Marvell: Fiscal 3Q18 Financial Results

No growth but high profitability before acquisition of Cavium

This is a Press Release edited by StorageNewsletter.com on November 30, 2017 at 2:48 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

| Revenue | 623.7 | 616.3 | 1,735 | 1,794 |

| Growth | -1% | 3% | ||

| Net income (loss) | 72.6 | 200.2 | 101.2 | 472.1 |

Marvell Technology Group Ltd. reported financial results for the third fiscal quarter of fiscal year 2018.

Revenue for the third quarter of fiscal 2018 was $616 million, which exceeded the midpoint of the company’s guidance provided on August 24, 2017.

GAAP net income from continuing operations for the third quarter of fiscal 2018 was $149 million, or $0.30 per share. Non-GAAP net income from continuing operations for the third quarter of fiscal 2018 was $172 million, or $0.34 per diluted share. Cash flow from operations for the third quarter was $216 million.

“Our strong performance in the third quarter is a direct result of growth in our core businesses and improved execution across the company, enabling us to continue to unlock the earnings power of Marvell,” said Matt Murphy, president and CEO.

Fourth Quarter of Fiscal 2018 Financial Outlook

• Revenue is expected to be $595 million to $625 million.

• GAAP and non-GAAP gross margins are expected to be approximately 62%.

• GAAP operating expenses are expected to be $240 million to $246 million.

• Non-GAAP operating expenses are expected to be $215 million to $220 million.

• GAAP diluted EPS from continuing operations is expected to be in the range of $0.23 to $0.29 per share.

• Non-GAAP diluted EPS from continuing operations is expected to be in the range of $0.29 to $0.33 per share.

On November 20, 2017, Marvell announced a definitive agreement to acquire all outstanding shares of the common stock of Cavium, Inc. The transaction is expected to close in mid-calendar 2018, subject to regulatory approval as well as other customary closing conditions, including the adoption by Cavium shareholders of the merger agreement and the approval by Marvell shareholders of the issuance of Marvell common shares in the transaction.

Comments

Sales were $315.3 million for storage, representing 51% of global revenue, compared to $311.5 million (52%) for the former quarter and $329.0 (53%) one year ago. So storage grew 1% sequentially and declined 4% Y/Y.

During the most recent three-month period, storage business performed slightly above expectations, driven primarily by the performance of SSD portfolio.

The company continues to ramp new MVMe-based solutions and is well positioned as the SSD market transitions to this high performance interface. Overall, it sees continued traction of SSD products, particularly in the enterprise and cloud data center.

HDD revenue came in higher than originally expected, fueled by the ramp of 1TB per platter drive controllers, enabling customers to offer higher capacity and lower power solutions.

At midpoint of guidance, Marvell expects storage revenue to be approximately flat sequentially in line with seasonal trends.

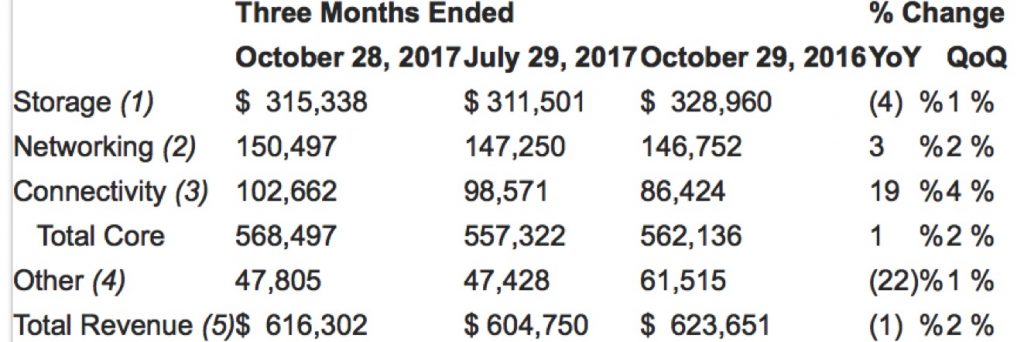

Quarterly Revenue

(in $ thousand)

(1) Storage products are comprised primarily of HDD, SSD controllers and data center storage solutions.

(2) Networking products are comprised primarily of Ethernet switches and transceivers, embedded ARM processors and automotive Ethernet, as well as a few legacy product lines.

(3) Connectivity products are comprised primarily of WiFi solutions including WiFi only, WiFi/Bluetooth combos and WiFi microcontroller combos.

(4) Other products are comprised primarily of printer solutions and application processors.

(5) Excludes the revenue of certain non-strategic businesses classified as discontinued operations.

To read the earnings call transcript

Read also:

Marvell to Acquire Cavium for $6 Billion

Storage representing 46% of combined revenue

2017.11.22 | Press Release | [with our comments]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter