Pure Storage: Fiscal 3Q18 Financial Results

More than $1 billion in revenue expected for FY18

This is a Press Release edited by StorageNewsletter.com on November 29, 2017 at 2:38 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

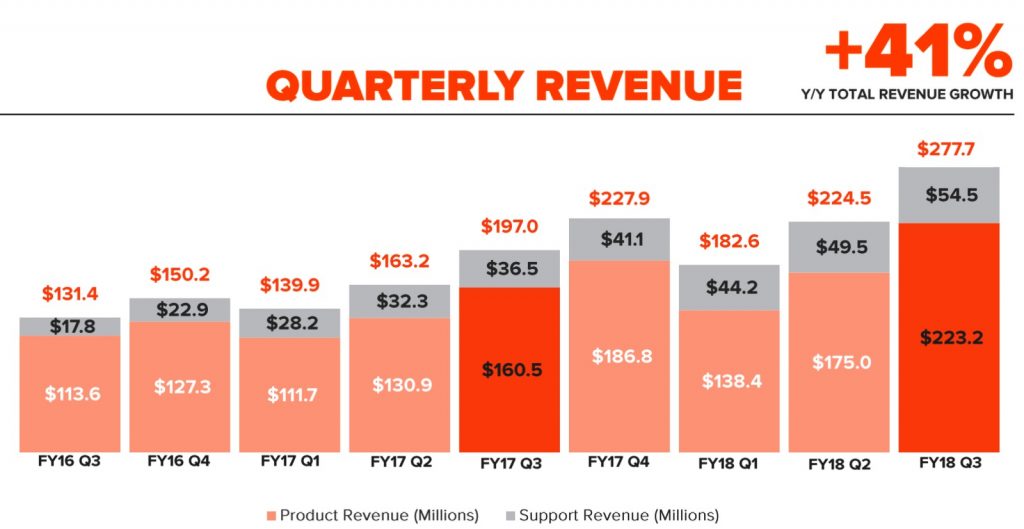

| Revenue | 197.0 | 277.8 | 500.1 | 684.8 |

| Growth | 41% | 37% | ||

| Net income (loss) | (78.8) | (41.6) | (202.2) | (165.7) |

Pure Storage, Inc. announced financial results for its third quarter ended October 31, 2017.

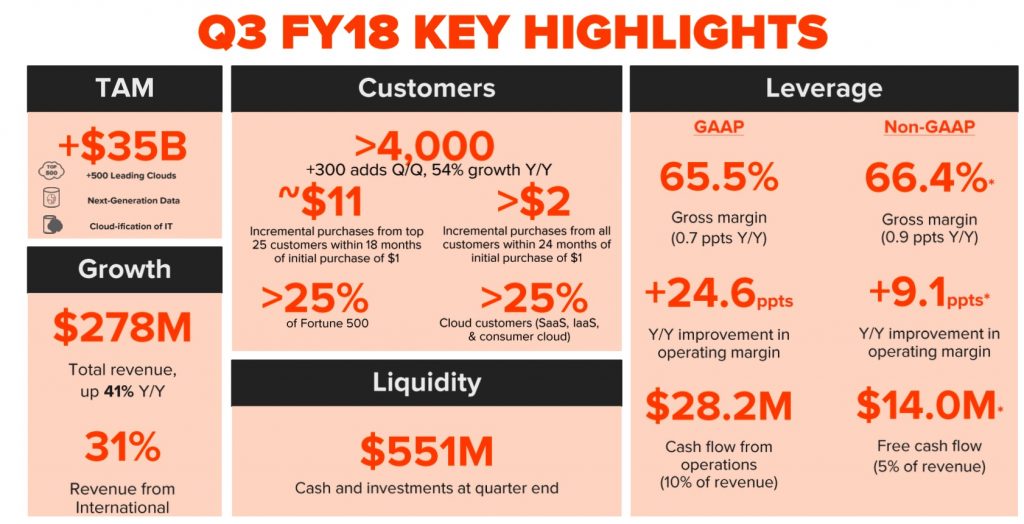

Key quarterly business and financial highlights include:

• Record quarterly revenue: $278 million, up 41% Y/Y, 2% ahead of midpoint of guidance

• Quarterly gross margin: 65.5% GAAP; 66.4% non-GAAP

• Quarterly operating margin: -15.1% GAAP; -0.7% non-GAAP, up 24.6 ppts and 9.1 ppts Y/Y, respectively

• Raising full-year fiscal 2018 revenue guidance to between $1.012 billion and $1.020 billion and non-GAAP operating margin guidance to between -4.9% and -3.5%

“Pure has built a platform that allows customers to build a better world with data,” said CEO Charlie Giancarlo. “Pure offers a simpler, more effective, and agile solution for data-rich applications like artificial intelligence.”

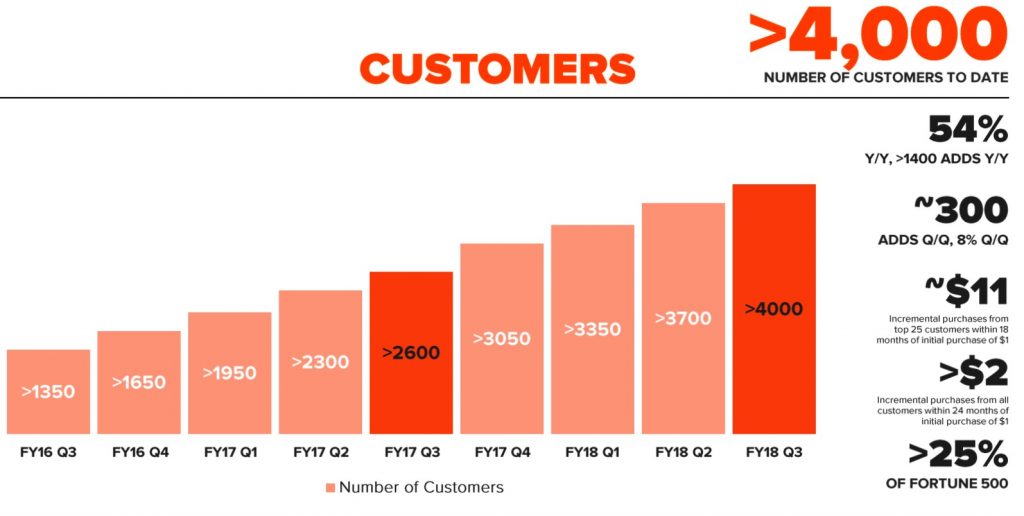

In the quarter, more than 300 new customers joined Pure Storage, increasing the total to more than 4,000 organizations, including more than 25% of the Fortune 500. New customer wins in the quarter include: NASA Goddard, Krispy Kreme, John Lewis PLC, Movado Group, Weave Communications, Comodo Group, and Pronto Software.

“We had an excellent quarter, highlighted by strong revenue growth, positive free cash flow, and a continued march toward profitability,” said CFO Tim Riitters. “We are excited to be fast approaching the $1 billion annual revenue mark and our first profitable quarter on a non-GAAP basis.”

Pure Storage’s fourth quarter fiscal 2018 guidance:

• Revenue in the range of $327 million to $335 million

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of 3.0% to 7.0%

Pure Storage’s full year fiscal 2018 guidance:

• Revenue in the range of $1.012 billion to $1.020 billion

• Non-GAAP gross margin in the range of 65.6% to 66.6%

• Non-GAAP operating margin in the range of -4.9% to -3.5%

Comments

Pure Storage never stops to grow, and rapidly, but never was profitable. Net loss is diminishing yearly and quarterly even if it continues to be a huge amount ($42 million compared to revenue of $278 million). Accumulated loss now reach around $832 million since FY13.

The all-flash array company expects 4Q18 non-GAAP operating margins of between positive 3% and positive 7% that will represent its first historical profitable quarter.

3Q18 product Y/Y revenue grew 39% to $223.2 million and support revenue 50% to $54.5 million, driven by continued revenue recognition of ongoing support contracts.

From a geographic perspective, 69% of revenue came from the U.S. and 31% from international, an all-time high for the company, up from 26% last quarter.

Total headcount is now over 2,000, up from over 1,900 at the end of 2Q18 and up from over 1,650 a year prior, reflecting ongoing hiring in sales and R&D organizations.

Company finished the October quarter with cash and investments of $551 million that is a $28 million addition to overall cash position from the previous quarter and represents the first positive cash flow generation in the firm's history. The firm looks forward to another quarter of free cash flow generation in 4Q18.

Contributions from cloud customers continue to represent more than 25% of the business.

Repurchase rates is over 70% of the firm's business coming from existing customers.

Charles Giancarlo, CEO since just three months, stated: "In the spirit of doing more with more customers, we will focus on three growth areas. One, growing our roster of cloud customers; two, cementing our lead as the core data infrastructure for next-generation applications, like artificial intelligence, machine learning and analytics; and three, expanding our footprint in the world's largest enterprises and government organizations."

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter