Seagate: Fiscal 1Q16 Financial Results

Revenue and profit tumble.

This is a Press Release edited by StorageNewsletter.com on November 2, 2015 at 3:09 pm| (in $ million) | 1Q15 | 1Q16 | Growth |

| Revenue |

3,785 | 2,925 | -23% |

| Net income (loss) | 381 | 34 | -91% |

Seagate Technology plc reported financial results for the first quarter of fiscal year 2016 ended October 2, 2015.

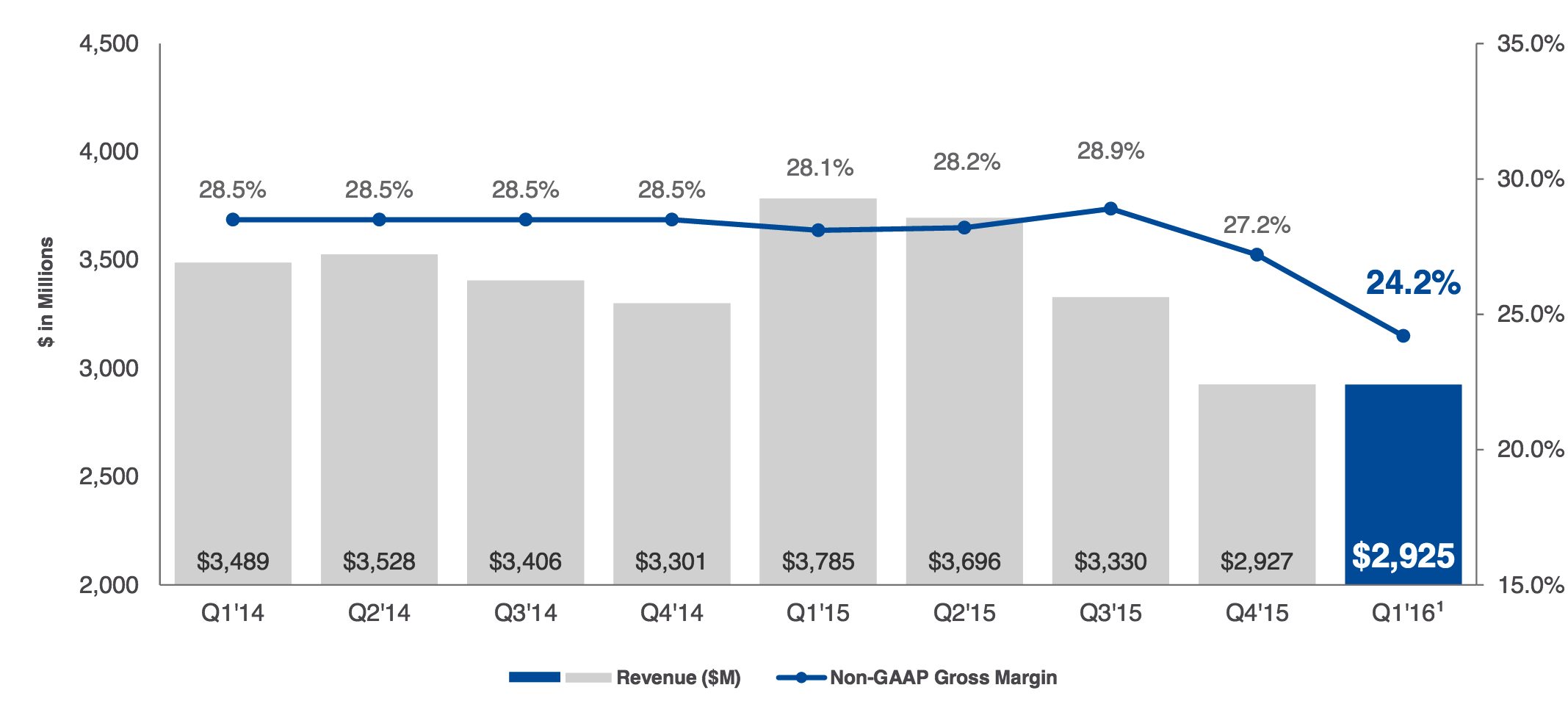

For the first quarter, the company reported revenue of approximately $2.9 billion, gross margin of 23.6%, net income of $34 million and diluted earnings per share of $0.11.

On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 24.2%, net income of $165 million and diluted earnings per share of $0.54. For a detailed reconciliation of GAAP to non-GAAP results, see the accompanying financial tables.

During the first quarter, the company generated approximately $824 million in operating cash flow, paid cash dividends of $163 million and repurchased approximately 20 million ordinary shares for $983 million. There were 299 million ordinary shares issued and outstanding as of the end of the quarter. Cash, cash equivalents, and short-term investments totaled approximately $1.9 billion at the end of the quarter.

“During the quarter, we made solid progress against our core initiatives to bolster our product portfolio, contain costs and return capital to shareholders,” said Steve Luczo, chairman and CEO. “While lower than planned nearline enterprise demand temporarily impacted our financial results, we are pleased with the momentum we have across our products, which will be further supported by the newly acquired assets of Dot Hill and our ability to now completely integrate the Samsung HDD business. As we look forward, we are focused on delivering storage solutions for a significant range of existing, growing and emerging areas, and believe we have the right strategy and portfolio to deliver value to shareholders.”

As previously disclosed on October 21, 2015, the board has approved a quarterly cash dividend of $0.63 per share, which will be payable on November 20, 2015 to shareholders of record as of the close of business on November 6, 2015. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

We doubt that the complete integration of Samsung HDD business and the acquisition of Dot Hill will be enough to transform Seagate in a growing company on the long term.

Like competitor Western Digital, it needs a big acquisition outside declining HDD market to assure the future of the company but current cash is - only - $1.9 billion, compared to $5.1 billion for Western Digital at the end of the same three-end period.

Since a long time, Seagate preferred to distribute dividends to shareholders rather than to accumulate cash to invest for the future. The former acquisitions of Dot Hill and Avago LSI flash business were affordable at $696 million and $450 million respectively. Xyratex was even cheaper at $374 million. One of the highest investment was $1,375 million in 2011 to get Samsung HDD business. But the same year, Western Digital didn't hesitate to pay $4,800 million for a greater acquisition, HGST, and is now putting $19 billion on the table to get SanDisk.

Commenting the financial results of the last quarter of his company, chairman and CEO Steve Luczo said: "Our capital return to shareholders remains a top priority at Seagate, and we continue to balance the effective investment in our technology portfolio with shareholder returns and within an investment grade framework. We don't obviously feel great about having the broadest portfolio that we need. And we need to address that."

The financial figures for the same last three-month period are in favor of Western Digital for all main figures but the number of desktop and enterprise HDDs shipped (see table below).

Seagate's 1FQ16 global sales were flat sequentially at $2,9 billion and decreased as much as 23% yearly. Net income is going down 75% Q/Q and 91% Y/Y.

Seagate's Revenue and Non-GAAP Gross Margin

The manufacturer shipped $47.2 million HDDs during the period. It's a little better (4%) that during the former quarter but less that the global market (7% at around 119 million), and far from one year ago (-21%). Total exabytes shipped into drives is up 7% Q/Q and down 7% Y/Y.

Here is how Luczo explains the situation:" (..) the September quarter nearline and enterprise demand was marginally lower than expected in terms of both units and exabytes. We believe the overall storage market demand will continue to be relatively flat in the December quarter. This includes some slight uptick in enterprise nearline exabyte demand and seasonal declines in the client and gaming markets."

Desktop, notebook, CE and branded drives were up sequentially, while enterprises units declined.

For the December quarter, Seagate is planning stable revenue, to be between $2.9 billion and $3 billion. It corresponds to Trendfocus' expectations for 4CQ15 at $120 million HDDs sold worldwide, a figure "to be modestly higher than 3CQ15 given that Windows 10 systems will have had a full three months of sales combined and with improved enterprise sales despite a seasonal decline in game console HDDs."

According to Bill Mosley, Seagate's president, operations and technology, the reaction to HGST and its 10TB helium HDD is approaching: "(...) we said we'd be introducing helium at 10TB I think in the last call. We're still on plan for that. It'll happen in the first two calendar quarters."

To read the earnings call transcript

Seagate's HDDs from 4FQ13 to 1FQ16

(units in million)

| Fiscal period | Enterprise | Desktop | Notebook | CE | Branded | Total |

HDD ASP |

Exabytes | Average |

| HDDs | shipped | GB/drive | |||||||

| 4Q13 | 8.2 | 18.6 | 16.1 | 6.1 | 4.8 | 53.9 | $63 | 45.9 | 852 |

| 1Q14 | 8.1 | 19.1 | 17.2 | 6.2 | 5.1 | 55.7 | $62 | 48.9 | 878 |

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

| 3Q14 | 7.7 | 19.8 | 16.4 | 5.4 | 5.9 | 56.2 | $61 | 50.8 | 920 |

| 4Q14 | 7.4 | 18.4 | 16.8 | 5.1 | 4.8 | 52.5 | $60 | 49.6 | 945 |

| 1Q15 | 8.8 | 18.7 | 20.2 | 6.0 | 5.7 | 59.5 | $60 | 59.9 | 1,007 |

| 2Q15 | 9.1 | 16.0 | 19.7 | 6.1 | 6.0 | 56.9 | $61 | 61.3 | 1,077 |

| 3Q15 | 9.1 | 14.3 | 16.8 | 4.8 | 5.1 | 50.1 | $62 | 55.2 | 1,102 |

| 4Q15 | 8.2 | 11.9 | 14.6 | 5.8 | 4.7 | 45.3 | $60 | 52.0 | 1,148 |

| 1Q16 | 7.8 | 12.4 | 16.4 | 5.5 | 5.2 | 47.2 | $58 | 55.6 | 1,176 |

Seagate vs.WD for 1FQ16

(revenue and net income in $ million, units in million)

| Seagate | WD | % in favor of WD |

|

| Revenue | 2,925 | 3,360 | 15% |

| Net income | 34 | 283 | 32% |

| Notebook | 16.4 | 15.8 | x8.3 |

| Desktop | 12.4 | 11.7 | -5% |

| Branded | 5.2 | 5.6 | 8% |

| CE | 5.5 | 11.5 | 109% |

| Enterprise | 7.8 | 7.2 | -8% |

| Total HDDs | 47.2 | 51.7 | 10% |

| Market share | NA | 43.6% | NA |

| Average GB/drive | 1,176 | 1,228 | 4% |

| Exabytes shipped | 55.6 | 63.5 | 14% |

| HDD ASP | $58 | $60 | 20% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter