EMEA Purpose-Built Backup Appliance Market Flat in 3Q17 – IDC

Growth of 0.4% Y/Y to reach $196 million

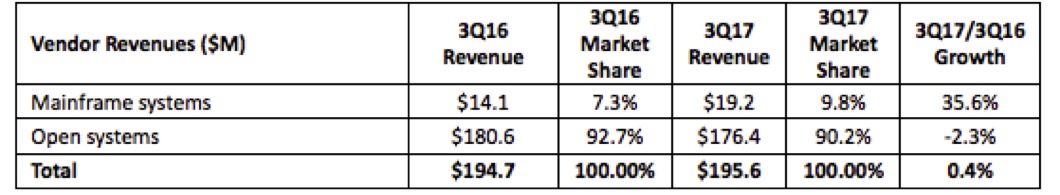

This is a Press Release edited by StorageNewsletter.com on December 18, 2017 at 2:38 pmEMEA purpose-built backup appliance (PBBA) vendor revenues remained nearly flat with growth of 0.4% Y/Y to reach $196 million in the third quarter of 2017, according to the International Data Corporation‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

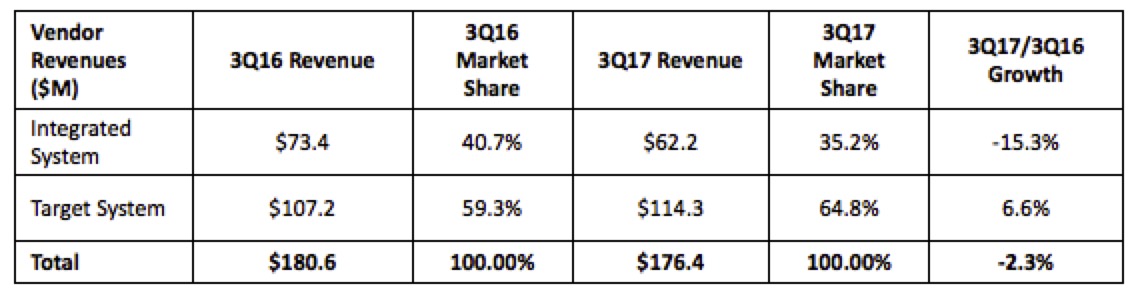

Total EMEA PBBA open systems vendor revenue decreased 2.3% Y/Y, and rose 3.5% Q/Q during the third quarter, with revenues of $176 million.

Mainframe system sales increased 35.6% year on year in 3Q17.

“Hardware-centric solutions have been facing difficult market conditions due to the shift of certain applications/activities to the cloud. However, the advent of the GDPR deadline is driving organizations’ IT investment in on-premise solutions due to the benefits they offer – a cost effective way to extend an organization’s existing investment and data protection hardware and software without having to change existing processes – which has helped to boost the PBBA market in EMEA,” said Jimena Sisa, senior research analyst, EMEA storage systems, IDC.

EMEA PBBA Vendor Revenue by Product, 3Q17

Open Systems

Western Europe

Vendor revenue in Western Europe increased 2.0% Y/Y in 3Q17 to $147.5 million. The main increase came from mainframe systems with a 49.1% rise year on year.

“Despite constrained IT budgets, many Western European organizations have increased expenditure in on on-premise storage solutions such as PBBA (in the Nordic region PBBA spending increased 45% Y/Y, Italy 53% Y/Y, and the Netherlands 55% Y/Y possibly to comply with GDPR through the creation of a single data store and data protection solution. A consolidated on-premise storage infrastructure contributes to GDPR compliance through better visibility of the data estate and by addressing data residency requirements,” said Sisa.

CEMA

The PBBA market in Central and Eastern Europe, Middle East, and Africa (CEMA) recorded $48 million in revenue, claiming one fourth of EMEA total sales. This result was a significant improvement over the last three years’ performance and limited the double-digit Y/Y decline to 4.1% in 3Q17.

The recovery of PBBA sales came on the back of the long-expected growth of enterprise systems markets following the stabilization of the region. Middle East and Africa (MEA) revenue continued to grow and Central and Eastern Europe (CEE) reduced its rate of decline three times Q/Q, as most vendors performed better than the market average.

“The pending infrastructure projects featuring secondary storage workloads and targeted vendor programs will boost PBBA performance in CEMA in the near to medium term,” said Marina Kostova, research manager, IDC CEMA. “While the transition to cloud is underway, it is happening more slowly than in mature markets, clearing the ground for hardware backup appliances.”

Major companies covered in this tracker include Dell, Veritas, HPE, IBM, Quantum, Barracuda, Oracle, Fujitsu, Exagrid, HDS, Unitrends, and FalconStor.

Taxonomy Notes

IDC defines a purpose-built backup appliance as a standalone disk-based solution that utilizes software, disk arrays, server engines, or nodes that are used for backup data and specifically for data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. PBBAs are deployed in standalone configurations or as gateways. PBBA solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device serves as the component that is purpose built solely for backup and not to support any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. They can also provide and receive replication to or from remote sites and a secondary PBBA for DR.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter