Nutanix: Fiscal 4Q17 Financial Results

Explosive growth and loss

This is a Press Release edited by StorageNewsletter.com on September 4, 2017 at 2:39 pm| (in $ million) | 4Q16 | 4Q17 | FY16 | FY17 |

| Revenue | 139.8 | 226.1 | 444.9 | 766.9 |

| Growth | 62% | 72% | ||

| Net income (loss) | (49.9) | (90.7) | (168.5) | (458.0) |

Nutanix, Inc. announced financial results for its fourth quarter and fiscal year ended July 31, 2017.

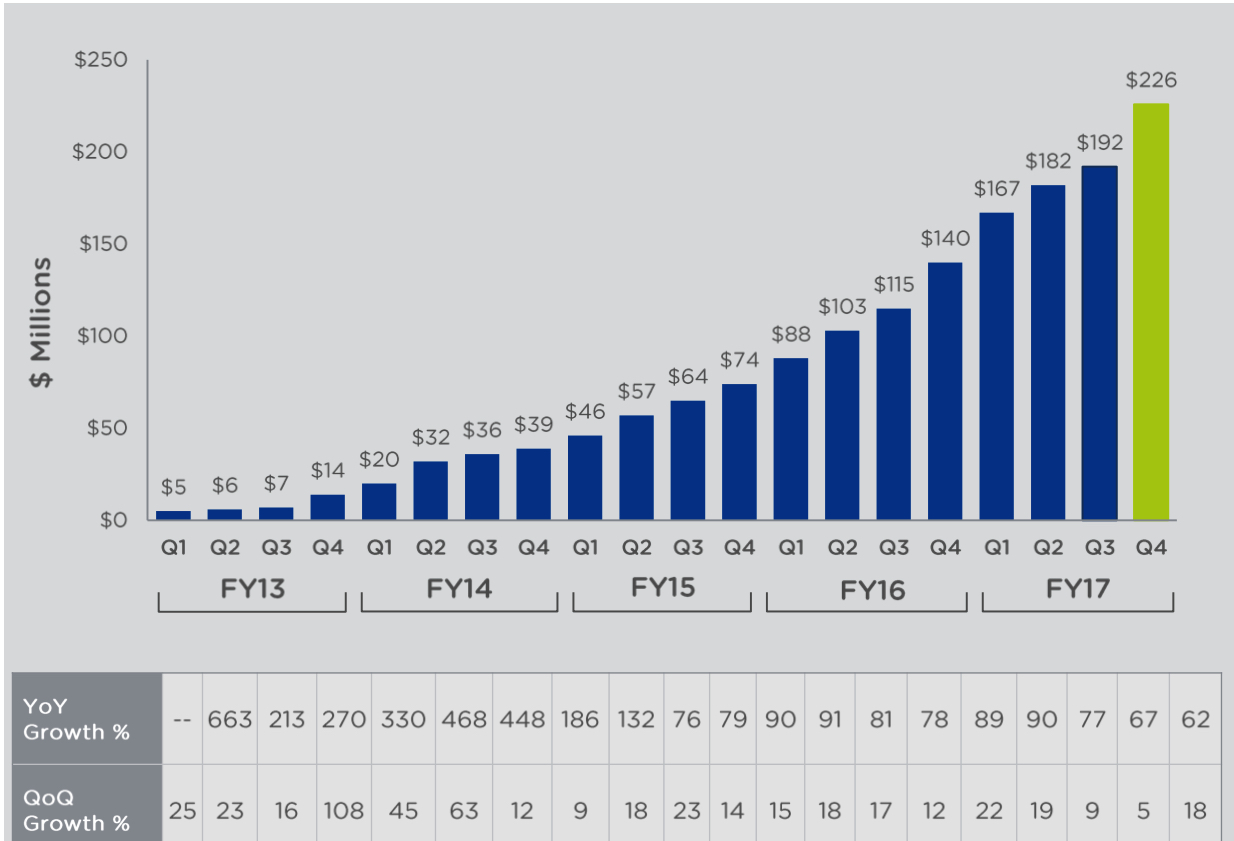

Fourth Quarter Fiscal Year 2017

• Revenue: $226.1 million, growing 62% year-over-year from $139.8 million in the fourth quarter of fiscal 2016

• Billings: $289.2 million, growing 40% year-over-year from $206.6 million in the fourth quarter of fiscal 2016

• Net Loss: GAAP net loss of $90.7 million, compared to a GAAP net loss of $49.9 million in the fourth quarter of fiscal 2016; Non-GAAP net loss of $50.6 million, compared to a non-GAAP net loss of $46.7 million in the fourth quarter of fiscal 2016

• Net Loss Per Share: GAAP net loss per share of $0.59, compared to a pro forma GAAP net loss per share of $0.41 in the fourth quarter of fiscal 2016; Non-GAAP net loss per share of $0.33, compared to a pro forma non-GAAP net loss per share of $0.39 in the fourth quarter of fiscal 2016

• Cash and Short-term Investments: $349.1 million, up 88% from the fourth quarter of fiscal 2016

• Deferred Revenue: $526.1 million, up 77% from the fourth quarter of fiscal 2016

• Operating Cash Flow: $5.9 million, compared to $2.4 million in the fourth quarter of fiscal 2016

• Free Cash Flow: $(6.5) million, compared to $(6.5) million in the fourth quarter of fiscal 2016

Fiscal 2017

• Revenue: $766.9 million, growing 72% year-over-year from $444.9 million in fiscal 2016

• Billings: $990.5 million, growing 55% year-over-year from $637.8 million in fiscal 2016

• Net Loss: GAAP net loss of $458.0 million, compared to a GAAP net loss of $168.5 million in fiscal 2016; Non-GAAP net loss of $199.1 million, compared to a non-GAAP net loss of $150.4 million in fiscal 2016

• Net Loss Per Share: GAAP net loss per share of $3.57, compared to a GAAP net loss per share of $3.83 in fiscal 2016; pro forma GAAP net loss per share of $3.23, compared to a pro forma GAAP net loss per share of $1.40 in fiscal 2016; pro forma Non-GAAP net loss per share of $1.40, compared to a pro forma non-GAAP net loss per share of $1.25 in fiscal 2016

• Operating Cash Flow: $13.8 million, compared to $3.6 million in fiscal 2016

• Free Cash Flow: $(36.4) million, compared to $(38.7) million in fiscal 2016

“The fourth quarter was another record quarter and an outstanding conclusion to the fiscal year. Our newly announced products, Nutanix Calm and Xi Cloud Services, extend our market opportunity by simplifying and harmonizing datacenter operations for the multi-cloud era,” said Dheeraj Pandey, CEO. “This quarter, marked by record revenues, continued adoption of AHV, increased software-only sales, strong growth from our OEM partners, and positive operating cash flow, was a great way to end our first year as a public company.“

Recent company Highlights

• Continued Customer Growth: Eended the fourth quarter of fiscal 2017 with 7,051 end-customers in 125 countries, adding over 875 new end-customers during the quarter. Fourth quarter customer wins included ABC Stores, Amgen, Bacardi, HCA Healthcare, Konica Minolta Business Solutions Europe GmbH, The Hershey company, The Home Depot, and Tokopedia.

• Increased Number of $1 Million+ Deals: 43 customers with deals over $1 million in the quarter, up 39% Y/Y.

• Innovating for the Multi-Cloud Era: Introduced Nutanix Calm and Xi Cloud Services, along with a strategic alliance with Google to blend the Nutanix environment with the Google Cloud Platform, providing new functionality to address the challenges of the multi-cloud era.

• Increased AHV Penetration: Saw a 75% Y/Y increase in adoption of AHV, built-in hypervisor, based on a four-quarter rolling average of nodes using AHV as a percentage of total nodes sold.

• Participation in 3rd Annual .NEXT Conference: 3,500+ attendees with 50+ customer speakers, over 60 partner sponsors, and keynote addresses from industry visionaries including Bill McDermott, CEO, SAP; Diane Greene, SVP, Google Cloud; Chad Sakac, president, VCE – Converged Platform Division, Dell EMC; and Kirk Skaugen, EVP and president, Lenovo Datacenter Group.

For the first quarter of fiscal 2018, Nutanix expects:

• Revenues between $240 and $250 million;

• Non-GAAP gross margin of approximately 58%;

• Non-GAAP operating expenses between $195 and $200 million;

• Non-GAAP net loss per share of $0.37, using 156 million weighted shares outstanding.

Comments

Nutanix is one of the fastest growing companies in the worldwide storage industry but also with the fastest growing net loss. Y/Y sales were up 62% and net losses 82%.

Billings, revenue, gross margin, and EPS performance were better than company's guidance and consensus.

It will take several quarters to be profitable but the firm has enough cash, $349 million, to pursue its successful business.

Nutanix has a good chance to be a one billion dollar company next fiscal year. It will happen with yearly growth of 30% in FY18 compared to 75% in FY17.

Software only bookings grew by 96% and hypervisor AHV adoption by 214% based on number of nodes.

Number of employees is now 2,813 from 1,980 at the end of FY16.

Customers

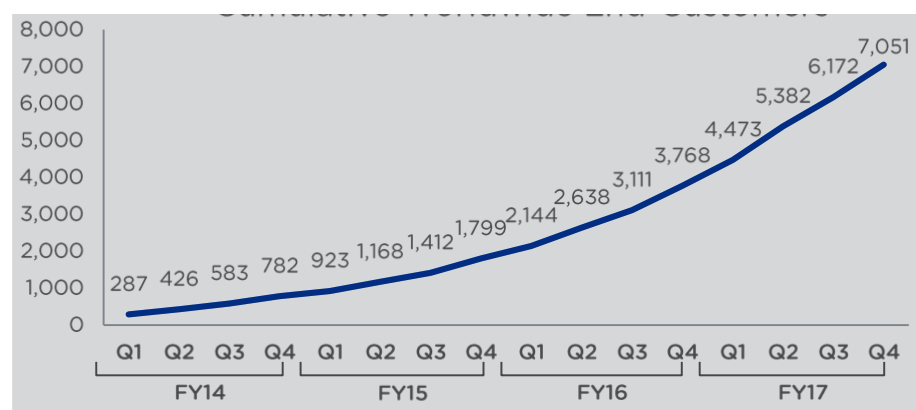

Cumulative worldwide end customers

• Total of 7,051 up 87% Y/Y

• 3,300 new customers during the year

• 4.1x initial purchase for customers >18 months average repeat purchase

• 70% of bookings from repeat customers

• 559 Global 2000 customers

• 330 with lifetime bookings of $1-3 million

• 52 with lifetime bookings of $3-5 million

• 39 with more than $5 million in lifetime bookings

• 11 customers have purchased over $10 million lifetime to-date

• In 4FQ17 alone, top 25 customers made up $74 million in bookings

• 37% of bookings from international customers: in 4FQ17, EMEA region nearly doubled their performance from the 1FQ17. APAC region was the best performing geography in FY17 with a 90% increase in Y/Y bookings.

Largest partner is CDW. Fourth quarter software bookings were aided by Dell representing slightly above 10% of total bookings.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter