Worldwide All-Flash Array in 2017 – IDC

Pure Storage leader in front of Dell EMC, NetApp, HPE and IBM

This is a Press Release edited by StorageNewsletter.com on January 12, 2018 at 2:23 pm This summarized report was published on December 2017 and written by Eric , research director for storage, IDC Corp.

This summarized report was published on December 2017 and written by Eric , research director for storage, IDC Corp.

IDC MarketScape: Worldwide All-Flash Array 2017

Vendor Assessment

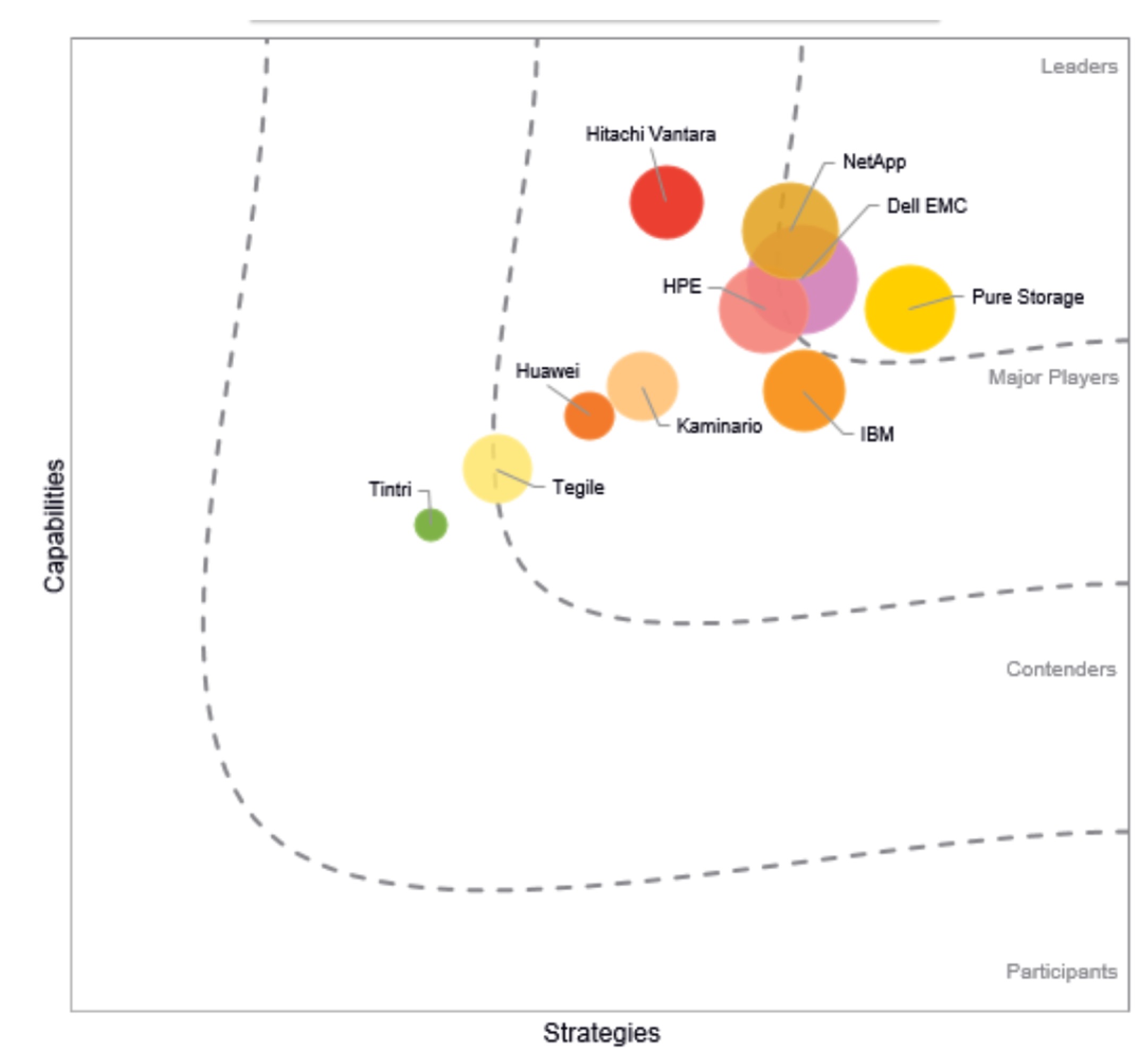

IDC MarketScape Worldwide All-Flash Arrays 2017

IDC opinion

The all-flash array (AFA) market has undergone significant maturation over the past two years. A high percentage of customers have already committed to an ‘all flash for primary storage’ strategy, and every customer interviewed for this study was among those.

In 2017, AFAs will drive over 80% of all primary storage revenue.

All of the established storage vendors have entered this space, and there are several start-ups with over $100 million in revenue. With this level of market maturation, multiple segments have developed within the primary flash array space. There are systems targeted for dedicated application deployment, there are systems specifically for web-scale applications, and there are systems intended for dense mixed workload consolidation. These latter systems are driving most of the AFA revenue, and they aspire to become the primary storage platforms of record for enterprises of all sizes.

This study evaluates the suitability of 10 vendors’ AFA platforms for dense mixed enterprise workload consolidation that includes at least some mission-critical applications.

The successful vendors in this space have all basically determined what is required for dense mixed workload consolidation and, for the most part, have delivered it. Any of the AFAs evaluated in this study is appropriate for this use case, but some are better geared for specific requirements (dual- controller or scale-out designs, block or file storage or both at the same time, virtual only or mixed physical/virtual, etc.). They all offer adequate performance (in terms of throughput and latency), capacity, and functionality to consolidate workloads, although a few are still missing support for advanced replication configurations like stretch clusters. Platform maturity is another important consideration, and several of the vendors entered the AFA market in only the past couple of years (although their storage OSs may have been shipping for several years before that on hybrid flash arrays – HFAs).

The areas where the most differentiation between vendors was noted were in their strategies around NVMe and cloud-based predictive analytics, how they track and manage customer experience (CX), and how they handle technology refresh. For most customers looking for a reliable platform for mixed enterprise workload consolidation, these may all be secondary considerations today, but the more forward-thinking vendors in these areas are driving industry transformation in a way that will benefit customers over the long run.

While Pure Storage was rated highly in this analysis, three other vendors (HPE, Dell EMC, and NetApp) also fared well. While all four of these vendors were very similar in terms of capabilities, Pure Storage’s strategies in NVMe, cloud-based predictive analytics, CX, and technology refresh (with the Evergreen Storage program) made the difference for the company.

Other vendors that were rated as major players each exhibit some strongly differentiating features and/or reputations: Hitachi Vantara for its reliability (backed by the industry’s only 100% availability guarantee), Kaminario for its excellent blend of scale-up and scale-out capabilities and innovative composable storage strategy based around NVMe over Fabric (the latter capability was not announced in time to be incorporated into its rating), IBM for its strong FlashCore technology (its use of custom flash modules – CFMs – across multiple AFA platforms), and Tegile for the value it provides based on its pricing models. Huawei, which is rated as a major player, has product functionality on par with all the others in the market but exhibited more conventional thinking in its telemetrics, CX, and technology refresh approaches. Tintri, a smaller vendor that shows up as a contender, has the strongest VM-aware offering across all vendors, a factor that differentiates it in terms of ease of use. Although Fujitsu did not meet the revenue requirement for inclusion, as its platform (the ETERNUS AF) had just recently started to ship, functionally the company is on par with many of the vendors in this study, but it did not fare as well in some of the newer ways that forward-thinking enterprise storage vendors are driving value for their customers (CX management, cloud-based predictive analytics, and technology refresh).

One of the key criteria in selecting AFA vendors for this study was whether or not they were pursuing a ‘flash first’ sales strategy and when that started. From IDC’s point of view, a vendor makes the shift to a ‘flash first’ sales strategy when it markets either a type 1 or a type 2 AFA, leads with AFA offerings for primary storage opportunities, and has trained both its own direct sales force and channel providers on that sales strategy.

For each of the established enterprise storage providers covered in this document that also sell HFAs (Dell EMC, Hitachi Vantara, HPE, IBM, and NetApp), IDC noted a distinct upward surge in AFA revenue growth for that vendor in the wake of its commitment to a ‘flash first’ sales strategy. At this point, all the majors have made that leap, and several of the smaller AFA vendors that have evolved over time out of HFA backgrounds (Tegile and Tintri) have done that as well. The ‘pure play’ AFA vendors (Kaminario and Pure Storage) have obviously been following ‘flash first’ sales strategies since their inception. For prospective buyers, it may be of interest to take note when a vendor initially committed to a ‘flash first’ sales strategy as part of the vendor evaluation process.

There is no best AFA for all needs. Factors that positively contributed to an AFA vendor’s position on the IDC MarketScape figure included the vendor’s range of scalability, the extent of data services support, platform design efficiencies, ability to integrate into preexisting datacenter workflows, overall platform maturity, and the vendor’s strategies around cloud-based predictive analytics, CX management, and technology refresh. Once a customer has created a short list based on higher-level considerations like architecture (dual controller or web scale), block and/or file, synchronous replication/stretch clusters or not, performance and storage density sweet spots, and incumbent vendor or new, any of the remaining AFAs will likely be a good fit. As an example, Huawei offers a very scalable, very high-performance AFA with a very comprehensive set of enterprise data services, but the platform is relatively new and uses more traditional approaches to telemetrics, CX management, and technology refresh. On a pure feature comparison, that system would rate very high, but platform maturity and other considerations could limit its appeal with some customers.

A note on failure domains

Although we are looking at overall system scalability, some customers are specifically interested in limiting the size of their failure domains and are willing to take on a little bit more management complexity to achieve their goals in this area. Note that while this analysis does comment on AFA scalability, many vendors offer multiple models to let customers determine what size of platform best meets their needs. For example, for NetApp, while much of the analysis is done around the All Flash FAS (AFF) A700 platform, NetApp fields smaller platforms that use that same architecture but offer lower entry price points and smaller failure domains (the A200, the A300, and the A700s). This flexibility is taken into account as part of a vendor’s portfolio strategy.

Storage density (TB/U) is another consideration here. The highest storage density, while it may result in the most efficient energy and floor space consumption, also has potentially the biggest impact with the failure of an entire disk shelf. Vendors are clearly consciously aware of this, and some even claim to have limited their storage densities because of working with customers to define a ‘sweet spot’ storage density. Many vendors offer multiple SSD or CFM device sizes, letting the customer mix and/or match to meet its own density requirements. This study does take storage density into account, but the most flexible systems in it will offer customers multiple device size options to hit their own storage density requirements rather than just offering the highest storage density period. For those systems on the lower end of storage density, however, this detracts from the value the system provides. Clearly, one of the benefits that flash media-based devices offer relative to HDDs is an ability to achieve much higher storage densities with relatively lower energy and floor space consumption.

Market definition

Under IDC’s AFA taxonomy, any external storage array that supports only all-flash media as persistent storage and is available under a unique SKU will be considered an AFA. System pedigrees are important, however, in helping customers understand differentiating functionality between platform types.

Under the current taxonomy, there are three types of AFAs:

- Type 1. These are arrays that were originally born as AFAs, and they include products such as the Huawei OceanStor Dorado V3, the IBM FlashSystem A9000, the Kaminario K2, and the Pure Storage FlashArray//X.

- Type 2. These are arrays that originally began life as hybrid designs but have undergone significant flash optimization, do not support HDDs, and include at least some unique, high- performance hardware (typically controllers that are faster than those included in the vendor’s HFAs) unique to the all-flash configuration. Examples are the Hitachi Vantara Virtual Storage Platform (VSP) F Series, the HPE 3PAR StoreServ 9450 and 20850, and the Tintri EC6000 Series.

- Type 3. These are arrays that originally began life as hybrid designs but have undergone significant flash optimization, do not support HDDs, and do not include hardware (other than the flash media) that is any different from the hardware the vendor ships on its HFA products. Examples are the Dell EMC VMAX All Flash and the NetApp All Flash FAS (AFF).

Note that some vendors have arrays that they will ship in either all-flash or mixed configurations. If an array is allowed by the vendor to support HDDs (regardless of whether it is shipped from the factory without them), then it is considered to be an HFA. Examples of this type of system are the Dell EMC SC4020 and the HPE 3PAR StoreServ 8440 and 20840. This study does not evaluate any of these types of systems.

Flash media options for AFAs include CFMs and SSDs, and some vendors offer customers the option to configure either in the same system (like Hitachi Vantara in the VSP G Series). Some vendors use CFMs for one platform and SSDs for another (e.g., IBM’s CFM-based FlashSystem A9000 and the SSD-based DS8888), aiming these products at different target markets. CFM-based options use flash media that has not been packaged in an HDD form factor but is instead just accessed as a media store of a given capacity. These systems can use SCSI or NVMe (PCIe) as the storage interface, although versions based on NVMe (PCIe) offer differentiated performance. Vendor products evaluated for this study that use CFMs include the IBM FlashSystem A9000 and the Hitachi Vantara VSP F Series, while those that use SSDs include the Dell EMC VMAX All Flash, the Kaminario K2, the NetApp AFF, the Pure Storage FlashArray//X, the Tegile IntelliFlash HD, and the Tintri EC6000 Series. Vendor products using SSDs but with modified firmware include the Huawei OceanStor Dorado and the HPE 3PAR StoreServ platforms.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter