing market,” said Silvia Cosso, research manager, European storage and datacenter research, IDC.

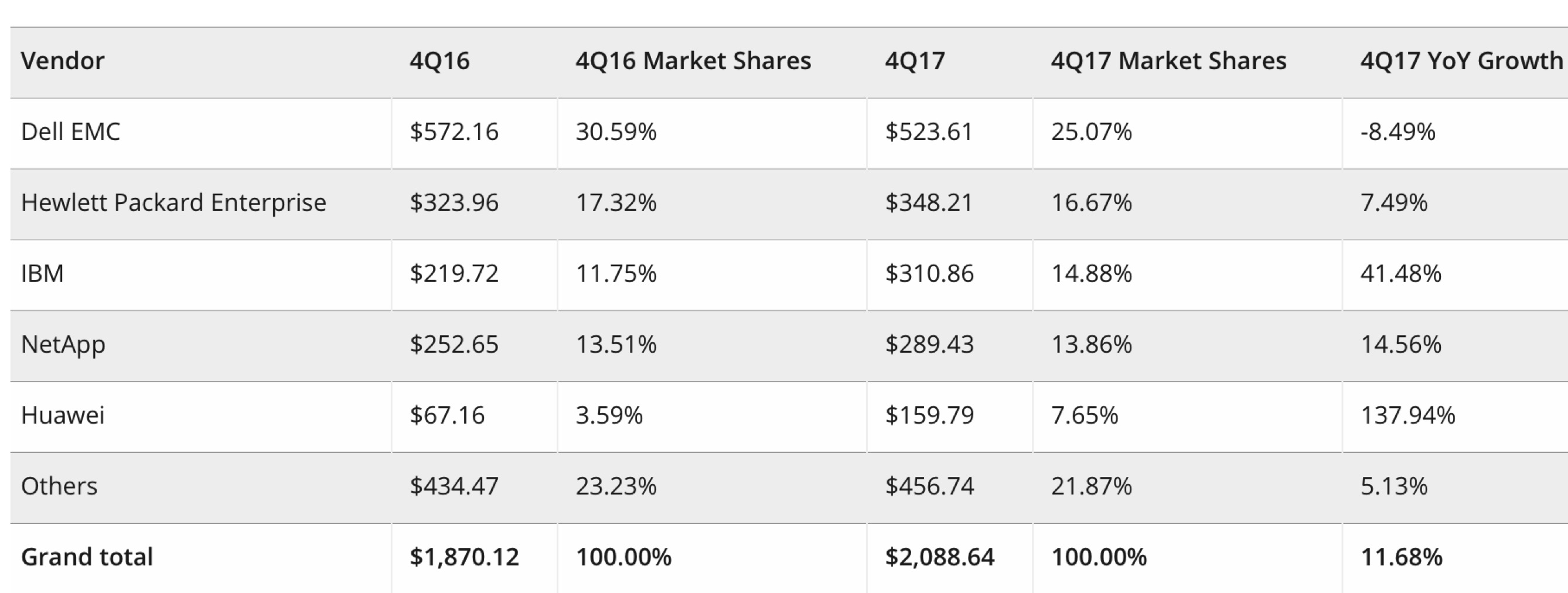

Top 5 Vendors, EMEA External Disk Storage Systems Value

(in $ million)

Click to enlarge

Western Europe

With total AFA shipments now firmly at a third of the market in terms of value (33.3%), the Western European external storage market recorded sound growth of 9.8% in dollar terms (+0.7% in euros). Capacity, meanwhile, grew 8.7% to 3,043PB.

The German market remained particularly strong, more than offsetting a still weak UK market which has been hit by an uncertain macroeconomic situation that has halted investments. But structural challenges remain in the subregion, as new infrastructure consumption models brought about by public cloud become mainstream and hardware commoditization accelerates in the region.

Central and Eastern Europe, the Middle East, and Africa

The external storage market in CEMA reached another milestone over the past five years, posting a Y/Y value increase of 17.0% ($566.2 million) and a capacity increase of 16.9% (1.1PB). The high-end segment, which was particularly strong across the wider EMEA area, flourished in CEMA too, increasing its share by nearly 5% with 50% Y/Y growth.

IT departments in the bigger CEMA countries and smaller Central and Eastern Europe (CEE) markets continued with DC infrastructure refreshments and optimization, while run-rate business also intensified. Supported by special vendor programs, the deals featuring flash storage upgrades for customers reaching a certain capacity threshold contributed to the double-digit growth in both CEE and the Middle East and Africa (MEA).

AFAs continued to thrive (50.4%) but hybrid flash arrays (HFAs) also accounted for a sizeable portion of storage investments (30% Y/Y growth), reclaiming 50% of the total market value.

“Undeniably, storage spending is transforming across all regions, increasingly opening up to new technologies and consumption models. But the external storage market in CEMA still has the potential to grow and attract the bulk of storage-dedicated budgets,” said Marina Kostova, research manager, storage systems, IDC CEMA.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter