Quantum: Fiscal 1Q18 Financial Results

Revenue stabilizing, losses continue, will engage consulting firm to identify and deliver improvements in operating characteristics of business over next 6 to 12 months.

This is a Press Release edited by StorageNewsletter.com on August 10, 2017 at 2:25 pm| (in $ million) | 1Q17 | 1Q18 | Growth |

| Revenue |

116.3 | 116.9 | 1% |

| Net income (loss) | (3.5) | (3.7) |

Quantum Corp. reported results for the fiscal first quarter 2018 ending Friday 30 June 2017, and provided guidance for the fiscal second quarter and full year.

Fiscal first quarter 2018 financial results

(All comparisons are relative to the fiscal first quarter 2017 unless otherwise stated.)

- Total revenue increased to $116.9 million, up from $116.3 million.

- Branded revenue was $99.6 million, a 3% increase.

- Scale-out tiered storage revenue was $33.7 million, up from $30.8 million.

- Total data protection revenue was $73.1 million, down from $76.9 million and consisting of:

- $58.4 million in tape automation, devices and media revenue, up 6% overall, with branded revenue growing 14% and OEM revenue declining 32% .

- $14.7 million in disk backup systems revenue, down from $21.5 million in the same quarter a year earlier which included a large, multi-million dollar deal.

- Royalty revenue was $10.0 million, up from $8.6 million.

- GAAP operating loss was $2.5 million, and non-GAAP operating income was $2.2 million, compared to a loss of $1.8 million and income of $2.4 million, respectively.

- GAAP net loss was $3.7 million, compared to $3.5 million, a net loss of $0.11 per diluted share in both quarters.

- Non-GAAP net income was $1.4 million, or $0.04 per diluted share, up from $0.8 million, or $0.02 per diluted share.

“We continued to build on our momentum over the past year, growing total revenue year-over-year and generating non-GAAP net profit for the fifth consecutive quarter,” said Jon Gacek, president and CEO. “Although the total revenue increase was slight, branded revenue grew 3%. Other revenue highlights included year-over-year growth in scale-out tiered storage of 10% and another strong quarter for branded tape automation, devices and media sales.

“We also announced StorNext 6, a major new release of our industry-leading scale-out file system and data management software, which recently began shipping. StorNext 6 will enable us to deliver greater value to customers and, we believe, help further broaden our market reach, along with several new partnerships we announced during the quarter. They include ecosystem partnerships with Veeam in data protection, Veritone in artificial intelligence and DataFrameworks in data visualisation and management, as well as a strategic reseller partnership with Uniview in video surveillance.

“As we look forward to the rest of fiscal 2018, we continue to be excited about the opportunity to grow total revenue, driven by expected scale-out tiered storage growth of at least 20% for the year. At the same time, we remain focused on generating profit and cash and are confident in our ability to manage our debt D including paying off our November 2017 convert D with existing resources.

“In addition, our newly constituted board of directors has launched a number of strategic initiatives and is working closely with the management team to implement various work streams, with the goal of improving long-term growth, recurring revenue and profitability. As part of this work, we are in the process of engaging a top-tier consulting firm which we expect will help the company to identify and deliver improvements in the operating characteristics of the business over the next six to 12 months, including accretive contributions to non-GAAP earnings. We plan to update investors on a quarterly basis regarding the progress of this important initiative.”

Guidance for the fiscal second quarter 2018:

- Total revenue of $120 million to $125 million.

- GAAP and non-GAAP gross margin of 41-42% .

- GAAP and non-GAAP operating expenses of approximately $49 million and $47 million, respectively.

- GAAP and non-GAAP interest expense of $2.4 million and $1.9 million, respectively, and taxes of $400,000.

- GAAP loss/earnings per share of ($0.06) to breakeven and non-GAAP earnings of $0.01 to $0.05 per diluted share.

Guidance for the full fiscal year:

- Total revenue of $515 million to $525 million.

- GAAP and non-GAAP earnings per share above the levels achieved in fiscal 2017.

Comments

Total revenue for this quarter was $116.9 million, up only 1% from $116.3 million a year ago and down 3% sequentially.

Click to enlarge

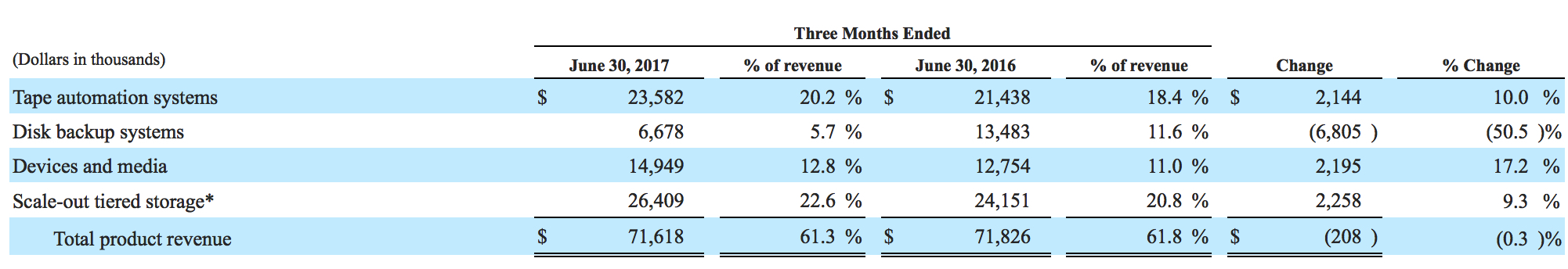

Total product revenue, which includes sales of hardware and software products sold through both branded and OEM channels, decreased $0.2 million in 1FQ18 compared to one year ago.

Sales of branded products increased 5% and revenue from sales of products to OEM customers decreased 36% in the 1FQ18 as compared to 1FQ17.

For data protection solutions, total revenue, which includes both branded OEM product and related services revenue, was $73.1 million, a decrease of $3.7 million or 5% compared to 1FQ17, $3.3 million being attributable to lower OEM sales.

Total tape automation systems, devices media and related service revenue was $58.4 million for most recent three-month period. This was up 6% from $55.4 million in 1FQ17. More specifically, OEM product and related service revenue for these tape offerings were $6.8 million, down 32% from $10.1 million a year ago.

In contrast, branded products and service-related revenue was $51.6 million for the quarter compared to $45.3 million a year ago, up 14%.

Product revenue from tape automation systems was up yearly for the quarter due to an increase from branded tape automation of $5.6 million, partially offset by a decrease of $3.5 million in revenue from OEM tape automation systems.

Revenue from disk backup systems in the quarter decreased Y/Y primarily due to decreased sales of DXi 6900.

Total product and related service revenue for disk backup systems was $14.7 million, down $6.8 million from the prior year. The year-over-year decline was entirely attributable to a single multi-million dollar deal in first quarter of last year. Disk backup win rates remain high in the 65% range, and the firm added 30 new customers in the most recent quarter.

Product revenue from media and devices, which includes tape drives and removable HDDs, and non-royalty media sales increased during 1FQ18 compared to 1FQ17 due to higher sales of branded media.

Scale-out tiered storage sales grew between the same two periods primarily due to increased sales of scale-out storage automation.

Total product and related service revenue for scale-out tiered storage solutions was up 10% to $33.6 million compared to $30.7 million in the same quarter a year ago. Quantum recorded particularly strong growth in video surveillance and technical workflow use cases, and added 19 new customers while maintaining 70% win rates.

Total service revenue was $35.2 million during the quarter, down 2% from $35.8 million the same quarter last year. This decrease was primarily driven by exploration of service contracts for early generation tape automation and disk backup systems.

Decreased service revenue from data protection products was partially offset by increased revenue from branded service contracts for scale-out tiered storage.

Royalty revenue was $10 million, up 16% from $8.6 million in the same quarter a year ago, mainly due to increased media royalties from LTO-7, partially offset by decreased media royalties from previous LTO generations.

Non-royalty revenue totaled $106.9 million, of which 93% was branded and 7% was OEM, compared to 90% branded and 10% OEM a year ago.

The company expects sales to grow sequentially next quarter from 3% to 7%, and 2% to 4% for entire FY18.

It estimates branded data protection to be down slightly for the year, and OEM and tape royalty revenue to decline further.

The firm expects that scale-out tiered storage will grow at least 20% for the year and continue to be the main driver of overall revenue growth.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter