HPE: Fiscal 4Q17 Financial Results

Modest growth for storage, 5% Q/Q, compared to 21% last three-month period

By Jean Jacques Maleval | November 23, 2017 at 2:35 pmHewlett Packard Enterprise Development LP (HPE) announced financial results for its fiscal 2017 fourth quarter, ended October 31, 2017.

The storage figures are modest compared to former three-month period.

Of course, storage revenue at $871 million for the period is the best number since 4FQ13, up 3% Q/Q and 5% Y/Y, but is was 21% and 11% respectively last quarter.

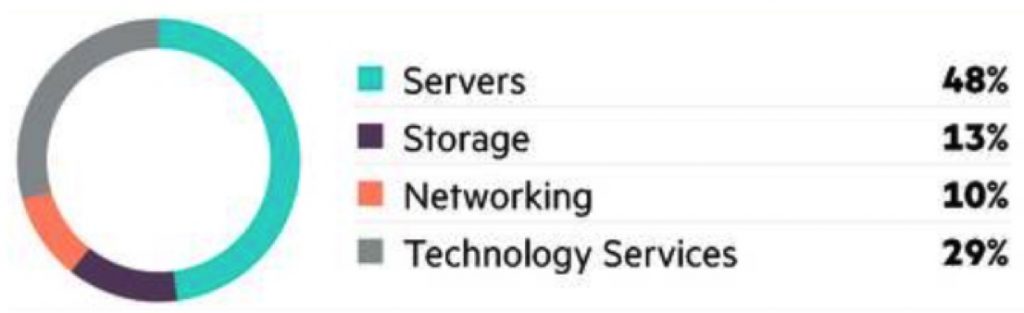

For the most recent period, storage represents 11% of the company’s global revenue ($7.8 billion).

Enterprise group revenue, 4FQ17

For the global fiscal year just closed, storage is reaching $3,144 million, down 3% from FY16, or the equivalent of 8% of total yearly sales ($37.4 billion).

All-flash array quarterly revenue are growing yearly 16% (compared to 30% last quarter) driven by the Nimble acquisition – up over 80% – which continues to outpace expectations.

3Par performance was soft due to a tough competitive environment in the mid-range and some go-to-market challenges in America.

The company is addressing these challenges by bringing together the Nimble and 3Par sales team under a new leader, Keegan Riley – who was VP of Americas sales at Nimble after 4 years at HP storage division and 2 years as EMC account executive – with the position of VP and GM, North America storage business unit, and is hiring more storage specialists for the field.

The company is addressing these challenges by bringing together the Nimble and 3Par sales team under a new leader, Keegan Riley – who was VP of Americas sales at Nimble after 4 years at HP storage division and 2 years as EMC account executive – with the position of VP and GM, North America storage business unit, and is hiring more storage specialists for the field.

Phil Davis, new HPE’s chief sales officer, comes from a storage background. He was VP and GM, storage, enterprise group, AsiaPac and Japan from 2014 to 2016 after being VP and GM enterprise solutions at Dell for 6 years, EVP of Dot Hill during 4 years, following 1 year as SVP, WW sales at Chapparal Network Storage.

Phil Davis, new HPE’s chief sales officer, comes from a storage background. He was VP and GM, storage, enterprise group, AsiaPac and Japan from 2014 to 2016 after being VP and GM enterprise solutions at Dell for 6 years, EVP of Dot Hill during 4 years, following 1 year as SVP, WW sales at Chapparal Network Storage.

Our readers remember probably Alain Andreoli who was president and CEO of Xiotech from 2003 to 2005, later president of Sun Europe (now Oracle), president and CEO of Grass Valley. He joins HP in July 2010 being named last September SVP and GM of hybrid IT group.

Our readers remember probably Alain Andreoli who was president and CEO of Xiotech from 2003 to 2005, later president of Sun Europe (now Oracle), president and CEO of Grass Valley. He joins HP in July 2010 being named last September SVP and GM of hybrid IT group.

By region, HPE’s performance in the Americas remains steady as core compute stabilized and networking growth accelerated offset somewhat by softer organic storage results.

About price of flash chips, CFO Tim Stonesifer commented: “So over the course of the year and as far as NAND goes we have had supply constraint earlier in the year those are fairly minimal now and there have been some limited price increases there, but not to the extent of the memory.”

Quarterly revenue for HP end then HPE for storage only

(in $ million)

| 4FQ16 | 3FQ17 | 4FQ17 | FY16 | FY17 | |

| Storage revenue | 827 | 844 | 871 | 3,235 | 3,144 |

| Q/Q growth | -5% | 21% | 3% | Y/Y growth | -3% |

Quarterly revenue for HP and then HPE for storage only since 1FQ13*

(in $ million)

| Fiscal quarter |

Revenue |

Q/Q Growth |

| 1Q13 | 833 | -12% |

| 2Q13 | 857 | 3% |

| 3Q13 | 833 | -3% |

| 4Q13 | 952 | 14% |

| 1Q14 | 834 | -12% |

| 2Q14 | 808 | -3% |

| 3Q14 | 796 | -1% |

| 4Q14 | 878 | 10% |

| 1Q15 | 837 | -5% |

| 2Q15 | 740 | -12% |

| 3Q15 | 784 | 6% |

| 4Q15 | 905 | 3% |

| 1Q16 | 863 | 3% |

| 2Q16 | 752 | -13% |

| 3Q16 | 763 | 1% |

| 4Q16 | 779 | 8% |

| 1Q17 | 730 | -6% |

| 2Q17 | 699 | -4% |

| 3Q17 | 844 | 21% |

| 4Q17 | 871 | 3% |

* During these more recent periods, HPE has changed the spectrum of its storage business. We have kept the initial figures.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter