Broadcom: Fiscal 4Q17 Financial Results

Decline in storage revenue driven by anticipated correction in demand for HDDs

This is a Press Release edited by StorageNewsletter.com on December 7, 2017 at 2:42 pm| (in $ million) | 4Q16 | 4Q17 | FY16 | FY17 |

| Revenue | 4,146 | 4,848 | 13,240 | 17,636 |

| Growth | 17% | 33% | ||

| Net income (loss) | (668) | 671 | (1,861) | 1,894 |

Broadcom Limited reported financial results for the fourth fiscal quarter and fiscal year ended October 29, 2017, and provided guidance for the first quarter of its fiscal year 2018.

The company completed its acquisition of Brocade Communications Systems, Inc. on November 17, 2017. The financial results provided below for the fourth quarter and fiscal year 2017 do not include any contribution from Brocade.

Fourth Quarter Fiscal Year 2017 GAAP Results

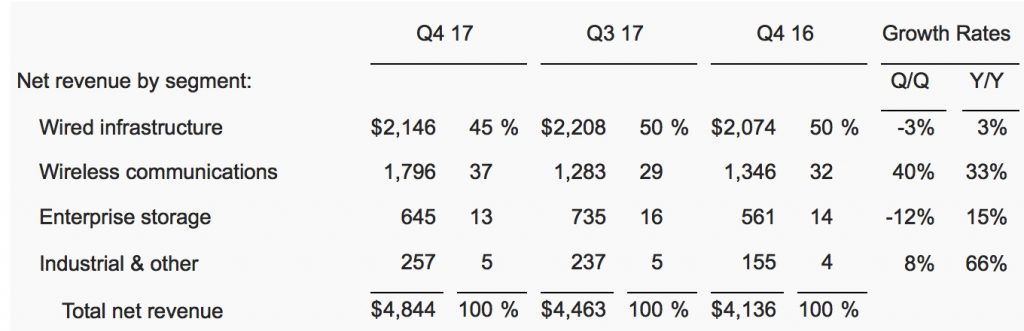

- Net revenue was $4,844 million, an increase of 9% from $4,463 million in the previous quarter and an increase of 17% from $4,136 million in the same quarter last year.

- Gross margin was $2,383 million, or 49.2% of net revenue. This compares with gross margin of $2,149 million, or 48.2% of net revenue, in the prior quarter, and gross margin of $2,171 million, or 52.5% of net revenue, in the same quarter last year.

- Operating expenses were $1,518 million. This compares with $1,501 million in the prior quarter and $1,790 million for the same quarter last year.

- Operating income was $865 million, or 17.9% of net revenue. This compares with operating income of $648 million, or 14.5% of net revenue, in the prior quarter, and operating income of $381 million, or 9.2% of net revenue, in the same quarter last year.

- Net income, which includes the impact of discontinued operations, was $671 million, or $1.50 per diluted share. This compares with net income of $507 million, or $1.14 per diluted share, for the prior quarter, and net loss of $668 million, or $1.59 per diluted share, in the same quarter last year.

- Net income attributable to ordinary shares was $636 million. Net income attributable to the noncontrolling interest (restricted exchangeable limited partnership units (REUs) in the company’s subsidiary, Broadcom Cayman L.P. (the Partnership), was $35 million.

The company’s cash and short term investment balance at the end of the fourth fiscal quarter was $11,204 million, compared to $5,449 million at the end of the prior quarter.

During the fourth quarter, the company generated $1,959 million in cash from operations and received $3,980 million from issuance of long-term debt, and $440 million from the sale of real property. In the fourth quarter, the company spent $233 million on capital expenditures.

On September 29, 2017, the company paid a cash dividend of $1.02 per ordinary share, totaling $416 million. On the same date, the Partnership, of which the company is the General Partner, paid holders of REUs a corresponding distribution of $1.02 per REU, totaling $23 million.

Fourth Quarter Fiscal Year 2017 Non-GAAP Results From Continuing Operations

- Net revenue was $4,848 million, an increase of 9% from $4,467 million in the previous quarter, and an increase of 17% from $4,146 million in the same quarter last year.

- Gross margin was $3,068 million, or 63.3% of net revenue. This compares with gross margin of $2,827 million, or 63.3% of net revenue, in the prior quarter, and gross margin of $2,522 million, or 60.8% of net revenue, in the same quarter last year.

- Operating income was $2,293 million, or 47.3% of net revenue. This compares with operating income from continuing operations of $2,059 million, or 46.1% of net revenue, in the prior quarter, and $1,719 million, or 41.5% of net revenue, in the same quarter last year.

- Net income was $2,091 million, or $4.59 per diluted share. This compares with net income of $1,871 million, or $4.10 per diluted share last quarter, and net income of $1,549 million, or $3.47 per diluted share, in the same quarter last year.

“On the heels of very strong fiscal 2017 financial results, and continuing momentum into the new fiscal year, we are increasing capital returns to our shareholders and have raised our interim quarterly dividend by 72%,” said Hock Tan, president and CEO. “We also closed the acquisition of Brocade early in the first fiscal quarter of 2018, adding to our very successful track record of highly accretive M&A.”

Fiscal Year 2017 Financial Results From Continuing Operations

- Net revenue from continuing operations was $17,636 million, an increase of 33% from $13,240 million in the prior year. Gross margin was $8,509 million, or 48.2% of net revenue, versus $5,940 million, or 44.9% of net revenue, in the prior year.

- Operating income was $2,493 million compared with an operating loss of $409 million in the prior year. Net income, which includes the impact from discontinued operations, was $1,894 million, or $4.27 per diluted share. This compares with a net loss of $1,861 million, or $4.86 per diluted share, in fiscal year 2016. Net income attributable to ordinary shares was $1,796 million in fiscal year 2017. Net income attributable to the noncontrolling interest REUs in the Partnership was $98 million.

- Non-GAAP net revenue from continuing operations was $17,665 million, an increase of 33% from $13,292 million in the prior year. Non-GAAP gross margin was $11,137 million, or 63% of net revenue, versus $8,046 million, or 60.5% of net revenue, in the prior year. Non-GAAP operating income from continuing operations was $8,011 million. This compares with $5,320 million in the prior year. Non-GAAP net income was $7,255 million, or $16.02 per diluted share. This compares with non-GAAP net income of $4,672 million, or $11.45 per diluted share, in fiscal year 2016.

First Quarter Fiscal Year 2018 Business Outlook

Based on current business trends and conditions, the outlook for continuing operations for the first quarter of fiscal year 2018, ending February 4, 2018, including the projected partial quarter contribution from the acquired Brocade FC SANing business, is expected to be as follows:

Net revenue at $5,296 million +/-$75 million

Comments

After finally getting Brocade for $5.5 billion, now Broadcom is trying to get big firm Qualcomm, proposing more than $100 billion, but the battle continues between the two companies and the deal is far to be closed even if Broadcom is considering to increase its offer to conclude.

Abstracts of the earnings call transcript:

Hock Tan, president and CEO:

"In the fourth quarter 2017, enterprise storage revenue was $645 million growing 15% year-on-year and declining 12% sequentially. The storage segment represented 13% of October revenue. Sequential decline in storage revenue was driven by an anticipated correction in demand for HDD products.

"In contrast, our servers and storage connectivity business, the [immigrate] business experienced an increase in demand driven by the Purley server launch cycle. Looking into the first quarter 2018, we're seeing this Purley launch continue to gain traction and drive very strong growth in demand for our several storage connectivity products. We also expect HDD described demand to have bottomed in the first quarter and start to recover.

"Starting with the first quarter of fiscal 2018, the enterprise storage segment - this enterprise storage segment will include Brocade FC SAN business which is expected to generate a partial quarter revenue contribution of $250 million in Q1 fiscal '18. Beyond this as we look into 2018 we see the storage landscape in being driven fairly well by our products supporting the adoption of all-flash arrays in storage appliances infrastructure with our PCIe and NVMe technology."

Thomas Krause, CFO:

"We entered the fourth quarter of the cash balance of $11.2 billion but I'll note the cash balance was an elevated level through the fourth quarter in anticipation of closing the acquisition of Brocade."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter