j2 Global: Fiscal 2Q16 Financial Results

Revenue at $29 million for cloud backup, up 77% Y/Y and 6% Q/Q

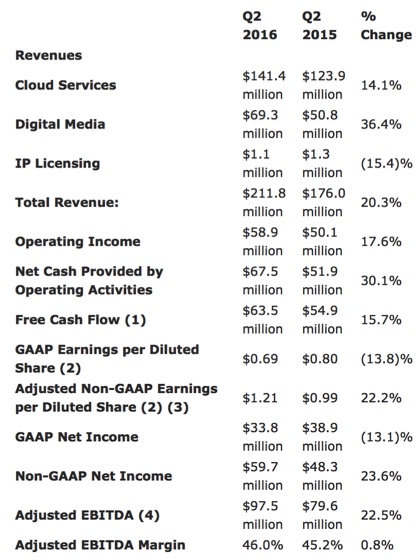

This is a Press Release edited by StorageNewsletter.com on August 16, 2016 at 3:19 pm| (in $ million) | 2Q15 | 2Q16 |

| Revenue | 176.0 | 211.8 |

| Growth | 20% | |

| Net income (loss) | 38.9 | 33.8 |

j2 Global, Inc. reported financial results for the second quarter ended June 30, 2016 and announced that its board of directors has declared an increased quarterly cash dividend of $0.3450 per share.

2Q16 results

Quarterly revenues increased 20.3% to a Q2 record of $211.8 million compared to $176.0 million for Q2 2015.

Net cash provided by operating activities increased by 30.1% to $67.5 million compared to $51.9 million for Q2 2015. Q2 2016 free cash flow increased by 15.7% to $63.5 million compared to $54.9 million for Q2 2015 which included an adjustment to free cash flow of $5.8 million associated with taxes for prior periods under audit. Exclusive of the impact in Q2 2015, free cash flow increased by 29.3% compared to $49.1 million for Q2 2015.

In Q2 2015, the company released certain income tax reserves in conjunction with a favorable IRS tax settlement of $11.9 million, or $0.25 per diluted share which contributed to a decrease in GAAP earnings per diluted share of (13.8)% to $0.69 in Q2 2016 compared to $0.80 for Q2 2015. Exclusive of the impact of the tax reserves release in Q2 2015, GAAP earnings per diluted share(1) increased by 25.5% compared to $0.55 for Q2 2015. Adjusted Non-GAAP earnings per diluted share(2)(3) for the quarter increased 22.2% to $1.21 compared to $0.99 for Q2 2015.

GAAP net income decreased by (13.1)% to $33.8 million compared to $38.9 million for Q2 2015. As noted above, the decrease was attributed to certain non-recurring income tax reserves in conjunction with a favorable IRS tax settlement.

Quarterly Adjusted EBITDA increased 22.5% to $97.5 million compared to $79.6 million for Q2 2015.

j2 ended the quarter with approximately $407.2 million in cash and investments after deploying $43.0 million during the quarter for acquisitions and j2?s regular quarterly dividend.

“Our second quarter results highlight the positive combination of healthy revenue growth and efficient expense management,” said Hemi Zucker, CEO. “Our employees’ efforts yielded an impressive 23% year-over-year adjusted EBITDA growth on 20% year-over-year revenue growth. With the excellent results of our first-half in hand, I am both optimistic and confident in the future of j2?s businesses and their prospects.”

Business outlook

For fiscal 2016, the company estimates that it will achieve revenues between $830 and $860 million and adjusted non-GAAP earnings per diluted share of between $4.70 and $5.00.

Adjusted non-GAAP earnings per diluted share for 2016 excludes share-based compensation of between $12 and $14 million, amortization of acquired intangibles and the impact of any currently unanticipated items, in each case net of tax.

It is anticipated that the Non-GAAP effective tax rate for 2016 (exclusive of the release of reserves for uncertain tax positions) will increase from 28.4% to between 29% and 31%.

Dividend

j2’s board of directors has approved a quarterly cash dividend of $0.3450 per common share, a $0.01, or 3.0% increase versus last quarter’s dividend. This is its twentieth consecutive quarterly dividend increase since its first quarterly dividend in September 2011. The dividend will be paid on September 1, 2016to all shareholders of record as of the close of business on August 17, 2016.

Comments

Abstracts of the earnings call transcript:

R. Scott Turicchi, president and CFO:

"The cloud services, which include our backup business, our email security, email marketing and hosting business, had $48.5 million of revenues in the quarter, almost $23 million of EBITDA and an EBITDA margin of 47%. As we have said before, as these businesses both individually and in the aggregate scale, we expect them to reach 50% EBITDA margins; we are now closing in on that."

Nehemia (Hemi) Zucker, CEO:

"(...) about our cloud backup highlights. Revenue was $29 million, 77% up versus last year, and 6% up versus last quarter. EBITDA of $15.5 million, 125% versus Q2 2015. EBITDA margin increased to 53% versus 42% in Q2 2015. We're very excited about it as we scale up the margins and the EBITDA on the backup.

"We have also acquired early in the third quarter a company called Frontsafe. Frontsafe is a Denmark company which is now becoming part of the KeepItSafe business, which helps us to grow into the Scandinavia market. We continue to grow our backup business. We have completed additional three smaller acquisitions in Q2, altogether eight acquisitions year-to-date in 2016 with a still healthy acquisition pipeline for backup business."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter