Pure Storage: Fiscal 4Q17 Financial Results

Revenue and loss growing

This is a Press Release edited by StorageNewsletter.com on March 6, 2017 at 2:36 pm| (in $ million) | 4Q16 | 4Q17 | FY16 | FY17 |

| Revenue | 150.2 | 227.9 | 440.3 | 728.0 |

| Growth | 52% | 65% | ||

| Net income (loss) | (44.3) | (42.9) | (213.8) | (245.1) |

Pure Storage, Inc. announced financial results for its fourth quarter and fiscal year ended January 31, 2017.

Key quarterly business and financial highlights include:

• Record quarterly revenue of $227.9 million, up 52% Y/Y, 2.2% above midpoint of guidance

• Record full year revenue of $728.0 million, up 65% Y/Y, 3.3% above midpoint of guidance

• Record quarterly operating leverage, GAAP margin of -18.6%, 10.0 ppts improvement Y/Y and non-GAAP margin of -1.9%, 12.0 ppts improvement Y/Y

• Positive momentum in unstructured data market with FlashBlade now available

“Pure Storage is delivering the data platform for the cloud era, helping customers put data to work for their businesses,” said CEO Scott Dietzen. “This year, Pure expects to reach $1 billion in revenue – a remarkable achievement and evidence that we’re only just getting started. We could not be more excited about the opportunities ahead.”

“Q4 was a solid quarter and a strong end to our fiscal 2017 with consistent year-over-year revenue growth and a strong improvement in our operating leverage,” said CFO Tim Riitters. “We are confident in our outlook for fiscal 2018 and remain focused on executing steadily on our business model for continued growth and industry leadership.”

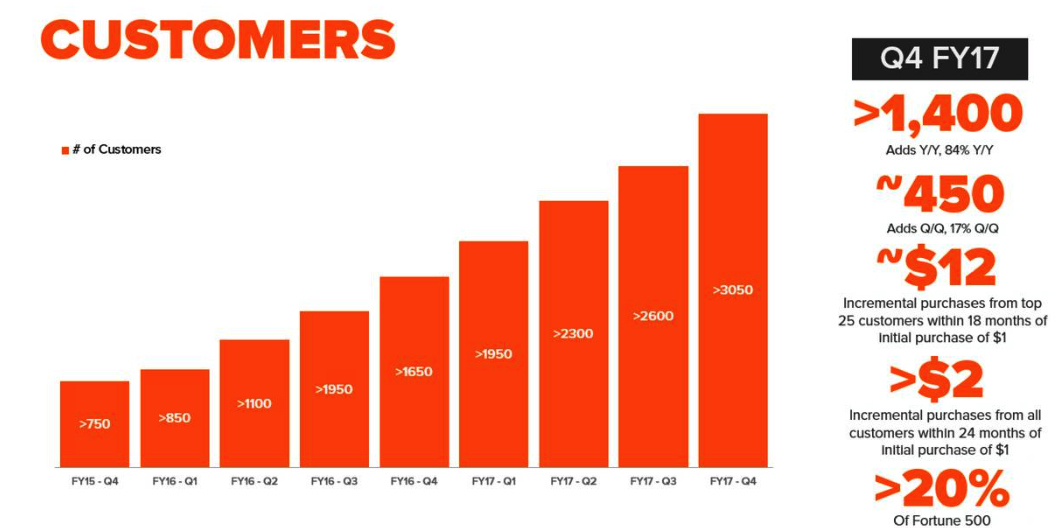

A record 450 new customers joined Pure Storage this quarter, increasing the total to more than 3,000 organizations, including more than 20% of the Fortune 500. New customer wins in the quarter include: Hulu, Konami, Optus Business, Royal Philips, Phreesia and Subway. New FlashBlade customer wins include: the National Hockey League, law firm Keker, Van Nest & Peters LLP and geoscience solutions provider ION.

Full Year Fiscal 2018 Guidance:

• Revenue in the range of $975 million to $1,025 million

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of -9% to -5%

First Quarter Fiscal 2018 Guidance:

• Revenue in the range of $171 million to $179 million

• Non-GAAP gross margin in the range of 63.5% to 66.5%

• Non-GAAP operating margin in the range of -27% to -23%

Comments

Pure Storage continues to grow yearly at a fast rate, but each year at a lower one: 65% in FY17 compared to 152% in FY16, 308% in FY15 and 603% in FY14. For FY18 it expects a growth between 34% and 41% to finally probably reach its goal of $1 billion.

The company never was profitable and annual losses always increase each year since its inception, reaching this time $245 million, up 15% from the former year for an accumulated loss of $666 million since FY13.

For the most recent quarter, sales were up only 16% compared to the former period but reach a record of $228 million. Product revenue in 4FQ17 grew 47% Y/Y and 16% quarter Q/Q to $186.8 million. Support revenue grew 79% and 13% respectively to $41.1 million, driven by revenue recognition on ongoing support contracts.

Now Pure records a total of 3,050 customers. In the quarter it added 450 new customers, bringing total for the year up to 1,400 added.

President David Hatfield added: "We have hundreds of customers now spending greater than $1 million and many spending $5 million, $10 million, $20 million or more by easily expanding their initial FlashArray deployments. 50% of our FlashBlade customers have come from our existing FlashArray install base."

President David Hatfield added: "We have hundreds of customers now spending greater than $1 million and many spending $5 million, $10 million, $20 million or more by easily expanding their initial FlashArray deployments. 50% of our FlashBlade customers have come from our existing FlashArray install base."

The company received 20% of incremental purchases from top 25 customers within 18 months of initial purchase of $1 million 20% of Fortune 500.

25% of customers are involved in cloud (SaaS, IaaS and consumer cloud).

CFO Tim Riitters added: "This quarter, across our entire customer base, for every $1 that our customers spent initially, they spent an average of an additional $2 within the next 24 months. (...) In fact, we anticipate that repeat purchases from current customers will account for a full 70% of the bookings required to reach our $1 billion goal this year."

USA represented 77% of global sales for the year, 23% for the rest of the world compared to an 80/20% split in the prior fiscal year.

Total headcount are now 1,700, up from 1,300 a year ago.

The all-flash array firm finished fiscal 2017 with cash and investments of $546.7 million.

Hatfield revealed that: "Over the next year we'll be offering new software innovations for our flagship FlashArray and FlashStack technologies, including the debut of synchronous replication."

Guidance for next quarter is not impressive: revenue in the range of $171 million to $179 million or down between 25% and 21% sequentially but note that the first quarter of fiscal year is company's seasonally softest quarter in revenue and operating margin.

Revenue in $ thousand

(FY ended January 31)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter