Broadcom: Fiscal 3Q17 Financial Results

Enterprise storage at $735 million, 16% of global revenue and up 39% Y/Y

This is a Press Release edited by StorageNewsletter.com on August 28, 2017 at 12:10 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenue | 3,792 | 4,463 | 9,104 | 12,792 |

| Growth | 18% | 41% | ||

| Net income (loss) | (315) | 507 | (1,193) | 1,223 |

Broadcom Limited reported financial results for its third quarter of fiscal year 2017, ended July 30, 2017, and provided guidance for the fourth quarter of its fiscal year 2017.

Third Quarter Fiscal Year 2017 GAAP Results

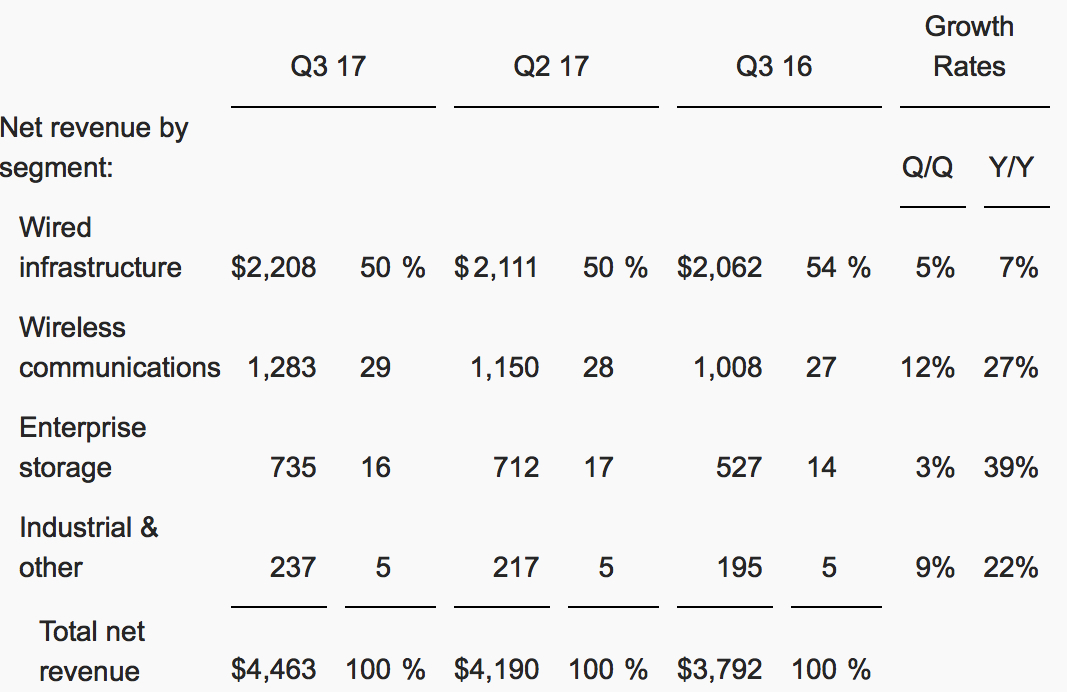

- Net revenue was $4,463 million, an increase of 7% from $4,190 million in the previous quarter and an increase of 18% from $3,792 million in the same quarter last year.

- Gross margin was $2,149 million, or 48.2% of net revenue. This compares with gross margin of $1,976 million, or 47.2% of net revenue, in the prior quarter, and gross margin of $1,782 million, or 47.0% of net revenue, in the same quarter last year.

- Operating expenses were $1,501 million. This compares with $1,502 million in the prior quarter and $2,046 million in the same quarter last year.

- Operating income was $648 million, or 14.5% of net revenue. This compares with operating income of $474 million, or 11.3% of net revenue, in the prior quarter, and operating loss of $264 million, or 7.0% of net revenue, in the same quarter last year.

- Net income, which includes the impact of discontinued operations, was $507 million, or $1.14 per diluted share. This compares with net income of $464 million, or $1.05 per diluted share, in the prior quarter, and net loss of $315 million, or $0.75 per diluted share, in the same quarter last year.

- Net income attributable to ordinary shares was $481 million. Net income attributable to the noncontrolling interest (restricted exchangeable limited partnership units, or REUs) in the company’s subsidiary, Broadcom Cayman L.P. was $26 million.

The company’s cash, cash equivalents and short term investments balance at the end of the third fiscal quarter was $5,449 million, compared to $4,454 million at the end of the prior quarter. During the third fiscal quarter, the company generated $1,656 million in cash from operations and spent $255 million on capital expenditures.

On June 30, 2017, the company paid a cash dividend of $1.02 per ordinary share, totaling $415 million. On the same date, the Partnership, of which the company is the General Partner, paid holders of REUs a corresponding distribution of $1.02 per REU, totaling $23 million.

Third Quarter Fiscal Year 2017

Non-GAAP Results From Continuing Operations

- Net revenue was $4,467 million, an increase of 6% from $4,201 million in the previous quarter, and an increase of 17% from $3,802 million in the same quarter last year.

- Gross margins was $2,827 million, or 63.3% of net revenue. This compares with gross margin from continuing operations of $2,652 million, or 63.1% of net revenue, in the prior quarter, and $2,297 million, or 60.4% of net revenue, in the same quarter last year.

- Operating income was $2,059 million, or 46.1% of net revenue. This compares with operating income from continuing operations of $1,853 million, or 44.1% of net revenue, in the prior quarter, and $1,489 million, or 39.2% of net revenue, in the same quarter last year.

- Net income was $1,871 million, or $4.10 per diluted share. This compares with net income of $1,666 million, or $3.69 per diluted share, in the prior quarter, and net income of $1,293 million, or $2.89 per diluted share, in the same quarter last year.

“We continue to execute consistently and delivered strong financial results for our third fiscal quarter, with revenue growth of 6% and EPS growth of 11% sequentially,” said Hock Tan, president and CEO. “We are expecting revenue growth to further accelerate in the fourth fiscal quarter, led by robust content gains and seasonal strength in our wireless segment.”

Comments

Abstracts of the earnings call transcript:

Hock Tan, president and CEO:

"We are also looking forward to completing the acquisition of Brocade and subject to the satisfaction of the remaining closing condition, we presently expect to close this transaction within our fourth fiscal quarter 2017.

"However, as noted in our last earnings call, we do not believe this strength to be sustainable in hard disk drive and sure enough we expect a sharp decline in demand for our hard disk drive products in the fourth quarter, driven by the start of an anticipated correction in a hard disk drive market.

"On the other hand, we expect our server and storage connectivity business to start to benefit from the [indiscernible] launch as it starts to ramp during the quarter. So despite these anticipated sharp correction in hard disk drive year-on-year, we expect this enterprise storage segment to show double-digit growth."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter