Market of Non-Volatile Dual In-Line Memory Module (NVDIMM) – Technavio

Growing at CAGR of 64% to reach $3.805 billion by 2020

This is a Press Release edited by StorageNewsletter.com on November 29, 2016 at 4:00 pmTechnavio‘s (Infiniti Research Limited) report on the global non-volatile dual in-line memory module (NVDIMM) market provides an analysis on the trends expected to impact the market outlook from 2016-2020.

It defines an emerging trend as a factor that has the potential to impact the market and contribute to its growth or decline.

Sunil Kumar Singh, an analyst from Technavio, specializing in research on embedded systems sector, says: “Intel plans to release its 3DX point NVDIMM by the end of 2016. The adoption rate of this product will be high due to its high speed and low cost when compared to dynamic random access memory.”

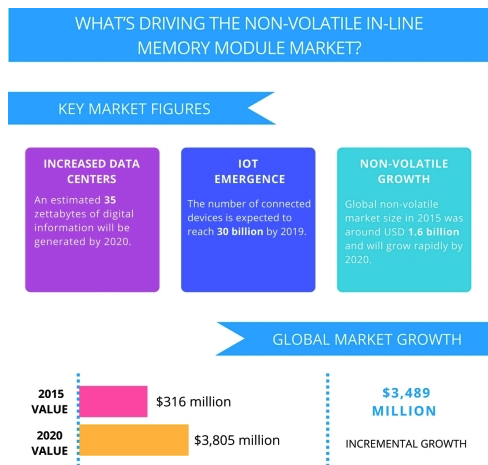

In 2015, the global NVDIMM market was valued at $316 million and is expected to reach $3,805 million by 2020, growing at a CAGR of 64.49% during he forecast period.

NVDIMMs are mainly used in server and storage applications. It is economical and efficient to add NVDIMM to a server system to protect fast-moving and critical data. Combining NAND flash memory with DRAM on a memory stick helps reduce latency at a faster rate when compared to a PCIe flash card. In traditional storage arrays, data is replicated to prevent data loss during a power outage by using a RAID controller cards – one in a master node and another in a slave node in the cluster – with non-volatile memory embedded in them. While NVDIMMs eliminates the wait time to write on a RAID card, as they do not have clusters.

The top four emerging trends driving the global NVDIMM marketaccording to Technavio hardware and semiconductor research analysts are:

Rapid growth in non-volatile market

The global non-volatile market size in 2015 was around $1.6 billion and is expected to grow rapidly by 2020. Enterprise servers and storage will be the largest adapters of NVDIMM, expected to account for nearly 60% of the market by the end of 2018, followed by workstations and networking equipment. By regions, North America is the largest market in 2015 accounting for 3/4 of the total NVDIMM sales globally followed by Europe and Asia accounting for 12% and 10%, respectively. North America is expected to be the leader until 2020, due to increasing demand from the server industry.

Adoption of DDR4 technology

DDR4, a transfer mode for data on a computer bus, is expected to penetrate the market by 50% by the end of 2016. With the introduction of DDR 4, NVDIMM is expected to go mainstream as the high read and write speed is expected to be accommodated by it. DRAM manufacturers co-operated under Intel’s leadership to bring out DDR4 for server field; server DRAM needs to be stable and fast at low voltages.

“According to the JEDEC, the speed of DRAM is expected to reach 3,200MHz at 1.2V of electricity. With the price gap between DDR3 and DDR4 reducing, DDR4 is expected to be mainstream by the end of 2016,” adds Sunil.

Advances in super capacitors

Hybrid super capacitors help increase energy density for NVRAM backup. NVDIMMs can retain data in case of power interruption as the data is transferred from DRAM to NAND flash. This transfer of data is possible with the help of supercapacitors, which powers the DRAM when the main supply is cut off. Large data transfers require more energy in capacitors to provide uninterrupted power supply. Hybrid capacitors achieve higher energy density with increased cycle times of 1,000s to 100,000s time by storing charge in redox reactions and in electrostatic Helmholtz layers. Hybrid super capacitors have energy density around 20-40Wh/L and peak power discharge at around 1-10Wh/L with no thermal runaway risk.

New product launches

Traditional DRAM manufacturers are shifting their focus to new non-volatile memory technologies with the launch of NVDIMMs and other memory devices. Hewlett Packard launched their line of NVDIMMs and NVMe products in March 2016 under a new product category called persistent memory products that can be used with HPE ProLiant storage servers, including DL360, DL380, DL550, DL580, and ML350 models. This was preceded by Intel’s launch of their non-volatile portfolio in January 2016 called 3D XPoint NVDIMM that utilizes DDR4 interface to communicate directly with the CPU with maximum capacity per 3D XPoint NVDIMM at 512GB, and dual-socket servers can address up to 6TB total with two CPUs. This was followed by launches by Netlist, crucial, AgigA, Smart Modular and many more.

Key vendors are:

• AgigA Tech

• Diablo Technologies

• HPE

• Micron Technology

• Netlist

• SK Hynix

• SMART Modular Technologies

• Viking Technology

To request sample report (registration required)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter