Quantum: Fiscal 2Q16 Financial Results

When scale-out storage will finally stop decline of global revenue with loss increasing ?

This is a Press Release edited by StorageNewsletter.com on October 30, 2015 at 2:47 pm| (in $ million) | 2Q15 | 2Q16 | 6 mo. 15 | 6 mo. 16 |

| Revenue | 135.1 | 117.0 | 263.2 | 227.9 |

| Growth | -13% | -13% | ||

| Net income (loss) | 1.2 | (11.2) | (3.1) | (22.0) |

Quantum Corp. reported results for the fiscal second quarter 2016 ended Sept. 30, 2015.

Total revenue was $117.0 million, in line with the preliminary results the company announced earlier this month.

Quantum ended the quarter with $7.8 million of backlog sales orders, higher than its typical quarterly backlog of approximately $1 million. The large backlog was due to an unusually high number of customers placing orders on the last day of the quarter, the magnitude of many of the orders and a shortage of parts available from Quantum’s disk suppliers.

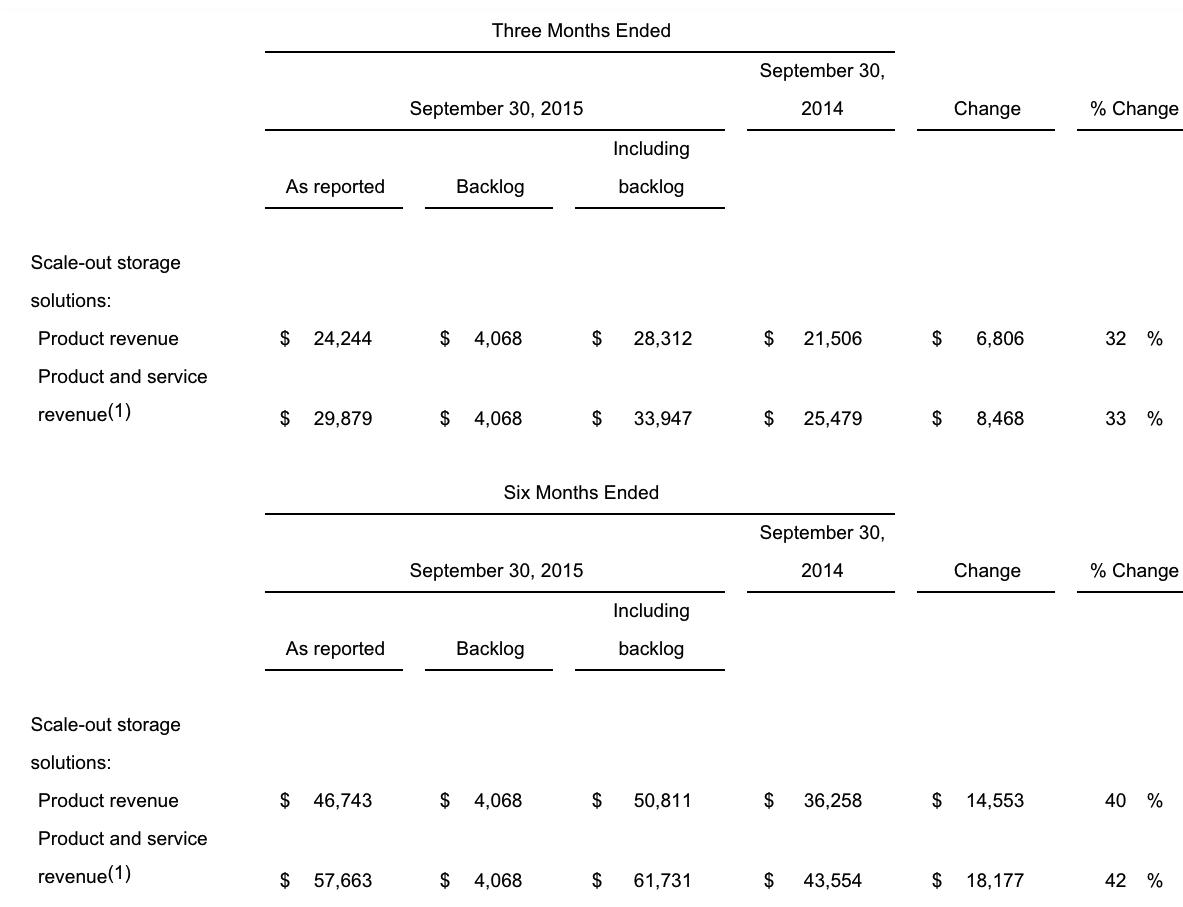

The company continued to see strong demand for its scale-out storage solutions, generating $29.9 million in product and related service revenue from these solutions. This represented a 17% increase over the fiscal second quarter 2015 and the 17th consecutive quarter of year-over-year growth. Including scale-out storage backlog orders of $4.1 million, revenue grew 33% year-over-year.

Reflecting the softness in the enterprise storage market generally,

Quantum also reported the following results:

- Disk backup systems and related service revenue was $18.2 million, with backlog orders totaling an additional $1.6 million.

- Total tape automation and related service revenue was $48.7 million, consisting of $38.0 million in branded revenue and $10.7 million in OEM revenue, with backlog orders totaling an additional $1.5 million ($1.2 million branded and $300,000 OEM).

- Devices and media revenue was $11.5 million.

- Royalty revenue was $8.7 million.

- GAAP net loss for the quarter was $11.2 million, or $0.04 per diluted share, and non-GAAP net loss was $7.4 million, or $0.03 per diluted share.

- Quantum generated $11.2 million in cash from operations and ended the quarter with $65.3 million in cash and cash equivalents.

“As other companies have reported, the overall market environment in the quarter was challenging, which was most apparent in the data protection line of our business,” said Jon Gacek, president and CEO. “However, our data protection revenue increased sequentially, with higher sales of both disk and tape products.

“In our scale-out storage solutions line, with backlog orders included, we grew revenue 33% over the comparable quarter a year ago. In addition, our scale-out storage run-rate revenue from deals below $1 million – including backlog orders – grew 90% in the first half of fiscal 2016 compared to the same period a year ago, demonstrating the strength of our solutions and market opportunity. In the second half of the year, we are focused on further growing scale-out run-rate revenue and closing an increasing rate of large deals to achieve our overall scale-out storage growth target of 50% for the full year. While large deals have been impacted by current market conditions and longer sales cycles, we believe we can close more of these deals moving forward, as we did last year.

“Another key focus for Quantum is driving non-GAAP profitability, and we will manage our spending and investments accordingly to achieve the right balance across our financial objectives.”

Fiscal Third Quarter 2016 Outlook

- Revenue of $130 million to $140 million.

- GAAP and non-GAAP gross margin of approximately 42-43%.

- GAAP and non-GAAP operating expenses of approximately $51 million to $53 million and $48 million to $50 million, respectively.

- Interest expense of $1.4 million and taxes of $400,000.

- GAAP and non-GAAP earnings per share of $0.01 to $0.02 and $0.02 to $0.03, respectively.

Fiscal Second Quarter 2016 Business Highlights

- Quantum continued to gain traction in scale-out storage markets and use cases beyond media and entertainment. In video surveillance, sales grew more than 200% year-over-year; the company completed certification with another of the top five VMS providers; and it finalized a global distribution agreement with one of the world’s largest security-focused distributors. Scale-out storage revenue from technical applications (e.g., genomics, oil and gas, geospatial use cases and intelligence) increased 140% year-over-year and 200% with backlog included. Key wins included a $700,000 intelligence deal, a $480,000 seismic analysis-related sale to one of the world’s top oil companies and a $170,000 deal at a leading provider of data management solutions for oil and gas customers that is building its new private cloud storage offering on Quantum’s StorNext platform, including Lattus object storage and StorNext AEL tape archive.

- The company continued to see scale-out storage momentum in corporate video. Product revenue increased 14% year-over-year, with backlog orders included, and one of the top sales wins was a follow-on deal of nearly $1 million at a global consumer electronics company.

- Building on its leadership in tape automation, Quantum announced significant new enhancements to its Scalar i6000 tape library, doubling drive density to provide the most compact LTO storage footprint in the enterprise market, adding unique RESTful web services management capabilities and offering 80 PLUS certified power supplies for the most efficient power usage available.

- The company established a new partnership with Veeam to maximize data availability for virtual environments. Leveraging Veeam Backup & Replication software and DXi, customers can restore files in justs and VMs in minutes, while reducing both on-premise and DR site storage costs compared to traditional backup applications. This combination also shortens backup windows and dramatically simplifies VM backups.

- Revenue generated from sales of Quantum’s DXi4700 deduplication appliance grew 39% year-over-year and 144% sequentially. In addition, the DXi6900 was named Disk Based Product of the Year: Enterprise at The Storage Awards 2015.

Comments

Revenue of $117 million is up 6% Q/Q but below guidance ($120 million to $130 million), due primarily to three main factors:

- 1/ Unusually high number of customers were placing orders on the last day of the quarter, particularly in scale-out storage with a shortage of parts from disk suppliers.

- 2/ Lower revenue was recorded from large (over $200,000) and mega deals (over $1 million), even including the backlog due to the continued softness in the overall enterprise storage market. The company didn't have mega deals at all for the quarter. Revenue from large deals was 10% lower than the same period in the prior year.

- 3/ Continued pricing pressure on commodity, low-margin devices, and media.

Scale-out storage is the only segment really pushing Quantum since several quarters but not compensating other declining activities. Win rates for the quarter remained strong in the 70th percentile, and the firm added 130 new scale-out storage customers during the last three-month period.

(1) Management considers product and service revenue in its evaluation of the business for decision making and to compare against competitors. Total product and service revenue less total product revenue equals service revenue in GAAP results.

Tape automation systems represent $48.7 million for the quarter down 25% from one year. OEM tape automation was decreasing at $5.2 million, or 33% Y/Y, reflecting lower sales in all product categories with the largest decline in midrange libraries.

Disk systems backup revenue was $18.2 million, down $3 million from the prior year. Quantum saw growth in systems over 80TB with revenue increasing 13% over the same period last year. However, revenue from large deals decreased more than 30%. DXi win rates remained in the 60th percentile, with the addition of 65 new customers in the quarter.

Concerning data protection revenue, devices and media, it totaled $11.5 million in 2FQ16 compared to $13 million in 2FQ15.

Service revenue was $37.3 million, down 5% from $39.2 last year. The decrease was primarily driven by a decline in service contracts for tape automation system, partially offset by growth in contracts for scale-out storage solutions.

Royalty revenue on tape was $8.7 million, down 19% from $10.7 million a year ago. LTO-6 royalties grew 87%, offset by a decrease in LTO-1 to -5.

In December, Quantum plans to begin offering LTO-7 technology in its Scalar tape libraries with StorNext AEL archives libraries to follow in subsequent months.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter