FalconStor: Fiscal 3Q17 Financial Results

Revenue from FreeStor decreased by $0.1 million.

This is a Press Release edited by StorageNewsletter.com on November 24, 2017 at 2:49 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 7.3 | 6.1 | 22.8 | 18.9 |

| Growth | -16% | -7% | ||

| Net income (loss) | (2.0) | 1.3 | (9.7) | (0.4) |

FalconStor Software, Inc. announced financial results for its third quarter ended September 30, 2017.

“Q3 marks an important pivot point for FalconStor as the strategic restructuring launched earlier in 2017, and additional focus implemented during the quarter, have produced a return to profitability,” stated Todd Brooks, CEO. “Our products and solutions play a key role in managing and protecting critical data within enterprises around the world. The financial stability we are creating will enable us to continue innovating and delivering outstanding value to our existing partners and customers, while positioning the company for future growth.”

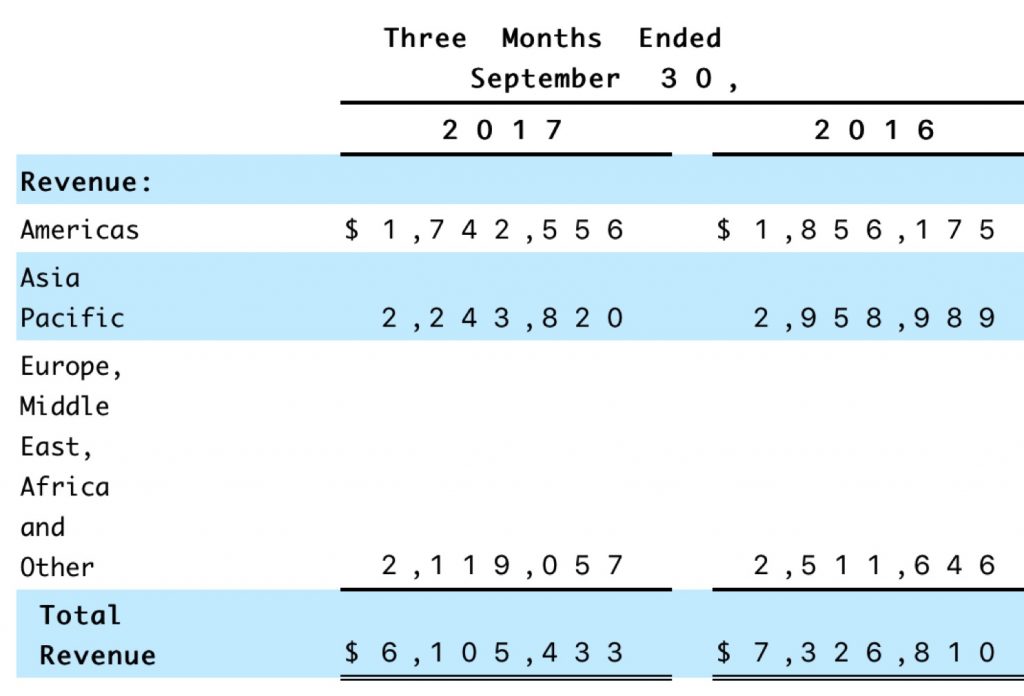

For the three months ended September 30, 2017 we delivered net GAAP operating income of $1.3 million on revenues of $6.1 million. Included in operating results above for the three months ended September 30, 2017 and 2016 were $(0.3) million and $0.3 million of share-based compensation expense, respectively, and $0.2 million and $0.4 million of severance expense, respectively.

For the nine months ended September 30, 2017 the company has incurred a GAAP net operating loss of $.4 million as compared to a net loss of $9.7 million for the same period last year. Included in operating results above for the nine months ended September 30, 2017 and 2016 were $0.3 million and $2.4 million of share-based compensation expense, respectively, and $1.0 million and $1.4 million of severance expense, respectively. Included in net loss for the nine months ended September 30, 2017 and 2016 was an income tax provision of $0.2 million and $0.4 million, respectively. Due to cost rationalization initiatives completed during 2016 and continued into 2017, the firm reduced net loss by (97)% for the nine months ended September 30, 2017 as compared to the prior year period.

Deferred revenue at September 30, 2017 was $18.8 million, compared with $23.7 million at December 31, 2016. Cash balance at September 30, 2017 was $1.8 million, compared with $3.4 million at December 31, 2016.

In June 2017, board of directors approved a comprehensive plan to increase operating performance. It result in a realignment and reduction in workforce and a change in the leadership of the company. It is substantially complete and the company ended the quarter with 83 employees worldwide. These actions are anticipated to result in an annualized cost savings of approximately $10.0 million. In connection with this plan, the firm have incurred year to date severance expense of $1.0 million which is included in operating expenses. In making these changes, it prioritized customer support and development while consolidating operations and cutting direct sales resources, therefore allowing to focus on install base and develop more efficient market channels.

Comments

FalconStor is betting on its FreeStor software, available since June 2015, to rebound but the results are not impressive even if it registered net income for the first time on more than two years following restructuration. Quarterly revenue are down 9%Q/Q and 16% Y/Y.

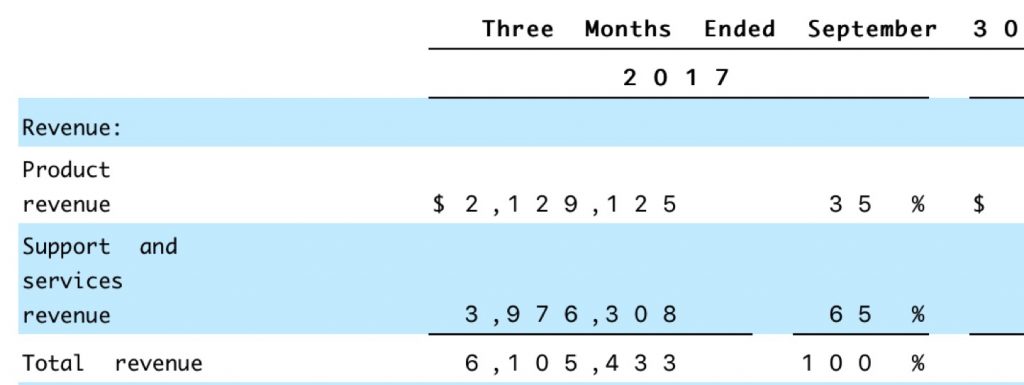

Product revenue from FreeStor product decreased by $0.1 million; this was offset by an increase of product revenue from legacy products of $0.1 million for the three months ended September 30, 2017, compared with the prior year period. FreeStor represented 41% and 47% of total product revenue for the three months ended September 30, 2017 and 2016, respectively. Product revenue from legacy products represented 59% and 53% of total product revenue for the three months ended September 30, 2017 and 2016, respectively.

Product revenue from FreeStor product increased by $0.5 million; however, this increase was more than offset by a decrease of product revenue from legacy products of $1.3 million for the nine months ended September 30, 2017, compared to one year ago.

Product revenue represented 35% and 33% of total revenue for the nine months ended September 30, 2017 and 2016, respectively.

In third quarter of 2013, the company adopted a restructuring plan intended to better align cost structure with the skills and resources required to more effectively execute its long-term growth strategy and to support revenue levels expected to achieve on a go forward basis. It eliminated over 100 positions worldwide, implemented tighter expense controls, ceased non-core activities and closed or downsized several facilities.

Q3 Initiatives of the company:

- 1. Assembling leadership team

- 2. Improving expense base

- 3. Re-engaging install base

- 4. Securing funding commitment

To read the earnings call transcript

Read also:

Why FalconStor Never Was and Will Become FalconStar

Quarterly sales of only $6.7 million after 17 years of business

by Jean-Jacques Maleval | 2017.08.21 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter