SK Hynix: Fiscal 1Q17 Financial Results

For NAND flash, bit shipment decreased by 3% but ASP rose by 15%.

This is a Press Release edited by StorageNewsletter.com on April 28, 2017 at 2:36 pm| (in KRW billion) | 1Q16 | 1Q17 | Growth |

| Revenue |

3,656 | 6,290 | 71% |

| Net income (loss) | 448 | 1,899 | 324% |

SK Hynix Inc. announced financial results for its first quarter ended March 31, 2017.

The company has set all-time high numbers in quarterly revenue, operating profit and net income.

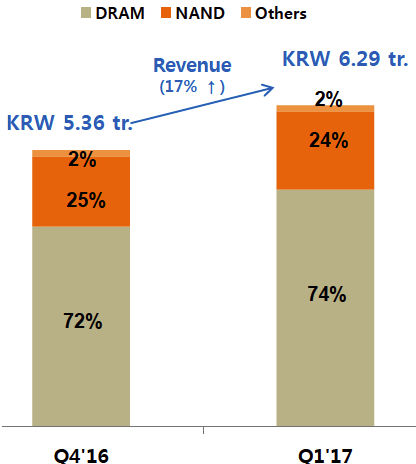

The consolidated first quarter revenue totaled 6.29 trillion won while operating profit amounted to 2.47 trillion won and net income was 1.9 trillion won. Operating margin for the quarter was 39% and net margin was 30%.

The company set the record-high quarterly revenue and operating profit thanks to favorable market conditions attributed to product price hikes during the first quarter, which has been traditionally off-season in the memory semiconductor industry. The revenue increased by 17% and the operating profit rose by 61% compared to the previous quarter.

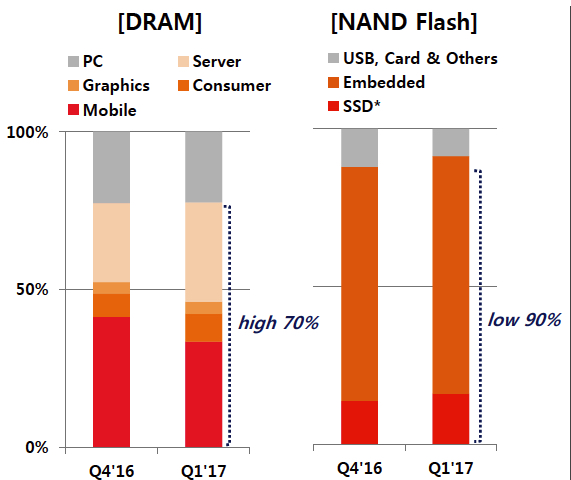

Quarter-over-quarter, DRAM bit shipment decreased by 5% but the average selling price increased by 24%. The shipment declined due to a continuous DRAM short-supply caused by low inventory level at the beginning of the year and limited supply growth. The ASP rapidly rose, courtesy of strong demand from PC and server sectors.

For NAND flash, the bit shipment decreased by 3% but the average selling price rose by 15%. The shipment declined due to limited supply growth related to low inventory level despite demand growth from mobile and SSD sectors. The ASP increase took place in every NAND flash product category.

SK Hynix will speed up to further expand 2Znm DRAM and start to mass produce 1Xnm DRAM in the second half of this year. Also, the company will supply 48-layer and 72-layer 3D NAND to high density mobile and SSD markets.

Comments

Revenue mix by products

Revenue mix by applications

Abstracts of the earnings call transcript:

Kim Jun-Ho, president, head of corporate support:

"NAND flash bit shipment fell by 3% quarter-on-quarter, but ASP rose by 15% from the previous quarter, thanks to strong prices across all NAND products. Demand was driven by growth in NAND contents in Chinese smartphones as well as the growth in the SSD adoption in PCs.

"For mobile NAND there is a trend of adopting higher storage NAND across smartphone models despite the higher price as 256 gigabyte began to be used in major flagship smartphones last year. The most to higher density NAND is expected to continue this year in eMCP and eMMC for example. Adoption of UFS and 3D NAND is likely to increase in high-end products.

"And for enterprise SSD, which began to take off last year is expected to grow in data centers as a cloud services keep growing. Demand for enterprise SSD is expected to be generated elsewhere as well to support new services based on generating, storing and using data such as AI, Big Data and IoT.

"For NAND, we started mass production of the 48-layer TLC product late last year following the 36-layer MLC. We successfully developed the 72-layer product in the first quarter of this year. As such this year we plan to supply the 36-layer to the mobile market requiring MLC and the 48 and 72 layer for high density mobile and SSD markets.

"For DRAM, the company is planning for a shipment growth that is in line with the market growth this year. NAND bit shipment growth is planned to slightly under grow then the market. In the second quarter, DRAM bit shipment growth is planned at mid single-digit increase to recover from the drop in the first quarter while NAND bit shipment growth is planned to be flat sequentially."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter