WW Converged Systems Revenue Increased 6.2% Y/Y in 2Q17 – IDC

Vendor sales at $3.15 billion, HPE sharply down

This is a Press Release edited by StorageNewsletter.com on September 29, 2017 at 2:26 pmAccording to the International Data Corporation‘s Worldwide Quarterly Converged Systems Tracker, worldwide converged systems vendor revenues increased 6.2% year over year to $3.15 billion during 2Q17.

The market consumed 1.78EB of new storage capacity during the quarter, which was up 5.6% compared to the same period a year ago.

“The converged systems market is benefiting from an expansion into new environments and a new set of customers,” said Eric Sheppard, research director, enterprise storage and converged systems. “This expansion is driven by products that are offering new levels of automation, tighter integration between technologies, and, in many cases, software-defined solutions based on scale-out architectures.”

Converged Systems Segments

Converged systems market view recognizes four segments: integrated infrastructure, certified reference systems, integrated platforms, and hyperconverged systems. Integrated infrastructure and certified reference systems are pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Integrated Platforms are integrated systems that are sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools. Hyperconverged systems collapse core storage and compute functionality into a single, highly virtualized solution. A key characteristic of hyperconverged systems that differentiate these solutions from other integrated systems is their scale-out architecture and their ability to provide all compute and storage functions through the same x86 server-based resources.

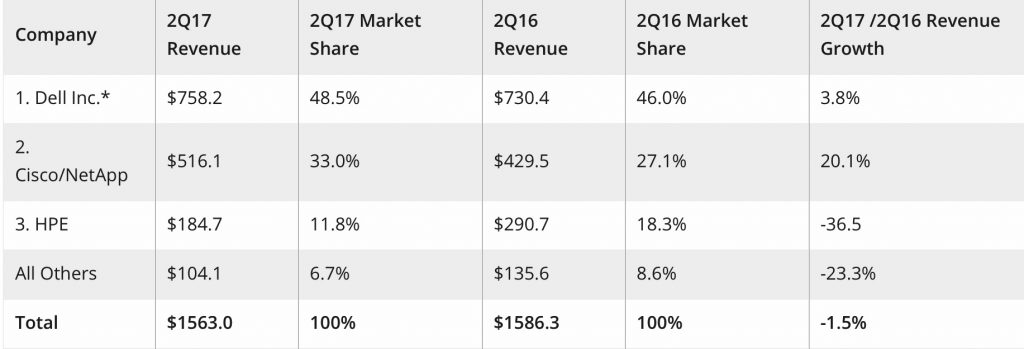

During the second quarter of 2017, the combined integrated infrastructure and certified reference systems market generated revenues of $1.56 billion, which represented a yearly decrease of 1.5% and 49.6% of the total market. Dell Inc. was the largest supplier of this combined market segment with $758 million in sales, or 48.5% share of the market segment.

Top 3 Companies, WW Integrated Infrastructure and Certified Reference Systems, 2Q17

(revenue in million)

(Source: IDC WW Quarterly Converged Systems Tracker, September 26, 2017)

(Source: IDC WW Quarterly Converged Systems Tracker, September 26, 2017)

* Note: Dell Inc. represents the combined revenues for Dell and EMC sales for all quarters shown.

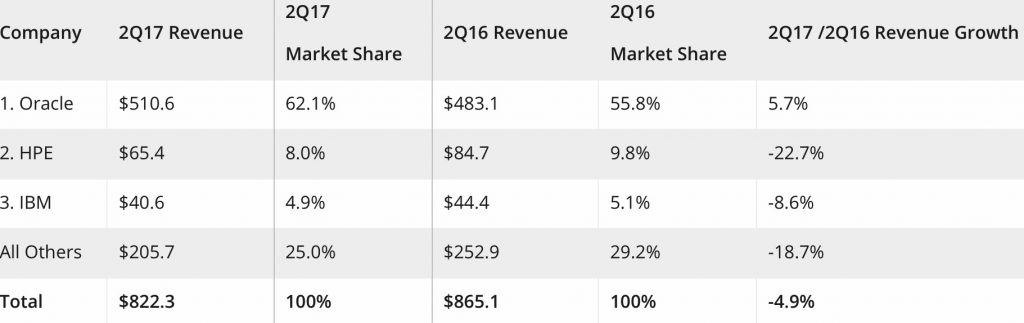

Integrated Platform sales declined 4.9% year over year during the second quarter of 2017, generating $822.3 million worth of sales. This amounted to 26.1% of the total market revenue. Oracle was the top-ranked supplier of integrated platforms during the quarter, generating revenues of $510 million and capturing a 62.1% share of the market segment.

Top 3 Companies, Worldwide Integrated Platforms, 2Q17

(revenue in million)

(Source: IDC WW Quarterly Converged Systems Tracker, September 26, 2017)

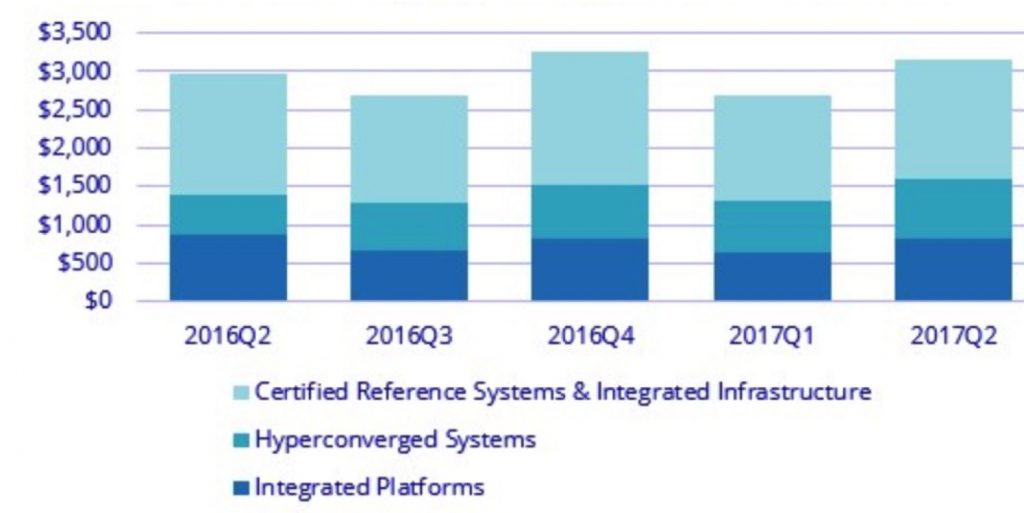

Hyperconverged sales grew 48.5% year over year during the second quarter of 2017, generating $763.4 million worth of sales. This amounted to 24.2% of the total market value.

WW Converged Sytems Market by Product Category 2Q17 Vendor Revenue

Taxonomy Notes

IDC defines converged and hyperconverged systems as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Systems not sold with all four of these components are not counted within this tracker. Specific to management software, IDC includes embedded or integrated management and control software optimized for the auto discovery, provisioning and pooling of physical and virtual compute, storage and networking resources shipped as part of the core, standard integrated system. Numbers in this press release may not sum due to rounding.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter