Seagate: Fiscal 1Q17 Financial Results

Earnings jump quarterly on stronger demand and cost cuts.

This is a Press Release edited by StorageNewsletter.com on October 20, 2016 at 2:36 pm| (in $ million) | 1Q16 | 1Q17 | Growth |

| Revenue |

2,925 | 2,797 | -4% |

| Net income (loss) | 34 | 167 | 391% |

Seagate Technology plc reported financial results for the first quarter of fiscal year 2017 ended September 30, 2016.

For the first quarter, the company reported revenue of $2.8 billion, gross margin of 28.6%, net income of $167 million and diluted earnings per share of $0.55.

On a non-GAAP basis, which excludes the net impact of certain items, the firm reported gross margin of 29.5%, net income of $299 million and diluted earnings per share of $0.99.

During the first quarter, the company generated $592 million in operating cash flow and repurchased 3 million ordinary shares for $101 million. Cash, cash equivalents, and short-term investments totaled approximately $1.5 billion at the end of the quarter.

There were 299 million ordinary shares issued and outstanding as of the end of the quarter.

“In response to strong cloud storage customer demand, Seagate delivered record levels of exabyte shipments, and generated strong revenues, margin and cash flow in the September quarter. In addition, as a result of our operating expense management, the company’s non-GAAP earnings per share increased by 85% year over year,” said Steve Luczo, Seagate’s chairman and CEO. “As the demand for HDD storage continues to benefit from the shift to data driven cloud based architectures, Seagate is in a strong position to grow its businesses, improve margins and continue with its dividend and buyback capital allocation objectives.”

The board of directors of the company has approved a quarterly cash dividend of $0.63 per share, which will be payable on January 4, 2017 to shareholders of record as of the close of business on December 21, 2016.

Comments

Following a better demand of hard disk drives in 3CQ16, Seagate reports better quarterly financial results for the period. And it will be also the case for Western Digital soon and especially much smaller Toshiba HDD booming.

Company's revenue at $2.8 billion was up 5% Q/Q and down 4% Y/Y with increasing net income.

1FQ17 HDD shipments at 38.9 million increase 6% quarterly and decrease 1% yearly.

Here is how CEO Steve Luczo summarizes the quarter: "We believe Seagate's September quarter reflects - results are reflective of a generally stable but mixed macroeconomic environment, as well as acceleration in the deployment of cloud-based storage associated with usage shifts of technologies and architectures by end users. Demand from cloud service providers for our nearline high capacity portfolio was stronger than we expected going into the September quarter."

CFO Dave Morton also noted: "During the September quarter, we implemented certain cost reduction activities and recognized approximately $82 million in pretax restructuring charges."

Luczo also announced: "With respect to our cloud systems business, we are on track to launch new converged storage platforms including hybrid and all flash array offerings later this fiscal year."

No figures were revealed for the next quarter. Luczo only said: "For the December quarter we expect this demand to remain stable, with overall market exabyte demand to be slightly stronger. (...) As such, we expect relatively flat revenue with improvement in gross margins in the December quarter."

Revenue by products in $ million

| 4FQ16 | 1FQ17 | Growth | |

| HDDs | 2,455 | 2,589 | 5% |

| Enterprise systems, flash and others | 199 | 208 | 5% |

Seagate's HDDs from 1FQ14 to 1FQ17

(units in million)

| Fiscal period | Enterprise | Desktop | Notebook | CE | Branded | Total |

HDD ASP |

Exabytes | Average |

| HDDs | shipped | GB/drive | |||||||

| 1Q14 | 8.1 | 19.1 | 17.2 | 6.2 | 5.1 | 55.7 | $62 | 48.9 | 878 |

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

| 3Q14 | 7.7 | 19.8 | 16.4 | 5.4 | 5.9 | 56.2 | $61 | 50.8 | 920 |

| 4Q14 | 7.4 | 18.4 | 16.8 | 5.1 | 4.8 | 52.5 | $60 | 49.6 | 945 |

| 1Q15 | 8.8 | 18.7 | 20.2 | 6.0 | 5.7 | 59.5 | $60 | 59.9 | 1,007 |

| 2Q15 | 9.1 | 16.0 | 19.7 | 6.1 | 6.0 | 56.9 | $61 | 61.3 | 1,077 |

| 3Q15 | 9.1 | 14.3 | 16.8 | 4.8 | 5.1 | 50.1 | $62 | 55.2 | 1,102 |

| 4Q15 | 8.2 | 11.9 | 14.6 | 5.8 | 4.7 | 45.3 | $60 | 52.0 | 1,148 |

| 1Q16 | 7.8 | 12.4 | 16.4 | 5.5 | 5.2 | 47.2 | $58 | 55.6 | 1,176 |

| 2Q16 | 8.1 | 11.7 | 13.6 | 6.2 | 6.4 | 45.9 | $59 | 60.6 | 1,320 |

| 3Q16 | 7.7 | 10.8 | 10.6 | 5.0 | 5.2 | 39.2 | $60 | 55.6 | 1,417 |

| 4Q16 | 8.5 | 8.6 | 8.5 | 6.5 | 4.7 | 36.8 | $67 | 61.7 | 1,674 |

| 1Q17 | 8.7 | 9.1 | 6.8 | 9.6 | 4.7 | 38.9 | $67 | 67 | 1,716 |

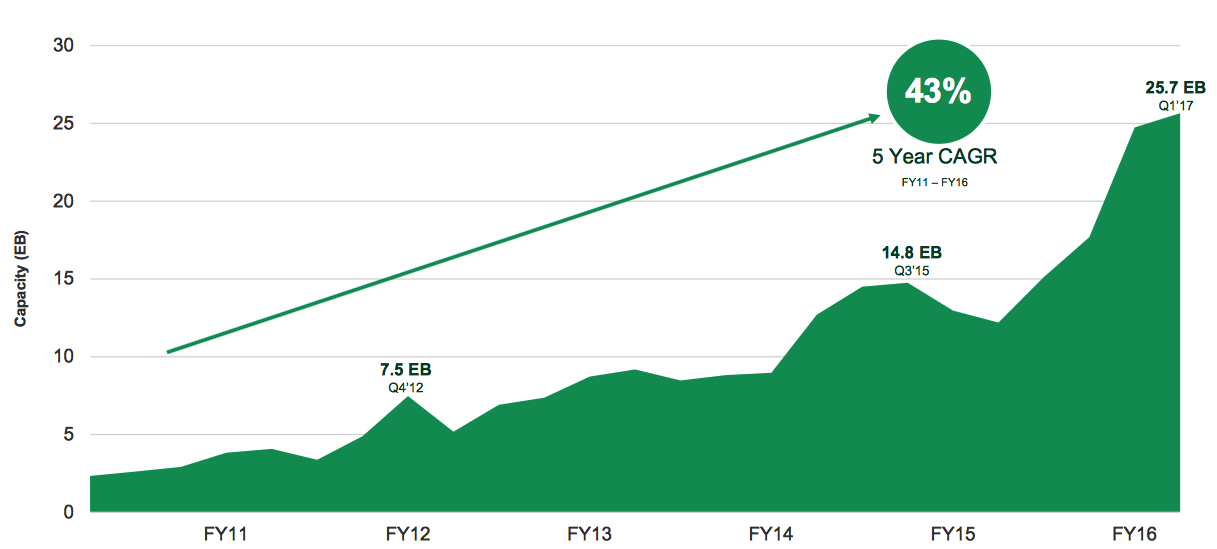

Nearline demand trend

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter