Brocade: Fiscal 3Q17 Financial Results

SAN product revenue down 2% Y/Y; no guidancen in light of acquisition by Broadcom

This is a Press Release edited by StorageNewsletter.com on August 28, 2017 at 2:14 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 590.7 | 549.3 | 1,688 | 1,683 |

| Growth | -7% | -0% | ||

| Net income (loss) | 10.5 | (19.6) | 147.2 | (36.2) |

Brocade Communications Systems, Inc. reported financial results for its third fiscal quarter, ended July 29, 2017.

It reported third quarter revenue of $549 million, down 7% year-over-year and down 1% quarter-over-quarter.

The company reported a GAAP diluted loss per share of $0.05, down from GAAP diluted earnings per share (EPS) of $0.02 in Q3 2016 and down from a GAAP diluted loss per share of $0.03 in Q2 2017. The year-over-year and sequential decline in GAAP diluted EPS was due in part to lower revenue, estimated losses related to completed and pending divestitures of certain software product lines, higher acquisition and divestiture-related expenses, and restructuring expenses associated with a voluntary separation plan for certain eligible employees implemented in Q3 2017. Non-GAAP diluted EPS was $0.16 for Q3 2017, down from non-GAAP diluted EPS of $0.21 in Q3 2016 and up from non-GAAP diluted EPS of $0.10 in Q2 2017. The year-over-year decline in non-GAAP diluted EPS was primarily due to lower revenue, while the sequential improvement was primarily due to lower operating expenses resulting from lower headcount.

In light of the pending acquisition of Brocade by Broadcom Limited, Brocade will not provide fiscal Q4 2017 guidance and will not hold a conference call to discuss these financial results.

Highlights:

• SAN product revenue of $276 million was down 2% year-over-year. The decline was primarily the result of lower fixed configuration and embedded switch sales, which declined 6% and 7%, respectively, partially offset by higher director sales, which increased 5% year-over-year. The year-over-year revenue performance was impacted by competition from alternative storage networking technologies and architectures, and customer uncertainty surrounding the pending acquisition of Brocade by Broadcom. Sequentially, SAN product revenue decreased 2%, consistent with historical seasonal revenue trends, with an 11% decline in director sales being partially offset by increased fixed-configuration and embedded switch sales of 3% and 14%, respectively.

• IP networking product revenue of $174 million, including $85 million of product revenue from Ruckus Wireless, was down 17% year-over-year. The decrease was primarily due to lower wired switch and router revenue partially offset by higher wireless revenue associated with the May 27, 2016 acquisition of Ruckus Wireless. The year-over-year increase in wireless revenue was primarily due to including only approximately two months of wireless revenue in the prior-year period. Sequentially, IP networking product revenue was flat as higher wireless revenue was offset by lower wired switch and router revenue. The year-over-year and sequential declines in wired switch and router revenue were due, in part, to Broadcom’s planned divestiture of Brocade’s IP networking business.

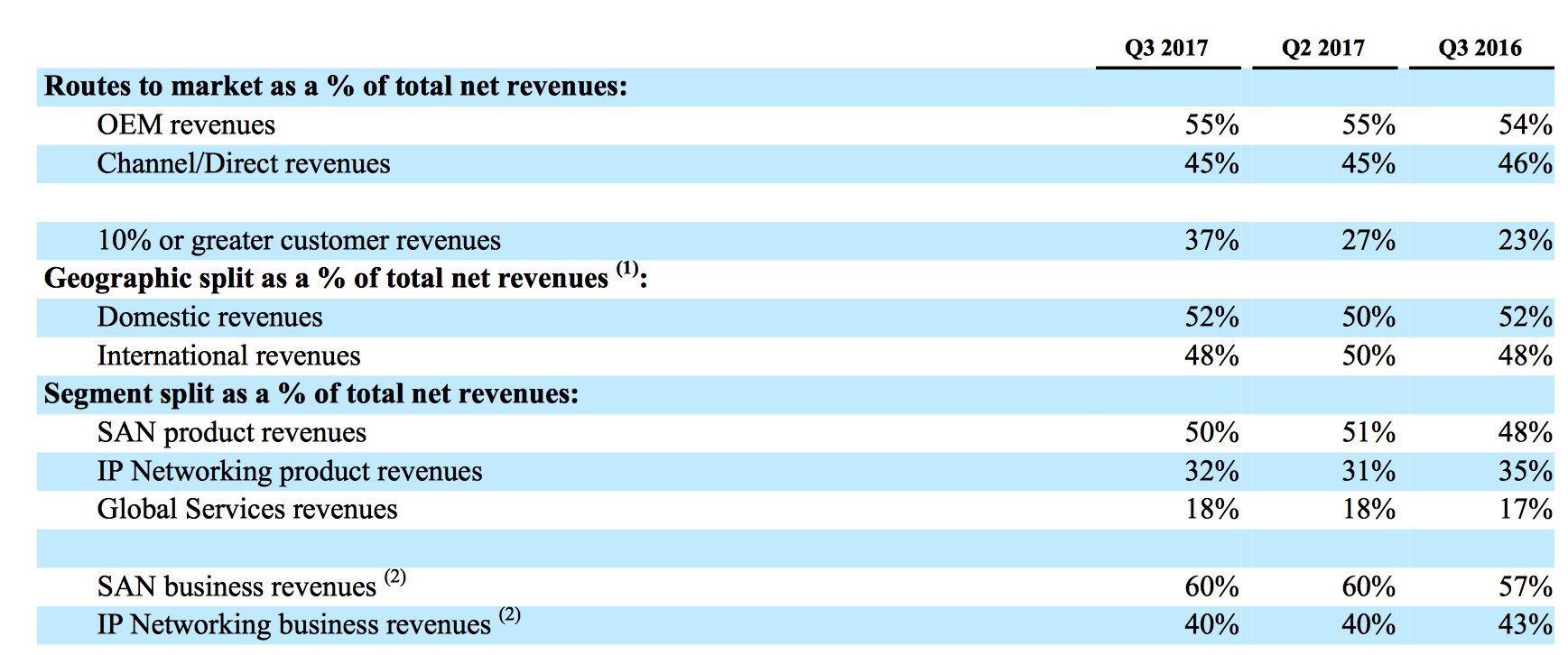

(1) Revenues are attributed to geographic areas based on known product delivery location. Since someOEM partner stake delivery of Brocade products domestically and then ship internationally to their end users, the percentage of international revenues based on end-user location would likely be higher.

(2) SAN and IP networking business revenues include hardware and software product, support,and services revenues.

The board of directors declared a regular fourth fiscal quarter cash dividend of $0.055 per share of the company’s common stock. The dividend payment will be made on October 3, 2017, to stockholders of record at the close of market on September 11, 2017.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter