Nutanix: Fiscal 2Q18 Financial Results

44% Y/Y revenue growth for quarter and loss continuing

This is a Press Release edited by StorageNewsletter.com on March 5, 2018 at 2:32 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 199.2 | 286.7 | 387.8 | 422.2 |

| Growth | 44% | 9% | ||

| Net income (loss) | (76.4) | (62.6) | (216.7) | (124.1) |

Nutanix, Inc. announced financial results for its second quarter of fiscal year 2018, ended January 31, 2018.

Second Quarter Fiscal Year 2018 Financial Highlights

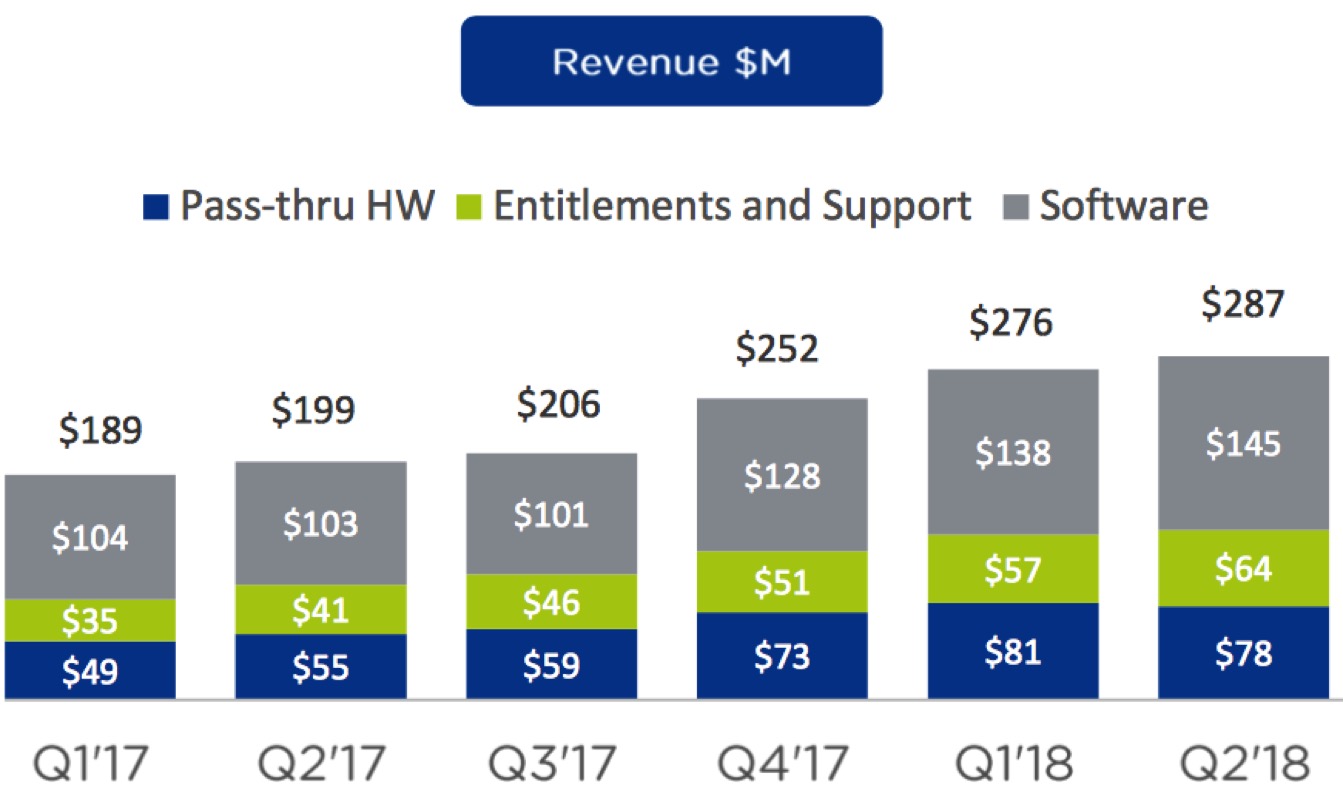

• Revenue: $286.7 million, growing 44% year-over-year from $199.2 million in the second quarter of fiscal 2017, reflecting the elimination of approximately $14 million in hardware revenue in the quarter as the company executes its shift toward increasing software revenue*

• Billings: $355.9 million, growing 57% year-over-year from $227.4 million in the second quarter of fiscal 2017

• Gross Profit: GAAP gross profit of $178.2 million, up 46% year-over-year from $122.4 million in the second quarter of fiscal 2017; non-GAAP gross profit of $182.2 million, up 45% year-over-year from $126.0 million in the second quarter of fiscal 2017

• Net Loss: GAAP net loss of $62.6 million, compared to a GAAP net loss of $76.4 million in the second quarter of fiscal 2017; non-GAAP net loss of $23.2 million, compared to a non-GAAP net loss of $23.0 million in the second quarter of fiscal 2017

• Net Loss Per Share: GAAP net loss per share of $0.39, compared to a GAAP net loss per share of $0.54 in the second quarter of fiscal 2017; non-GAAP net loss per share of $0.14, compared to a non-GAAP net loss per share of $0.16 in the second quarter of fiscal 2017

• Cash and Short-term Investments: $918.3 million, up 159% from the second quarter of fiscal 2017 primarily as a result of $509 million in net proceeds from its 0% 5-year convertible senior notes issued in the quarter

• Deferred Revenue: $478.0 million, up 57% from the second quarter of fiscal 2017

• Operating Cash Flow: $46.4 million, compared to $19.8 million in the second quarter of fiscal 2017

• Free Cash Flow: $32.4 million, compared to $7.1 million in the second quarter of fiscal 2017

“We had an outstanding quarter that demonstrated our strong execution across many business initiatives. Our shift toward a software-centric strategy is on track and we aligned our sales compensation in February to support this transition,” said Dheeraj Pandey, chairman, founder and CEO. “Our continued success with Global 2000 customers, the strength of our large deal execution and record number of new customers prove that we are reducing friction for our customers and providing them with a consumer-grade experience that is unmatched.”

“We are proud of our performance in Q2. During the quarter, we saw record results across all geographies, with particularly strong performances from our EMEA and APJ regions. Our 57% billings growth Y/Y and our 45% increase in non-GAAP gross profit Y/Y drove a better than expected bottom line,” said Duston Williams, CFO. “Our software and support billings also rose during the quarter, demonstrating our progress as we transition to a software-centric business model. Our strong execution on our strategic initiatives, together with our successful convertible debt offering, put us in a strong position for the future.”

Recent company Highlights

• Continued Customer Growth: Ended 2FQ18 with 8,870 end-customers, adding 1,057 new ones during the quarter. Second quarter customer wins included Arca Continental, DB Systel, JetBlue Airways, Multi Commodity Exchange of India Limited (MCX), Nexen (a CNOOC Limited company), and Schroders

• Accelerated Number of $1 Million+ Deals: 57 customers with deals over $1 million in the quarter, up 104% year-over-year

• Signed 5 Software and Support Deals Greater than $3 Million: Signed five software and support deals worth more than $3 million, of which three were worth more than $5 million during the quarter, all with Global 2000 customers

• Named a Leader in the Gartner Magic Quadrant for Hyperconverged Infrastructure: The company believes its placement in the Leaders quadrant is a validation of its leadership in the market it pioneered and of its vision to become the next-generation OS for the enterprise cloud

• Released Version 5.5: Featuring Calm automation and orchestration, the firm released its version 5.5, the largest and most comprehensive release in its history, with new features and enhancements to the its Enterprise Cloud OS software

• Issued $575 million Zero Coupon Convertible Senior Notes: The company fortified its balance sheet with the issuance of $575 million zero coupon convertible senior notes due in 2023, adding $509 million in net proceeds to its cash and short-term investments during the quarter

• Signed Definitive Agreement to Acquire Minjar: Announced in a separate release that the company had signed a definitive agreement to acquire Minjar and its Botmetric service, a cloud technology solutions company helping enterprises embrace the cloud effectively and optimize their multi-cloud environments for performance and cost

• Hired Key Roles: Addition of Aaron Bean, chief human resources officer; Rodney Foreman, VP, flobal channel sales; Ben Gibson, CMO; Ricardo Jenez, SVP, development; and Chris Kozup, SVP, global marketing

• Plans Inaugural Investor Day: The vendor will hold its first investor day for analysts and institutional investors on March 12 at the Nasdaq Marketsite

For 3FQ18, Nutanix expects:

• Revenues between $275 and $280 million; assuming the elimination of approximately $45 million in pass-through hardware revenue*;

• Non-GAAP gross margin between 67% and 68%;

• Non-GAAP operating expenses between $218 and $220 million;

• Non-GAAP net loss per share between $0.19 and $0.21, using 167 million weighted shares outstanding.

*The elimination of hardware revenue is based on the estimated cost of hardware in transactions where customers purchase such hardware directly fro contract manufacturers.

Comments

That's an excellent quarter even if losses are continuing, decreasing globally but slightly increasing quarterly.

Quarterly revenue grew only 4% Q/Q but 44% Y/Y.

And for next one, sales are expected to be down quarterly, between 2% to 4%. The guidance assumes a 35% growth rate from the year-ago period.

Wait for Nutanix to easily surpass milestone of $1 billion during current fiscal year like Pure Storage did it in its most recent FY18 ended January 31, 2018. These two companies are the most growing public storage companies in the world.

2FQ18 results for the hyperconverged vendor came in better than expected for virtually every significant metric with record performances in bookings, OEM bookings, billings, revenue, backlog, free cash flow, new customer adds, number of large deals, software-only bookings and Global 2000 bookings.

In this three-month period, revenue was up 44% Y/Y, even with the elimination of $14 million in pass-through hardware revenue. Software and support business is growing at significant pace. That business is now reached over $1 billion in annualized run rate for billings in its own rate.

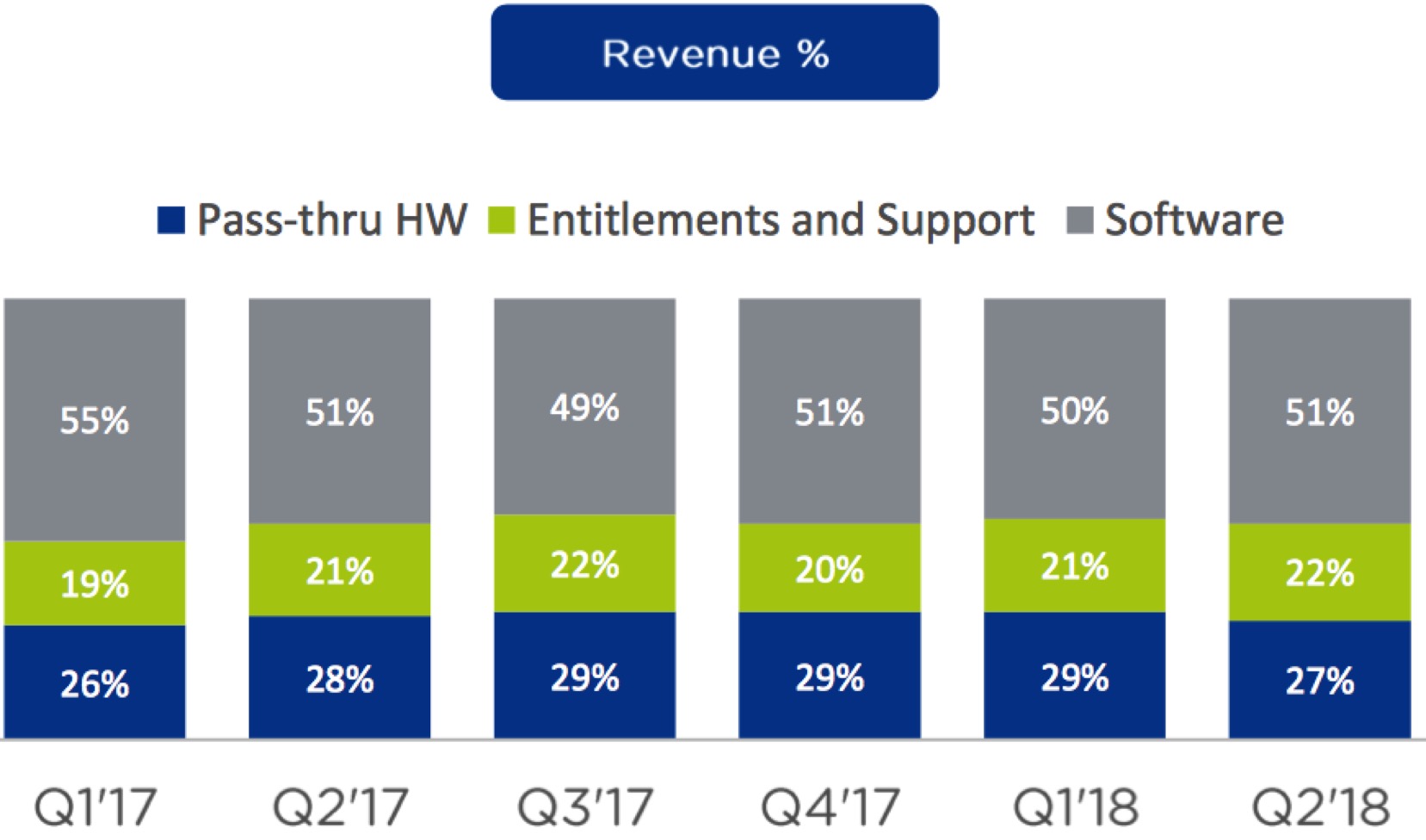

On a billings basis, product mix for 2Q18 was 77% software and support and 23% pass-through hardware. On a product mix, on a revenue basis was 73% software and support and 27% pass-through hardware.

EMEA's results exceeded its previous best quarter by over 50%, while APAC by 35%. Both of these regions also experienced record sales productivity in the quarter. Bookings from international regions were 49% of total bookings in 2Q18 versus 48% in 2Q017.

Good quarterly performance was due in part to a general over achievement and higher support renewals as well as receiving a great payment in 2Q18, in excess of $10 million, for a transaction that will ship next quarter.

18 customers were with over $10 million in lifetime bookings, and 10 with more than $15 million in lifetime bookings, up significantly from the previous quarter.

During the mot recent quarter, Nutanix saw 7 customer deals involving Calm, including one of the top deals of the quarter with a Global 2000 customer, which operates a large clinical laboratory networks.

About OEMs: Both Dell and Lenovo contributed nicely in the quarter. Dell matched its best historical performance and Lenovo recorded its best performance, increasing almost 80% sequentially. Dell bookings came in slightly less than 10% of total bookings, and included deal sizes net to Nutanix of $3.5 million and two deals at $2.6 million each. Lenovo included four deals greater than $1 million. IBM is still in its early stages of relationship and progressing. The company booked it first two initial IBM related deals within the quarter. And lastly, Cisco UCS related bookings increased over 40% sequentially, included deals of $2.5 million and $1.5 million.

Nutanix was granted its 50th US patent on building a distributed metadata system running on a cluster of commodity servers invented by the engineering trio of Karan Gupta, Pavan Konka and Alex Kaufman.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter