Macronix: Fiscal 1Q17 Financial Results

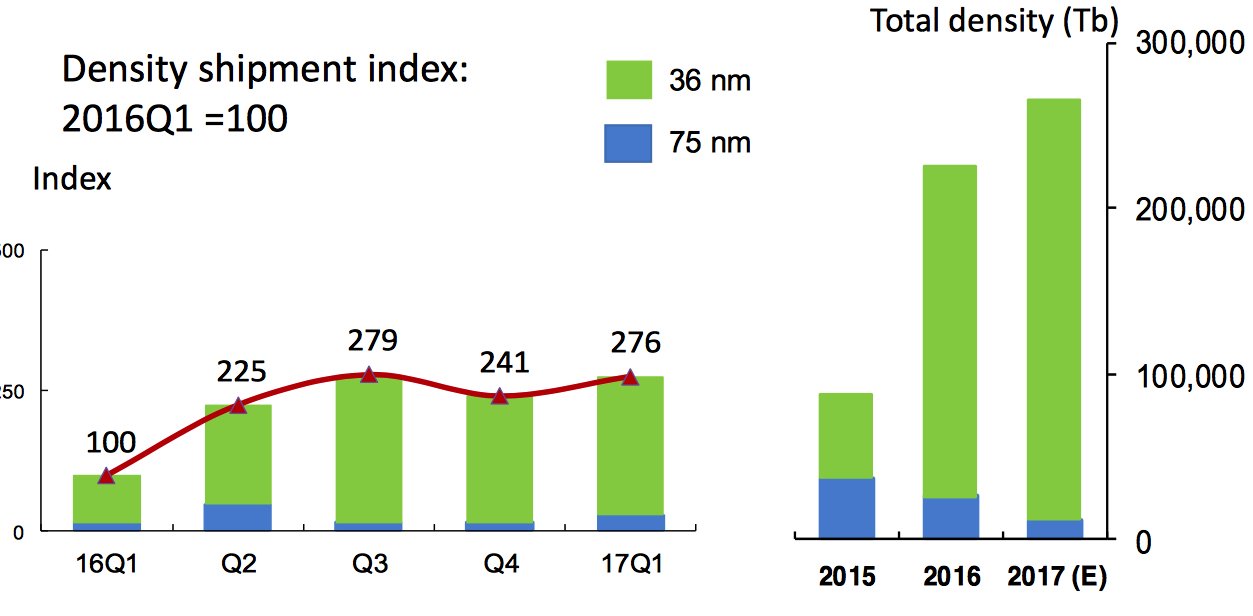

Unit shipments of NAND flash increased 123% Y/Y and 9% Q/Q, engaged in 3D NAND.

This is a Press Release edited by StorageNewsletter.com on May 1, 2017 at 2:58 pm| (in NTD million) | 1Q16 | 1Q17 | Growth |

| Revenue |

5,086 | 6,610 | 30% |

| Net income (loss) | (890) | 203 |

Macronix International Co., Ltd. announced the unaudited financial results for the first quarter ended Mar. 31, 2017. All numbers were prepared in compliance with the TIFRS on a consolidated basis.

Summary of the First Quarter 2017:

• Net revenues decreased 2% sequentially and increased 30% over the first quarter 2016 to NT$6,610 million ($214.8 million).

• Gross profit was NT$1,815 million ($59.0 million) with 27% gross margin.

• Operating income was NT$414 million ($13.5 million) with 6% operating margin.

• Income before tax was NT$204 million ($6.6 million); net income was NT$203 million ($6.6 million).

• EPS was NT$0.06; book value per share was NT$5.07.

First-Quarter 2017 Financial Highlights:

• Revenue was NT$6,610 million and gross profit was NT$1,815 million

• Net income was NT$203 million with EPS NT$0.06.

Revenues

The company announced the first quarter net revenues of NT$6,610 million ($214.8 million), a 2% decrease sequentially because of seasonality and a 30% increase year-over-year due to strong demand for memory product lines.

Gross Profit and Gross Margins

Gross margin for the first quarter 2017 was 27%, lower than 32% in the fourth quarter 2016 and higher than 15% in the first quarter of 2016. Gross profit was NT$1,815 million ($59.0 million). Gross margin decreased by 5ppt caused by unfavorable FX rate.

Operating Expenses and Operating Income

Operating expenses for the first quarter were NT$1,401 million ($45.5 million), a decrease of 9% sequentially and a decrease of 12% year-over-year. Operating income for the first quarter was NT$414 million ($13.5 million), compared to NT$618 million in the fourth quarter of 2016 and NT$-805 million in the first quarter of 2016.

Net Income and EPS

Net income before tax was NT$204 million ($6.6 million), compared to NT$619 million in the fourth quarter of 2016 and NT$-890 million in the first quarter of 2016. For the first quarter of 2017, the estimated tax provision was NT$1 million ($0.03 million), the net income after tax was NT$203 million ($6.6 million). EPS was NT$0.06 ($0.002), compared to NT$0.20 in the fourth quarter of 2016 and NT$-0.25 in the first quarter of 2016. The book value was NT$5.07 per share.

Balance Sheet

The debt-to-asset ratio is 48.1% which was lower than 48.5% in the fourth quarter 2016. As of Mar. 31, 2017, the company had NT$6,062 million ($ 199.9 million) in cash and cash equivalents. Net inventory increased by NT$296 million to NT$7,384 million ($ 243.5 million), compared to NT$7,087 million for the fourth quarter of 2016.

The total liability increased to NT$17,243 million ($ 568.5million), an increase of NT$18 million, compared to NT$17,225 million at the end of Dec 31, 2016. Shareholders’ equity was NT$18,608 million ($ 613.5 million). Depreciation and amortization expenses were NT$499 million ($16.2 million) for the quarter, a decrease of NT$7 million, compared to the fourth quarter of 2016. Net cash flow in operating activities was NT$487 million ($15.8 million) in the quarter. Capital expenditure for the quarter was NT$563 million ($18.3 million) mainly for the procurement of production related equipment.

Business Highlights

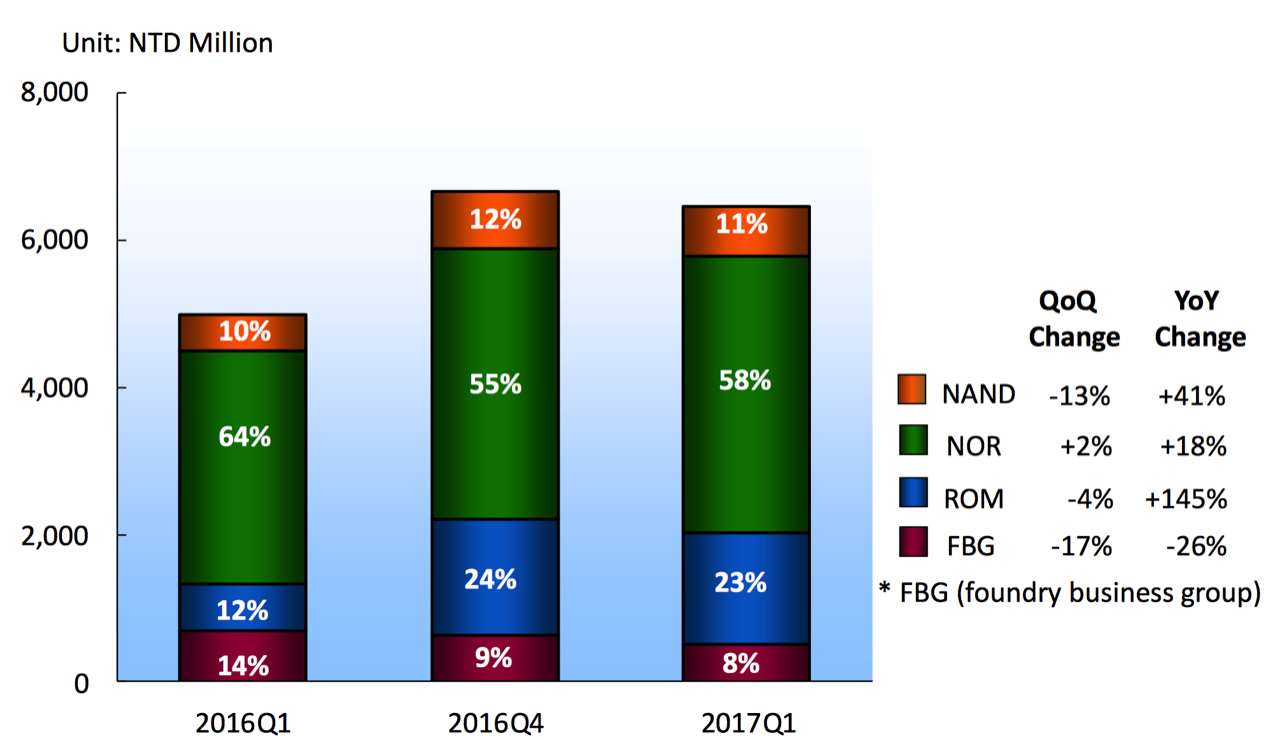

• NAND flash, NOR flash, ROM and FBG 11%, 58%, 23% and 8% of the net sales respectively

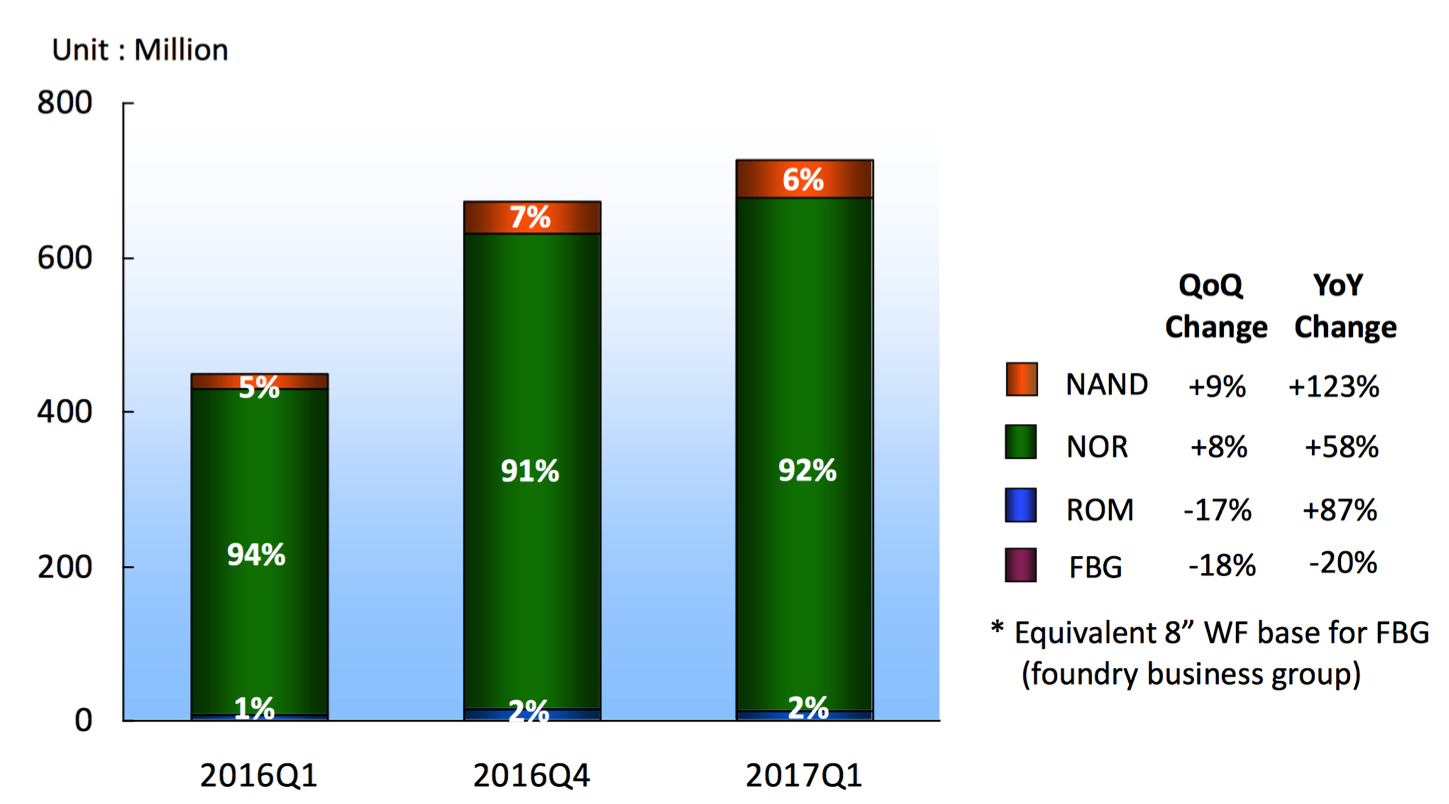

• NAND flash products accounted for 11% of net sales, an increase of 41% year-over-year and a sequential decrease of 13%. The unit shipments of NAND flash increased 123% year-over-year and increased 9% sequentially.

• NOR flash products accounted for 58% of net sales, an increase of 18% year-over-year and a sequential increase of 2%. The unit shipments of NOR flash increased 58% year-over-year and increased 8% sequentially.

• Sales in the first quarter from ROM revenue accounted for 23% of net sales, an increase of 145% year-over-year and a sequential decrease of 4%. The unit shipments of ROM increased 87% year-over-year and decreased 17% sequentially.

• Sales in FBG products accounted for 8% of net sales, a decrease of 26% year-over-year and a sequential decrease of 17%

Comments

There was an increase demand and limited supply for SLC NAND flash, the pricing being on upward trend.

Quarterly sales breakdown by products

Quarterly quantity breakdown by products

SLC NAND flash equivalent density shipment

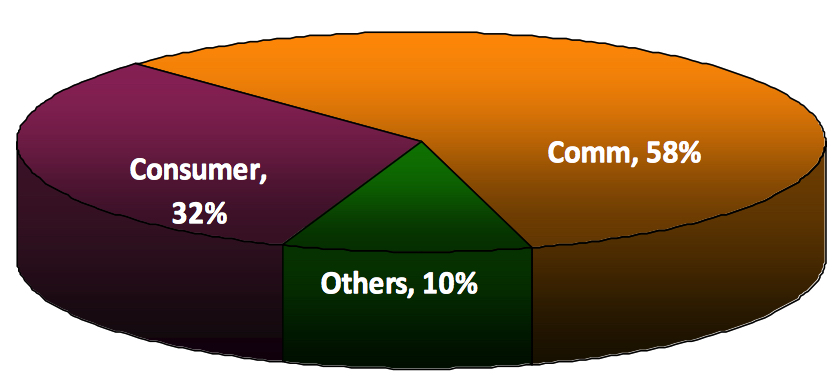

1Q17 NAND revenue breakdown

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter