Seagate: Fiscal 2Q18 Financial Results

Good quarter but next one expected to be down 5% to 7%

This is a Press Release edited by StorageNewsletter.com on January 30, 2018 at 2:41 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 2,894 | 2,914 | 5,691 | 5,546 |

| Growth | 1% | -3% | ||

| Net income (loss) | 297 | 159 | 464 | 340 |

Seagate Technology plc reported financial results for the quarter ended December 29, 2017.

For the second quarter, the company reported revenue of $2.9 billion, gross margin of 30.1%, net income of $159 million and diluted earnings per share of $0.55.

On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 30.4%, net income of $431 million and diluted earnings per share of $1.48.

During the second quarter, the company generated $850 million in cash flow from operations and $773 million in free cash flow. Cash and cash equivalents totaled approximately $2.6 billion at the end of the quarter.

There were 285 million ordinary shares issued and outstanding as of the end of the quarter.

“Achieving year-over-year revenue and profitability growth and significant cash flow generation in the December quarter reflects Seagate’s solid execution and competitiveness of our storage solutions portfolio, particularly in the cloud-based environments. With our leading storage technology platforms, manufacturing and supply-chain management capabilities, Seagate is in a strong position to support ever-increasing storage demand from diverse markets and applications. Looking ahead, we will continue to focus on operational excellence and accomplishing our financial and shareholder-return objectives,” said Dave Mosley, CEO.

The board of directors has approved a quarterly cash dividend of $0.63 per share, which will be payable on April 4, 2018 to shareholders of record as of the close of business on March 21, 2018. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

Seagate achieved good quarterly financial results with revenues of $2.9 billion, up 11% sequentially and up 1% year-over-year, with net income of $158 million.

Per comparison for the same period, the figures are $5.3 billion, 3%, 9% and net loss of $823 million for main competitor Western Digital.

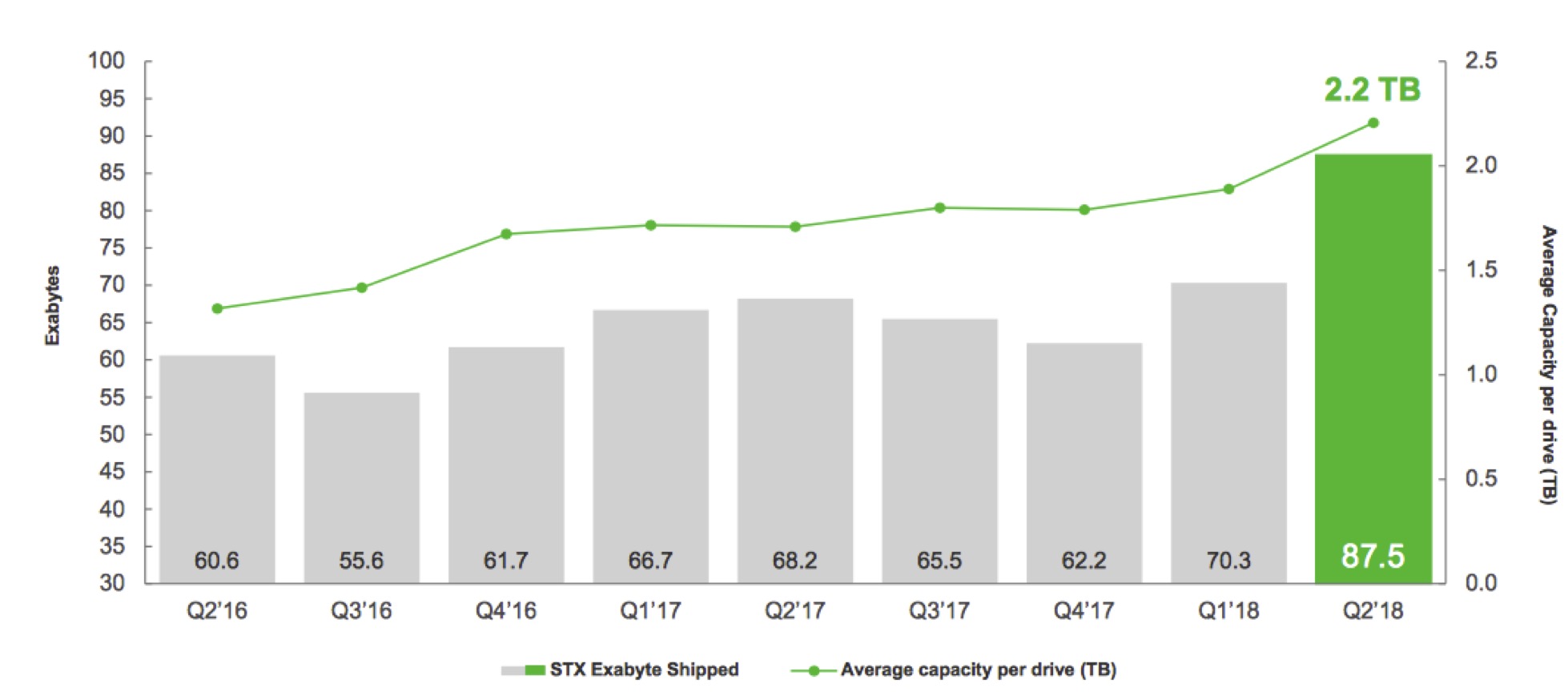

HDD exabyte shipments for the December quarter were a record 87.5EB, up 28% Y/Y. The average capacity per drive across the HDD portfolio was also a record of 2.2TB per drive, up 29% yearly, and the ASP per unit was $68, up 6% quarterly and 3% year-over-year.

Overall, HDD revenue was up 2% year-over-year in the December quarter. The growth in hyperscale and cloud storage deployments continues to represent an important opportunity for the firm being confident in its nearline HDD portfolio designed to serve these environments.

For the enterprise HDD market, a record 37.4EB were shipped with a record average capacity of 4.3TB per unit. In the nearline market, 35.1EB were sold and average capacity per drive reached 5.9TB, up 31% over last year's strong demand and up 75% from the December quarter two years ago.

In the edge and consumer verticals, the company had a strong year-over-year exabyte growth in almost all end markets, including PC compute, consumer, surveillance, gaming, and NAS. 1TB per platter 2.5 inch platform continues to perform well. 2TB per platter 3.5-inch platform continues to ramp for desktop markets for customers needing a 2TB, 4TB and 8TB capacity points.

The vendor continue to minimize its alignment with the 500GB client consumer and mission-critical 15,000rpm HDD markets as it believe these workloads will over time move to mobile, silicon and cloud storage. In the December quarter, these products represented less than 8% of total consolidated revenue.

Seagate anticipates launching HAMR portfolio in 2019.

December quarter non-HDD revenue, primarily from the cloud systems and silicon group, was $213 million, is down as much as 12% year-over-year mostly due to the divesting of its performance computing assets and OEM legacy system demand.

Seagate invests up to $1.25 billion with the Bain-led consortium acquisition of the Toshiba Memory Corporation as competitor Western Digital couldn't acquire this flash chip maker. This agreement will provide continuity of NAND supply but Seagate never was big actor in SSDs.

For next quarter, the HDD maker anticipates year-over-year exabyte growth with continued strong demand in cloud storage as supply remains tight in its highest capacity solutions. For the other markets, it anticipates normal sequential seasonal demand declines. As a result of the strong cloud demand and seasonality in other markets, Seagate finally expects total revenues to be down 5 to 7% sequentially from the December quarter.

HDD exabyte shipped and average capacity per drive

Click to enlarge

The manufacturer has decided once more not to reveal its quarterly HDD unit shipments, estimated between 39.5 and 40.0 million by Trendfocus, but only exabytes per product. Here it is:

HDD mix trends

| 1Q18 | 2Q18 | |

| EB enterprise mission critical | 2.1 | 2.4 |

| EB enterprise nearline | 25.1 | 35.1 |

| EB client non-compute consumer electronics | 13.5 | 17.1 |

| EB client non-compute consumer | 11.1 | 13.8 |

| EB client compute, desktop+notebook | 18.6 | 19.2 |

| Enterprise as % of total revenue | 36% | 40% |

| Client non-compute as % of total revenue | 29% | 30% |

| Client compute as % of total revenue | 26% | 23% |

Revenue by products in $ million

| 4FQ17 | 1FQ18 | Growth | % of total revenue | |

| HDDs | 2,390 | 2,701 | 13% | 93% |

| Enterprise systems, flash and others |

242 | 213 | -12% | 7% |

Seagate's HDDs from 2FQ15 to 2FQ18

| Fiscal period |

HDD ASP |

Exabytes | Average |

| shipped | GB/drive | ||

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

Seagate vs. WD for 2FQ18

(revenue and net income in $ million, units in million)

| Seagate | WD | % in favor of WD |

|

| Revenue | 2,914 | 5,336 | 83% |

| Net income | 158 | (823) | NA |

| HDD shipped | 40 | 42.3 | 6% |

| Average GB/drive | 2,200 | 2,253 | 9% |

| Exabytes shipped | 87.5 | 95.3 | 9% |

| HDD ASP | $68 | $63 | -7% |

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter