Imation: Fiscal 3Q15 Financial Results

Horrible: quarterly revenue under $130 million

This is a Press Release edited by StorageNewsletter.com on November 9, 2015 at 3:35 pm| (in $ million) | 3Q14 | 3Q15 | 9 mo. 14 | 9 mo. 15 |

| Revenues | 175.0 | 129.2 | 532.5 | 435.2 |

| Growth | -26% | -18% | ||

| Net income (loss) | (1.5) | (3.7) | (2.5) | (4.5) |

Imation Corp. released financial results for the third quarter ended September 30, 2015.

Q3 Overview

For the third quarter of 2015, Imation reported net revenue of $129.2 million, down 26.2% from Q3 2014.

Operating loss from continuing operations totaled $148.7 million, including special charges of $113.9 million and diluted loss per share from continuing operations was $3.70. The company had a cash balance of $94.3 million as of September 30, 2015.

On September 27, 2015, Imation adopted a restructuring plan in which it will terminate certain sales and operations of its worldwide Storage Media business, terminate certain sales and operations of its worldwide Consumer Storage and Accessories (CSA) business, and further reduce and rationalize its corporate overhead. This decision impacted the results for third quarter of 2015 due to increased costs for the associated inventory write-offs, accounts receivable write-offs and special charges. For the third quarter of 2015, special charges included restructuring and other of $40.2 million, intangible impairments of $37.6 million and goodwill impairments of $36.1 million.

Imation’s Interim CEO Robert Fernander commented: “This was a very busy and productive quarter where we managed to accomplish a great deal toward positioning Imation as a more competitive company capable of continued growth and success. While these aggressive steps have impacted our key financial results and performance metrics for the quarter, we are confident that over the long-term the company and its shareholders will benefit from these necessary changes.

“As it relates to our restructuring, we continue to become leaner and more efficient. Our decision to exit certain legacy businesses will improve our near-term financial performance and allow us to leverage the cash generated from these exit activities to reinvest in our priority Tiered Storage and Security Solutions (TSS) segment, which is poised to benefit from our recent and highly complementary acquisition of Connected Data. However, restructuring alone will not achieve long-term valuation creation. This is the reason our board has determined that the best use of Imation’s excess cash involves considering strategic acquisition opportunities to diversify our business activities, including opportunities that may be outside the company’s historical focus.

“Product innovation continues to be a priority, and we are pleased to have introduced new and improved products. Specifically, we added a new Lock & Key feature to our Nexsan Assureon product line, further enhancing its ability to protect high-value data. In an important development that reflects Imation’s commitment to delivering advanced storage and security solutions, our IronKey Workspace W700 device earned a Gold Stevie Award in the Hardware – Computer & Peripheral category in The 13th Annual American Business Awards. This award is a testament to our unmatched standards for security, quality, innovation and customer satisfaction.”

Fernander concluded: “We will continue to explore potential strategic alternatives, including divesting non-core and non-operating assets, in addition to aligning the incentives of the company’s management team with those of our shareholders. Against the backdrop of our ongoing restructuring, these efforts are all centered on creating a stable foundation upon which we can build significant value for our customers, our employees and our investors. We have made considerable progress over the quarter, and I look forward to sustaining this momentum towards reestablishing Imation as a technology innovator.“

Detailed Q3 2015 Analysis

The following financial results are for continuing operations for the current and prior periods unless otherwise indicated.

Net revenue for Q3 2015 was $129.2 million, down 26.2% from Q3 2014. From a segment perspective, CSA declined 26.3% and TSS declined 26.0%. CSA revenue decreased due to the ongoing decline in sales of optical media products along with negative foreign currency impacts. Within the TSS segment, Commercial Storage Media revenue decreased 32.6% due to the expected secular declines of our legacy magnetic tape business. Storage and Security Solutions revenue declined by 13.6% due to softer sales and negative foreign currency impacts. Foreign currency exchange rates negatively impacted total Q3 2015 revenues by 7.2% compared to Q3 2014.

Gross margin for Q3 2015 was 10.4%, 7.4 percentage points lower than Q3 2014. CSA gross margin was 3.5%, down from 21.5% in Q3 2014, primarily driven by inventory write-offs of $9.7 million taken as a result of our actions to end certain sales and operations. TSS gross margin for Q3 2015 was 17.9%, down from 19.3% in Q3 2014, driven by inventory write-offs taken as a result of our actions to end certain sales and operations in our Commercial Storage Media business.

Selling, general and administrative expenses in Q3 2015 were $43.4 million, up $0.9 million compared with Q3 2014 expenses of $42.5 million, due to increased charges for accounts receivable write-offs which was partially offset by lower spending and currency impacts. The company incurred charges of $7.3 million for accounts receivable write-offs associated with our actions to end certain sales and operations in the CSA and Commercial Storage Media businesses. The increase was partially offset by reductions of legacy and administrative operating costs of $4.6 million in Q3 2015 in order to operate as a smaller company with more focused product lines and streamlined core operational processes.

R&D expenses in Q3 2015 were $4.8 million versus $4.9 million in Q3 2014. The company continued to invest in new product development in its priority businesses and has aggressively reduced R&D expenses associated with legacy media products.

Special charges were $113.9 million in Q3 2015 compared to special charges of $39.6 million in Q3 2014. Special charges in Q3 2015 related to restructuring and other of $40.2 million, intangible impairments of $37.6 million and goodwill impairments of $36.1 million. The restructuring and other relates to $17.7 million of severance and other costs and $22.5 million of other charges which are mainly related to a write-down of the carrying value of our corporate HQs. The goodwill and intangible asset impairments were the result of the company revising its strategy by adjusting its product portfolio, as well as changing its ongoing investment philosophy such that the investments in operating expenses will be reduced.

Operating loss from continuing operations was $148.7 million in Q3 2015 compared with an operating loss of $55.8 million in Q3 2014. Excluding the impact of special charges described above, adjusted operating loss would have been $34.8 million in Q3 2015 compared with adjusted operating loss on the same basis of $11.6 million in Q3 2014 (see Tables Five and Six for non-GAAP measures).

Income tax expense was $3.6 million in Q3 2015 compared with $3.4 million in Q3 2014. The expense in Q3 2015 was primarily due to valuation allowances established in the current year as a result of the announced restructuring plan which resulted in international tax losses not being benefited. We maintain a valuation allowance related to our U.S. deferred tax assets and, therefore, no tax benefit was recorded related to our U.S. losses in any of the periods presented.

Loss per diluted share from continuing operations was $3.70 in Q3 2015 compared with a loss per diluted share of $1.49 in Q3 2014. Excluding the impact of special items, adjusted loss per diluted share would have been $0.93 in Q3 2015 compared with an adjusted loss per diluted share of $0.42 in Q3 2014 (see Tables Five and Six for non-GAAP measures).

Cash and cash equivalents balance was $94.3 million as of September 30, 2015, up $4.5 million during the quarter.

Year-To-Date Summary

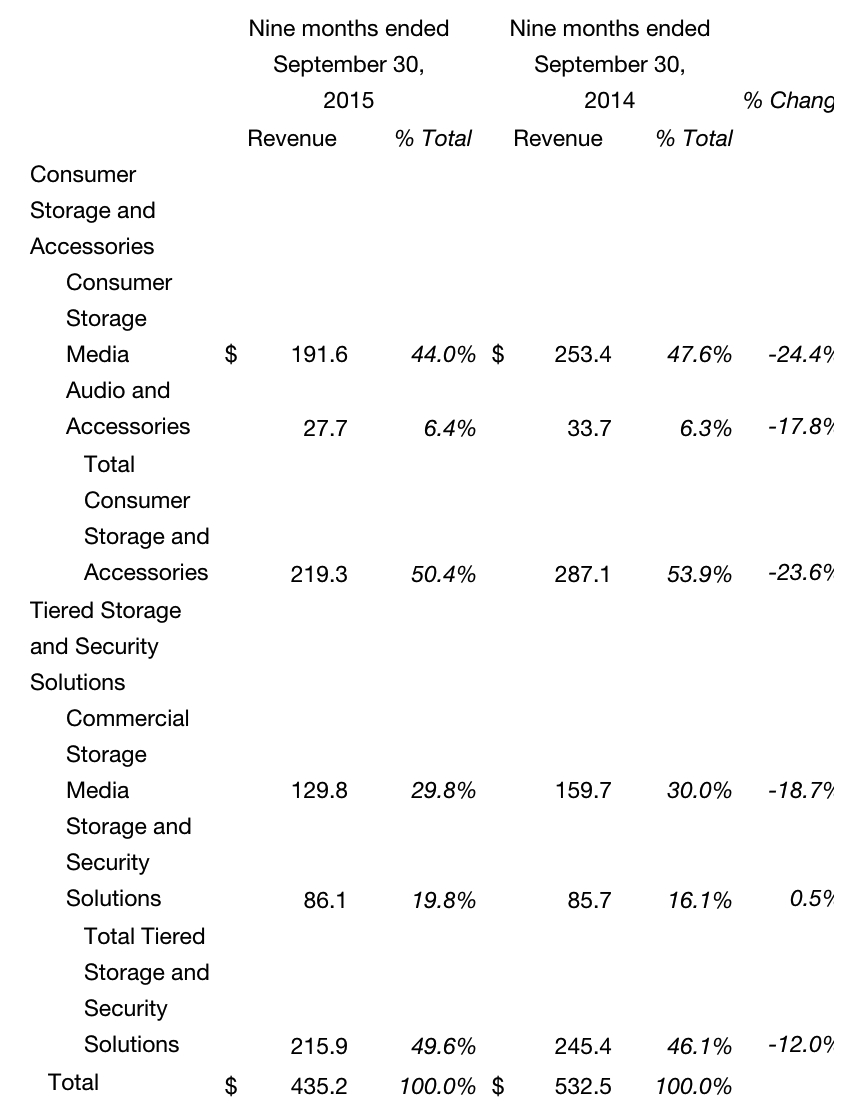

For the nine months ended September 30, 2015, Imation reported net revenue of $435.2 million, down 18.3% compared with the same period last year. Operating loss from continuing operations totaled $177.6 million for the nine months ended September 30, 2015, including special charges of $116.6 million, and diluted loss per share from continuing operations was $4.48. For the nine months ended September 30, 2014, Imation reported net revenue of $532.5 million, an operating loss from continuing operations of $92.0 million, including special charges of $51.5 million, and a diluted loss per share from continuing operations of $2.39.

Comments

You can search amidst all the Imation's figures, you will not find anything positive but a small increase of cash.

The company is betting on Nexsan and security products to rebound, but together their sales are decreasing by 12% for the last six months.

According to interim CEO Bob Fernander, "Tiered Storage and Security Solutions TTS revenue declined 26% compared with the same period last year due to a 32.6% decline in our commercial storage media revenues and a 13.6% decline in our storage and security solution revenues. The decrease was primarily driven by inventory and accounts receivable write-offs taken as a result of our announcement in certain sales and operations in the commercial storage media business."

The recent acquisition of small company Connected Data for $7.5 million and the selling of RDX business for $6 million will not be sufficient.

Now it would take a miracle for the company to come back. Will new CTO Geoff Barrall be the savior?

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter