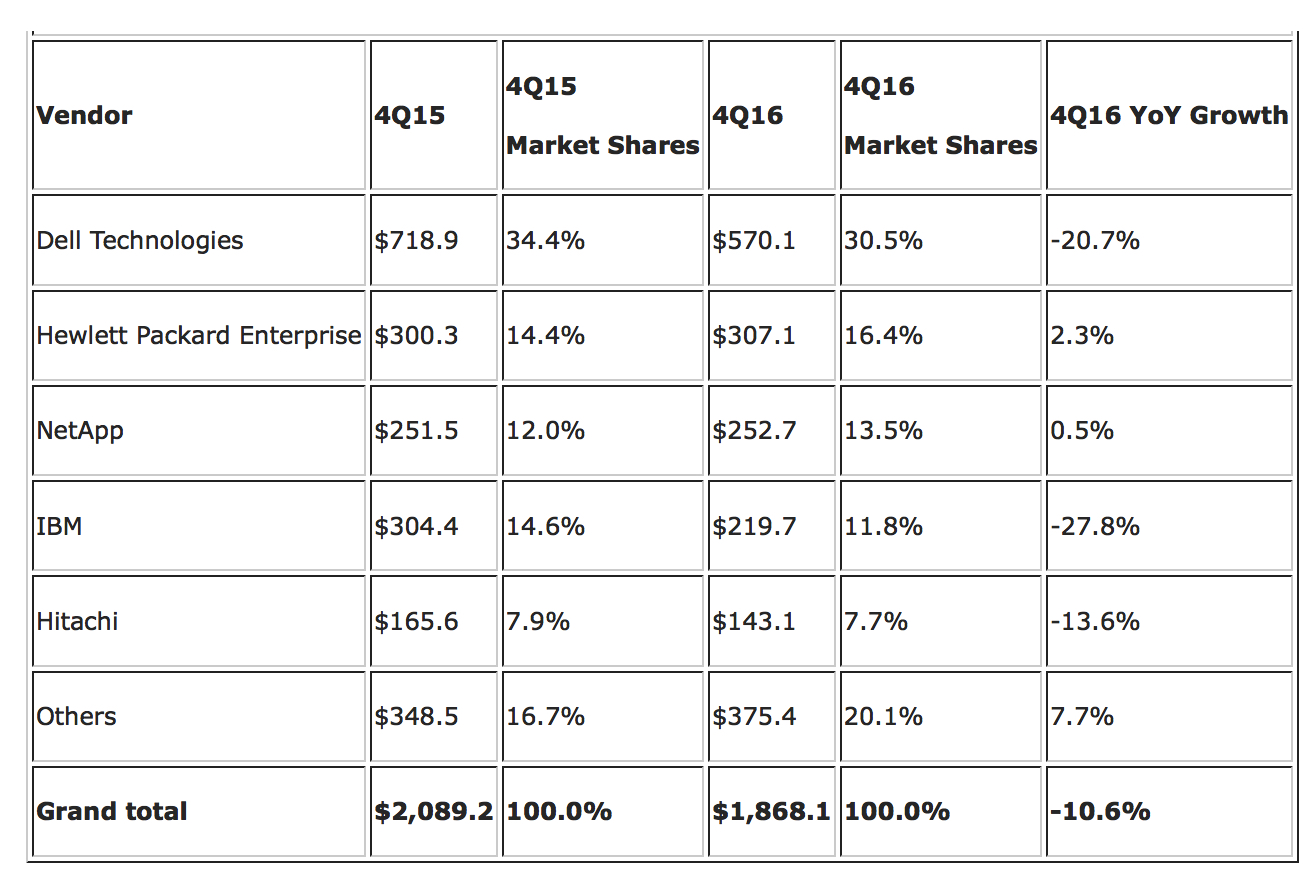

EMEA External Storage Market Declines by 11%, but All-Flash Grew 54% – IDC

IBM -28%, Dell -21%, Hitachi -14%, HPE +2%, NetApp +0.5%

This is a Press Release edited by StorageNewsletter.com on March 16, 2017 at 2:36 pmTotal EMEA external storage systems revenue fell by 10.6% in the fourth quarter of 2016, according to the International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker 4Q16.

Top 5 Vendors, EMEA External Disk Storage Systems Value

($ million)

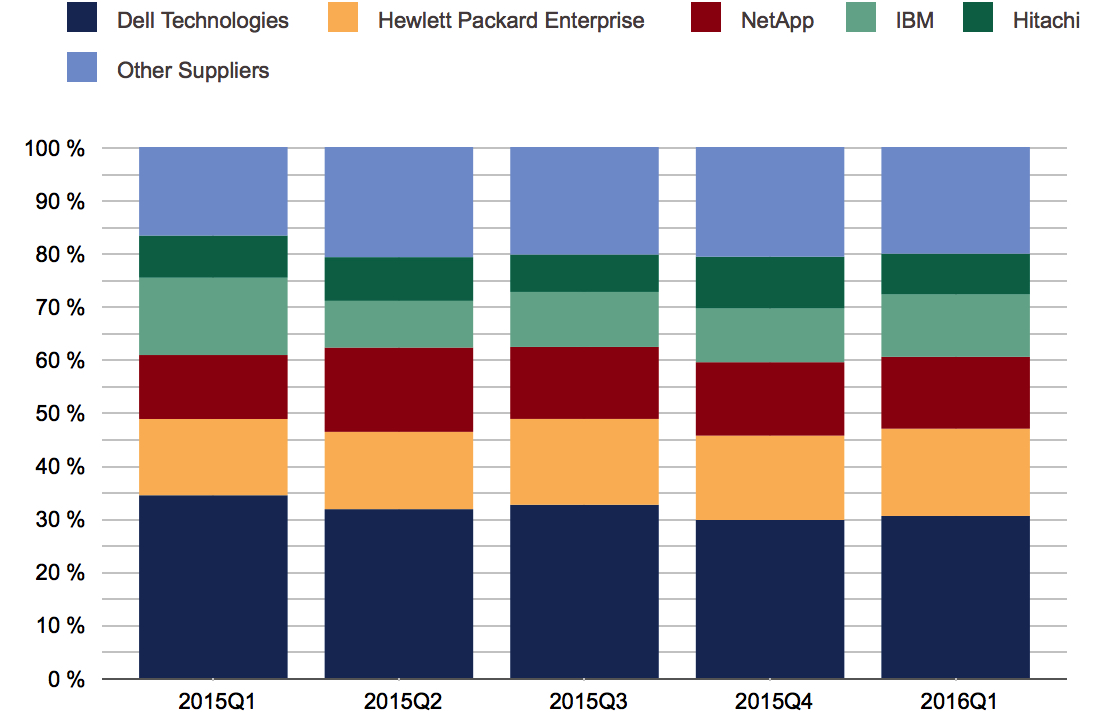

Top 5 Vendors, EMEA External Enterprise Storage Systems, 4Q16

(value market share)

The all-flash market grew 53.6% in the region, driven mainly by Central and Eastern European growth.

Meanwhile, the traditional HDD arrays (HDD-only) segment fell by 37.9% and hybrid flash arrays fell 4.7%, bringing down the overall external storage systems market in the region.

“The EMEA external storage market still seems trapped in a revenue decline, dragged down by legacy, HDD-only systems,” said Silvia Cosso, research manager, European storage and datacenter research, IDC. “However, the seeds of the next-generation datacenter are more clearly emerging: the all-flash array segment increased to a quarter of the total external market value in the fourth quarter of 2016 and a fifth for the whole year, and hyperconverged appliances, although still a fraction of total sales, are also growing fast. Intensified competition in the AFA segment in particular is pushing $/GB further down and this is opening up new opportunities for such systems being deployed for a wider range of applications, including data-intensive ones.”

Western Europe

Western European external storage market value continued to decline for yet another quarter in 4Q16, to $1.38 billion, down 7.9% Y/Y. Capacity, however, grew moderately (4.5%) to 2,789.4PB.

All-flash storage arrays (AFAs) continued to grow in strong double digits in Western Europe in the last quarter of 2016 to remain the only bright spot in the external storage category. Flash storage systems (AFA and HFA) together now account for over 60.4% of the total market in the region.

“The growth of object storage appliances in Western Europe, at 54.6% in the fourth quarter of 2016, along with the continued growth in AFA, shows that enterprises are investing in storage technologies mainly to accelerate application performance – flash investment – and speed and to have cloud-friendly storage technologies such as object storage for data interoperability,” said Archana Venkatraman, research manager, IDC Europe.

Central and Eastern Europe, the Middle East, and Africa

The last quarter of 2016 was marked by a significant decline in external storage market value in Central and Eastern Europe, the Middle East, and Africa (CEMA), dropping by 18% for $484 million capitalization.

The only growth segment was AFAs, which recorded double-digit growth and nearly 20% market value penetration. The results for the full year were slightly better, with a 10% decline in total external storage and AFA doubling its share.

The market inhibitors from last quarter were still in place and these affected both CEMA subregions.

Country-wise, the smallest CEE countries were better able to absorb EU funds to finance various storage projects and were less affected by the weaker macroeconomic situation in Western Europe. Postponed deals in government and banking were the major factor behind market underperformance at the end of 2016. On the other hand, the mid-market invested more heavily in flash technologies, both AFA and server-based, as part of consolidation projects that suppressed total external storage value.

The Middle East and Africa (MEA) storage market recorded a double-digit decline in 4Q16 and the full year. Most countries contributed to this decline, with large infrastructure projects constantly delayed due to political instability; the market was also affected by economic stagnation and oil-dependency, which are directly related to storage spending in the region – a trend that is gradually diverging. The appetite for flash storage remained high, boosted by AFA offerings with bundled richer data services, general-purpose workload applications, and lower price points.

“Flash, software-defined, and cloud technologies – with most cloud infrastructure spending outside the region due to cloud providers’ location – had an impact on the deterioration of external storage value in CEMA, but non-market factors such as the EU funds transition periods, political uncertainty, country elections, and vendor restructuring had a far greater negative impact,” said Marina Kostova, research manager, storage systems, IDC CEMA. “The projections to 2020, however, remain positive with better and higher funds assimilation by EU member countries, and recovering markets in Russia, Poland, the Gulf countries, and Turkey.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter