HDD Shipments Fell to 404 Million in 2017 – Trendfocus

Third consecutive year of lower annual shipments

This is a Press Release edited by StorageNewsletter.com on February 23, 2018 at 2:36 pmThis is an abstract of SDAS: HDD Information Service – February 14, 2018 CQ4 ’17 Quarterly Update and Long-Term Forecast Rev. 021418 from Trendfocus, Inc.

HDD Exabytes, Unit Shipments Rise in CQ4 ’17

Solid PC and nearline demand lift HDD sales to 104.77 million on 198.56EB shipped; 2017 exabyte at 689, units at 404 million, revenue at $25 billion

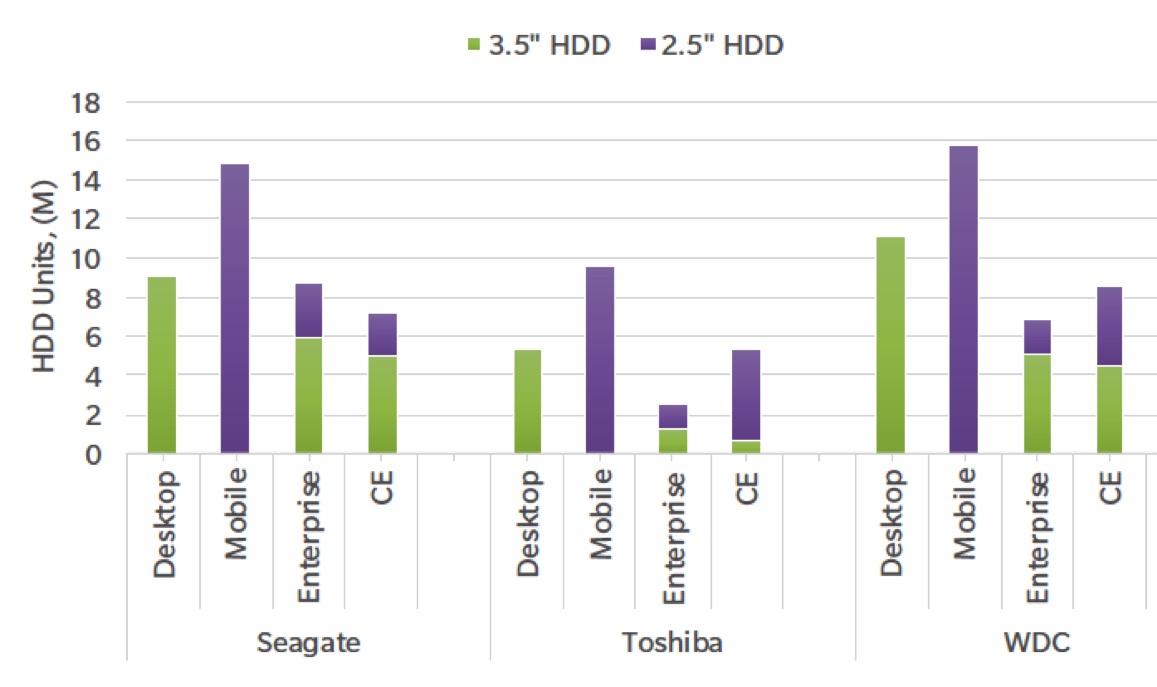

Total HDD Market Shipments, by Supplier, CQ4 ’17, Units (million)

HDD demand arising from the PC sector helped to offset lower CE HDD volumes in the quarter. In addition, strong hyperscale and cloud demand for high capacity HDDs drove record nearline shipments of 12.25 million in CQ4. As a result, CQ4 ’17 HDD sales were up very modestly, as total shipments rose 1.1% from the prior quarter to 104.77 million. A richer mix of HDD products lifted revenues for the quarter by $0.27 billion to $6.78 billion while exabytes shipped increased sequentially by 13% to 198.56.

For the year, richer product mix combined with a rapid transition to high-capacity nearline HDDs drove up exabytes nearly 14% sequentially to 688.74, and the average HDD capacity shot up nearly 20% to 1,706GB. HDD shipments fell to 403.71 million, marking the third consecutive year of lower annual shipments. Segment wise, all segments except CE posted lower results in 2017. Desktop and mobile HDD volumes fell 5.8% and 8.1%, respectively, while the enterprise HDD market slipped 2.4% with the reduction resulting from continued contraction of the traditional, or performance, enterprise HDD market. CE HDDs posted a nominal growth of 0.7% to 90.30 million driven by a growing branded surveillance HDD market and consistent game console demand. Revenue for the year declined to $24.91 billion, down 2.6%.

Holiday sales of PCs were better than expected, and both desktop and mobile HDD volumes increased sequentially. Despite higher notebook PC sales, HDDs bound for notebook PCs were down slightly as the incursion of SSDs continued to gain momentum in higher-end systems. Total mobile HDD sales, which includes 2.5″ external HDD shipments, rose almost 4% Q/Q to 40.27 million. Desktop PC sales were also higher in CQ4, fueled by end-of-the-year corporate budget flushes. Given the modest SSD penetration in the desktop PC space, desktop HDDs grew slightly from quarter-to-quarter. Total desktop PC HDDs plus 3.5″ external HDDs grew nearly 12% from Q/Q to 25.43 million. In the enterprise space, both nearline and performance HDD volumes were higher for the quarter, as enterprise HDD shipments shot up 16% sequentially in CQ4 to 18.03 million.

SMR (shingled magnetic recording) based HDD volumes have steadily grown in the client space, and its use will continue to spread across most applications. SMR recently launched in high-capacity nearline HDDs at 14TB, and this will be the technology to propel the capacities in each of the next few nearline HDD generations. Looking beyond SMR, Seagate is championing HAMR (heat assisted magnetic recording), and the company confirms it will have limited volumes of HAMR-based HDDs in late 2018, while Western Digital is gravitating towards MAMR (microwave assisted magnetic recording) technology, which it claims can achieve over 4Tb/in2 in time.

Client (desktop and mobile) HDD volumes have been impacted by rising SSD attach rates, but the attach rates will accelerate in 2018 as NAND supply re-balances with demand, resulting in lower prices after nearly two years of elevated ASPs. In the outer years of the forecast period, SSD attach rates are forecast to exceed 80% of all notebook PCs and more than one third of all desktop PCs. As a result, mobile and desktop HDD markets are on pace to fall 12% and 10%, respectively through 2022. However, there are market situations that could potentially help to support HDD shipments. One such case is expected in 2019, when Microsoft’s support for Windows 7 is scheduled to expire. If historical trends repeat, PC sales will rebound in 2019, albeit modestly, and this should have a small positive impact on HDD demand, tempered by continued growth in SSD-enabled systems bound for the commercial market.

Short-term, HDD shipments are expected to ease in CQ1 to 90.60 million, although normal seasonal demand trends will push quarterly unit volumes above 100 million later in the year. For the year, the HDD market will fall below 400 million to 384.91 million, reflecting an annual decline of 4.7%. However, market conditions, specifically in the client PC space appear to have stabilized, and despite the SSD takeover, desktop and mobile HDDs will continue to ship in measurable volumes for the next five years. As a result, the CAGR has been upgraded slightly from last year, and is now projected to be -4.3% through 2022, with the HDD market still well above the 300 million level at the end of the forecast period.

Note: The content of SDAS Quarterly Update has been changed. Due to industry dynamics, the ‘Enterprise HDD’ segment has been moved ahead of other segments.

Comments

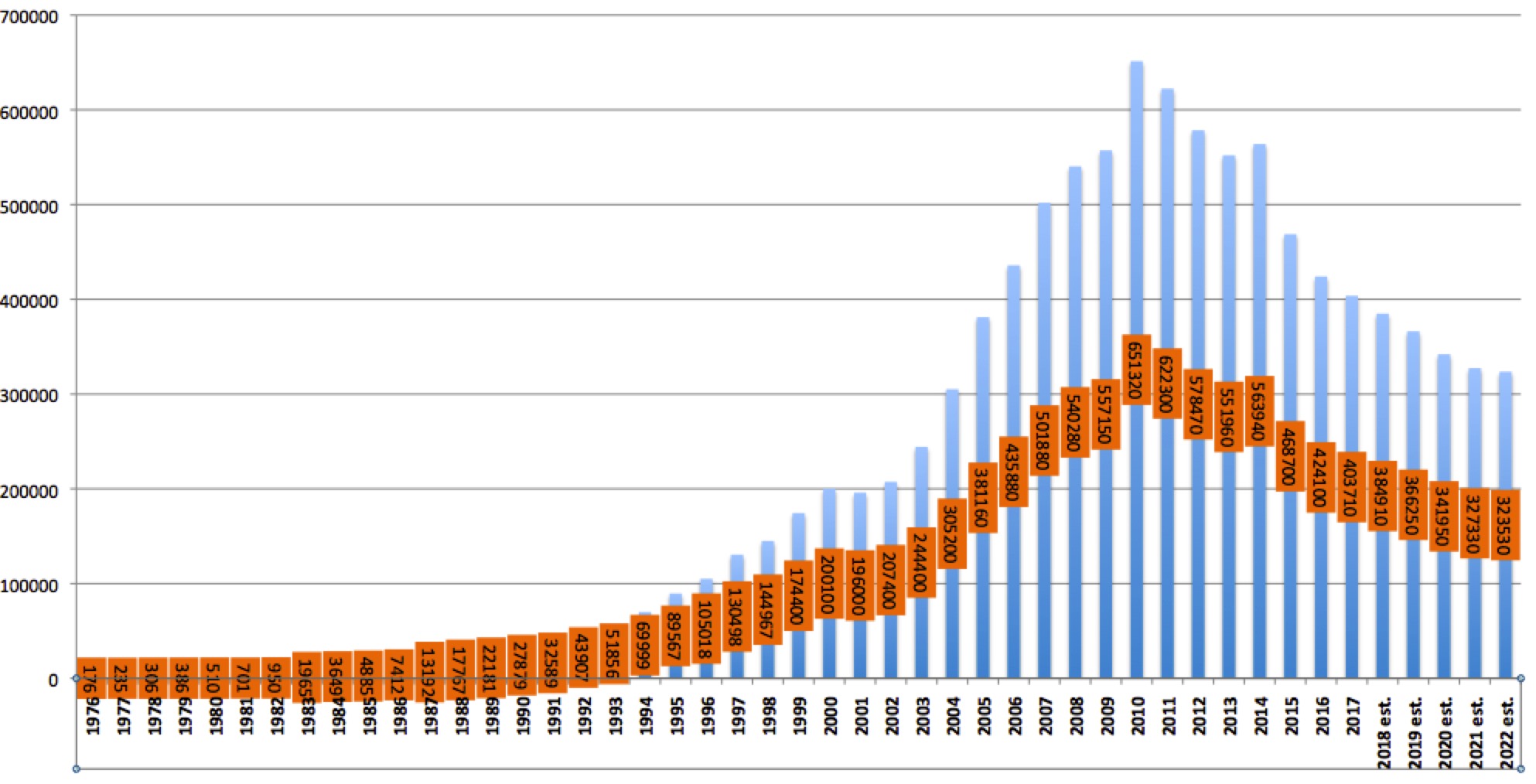

The number of HDDs shipped per year decreased since 2010 following the arrival of SSDs with a slight increase in 2014. This trend will continue regularly in next year acording to estimations of Trendfocus.

Enormous figure of 8.8 billion units have been sold since the arrival of the hard disk drives in 1976 for a CAGR of 20.2% until 2017.

Yearly HDD shipments since 1976 in thousands

Click to enlarge

(Sources: Disk/trend, IDC, Trendfocus, compiled by StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter