EMEA External Storage Market Declines Another Quarter, by 5% Y/Y – IDC

IBM -17%, Dell EMC -14%, Hitachi +51%

This is a Press Release edited by StorageNewsletter.com on December 13, 2016 at 3:08 pmTotal EMEA external storage systems revenue fell 5.1% year over year to $1.49 billion in 3Q16, according to the International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker 3Q16.

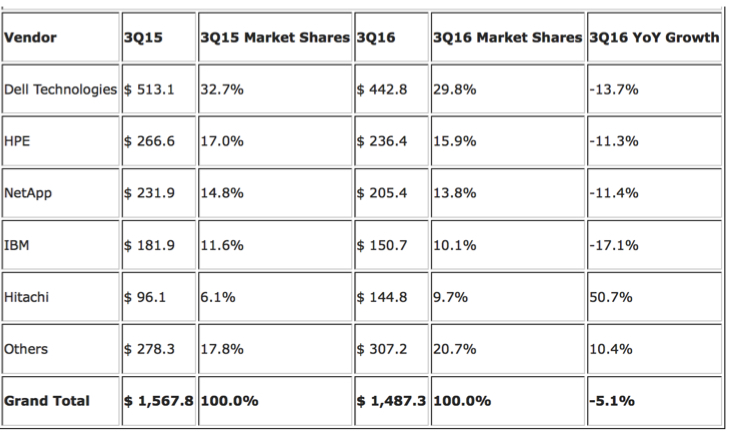

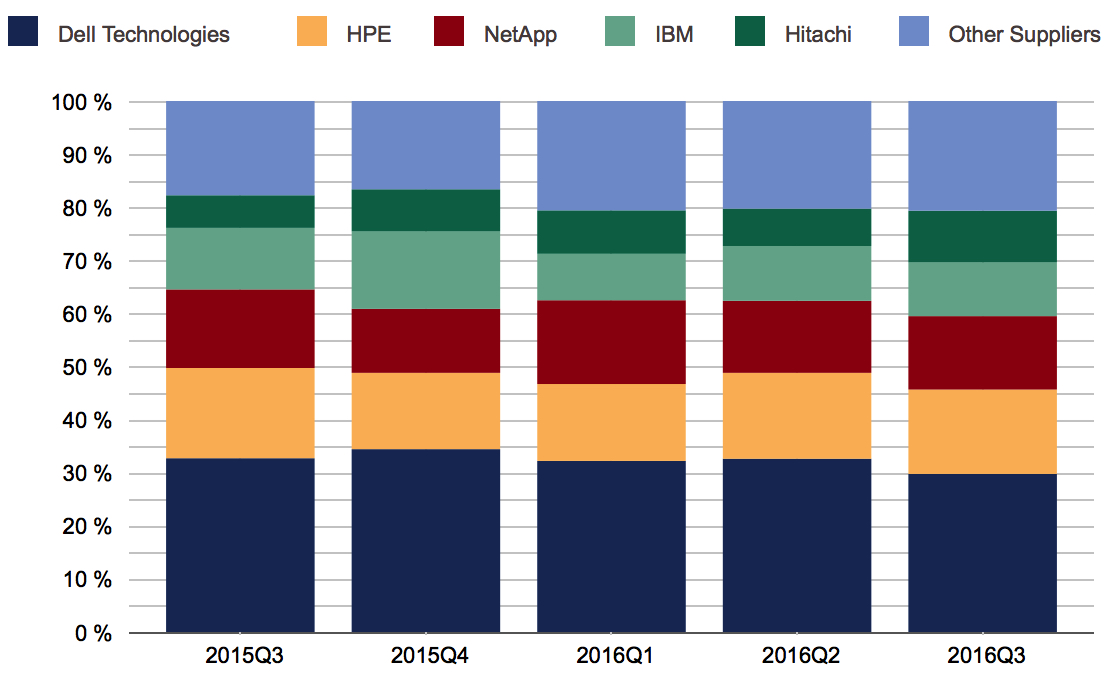

Top 5 Vendors, EMEA External Enterprise Storage Systems Value

(in $ million) Dell EMC for 3Q16 and Dell + EMC for all historical quarters

Dell EMC for 3Q16 and Dell + EMC for all historical quarters

Top 5 Vendors, EMEA External Enterprise Storage Systems in 3Q16

(value market share)

The flash market recorded huge growth, with all-flash systems growing 76.4% annually and hybrid flash arrays growing 3.5% Y/Y.

However, the 33.6% decline in the traditional HDD arrays (HDD-only) segment heavily affected the total EMEA market performance.

“Contingent factors such as macroeconomic volatility and turmoil on the supply side, coupled with acceleration in cloud deployment and infrastructure consolidation, is pushing the EMEA market into negative territory for the seventh quarter in a row,” said Silvia Cosso, senior analyst, European storage research, IDC. “On the bright side, the AFA segment kept very strong momentum in the region, almost doubling its shares compared to the same period a year ago, further improving workload consolidation.”

Regional Highlights

Western Europe

The value of the external storage market in Western Europe fell more than 5% Y/Y in 3Q16 to $1,068.51 billion.

Meanwhile, capacity fell almost 5% to 1978,7PB.

While spending on traditional external arrays continued to decline in Western Europe in the third quarter, spending on flash storage systems, especially AFAs, saw high growth. Together, flash storage systems accounted for more than 68% of spend in the region.

The external storage market declined by double digits across mature Western European countries, including the U.K., Germany, and France.

“The continued interest in software-defined storage, hyperconverged infrastructure, and cloud buildouts in mature economies such as the U.K., Germany, and France, coupled with geo-political uncertainties, has affected the demand for traditional external storage arrays in 3Q16 in these countries,” said Archana Venkatraman, senior analyst, European storage research, IDC. “But flash storage systems, especially AFAs, continued to buck the trend in Western Europe, with treble- or double-digit growth rates Y/Y.”

Central and Eastern Europe, the Middle East, and Africa

The value of the external storage market in Central and Eastern Europe, the Middle East, and Africa (CEMA) fell to $418.8 million in the third quarter of 2016, a decline of 4% in annual terms. Capacity, meanwhile, reached 760,2PB, representing a moderate growth of 5%.

Adhering to EMEA and global trends, flash storage systems (AFA and HFA) registered significant double-digit growth Y/Y in 3Q16, already accounting for over 60% of the total market.

The CEE storage market experienced a double-digit decline where the only bright spots were the recovering Russian market and some projects in large verticals, government, and education in smaller regional markets.

Conversely, the Middle East and Africa (MEA) storage market recorded single-digit growth, relying on results in Turkey, the Gulf region, and Central Africa. The volatile political situation on one side, and the pending global sports and trade events in the region on the other, are attracting a lot of investments in the defense and other public sectors. While consolidation projects in banking, telecommunications, and the energy sector are responsible for the market growth in the private sector.

“The CEMA region is still very turbulent but has significant market potential due to pent-up demand and the expected effect of a new EU funds program period on CEE countries and the ongoing economic diversification programs in the MEA region aiming to escape from oil-dependency,” said Marina Kostova, senior research analyst, storage systems, IDC CEMA. “End users in the region have restarted their datacenter investments and show even more propensity toward new storage technologies and particularly flash technologies due to a strong push by vendors, falling prices, consolidation, and growth in cloud and performance-hungry workloads.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter