Traditional PC Market in 2Q17 Fares Slightly Better Than Expectations as Component Shortage Pressures Ease – IDC

Such as SSD

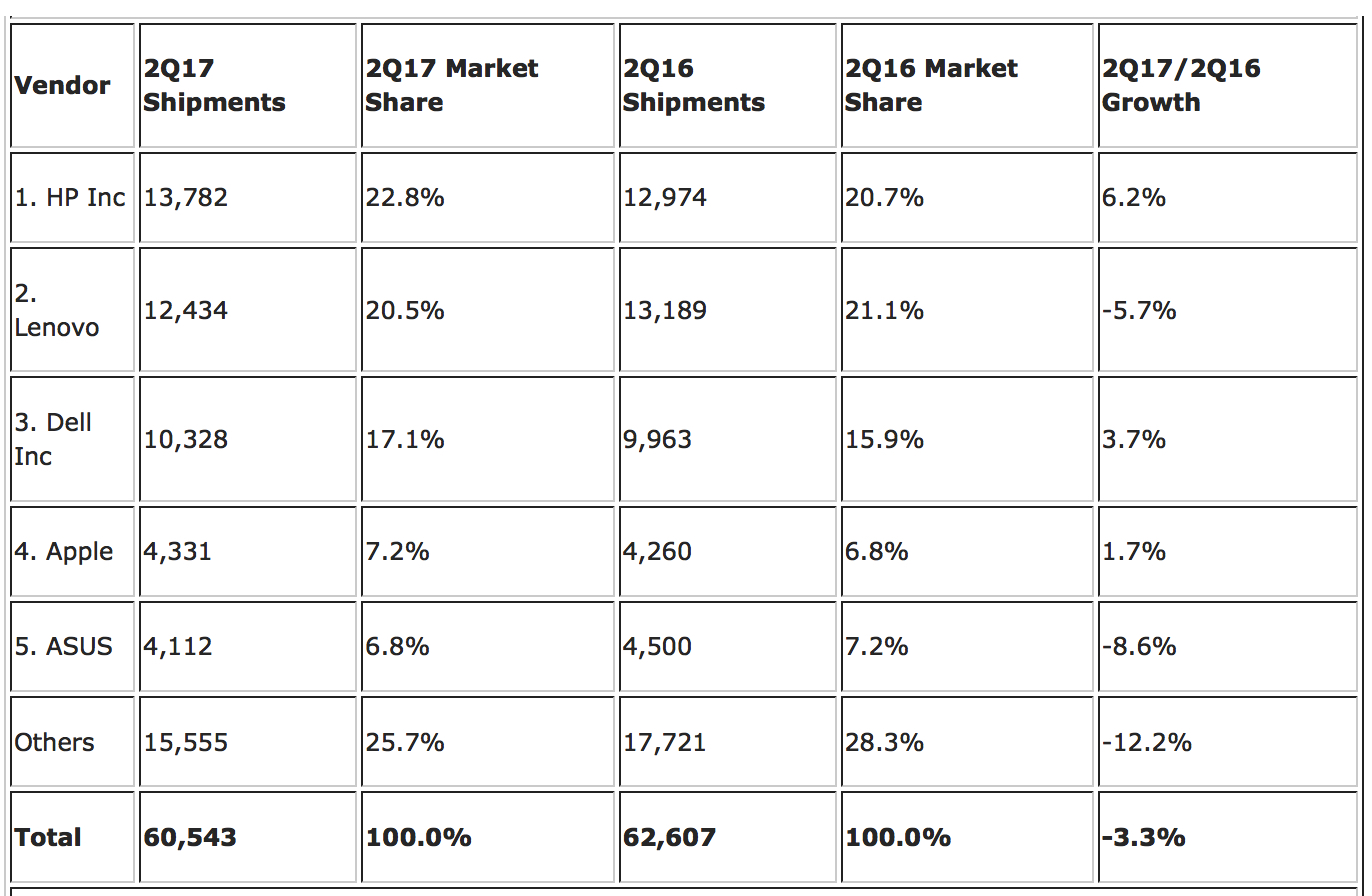

This is a Press Release edited by StorageNewsletter.com on July 17, 2017 at 2:21 pmWorldwide shipments of traditional PCs (desktop, notebook, workstation) totaled 60.5 million units in 2Q17, posting a year-on-year decline of 3.3%, according to the International Data Corporation‘s Worldwide Quarterly Personal Computing Device Tracker.

The results tilted just above the previous forecast that called for a decline of 3.9%, and hewed to the expectation that unlike past seasonal patterns of significant positive sequential growth, second quarter volume showed only a modest uptick from the first quarter.

Whereas one factor affecting shipments during the past several quarters was an inventory buildup caused by shortages of key components such as SSD, the second quarter operated under less harsh constraints, though in some instances component shortages still played a role in driving shipment dynamics. Moreover, as expected, the increased bill of materials cost due to the shortage also began to impact the final price of systems, which was also factored into IDC’s original assumption of inhibiting shipments.

From a geographic perspective, mature markets generally outperformed emerging markets, with AsiaPac (excluding Japan) and Latin America in particular showing weakness, though Latin America did outperform IDC’s original forecast. The U.S. posted just a slight decline but otherwise also pulled ahead of forecast in part due to Chromebook activity. Japan again posted positive growth, in part against the backdrop of tough market conditions in 2015 through the first half of 2016.

“Amid some unevenness in market trends across the regions, the global PC market has continued to trend toward stabilization,” said Jay Chou, research manager, IDC worldwide personal computing device tracker. “Despite recent issues wrought by component shortages and its effect on system prices, we expect the momentum of commercial market replacements will contribute to eventual market growth. Consumer demand will remain under pressure, although growth in areas like PC gaming and the increasingly attractive portfolio of sleek Windows-based systems will help push the consumer market to stabilize as well.”

“The U.S. PC market continues to hold, with an estimated 0.4% contraction in 2Q17,” added Linn Huang, research director, devices and displays. “The U.S. market remains relatively immune to currency issues in other regions. Chromebooks for K-12 continued its momentum unabated, and Apple appears to be back on track with an uncharacteristically poor 2016 in its rearview mirror.”

Regional Highlights

• The U.S. traditional PC market continued to hold in comparison to other regions. Pricing pressures brought on by currency weakness have not affected the aggregate product mix in the U.S. as it has in other regions. Chromebooks remained a source of significant volume growth in the education-buying mid-quarters. Inventory preparation and deployment for government projects, particularly around Windows 10 migration, also kept commercial volumes afloat.

• The EMEA traditional PC market showed further stability in 2Q17, primarily driven by the solid performance of notebook sales. An acceleration in mobility adoption was a major contributor to the positive notebook results, exceeding IDC’s expectations. However, desktop sales performed in line with forecast.

• The traditional PC market in the AsiaPac (excluding Japan) region returned negative results this quarter, slightly below IDC’s expectations. GST reform in India had an adverse impact on shipments in the country, with channel players placing cautious orders amid uncertainty in the market, while the anticipated ELCOT education tender has been postponed due to legal issues surrounding execution of the project. In China, the market is expected to return softer results, as consumer demand slowed and the industry faces high inventory levels.

• In Japan, the traditional PC market continued its recovery from tough conditions in 2015 and 2016, with further transition from desktop to notebook in the commercial sector, but more importantly a number of refresh projects to replace PCs bought during the last upgrade cycle four years ago.

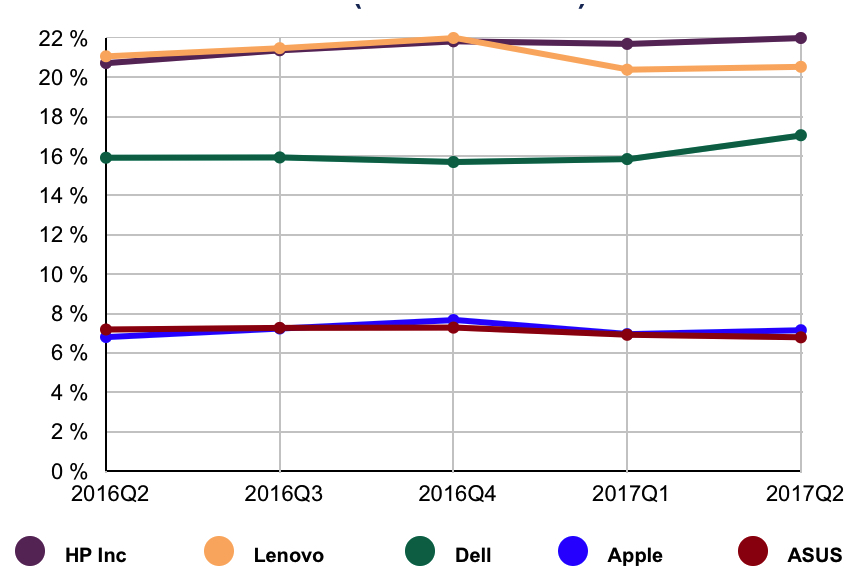

Vendor Highlights

• HP Inc. retained the top spot for the second quarter in a row. The vendor hit a new high mark for market share at nearly 23%, with aggressive growth in virtually all regions.

• Lenovo held the second position but shrank 5.7% globally. The vendor saw significant slowing in North America but still managed to grow its notebook business overall.

• Dell took the third position, growing 3.7% year over year, and continuing its positive growth in every region with strong notebook volume.

• Apple kept the fourth position and grew 1.7% year over year.

• ASUS regained the fifth position, overtaking Acer.

Top 5 Vendors, WW Traditional PC Shipments, 2Q17 (preliminary)

(in thousands of units)

Top 5 Vendors, WW Traditional PC Shipments, 2Q17 (preliminary)

(share in units)

(Source: IDC Worldwide Quarterly Personal Computing Device Tracker, July 12, 2017)

Table Notes:

• Some IDC estimates prior to financial earnings reports.

• Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

• Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device (PCD) Tracker, but are not addressed in this press release.

• Data for all vendors are reported for calendar periods.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter