Marvell: Fiscal 2Q18 Financial Results

Storage increasing 13% Y/Y despite headwinds in HDD market, representing 52% of global revenue

This is a Press Release edited by StorageNewsletter.com on August 28, 2017 at 2:16 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 597.3 | 604.8 | 1,111 | 1,177 |

| Growth | 1% | 6% | ||

| Net income (loss) | 51.3 | 165.3 | 28.6 | 271.9 |

Marvell Technology Group Ltd. reported financial results for the second fiscal quarter of fiscal year 2018.

Revenue for the second quarter of fiscal 2018 was $605 million, which exceeded the midpoint of the company’s guidance provided on May 25, 2017.

GAAP net income from continuing operations for the second quarter of fiscal 2018 was $135 million, or $0.26 per share. Non-GAAP net income from continuing operations for the second quarter of fiscal 2018 was $153 million, or $0.30 per diluted share. Cash flow from operations for the second quarter was $101 million.

“I am pleased to report that our second quarter results demonstrated Marvell’s continued transformation as a company, achieving revenue above the midpoint of our guidance, improved profitability and continued return of capital to shareholders,” said Matt Murphy, president and CEO. “I’m proud of our team – in a competitive environment, we are delivering innovative solutions that our customers clearly value.“

3FQ18 Financial Outlook

- Revenue is expected to be $595 million to $625 million.

- GAAP and non-GAAP gross margins are expected to be approximately 61% to 62%.

- GAAP operating expenses are expected to be $230 million to $240 million.

- Non-GAAP operating expenses are expected to be $205 million to $210 million.

- GAAP diluted EPS from continuing operations is expected to be in the range of $0.25 to $0.31 per share.

- Non-GAAP diluted EPS from continuing operations is expected to be in the range of $0.30 to $0.34 per share.

The company’s financial results for prior periods presented herein have been recast to reflect certain businesses that were classified as discontinued operations during the fourth quarter of fiscal year 2017 and second quarter of fiscal year 2018.

Comments

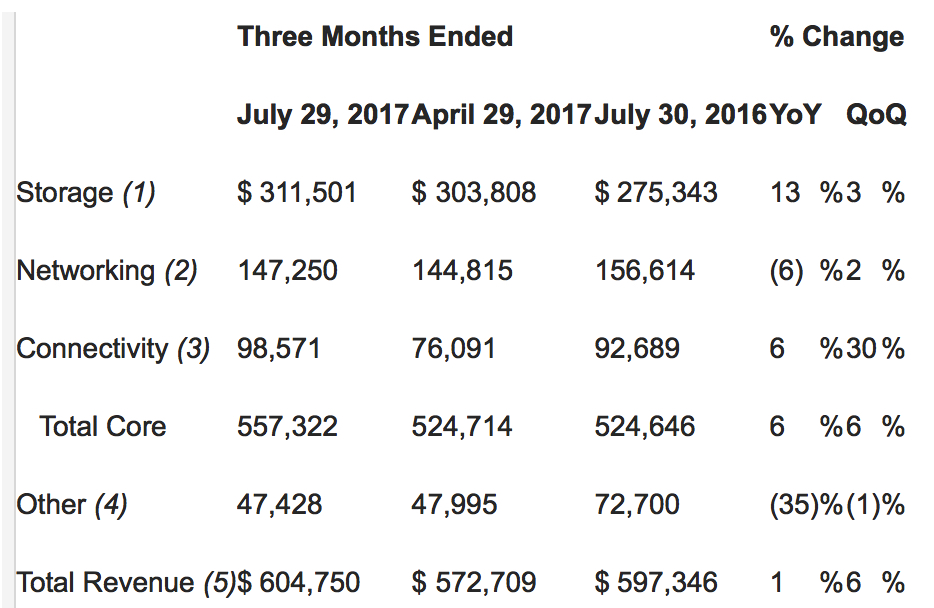

Quartely revenue trends

(in thousands)

(1) Storage products are comprised primarily of HDD, SSD controllers and enterprise storage solutions.

(1) Storage products are comprised primarily of HDD, SSD controllers and enterprise storage solutions.

(2) Networking products are comprised primarily of Ethernet switches, Ethernet transceivers, embedded ARM processors and automotive Ethernet, as well as a few legacy product lines in which we no longer invest, but will generate revenue for several years.

(3) Connectivity products are comprised primarily of WiFi solutions including WiFi only, WiFi/Bluetooth combos and WiFi microcontroller combos.

(4) Other products are comprised primarily of printer solutions, application processors and others.

Abstracts of the earnings call transcript:

Matthew Murphy, president and CEO:

"I'm pleased to report that in Q2, our storage business performed above expectations, growing 13% year-over-year despite headwinds in the HDD market. We achieved this upside by stronger-than-expected growth of our SSD products for the enterprise and data center market. Our SSD business grew sequentially and now accounts for more than 25% of our storage revenue. We achieved this growth despite supply constraints in the NAND market. Customers continue to choose Marvell because we offer one of the industry's broadest family of client-to-cloud controllers spanning all key protocols, including SATA, SAS and NVMe, as well as best-in-class power and performance. Our solutions, which feature Marvell's unique NANDEdge error-correction technology, are also helping enable new generations of 3D and QLC NAND memory. This demonstrates that Marvell is well positioned to benefit as the overall storage market continues to shift from hard disk drives to SSDs.

"We've also been making significant progress diversifying Marvell's HDD business. We're expanding in key growth segments such as the cloud and data center as well as into growing consumer markets. In addition, as our mix shifts to higher-capacity HDD products, we have the opportunity to capture more content. As a result of these diversification efforts, we estimate that our exposure to the HDD notebook segment represents less than 15% of total company revenue.

"We continue to believe that the storage market transition from HDD to SSD will be positive for Marvell. As an example, we estimate that our total storage sales into notebooks will grow in fiscal 2018 versus fiscal 2017, with growth in SSD sales more than offsetting the decline in HDD sales."

Jean Hu, CFO:

"Our core business of storage, networking and connectivity grew 6% year-over-year, above the midpoint of our guidance range and accounted for 92% of total revenue. Storage accounted for 52% of revenue and grew 13% year-over-year, driven by the rapid revenue ramp of SSD products and our increased market presence in the enterprise and the data center market with our broad HDD and SSD product portfolio.

"At the midpoint of our guidance, we expect our storage revenue to be approximately flat sequentially, reflecting our cautious view of HDD demand in the near term."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter