AsiaPac Excluding Japan Public Cloud Services to Reach $15 Billion in 2018 – IDC

Up 36% over 2017

This is a Press Release edited by StorageNewsletter.com on February 21, 2018 at 2:25 pmAsiaPac excluding Japan (APeJ) spending on public cloud services and infrastructure is forecast to reach $15.08 billion in 2018, an increase of 35.66% over 2017, according to the latest update of the IDC Corp.’s Worldwide Semiannual Public Cloud Services Spending Guide.

Although annual spending growth is expected to slow over the 2016-2021 forecast period, the market is expected to hit a five-year CAGR of 32.58% in public cloud services spending, or a total of $32.27 billion in 2021.

In 2018, the spending on public cloud services will be driven by banking ($1.85 billion), professional services ($1.75 billion), and discrete manufacturing ($1.63 billion).

Telecommunication and process manufacturing combined are also expected to spend more than $2.39 billion on public cloud services in 2018. These five industries are expected to remain as the highest spenders in 2021 due to their continued investment in public cloud solutions. However, the industries that will see the fastest spending growth over the five-year forecast period are construction (37.36% CAGR), professional services (36.84% CAGR), and personal and consumer services (36.65% CAGR).

“While digital transformation does help to drive the overall market growth, the rapid expansion of datacenter presence from global public clouds services providers at APeJ region does attract enterprises to migrate more workloads to the public cloud environment as that helps to address their concerns in data sovereignty and latency,” says Liew Siew Choon, senior market analyst, IDC AsiaPac’s Services Research team.

Infrastructure as a Service (IaaS) will be the largest category of public cloud spending in 2018, contributing about 47.60% to the overall cloud spending in the region. This is due to the fast expansion of datacenters by global public cloud service providers, followed by Software as a Service (SaaS), which is very close to the Infrastructure spending on cloud, with a share of 45.83% on the overall spend. IaaS spending will be fairly balanced throughout the forecast with server spending trending slightly ahead of storage spending.

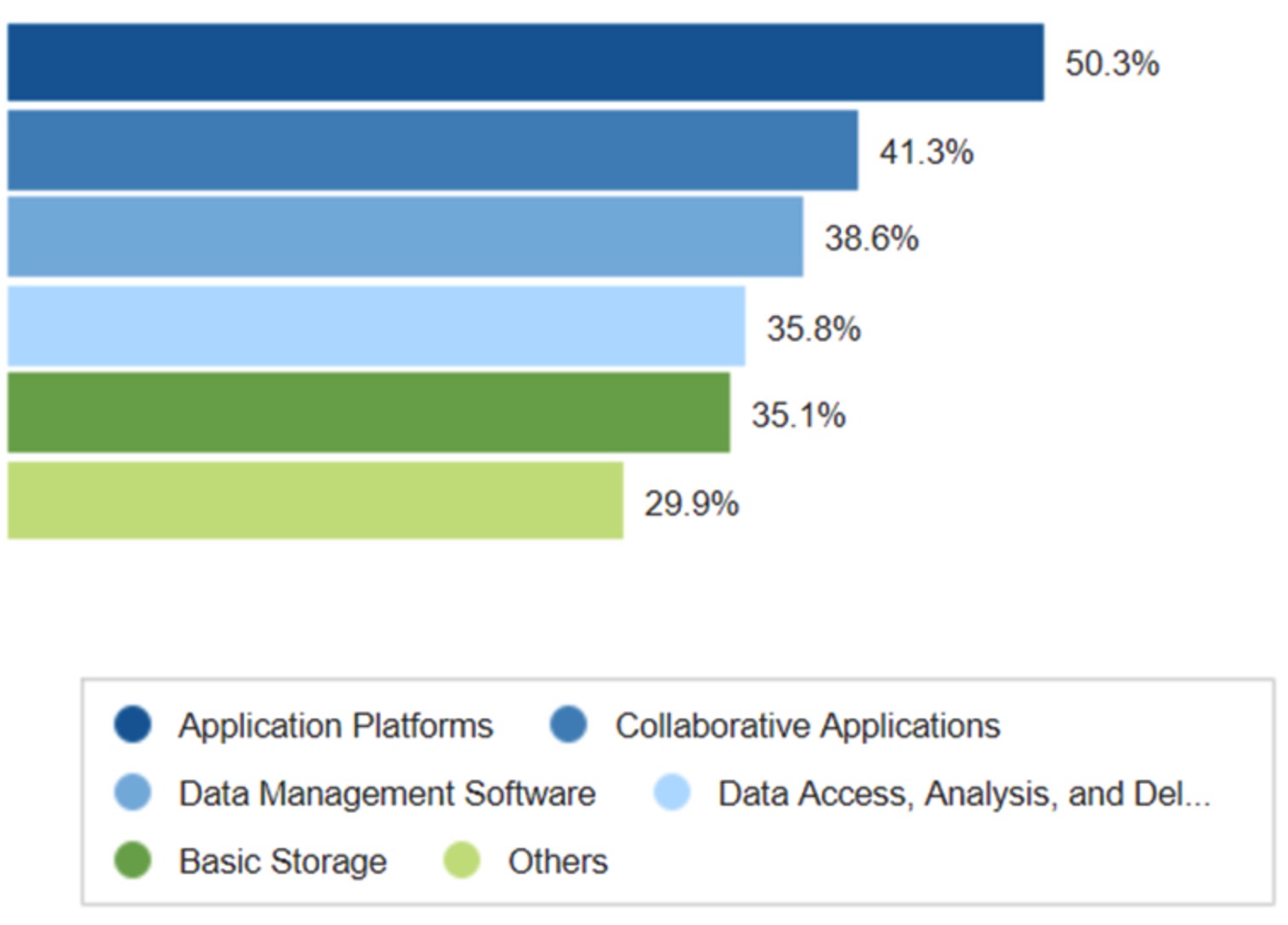

PaaS spending will be led by application platforms, which will see the fastest spending growth (37.93% CAGR) over the forecast period. Data management software, data access, analysis, and delivery, and integration and orchestration middleware will also see healthy spending levels in 2018 and beyond.

Top secondary market based on 5-year CAGR (2016-2021)

Vendor revenue (constant)

China will be the largest country market for public cloud services in 2018 with its $5.44 billion spending to account for about 36.10% of APeJ spending. Australia ($2.85 billion) and India ($2.12 billion) will be in second and third place respectively in terms of cloud spending in the region.

“China and India, the two largest markets in APeJ will account for about 60% of the region’s Cloud market size. The Chinese government has been actively promoting the development of the high-tech industry, and continues to implement its Internet+ strategy is a leading factor for China’s adoption to cloud technology, for India accelerated demand by enterprises and govt. towards the implementation of new technologies like Blockchain, AI, IoT, etc is making the cloud a bare necessity,” says Ashutosh Bisht, research manager for customer Insights & Analysis, IDC AsiaPac.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter