Flash Arrays Account for Over 50% of External Storage in EMEA in 3Q15 – IDC

But overall market declined 10% Y/Y, EMC as much as 20%, IBM 18% and Dell 13%

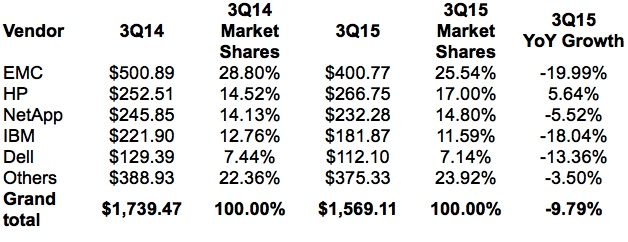

This is a Press Release edited by StorageNewsletter.com on December 17, 2015 at 2:51 pmThe value of the total EMEA external storage systems market fell 9.8% year over year to $1.57 billion in 3Q15, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker, 3Q15.

Top 5 Vendors, EMEA External Disk Storage Systems Value

(in $ million)

The traditional HDD segment in EMEA declined for yet another quarter, falling 27% in user value. The flash market, however, recorded huge growth, with all-flash system growing 75.4% annually and hybrid flash arrays growing 7% Y/Y.

“The downward trend was consistent across subregions in a quarter characterized by the lack of big deals, an exacerbating price war, and particularly unfavorable exchange rates,” said Silvia Cosso, senior analyst, European storage research, IDC. “On the other hand, a look at the trend in euros gives a completely different picture of the market, with five quarters of uninterrupted growth and a 7.6% increase year over year. The transition toward the 3rd Platform is also influencing purchase decisions, with users shying away from high-end systems, which declined for the 10th quarter in a row, to fully embrace new solutions such as flash systems, which passed the 50% threshold of total external storage value.”

The Western European external storage market fell 9.7% Y/Y in value to $1.13 billion in 3Q15, but grew 7.7% in euros.

“The Western European external storage market continued its downward trend in the third quarter of 2015 as spending on traditional HDDs declined sharply,” said Archana Venkatraman, senior analyst, European storage research, IDC. “The high growth in flash storage coupled with strong ODM vendor revenue growth shows that Western European enterprises are heavily investing in disruptive storage technologies such as flash, software-defined storage, cloud-based storage, and hyperconverged systems when they refresh their infrastructures.”

Country-wise, the decline in the U.K. storage market continues, with some traditionally strong segments such as financial services slowing down investments. The U.K. is also the main hub for storage start-ups in Europe and therefore faces greater competition in price. A positive picture is emerging for France, however, with the country returning to growth after a long run of negative quarters.

Both Central and Eastern Europe, Middle East, and Africa (CEMA) subregions had a similar performance in 3Q15, with a 10% Y/Y decline (or $440.4 million) in external storage market spending. The decline was across all storage classes and stemmed from all hard disk arrays, while both hybrid (HFA) and all-flash array (AFA) thrived, with AFA increasing its share in the Middle East and Africa (MEA) almost tenfold to 7.5% within a year. Despite the value drop, capacity continued to grow non-disruptively at 31.6% annually, reaching 734.2PB as dollar-per-gigabyte rates slumped for all types of storage media.

Country performance varied given the turbulence in the CEMA region, but there are signs of political and macroeconomic stabilization in the Central and Eastern Europe (CEE) subregion that levelled off any major fluctuations in the external storage market for the quarter. Major countries in MEA, however, performed below expectations. This squeezed business and government spending and created challenges for traditional storage vendors. The run rates were fairly stable, but not high enough to compensate for the overall slowdown in demand.

“To solve their pressing datacenter challenges, end users in CEMA, and particularly in MEA, are increasingly looking for innovation and TCO optimization beyond traditional storage arrays and vendors,” said Marina Kostova, senior storage analyst, IDC CEMA. “Providers of competitive integrated, hyperconverged, cloud-based and flash-optimized solutions are steadily expanding scope and attracting different end users, led by the financial sector but with projects in other verticals in the pipeline.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter