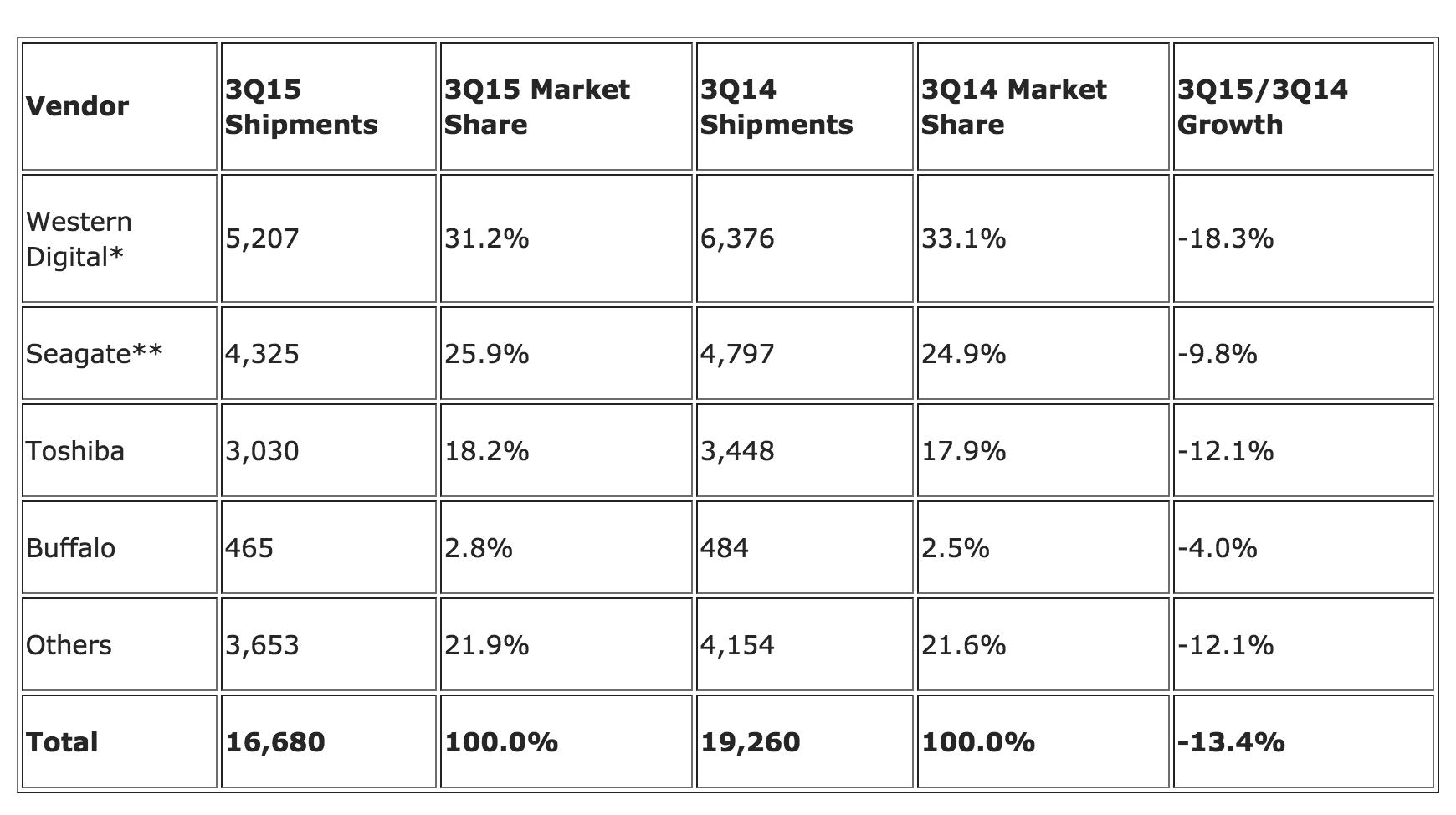

WW Personal and Entry-Level Storage Shipments Declined 13% Y/Y in 3Q15 to 16.7 Million Units – IDC

But up 10% Q/Q

This is a Press Release edited by StorageNewsletter.com on November 24, 2015 at 2:25 pmWorldwide personal and entry-level storage (PELS) shipments declined -13.4% year over year to 16.7 million units in 3Q15, but were up 10.3% compared to the previous quarter, according to the International Data Corporation‘s Worldwide Personal and Entry-Level Storage Tracker.

Shipment values declined along with unit shipments, down 19.8% from a year ago to $1.3 billion.

“The personal and entry-level storage market was stagnant in 2014 and started to show signs of decline in 2015,” said Jingwen Li, senior research analyst, storage systems, IDC. “The adoption of cloud storage has been gaining traction in the consumer space with its easy data access and mobile device integration. One of the negative impacts of cloud storage deployment leads to shrinking demand within the PELS market.“

Market Highlights

Personal storage remained the dominant component of the PELS market and accounted for over 98% of market shipments. This quarter marked the fourth consecutive quarter of declining shipments for personal storage, which were down 13.5% year over year. Entry-level storage, which represents the PELS market segment with higher margins, started to show shipment declines as well, with shipments down 4.5% during the quarter.

For personal storage, the majority of shipments were products with 1TB and 2TB capacity points, which combined accounted for nearly 75% of units shipped. On the entry-level side, 4TB and 8-20TB devices accounted for the majority of shipments, as SMBs demand larger capacity to meet their storage needs.

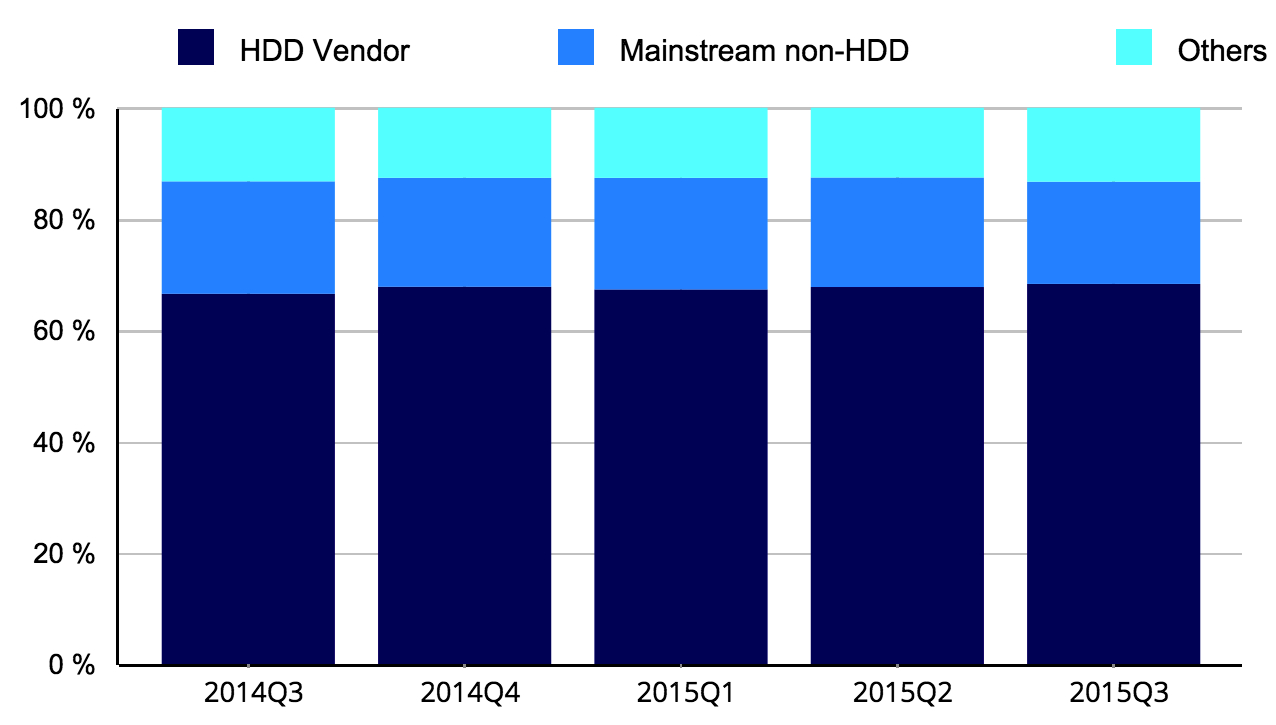

HDD vendors continued to dominate the personal storage segment (representing 80.5% of unit share) and gained shipment share in the entry-level segment (capturing 23.4% unit share). Due to the strong competition from HDD vendors, some mainstream non-HDD vendors (e.g. Lenovo) chose to withdraw from the PELS market and move up to the enterprise space for higher margins.

Regarding interface, USB remained the most popular choice in the market. Dual interface products continued to grow at a double-digit rate (51.8% year over year). Ethernet offerings experienced the largest decline in the recent four quarters (-17.6% Y/Y), which was primarily due to the decline in the entry-level space.

WW Personal and Entry-Level Storage Shipment, Market Share,

and Year-Over-Year Growth, Third Quarter * Western Digital does not include HGST

* Western Digital does not include HGST

** Seagate does not include LaCie and Samsung

WW Personal and Entry-Level Storage Shipment,

Vendor Type, 3Q14-3Q15 (Shares Based on Value)

(Source: IDC Worldwide Quarterly Personal and Entry Level Storage Tracker, November 2015)

Notes:

- The PELS market includes storage products and solutions with a single bay through twelve bay configurations that are manufactured and marketed for individuals, small offices/home offices, and small businesses.

- IDC defines personal storage as having 1-2 bays and entry-level storage as having 3-12 bays.

- IDC defines an HDD vendor as a vendor who manufactures its own HDD drive, in addition to branded external storage.

- IDC defines a mainstream non-HDD vendor as a major PELS vendor that does not manufacture its own HDD drives.

- Data for the PELS market is reported for calendar periods.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter