Pure Storage: Fiscal 2Q18 Financial Results

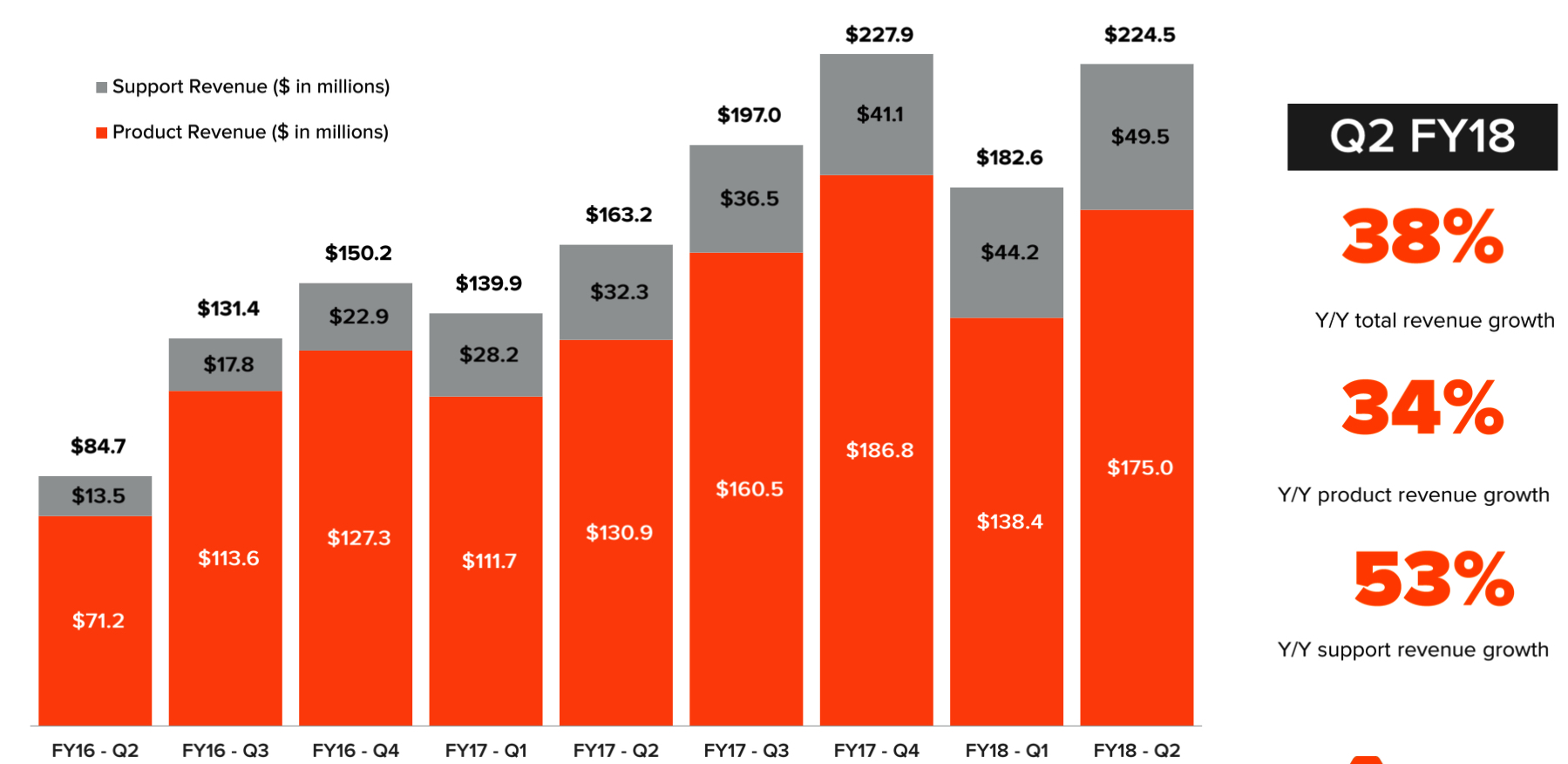

Revenue up 38% Y/Y and 23% Q/Q, but huge loss never stopping

This is a Press Release edited by StorageNewsletter.com on August 25, 2017 at 2:50 pm| (in $ million) | 2Q17 | 2Q18 | 6 mo. 17 | 6 mo. 18 |

| Revenue | 163.2 | 224.5 | 303.2 | 407.1 |

| Growth | 38% | 34% | ||

| Net income (loss) | (59.6) | (61.7) | (123.3) | (124.1) |

Pure Storage, Inc. announced financial results for its second quarter ended July 31, 2017.

Key quarterly business and financial highlights include:

• Quarterly revenue: $224.5 million, up 38% Y/Y, 3% ahead of midpoint of guidance

• Quarterly gross margin: 65.9% GAAP; 67.1% non-GAAP

• Quarterly operating margin: -28.6% GAAP; -11.8% non-GAAP, up 7.8 ppts and 7.5 ppts Y/Y, respectively

• Raising full-year fiscal 2018 revenue guidance to between $985 million and $1.025 billion and non-GAAP operating margin guidance to between -7% and -3%

“Pure continues to deliver the absolute best data platform for the cloud era,” said CEO Scott Dietzen. “We’re succeeding at our core mission: helping organizations get more value from their data through a radical increase in performance and radical reduction in complexity and total cost of ownership.”

“Our Q2 results highlight solid topline growth and continued improvement in operating leverage,” said CFO Tim Riitters. “We are laser-focused on executing against our plan to achieve $1 billion+ in revenue this year and marching steadily to profitability in the near future.”

In the quarter, more than 350 new customers joined Pure Storage, increasing the total to more than 3,700 organizations, including more than 25% of the Fortune 500. New customer wins in the quarter include: Airbus, COCC, Delta Dental of Michigan, Ford Otomotiv Turkey, Man AHL, Mentor, NASA’s Kennedy Space Center, ServiceNow, SSI, and Zenuity.

3FQ18 guidance

• Revenue in the range of $267 million to $275 million

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of -5% to -1%

FY18 guidance

• Revenue in the range of $985 million to $1.025 billion

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of -7% to -3%

Comments

Abstracts of the earnings call transcript:

Scott Dietzen, chairman:

"Momentum in the cloud is strong. Pure now serves more than 600 cloud companies across software-as-a-service, infrastructure-as-a-service, and consumer Internet. Cloud continues to be our strongest segment, at more than 25% of revenues and one that we believe we can increasingly take share in given our speed, our simplicity, our dev ops capable automation, and our Evergreen subscription model.

"We continue to benefit from the modernization of on-prem IT within enterprises, hospitals and governments, increasing our penetration in the Fortune 500 to over 25%. To highlight one key vertical, more than one-third of the top 25 largest U.S. healthcare organizations are Pure customers."

David Hatfield, president:

"We continue to see strong repeat purchases with approximately 70% of total sales coming from our installed base.

"Our first core growth market is selling into cloud-native businesses and we continue to deliver over 25% of our revenues into this segment.

"For FlashArray, we've led the charge to NVMe, delivering the first mainstream 100% NVMe all-flash array to "FlashArray//X. We now account Delta Dental of Michigan, and COCC, a Connecticut based company delivering enterprise processing solutions to financial institutions, as part of the growing list of X customers.

For FlashBlade, we are seeing great wins across many customer segments for data and compute intensive workloads, as this product is on track and continues to grow at 2x the rate of FlashArray during the same point in its evolution."

Tim Riitters, CFO:

"Looking at Q2 fiscal 2018 from a geographic perspective, 74% of our revenue came from the U.S. and 26% from international. We continue to observe notable growth across all our regions.

"Total headcount at the end of Q2 was over 1,900, up from over 1,800 at the end of Q1 and up from over 1,600 a year ago, largely reflecting ongoing hiring in both our sales and R&D organizations.

"We finished the July quarter with cash and investments of $523 million.

"Based on our performance to date and our guidance, we expect Q4 to be Pure's first profitable quarter."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter