Mimecast: Fiscal 2Q18 Financial Results

Sales up 42%, but once more with losses

This is a Press Release edited by StorageNewsletter.com on November 10, 2017 at 2:14 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 44.4 | 63.1 | 85.8 | 121.2 |

| Growth | 42% | 41% | ||

| Net income (loss) | 0.3 | (1.3) | 0.5 | (3.2) |

Mimecast Limited announced financial results for the second quarter ended September 30, 2017.

“In the second quarter, we expanded the organization into Germany to better serve our customers in the region with local support teams and data residency in 2018,” stated Peter Bauer, CEO.

CFO Peter Campbell noted, “Once again we delivered top and bottom line results that exceed our guidance. Balancing growth and profitability, we executed well on our business model.“

Second Quarter 2018 Financial Highlights

- Revenue: GAAP revenue was $63.1 million, an increase of 42% compared to $44.4 million of GAAP revenue in the second quarter of 2017. Revenue on a constant currency basis increased 41% compared to the second quarter of 2017.

- Customers: Added 900 net new customers. Now serves over 28,200 organizations globally.

- Revenue Retention Rate: Revenue retention rate was 111%, consistent with the prior quarter and the second quarter of 2017.

- Gross Profit percentage: Gross profit percentage was 74%, up from 72% in the second quarter of 2017.

- GAAP Net Loss: GAAP net loss was $1.3 million, or $(0.02) per basic and diluted share, based on 57.0 million weighted-average shares outstanding.

- Adjusted EBITDA: Adjusted EBITDA was $6.7 million, representing an adjusted EBITDA margin of 11% up from 6% in the second quarter of 2017.

- Non-GAAP Net Income: Non-GAAP net income was $0.1 million, or $0.00 per share, based on 60.9 million diluted shares outstanding.

- Free Cash Flow and Cash: Generated $1.7 million of free cash flow. Cash and investments as of September 30, 2017 were $123.1 million.

Second Quarter 2018 Business Highlights

- Launched the Multipurpose Cloud Archive delivering an all-in-one cloud service that integrates: a secure data repository, built-in data recovery, storage management, e-discovery and compliance capabilities. Customers gain access to their email archive anywhere, anytime, and on any device in record speed.

- Was named a Leader, with the Highest Ability to Execute in the Gartner 2017 Enterprise Information Archiving Magic Quadrant.

- Announced the expansion of operations into Germany in 2018 with local sales, customer support, and two data centers. Michael Heuer will lead German team from country HQs in Munich. Additional resources based in Dusseldorf and Frankfurt add support for the region.

- Announced Gerri Elliott had joined our board of directors. She is known as an enterprise go-to-market expert in technology companies given her three-decade executive history with Juniper, Microsoft and IBM. She is the founder of Broadrooms.com, a website focused on executive women who serve or want to serve on corporate boards. In addition to Mimecast, she currently serves as an independent director on the boards of Whirlpool, Marvell Technologies and Imperva.

- Achieved attestation to the SOC 2 Type II standard. The completion of this voluntary attestation demonstrates continuous dedication to maintaining stringent and effective operating controls for the security and availability of its customers’ data stored in Mimecast facilities.

- Sales of Targeted Threat Protection increased during the second quarter. More than 13,300 customers now use the service.

Third Quarter 2018 Guidance:

Constant currency revenue growth is expected to be in the range of 31% to 32% and revenue is expected to be in the range of $64.3 million to $65.0 million. Guidance is based on exchange rates as of October 31, 2017 and includes a positive impact of $1.3 million related to the weakening of the US dollar compared to the prior year. Adjusted EBITDA for the third quarter is expected to be in the range of $5.8 million to $6.8 million.

Full Year 2018 Guidance:

Revenue is expected to be the range of $251.8 million to $254.5 million or 34% to 36% growth in constant currency. Foreign exchange rate fluctuations are positively impacting this guidance by an estimated $1.4 million related to the weakening of the US dollar with respect to the pound. Relative to the prior annual guidance we gave in August, foreign exchange rate fluctuations are negatively impacting this guidance by an estimated $1.5m. Expected growth rate considers the McAfee end of life which resulted in high linearity of sales in the third quarter and second half of last year resulting in tougher compares in the second half of this year. Adjusted EBITDA is expected to be in the range of $21.9 million to $23.9 million.

Comments

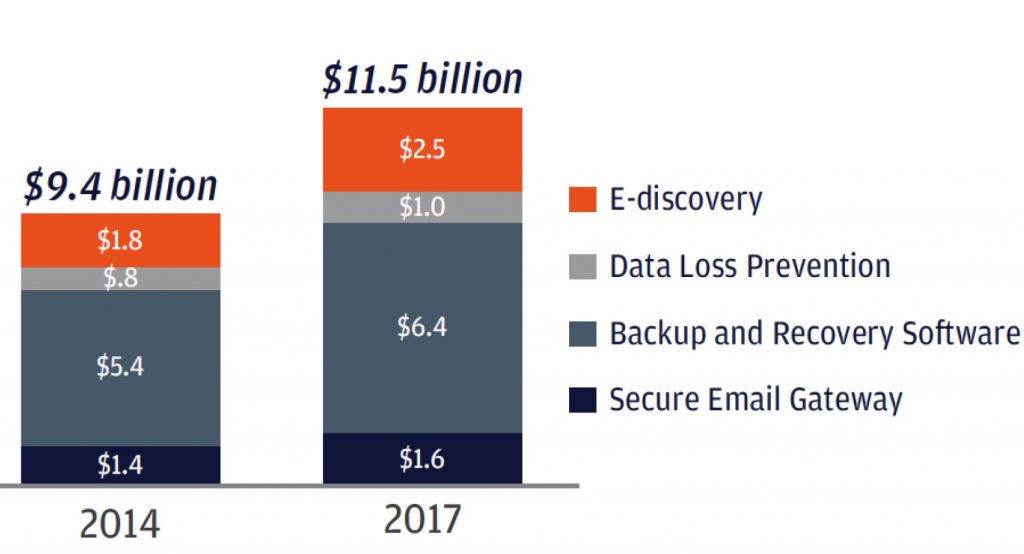

Market opportunity

Abstracts of the earnings call transcript:

Peter Campbell, CFO:

"We have seen a small increase in micro customer churn related to X-McAfee customers which has impacted our net customer additions.

"Our TTP Service is now deployed with 13,000 customers. Demand continues from both new and existing customers, which represents a significant opportunity as we expand the TTP family with add on products like internal email protect.

"Approximately 90% of our new customers are buying TTP when they buy our gateway product and in total 47% of our customers are using targeted threat protection.

"We have also seen customers buying our new products, like Internal Email Protect and Sync & Recover. We now have 300 customers using Internal Email Protect, which was launched in February and 100 customers using Sync & Recover which was launched in August.

"Product bundles introduced this time last year are positively impacting the number of products per customer. The percentage of customers with four or more services has increased and now represents 31% of users, across our base customers by an average of 2.8 services.

"Our revenue retention at 111% remains strong and is consistent with last quarter. Up sell of our products, especially TTP continue to drive a higher revenue retention number.

"As we roll out our German data centers, we expect a nominal reduction in our gross margin, while the German operation gets to scale. Gross margin can fluctuate due to the timing of expenditure to support our ongoing operations. We anticipate gross margins to be in the 71% to 73% range over the next several quarters."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter