Seagate: Fiscal 1Q18 Financial Results

Excellent quarter from former one, not from one year ago

This is a Press Release edited by StorageNewsletter.com on October 25, 2017 at 2:27 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

2,797 | 2,632 | -6% |

| Net income (loss) | 167 | 181 |

Seagate Technology plc reported financial results for the quarter ended September 29, 2017.

For the first quarter, the company reported revenue of $2.6 billion, gross margin of 28.0%, net income of $181 million and diluted earnings per share of $0.62.

On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 29.0%, net income of $279 million and diluted earnings per share of $0.96.

During the first quarter, the company generated $237 million in cash flow from operations and returned approximately $350 million to shareholders in the form of dividends and share repurchases. Cash and cash equivalents totaled approximately $2.3 billion at the end of the quarter.

There were 289 million ordinary shares issued and outstanding as of the end of the quarter.

“The results of our performance this quarter reflect solid execution and market demand for our storage product portfolio,” said Dave Mosley, CEO. “Seagate delivered record levels of exabyte shipments and generated sequential growth in revenue and profit. As the demand for storage continues to benefit from the proliferation of data, Seagate is in a strong position to grow its businesses, improve profitability and continue with its shareholder-return objectives.”

The board of directors of the company has approved a quarterly cash dividend of $0.63 per share, which will be payable on January 3, 2018 to shareholders of record as of the close of business on December 20, 2017. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

Global HDD industry records an excellent 3CQ16 following a surprising increase of demand, with around 8% of more units shipped from the former quarter according to Trendfocus.

Of course, Seagate, with 91% of total revenue in HDDs - and 9% form other businesses (enterprise systems, flash and others) -, benefits with sales up 9% Q/Q but down 6% Y/Y.

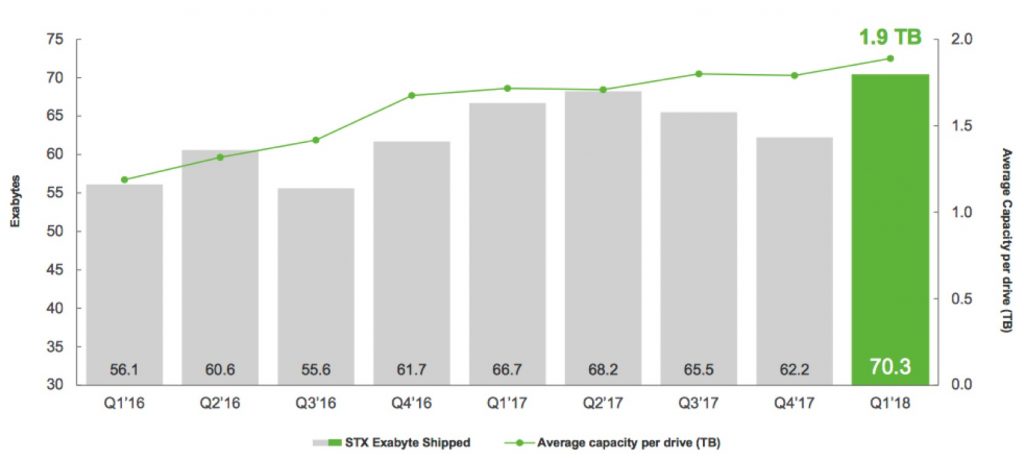

Consequently exabytes shipped are up 13% quarterly at more than 70EB, a record for the company, average capacity of HDDs shipped increasing from 1.8TB to 1.9TB with the same average price per drive, $64.

Notebook compute revenue was up 37% with exabytes up 75% yearly.

The HDD maker shipped over one million 10TB helium units, up threefold from the June quarter, and sequential volume and revenue grew in 12TB helium nearline products.

The company even expects next quarter to be better with revenue ranging from $2.71 billion to $2.76 billion (+3% to 5%) - which is better than consensus for $2.63 billion - with strong exabyte growth.

The firm said to make progress towards the introduction of HAMR devices, which are expected to be shipping in volume in 2019. Over the past year, it has been ramping production and have shared samples of current generation. It added that early customer feedback from more than six months ago, using standard qualification processes, demonstrated that the technology will not require any changes for customers to adopt.

In the earnings call transcript, here is what president and COO Dave Mosley said about its $1.25 billion investment into Toshiba Memory NAND business:

"At the end of September, Seagate announced our participation in this consortium led by Bank Capital Private Equity that has entered into an agreement with Toshiba Corporation to acquire Toshiba Memory Corporation. We are pleased to be part of the consortium and to help facilitate maintaining Toshiba Memory as a world-leading, independent NAND technology company.

"Over the course of many years, Seagate's developed a long-term relationship with Toshiba Memory, and we have also been impressed with their consistent leadership in advancing NAND technology. We believe that Bank Capital is dedicated to the long-term success of Toshiba Memory, and this acquisition is in the long-term best interest of our industry and the storage customers worldwide.

"In addition, we expect to enter into a long-term NAND supply agreement with Toshiba Memory, and that will provide continuity of raw NAND for our extending product portfolio. We have developed our NAND storage technology portfolio over the last several years and today, we have a broad offering of flash-based products that are ready to scale and grow across multiple markets.

"Our NAND supply agreement with Toshiba Memory will enable Seagate to continue innovating and providing customers with storage solutions that fit their needs, be it HDDs, SSDs or hybrid solutions. This agreement has the opportunity to increase the potential for meaningful future revenue growth from Seagate's NAND storage portfolio while providing significant value for our storage customers."

HDD exabyte shipped and average capacity per drive

Click to enlarge

The manufacturer has decided once more not to reveal its quarterly HDD unit shipments, estimated between 36.5 and 37.0 million by Trendfocus, but only exabytes per product. Here it is:

HDD mix trends

| 4Q17 | 1Q18 | |

| EB enterprise mission critical | 2.2 | 2.1 |

| EB enterprise nearline | 21.2 | 25.1 |

| EB client non-compute consumer electronics | 12.4 | 13.5 |

| EB client non-compute consumer | 9.5 | 11.1 |

| EB client compute, desktop+notebook | 16.8 | 18.6 |

| Enterprise as % of total revenue | 37% | 36% |

| Client non-compute as % of total revenue | 29% | 29% |

| Client compute as % of total revenue | 26% | 26% |

Revenue by products in $ million

| 4FQ17 | 1FQ18 | Growth | % of total revenue | |

| HDDs | 2,220 | 2,390 | 8% | 91% |

| Enterprise systems, flash and others |

186 | 242 | 30% | 9% |

Seagate's HDDs from 1FQ15 to 1FQ18

| Fiscal period |

HDD ASP |

Exabytes | Average |

| shipped | GB/drive | ||

| 1Q15 | $60 | 59.9 | 1,007 |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter