Pure Storage: Fiscal 3Q17 Financial Results

Continuing to grow fast but far to be profitable

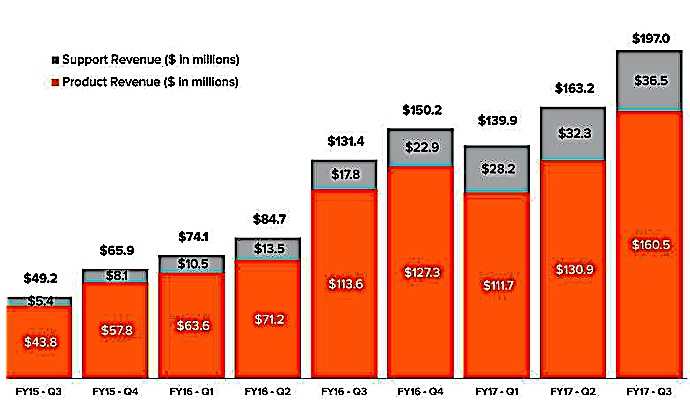

This is a Press Release edited by StorageNewsletter.com on December 2, 2016 at 3:04 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 131.4 | 197.0 | 290.1 | 500.1 |

| Growth | 50% | 72% | ||

| Net income (loss) | (56.5) | (78.8) | (169.5) | (202.2) |

Pure Storage, Inc. announced financial results for its fiscal third quarter ended October 31, 2016.

Highlights:

- Quarterly revenue: $197.0 million, up 50% Y/Y, and ahead of the guidance range of $187 million to $195 million.

- Quarterly gross margin: 64.8% GAAP; 65.5% non-GAAP, up 3.7 ppts and 3.8 ppts Y/Y, respectively, and in line with non-GAAP gross margin guidance of 64% to 67%.

- Quarterly operating margin: -39.7% GAAP; -9.8% non-GAAP, up 2.6 ppts and 11.6 ppts Y/Y, respectively, and ahead of non-GAAP operating margin guidance of -17.5% to -13.5%.

“Pure Storage continues to rewrite the rules for the storage industry,” said CEO Scott Dietzen. “We again reported better-than-expected financial performance, driven by customer enthusiasm for our smarter approach to enterprise storage. In a world dominated by big data and cloud computing, Pure’s software-centric approach is the right solution at the right time.”

“We are excited about our record Q3 revenue and significant operating leverage improvement,” said CFO Tim Riitters. “We continue to focus on driving growth and market share gains with a close eye on profitability.”

Over 300 new customers joined Pure Storage this quarter, increasing the total to more than 2,600 organizations, including more than 100 of the Fortune 500.

New customer wins in the quarter include Hyatt Hotels Corporation, Cushman & Wakefield, Academy Award-winning animation studio LAIKA, Bill.com and CallidusCloud.

New FlashBlade customer wins include CUProdigy, a technology organization delivering private cloud solutions for credit unions, and Paylocity, a developer of cloud-based payroll and human capital management software solutions for medium-sized organizations.

Fourth Quarter Fiscal 2017 Guidance:

- Revenue in the range of $219 million to $227 million

- Non-GAAP gross margin in the range of 64% to 67%

- Non-GAAP operating margin in the range of -9% to -5%

Comments

Never stopping deficit of Pure is totally more than half billion dollar ($520.7 million) since out of stealth mode in August 2011 but with revenue continuing to grow with 3FQ17 total sales up 50% Y/Y and 21% Q/Q to reach a record $197 million, 3.1% above the midpoint of guidance.

Product sales grew 41% yearly and 23% quarterly to $160.5 million. Support revenue is up 105% and 13% to $36.5 million respectively.

77% of revenue came from USA and 23% from international compared to an 80%-20% split in the quarter of prior fiscal year. International business grew 70% in the latest quarter.

In the latest quarter, 76% of net new logos came through the channel.

Cloud deployments continue to account for more than a quarter of sales driven service over 400 software and services, infrastructure of the service, and consumer cloud customers.

Repeat purchase rates remain strong with top 25 cohorts spending $12 more over the next 18 months for each dollar they spend initially. For every $1 that Pure's customers spend for first order, they spend an average of more than $2 additionally within the next 24 months.

3FQ17 total gross margins of 65.5% improved 3.8 percentage points year-on-year and declined 0.8 quarter-on-quarter.

Pure is spending a lot to get market share. Sales and marketing expenses of $82.5 million represented 42% of revenue in the most recent quarter vs. $59.2 million or 45% a year ago. In absolute dollars they grew 39% Y/Y, with heavy investing in headcount and programs.

The flash company finished the October quarter with cash and investments of $518 million.

4FQ17 guidance implies for current year that Pure will drive nearly 65% Y/Y revenue growth while cutting absolute operating losses by 20%.

Here is the comment from CEO Scott Dietzen about Dell EMC, especially aggressive competitor in all-flash storage subsystem: "Dell EMC of course remains our most frequent competitor, thrilled to say that in the quarter our win rates overall held strong, as good as they've been in a year. And our win rates specifically against Dell EMC, we maintained a two-thirds POC win rate that we've historically enjoyed. Now I think we are benefiting from the fact that the combined entity has nine different all-flash storage offerings and that's creating some confusion in the field about which tech for which solution. I will say broadly in our own experience we are seeing a lot more of flash VMAX, then we are XtremIO to-date, possible that moves overtime but it's certainly seems that their cadence has shifted there."

For next quarter, Pure expects lower quarterly growth, between 11% and 15%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter