Start-Up Profile: Weka.IO

In software eliminating silos of NAS and SAN with commodity compute infrastructure and SSDs

By Jean Jacques Maleval | December 26, 2016 at 2:35 pmCompany

Weka.IO

(The firm said Weka means 1030 bytes, after Peta (1015), Exa (1018), Zetta (1021) Yotta (1024) and Xona (1027) – it’s also the name of a bird in New Zealand.

Location

HQs in San Jose, CA, R&D in Tel Aviv, Israel

Founded

In mid-2013 and Incorporated in January 2014

Financial funding

Series A for $10 million in 2013, Series B for $22.25 million in 2016

Total: $32.25 million

Investors include Norwest Venture Partners, Walden Riverwood, Qualcomm Ventures, Gemini Israel Ventures, WR II, L.P. and individual investors.

Main executives (all co-founders from XIV)

Michael Raam, president and CEO, serves on the board of directors at Weka.IO. He is a two-time entrepreneur most recently with SandForce (acquired by LSI). His previous success in board-level, executive and technical leadership roles range across VLSI design, processor development, networking, video and flash-based storage and give him deep domain expertise. He currently sits on the board of CNEXLABS and Liqid and holds advisory position at Nantero and Talena. He previously held advisory positions at GetToChip, a CAD company acquired by Cadence, and Virsto, a storage virtualization software company acquired by VMware.

Michael Raam, president and CEO, serves on the board of directors at Weka.IO. He is a two-time entrepreneur most recently with SandForce (acquired by LSI). His previous success in board-level, executive and technical leadership roles range across VLSI design, processor development, networking, video and flash-based storage and give him deep domain expertise. He currently sits on the board of CNEXLABS and Liqid and holds advisory position at Nantero and Talena. He previously held advisory positions at GetToChip, a CAD company acquired by Cadence, and Virsto, a storage virtualization software company acquired by VMware.- Omri Palmonn, co-founder and chief product officer, brings his background in software development, research and product management. Previously he was VP marketing and product for XIV Storage System, a storage start-up, until its acquisition by IBM in 2008. Later he served as part of the IBM/XIV team until it reached half a billion dollars in sales.

- Liran Zvibel, co-founder and CTO, ran engineering at social start-up and Fortune 100 organizations including Fusic, where he managed product definition, design and development for a portfolio of rich social media applications. He also held principal architectural responsibilities for the hardware platform, clustering infrastructure and overall systems integration for XIV.

- Maor Ben-Dayan, co-founder and chief architect, was project lead for IBM/XIV. He also led development of collision avoidance technology at segment firm Mobileye and led a team developing Unix kernel code through all stages of development from requirements through research, development and testing under severe schedule pressure and high quality standards for the Israeli Defense Forces.

- Barbara Murphy, VP marketing, was VP marketing for the converged infrastructure business unit (Amplidata) of HGST. Prior to that, she was CMO for Panasas and was part of the 3ware team who pioneered SATA in enterprise storage. After the acquisition by AMCC, she served as a SVP for its storage division.

- Nir Makovski, VP of engineering, has developed domain expertise in mobile devices, wireless communication systems and telecommunications. This expertise was acquired in part over ten years as a senior member of the technical staff at Intel, where he led complex projects adroitly across organizations and geographies where he developed a reputation as an execution-driven manager with a sense of urgency and leadership, mentoring and communication skills. Prior to that, he served as a group manager with the rank of major in the Israeli Defense Forces with responsibility for technology development in the areas of highly reliable systems, networking, security and OS internals.

- Mujahid Malik, CFO, played key roles in M&A scenarios, negotiating and supporting term sheets, due diligence and definitive agreements, most recently as VP of finance at Tidal Systems, acquired by Micron and prior to that as corporate controller of SandForce acquired by LSI.

- Richard Dyke, VP sales, was WW VP sales for Hedvig and has held previous VP positions at Violin Memory and Riverbed. He began his career at EMC where he rose from an individual contributor to a regional VP.

Number of employees

40 including 35 developers with plan to double in the coming year

Products description

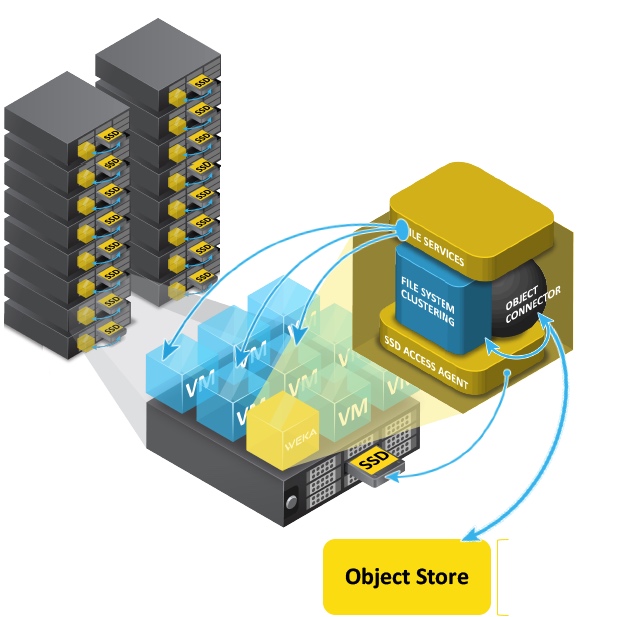

Weka.IO simplifies storage by eliminating the silos of NAS and SAN found in today’s data centers. The software leverages existing server infrastructure and local SSD storage. It virtualizes the SSDs into one logical pool of storage which is presented as a distributed, single namespace file system to the host applications. Define policy is based on location, timestamps, file type, and size. An automatic tiering layer offloads cold data to any S3 or Swift-based object store. The POSIX compliant virtual file system can be deployed on dedicated storage servers (appliance model) or as a hyper-converged solution (with compute and storage integrated in the same server). It uses commodity compute infrastructure and SSDs. Performance and capacity scale independently, resulting in a storage system that delivers the performance of an all-flash-array, the simplicity of hyper-converged storage, the data durability of object storage systems and the economics of the cloud.

According to the start-up, the software can handle billions of unstructured files, hundreds of petabytes and millions of IO/s, with linear scalability by adding cores and capacity SSDs, with 500μs for R/Ws. Patented erasure coding results in 80% space efficiency.

Released date

Initial product was released in March 2016 and is in early product design-in phase with availability next mid-year.

Price

The product is priced on an annual subscription basis, based on the amount of capacity consumed by the file system. There are two tiers of pricing, a primary tier for the performance layer under management on SSD and a secondary tier for the capacity tier on HDD.

Roadmap

- Web 2.0 design in process

- Plan to build a fully feature rich product to compete with appliance based scale-out NAS solutions.

Distribution

In the process of engaging with resellers

Partners

Qualified with HGST, Scality, IBM Cleversafe, and Cloudian

Number of customers

One issued purchase order from an unknown Web 2.0 company, four additional ones in product acceptance testing including two in media and entertainment studios and genomic research, four expected by 1Q17

Applications

Genomic research, life sciences, media and entertainment, semiconductor simulation, Web 2.0 Cloud infrastructure and big data analytics

Target market

High performance file sharing

Competitors

Primary competitors are legacy HDD-centric vendors creating dedicated scale-out NAS appliances including Dell EMC Isilon, Netapp, Qumulo, and also displacing legacy GPFS appliance installations (from vendors like DDN, Seagate Xyratex and IBM) with superior performance and lower cost.

[This article was written following a free four-day invitation in Israel by The IT Press Tour. Ed]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter