Hewlett Packard Company: Fiscal 4Q15 Financial Results

Fourth consecutive fiscal year of decline in storage revenue

By Jean Jacques Maleval | November 30, 2015 at 2:44 pm| (in $ million) | 4Q14 | 4Q15 | FY14 | FY15 |

| Storage revenue | 878 | 819 | 3,316 | 3,180 |

| Growth | -7% | -4% |

Hewlett-Packard Company reported financial results for its fiscal 2015 fourth quarter ended October 31, 2015.

For the fourth fiscal year in a row, HP storage sales declined Y/Y between 4% and 9%, each years being under $4 billion reached in FY11.

HP Storage Revenue

| Period | Revenue in $ million |

Y/Y growth |

| FY08 | 4,205 | NA |

| FY09 | 3,473 | -12% |

| FY10 | 3,785 | 9% |

| FY11 | 4,056 | 7% |

| FY12 | 3,815 | -9% |

| FY13 | 3,475 | -5% |

| FY14 | 3,316 | -5% |

| FY15 | 3,180 | -4% |

For the most recent quarter, storage revenue was down 7% Y/Y or flat in constant currency, and up 4% Q/Q. Biggest problem come from traditional storage activity, including EVA, MSA and tape, diminishing yearly by 19% at $389 million, as converged storage including 3par was up 9% and 17% in constant currency, representing $430 million or 53% of total storage portfolio.

Quarterly revenue for HP storage only

(without services, in $ million)

| Quarter |

Revenue |

Q/Q Growth |

| 1Q13 | 833 | -12% |

| 2Q13 | 857 | 3% |

| 3Q13 | 833 | -3% |

| 4Q13 | 952 | 14% |

| 1Q14 | 834 | -12% |

| 2Q14 | 808 | -3% |

| 3Q14 | 796 | -1% |

| 4Q14 | 878 | 10% |

| 1Q15 | 837 | -5% |

| 2Q15 | 740 | -12% |

| 3Q15 | 784 | 6% |

| 4Q15 | 819 | 4% |

About converged storage, Meg Whitman president and CEO of HP Enterprise, commented:” We are now seeing our R&D investments payoff with exceptional growth in all-flash, which has taking over ten points of share in the last year. We expect the improving mix of converged storage to drive overall growth in fiscal year 2016 at improved margins and with better TS [Technology Services] attach.”

On all-flash, he added:” Storage outpaced the market and we expect that we gained close to a point of share in the third calendar quarter. Our 3par all-flash portfolio is outperforming the competition. 3par all-flash is now a $500 million annualized run rate business and grew triple digits in the fourth quarter. That’s larger and growing faster than Pure [Storage] in their most recently reported quarter.”

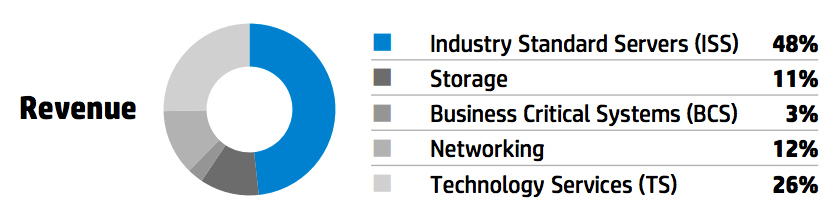

Storage represents 11% of global Enterprise Group sales, Business Critical Systems 3% yearly down 8%.

Now the question is: will the new Hewlett Packard Enterprise comprising Enterprise Group (servers, storage, networking, consulting and support), Enterprise Services, Software and Financial Services, now separated from HP Inc. into personal computer and printing business since November 1, 2015, will reverse the current long-term decline of HP storage?

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter