Nimble Storage: Fiscal 3Q17 Financial Results

Always same song: revenue up and huge losses

This is a Press Release edited by StorageNewsletter.com on November 25, 2016 at 2:36 pm| (in $ million) | 3Q16 | 3Q17 | 9 mo. 16 | 9 mo. 17 |

| Revenues | 80.7 | 102.0 | 232.1 | 285.6 |

| Growth | 26% | 23% | ||

| Net income (loss) | (28.6) | (39.3) | (87.7) | (121.9) |

Nimble Storage, Inc. reported financial results for the fiscal third quarter 2017.

“We executed well in Q3FY17, with strong momentum driven by all flash arrays (AFA) and growth in strategic customer segments. Our annualized AFA bookings run-rate is approximately $100 million in just our second full quarter of shipping AFAs. Bookings from large enterprises grew 53% and cloud service providers grew 65% over Q3FY16,” said Suresh Vasudevan, CEO. “The differentiation of our Predictive Flash platform is driving market-share gains and strong win-rates. A single architecture across All Flash and Adaptive Flash arrays is designed to accelerate every enterprise application. Our cloud-based predictive analytics delivers unmatched reliability and simplifies operations for customers.“

“We continue to execute well against our financial and operational plan. Our Q3 revenue grew 26% from a year ago and 28% at constant exchange rates. Our year-over-year quarterly growth rate accelerated from the first half of the year. In particular, strong adoption of our AFAs resulted in larger deal sizes with >$250,000 deals growing 75% and >$100,000 deals growing 35% over the same quarter last year. As we look ahead, our priority is to drive revenue growth while delivering improvements in operating leverage,” said Anup Singh, CFO.

Third Quarter Fiscal 2017 Financial Highlights:

• Total revenue increased 26% to $102.0 million, up from $80.7 million in the third quarter of fiscal 2016.

GAAP Financial Highlights in 3FQ17

• GAAP gross margin was 63.8% compared to 65.3% in the third quarter of fiscal 2016.

• GAAP operating loss was $39.0 million, compared to a loss of $28.3 million in the third quarter of fiscal 2016.

• GAAP net loss was $39.3 million, or $0.45 per basic and diluted share, compared with a net loss in the third quarter of fiscal 2016 of $28.6 million, or $0.36 per basic and diluted share.

Non-GAAP Financial Highlights in 3FQ17

• Non-GAAP gross margin was 66.0% compared to 66.9% in the third quarter of fiscal 2016.

• Non-GAAP operating loss was $15.4 million, compared to a loss of $10.8 million in the third quarter of fiscal 2016.

• Non-GAAP net loss was $15.7 million, or $0.18 per basic and diluted share, compared with a net loss of $11.0 million in the third quarter of fiscal 2016, or $0.14 per basic and diluted share.

For the fourth quarter of fiscal 2017, the firme expects:

• Total revenue of $112.0 million to $115.0 million.

• Non-GAAP operating loss of $11.0 million to $13.0 million.

• Non-GAAP net loss of $0.13 to $0.15 per share, based on weighted average basic shares outstanding of approximately 88.0 million.

Business Highlights

• Partnership with Lenovo to Transform the Data Center. This strategic partnership encompasses Lenovo flash-based storage and converged infrastructure solutions powered by Nimble. The two companies will enable the transformation of data center capabilities by delivering new levels of efficiency and scale, and slashing the time IT teams spend managing infrastructure.

• Named a Leader in the 2016 Gartner Magic Quadrant for General-Purpose Disk Arrays. Nimble has been positioned furthest on the visionary axis in the Leaders quadrant. The report analyzes hybrid and solid-state arrays that support SAN and network-attached storage protocols. This is the second consecutive year Nimble has been placed in the Leaders quadrant of the Gartner report.

• Released Aggressive Entry Point to All Flash Storage. The new AF1000 offers a full-featured all flash array with scalability, allowing customers to start small and scale non-disruptively up to 8PB at a substantially lower cost.

• Introduced a New Generation of Adaptive Flash Arrays. The new portfolio consists of the CS1000, CS3000, CS5000 and CS7000, delivering up to 2X performance improvement and 40% lower cost of capacity compared to the previous generation of CS-Series Adaptive Flash arrays.

• Nimble Storage Predictive Flash Becomes App-Centric. The company introduced a suite of features that are optimized around fast and predictable application delivery, including QoS and secure multi-tenancy. It now also offers app-based pricing for storage on demand, providing a cloud-like pricing model where enterprises only pay for the storage consumed by each application. Additionally, the firm now supports native persistent storage for Docker Containers, adding to the app-level granularity Nimble provides through VMware VVols and native support for OpenStack Clouds.

• Enabling Cloud Service Providers to Enhance Offerings. The firm announced a new cloud service provider program, enabling cloud partners to increase competitive advantage by offering comprehensive premium services. New features allow them to offer app-centric services to their customers, including QoS, secure multi-tenancy, and app-based storage on demand pricing.

• Investment in Channel Ecosystem with SiteAnalyzer. Cloud-based SiteAnalyzer expands InfoSight Predictive Analytics by delivering deep visibility into end user environments, eliminating guesswork that can shorten the sales cycle.

• OpenStack 8.0 Certification Completed. Predictive All Flash and Adaptive Flash arrays have been certified with Red Hat OpenStack Platform 8, ensuring that the products and services are tested, supported, and certified to perform with Red Hat technologies.

• Mark Stevens Named VP of EMEA. He brings nearly 35 years of technical, sales and leadership experience. He will draw from his background in the enterprise storage space to accelerate enterprise and channel strategy across EMEA.

• Nimble Storage Recognized for Exceptional Growth and Innovation.

• 2016 CRN Tech Innovator award presented to Nimble for the AF1000 All Flash array. This new entry-level all flash array was recognized for being the most innovative storage product in the channel.

• Deloitte’s 2016 Technology Fast 500 ranked Nimble 63 on its list for fastest growing companies in North America.

• Computerworld Malaysia awarded Nimble the 2016 Readers Choice Award. A combination of price, performance, features, reliability and ease of use lead the company to earning the award for networked storage.

Comments

Nimble Storage continues to grow sales at a fast pace, but it's the same for losses, here at $39.3 million, up 37% Y/Y and slightly down Q/Q (2%)

The company continues not to be profitable since its inception in 2007 and $168 million IPO in 2013. And this trend is going to continue in the future. Same question remains: will Nimble be ever profitable? For sure, not in the next future.

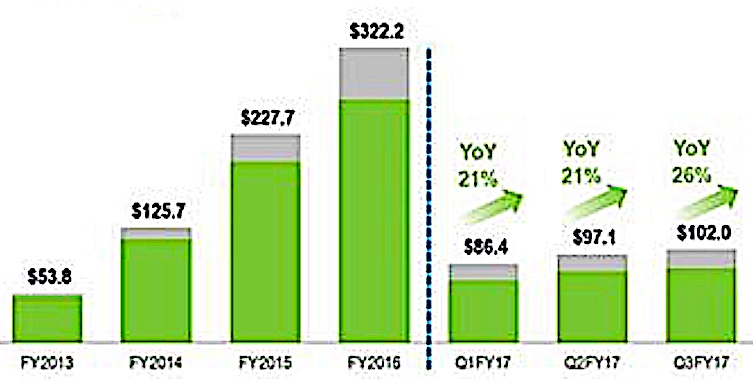

3FQ17 revenue was $102 million - above the midpoint of guidance of $100 million to $103 million - an increase of 26% from 3FQ16 and 5% from former three-month period. Growth during the quarter increased from the 21% growth achieved in 1FQ17 and 2FQ17.

Company added 600 new customers during the quarter and installed base now stands at 9,450, up 38% from a year ago.

It added 217 AFA end users in the quarter, 115 of whom were new ones. AFAs now account for 24% of total product bookings, up from 17% during the last quarter. AFAs are growing and hybrid platforms are declining, current trend in the storage subsystem market.

"A key driver of this expansion in deal sizes is the fact that we're now frequently being deployed in tier 1 workloads, displacing high-end legacy arrays and winning against high-end AFAs," commented CEO Suresh Vasudevan.

Bookings from large enterprises during 3FQ17 grew at 53% from 3FQ16. This customers' base at the end of 3FQ17 grew 28% over the same time last year.

On a trailing 12-month basis, repeat bookings, excluding renewals from installed base, grew to 49% compared to 44% in the prior 12—month period.

Channel initiated bookings accounted for 47% of total bookings during the most recent 3FQ17.

International sales grew 34% from one year ago and contributed 23% of revenue compared to 22% respectively.

During the last year, Nimble added over 200 people and ended with 1,250 employees.

It ended last quarter with cash and cash equivalents of 180.7 million, a decrease of 13.5 million during the quarter.

Guidance for next three-month period is revenue between $112 million to $115 million, representing a sequentially growth rate of 10% to 13%, or 24% to 28% compared to one year ago.

Revenue in $ million

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter