Western Digital: Fiscal 1Q16 Financial Results

Revenue drops 15% and net 33%

This is a Press Release edited by StorageNewsletter.com on October 29, 2015 at 2:08 pm| (in $ million) | 1Q15 | 1Q16 | Growth |

| Revenue |

3,943 | 3,360 | -15% |

| Net income (loss) | 423 | 283 | -33% |

Western Digital Corp. reported revenue of $3.4 billion and net income of $283 million, or $1.21 per share, for its first fiscal quarter ended Oct. 2, 2015.

On a non-GAAP basis, net income was $366 million, or $1.56 per share. In the year-ago quarter, the company reported revenue of $3.9 billion and net income of $423 million, or $1.76 per share. Non-GAAP net income in the year-ago quarter was $504 million, or $2.10 per share.

The company generated $545 million in cash from operations during the first fiscal quarter, ending with total cash and cash equivalents of $5.1 billion. It utilized $60 million to repurchase 0.7 million shares of its common stock. On Aug. 4, the company declared a cash dividend of $0.50 per share of its common stock, which was paid on Oct. 15.

“I am pleased with our execution and performance in the first fiscal quarter,” said Steve Milligan, CEO. “We continue to benefit from our strong product and technology positioning in today’s storage market. I am very excited about our future and ability to create long term value in the evolving storage ecosystem, especially in light of our three recent announcements regarding the planned investment in our company by Unisplendour, the MOFCOM decision and our planned acquisition of SanDisk.”

Comments

It's not a good quarter for Western Digital but future is bright following:

- - the $19 billion deal for acquisition of flash maker SanDisk that will boost the HDD manufacturer with a large line of silicon memory products, and

- - the end of most of the MOFCOM conditions from combining WD and HGST divisions for the past three years, an operation supposed to realize $400 million of annual operating expense savings.

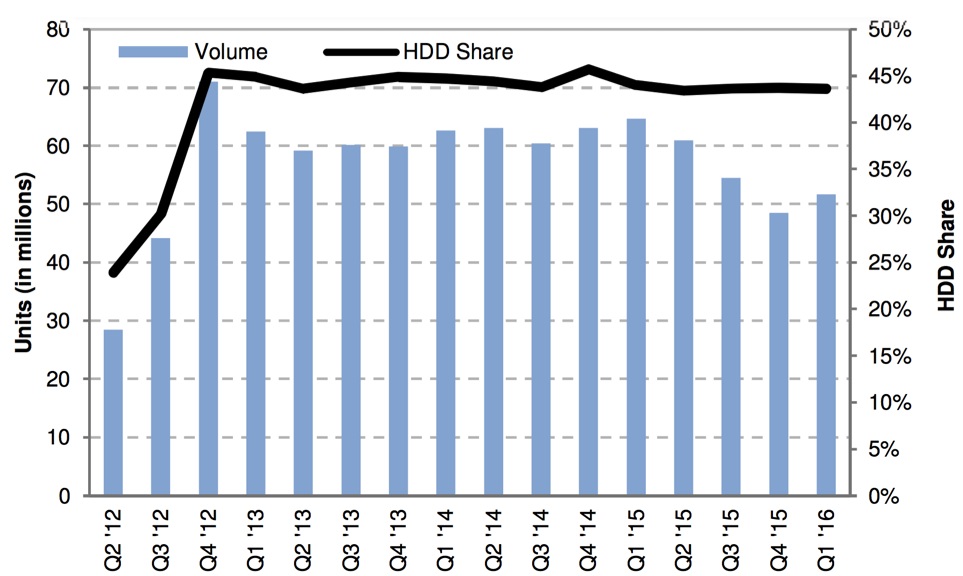

Main Y/Y figures are down with revenue dropping 15% and net income 33%, number of HDDs shipped down 20% at 51.7 million. It's down for all categories of devices (enterprise, desktop, notebook and branded), but CE.

Sequentially, on the contrary, about all most important figures are increasing: revenue by 5%, net by 29%, HDDs shipped by 7% - at the same average price of $60 - with an average capacity up 6% at 1.2TB for a global 63.5EB shipped during the three months and increasing 13%.

The firm sold more than one million helium HDDs (from HGST) in the quarter, volume shipping 8TB and expecting to ramp 10TB in the year ahead. But CEO Steve Milligan stated: "Overall, demand in the high capacity space was somewhat softer than anticipated. This was due to absorption of previously deployed storage assets purchased earlier in the calendar year by some of our large customers."

Enterprise SSDs represent $233 million, falling by $11 million from previous quarter.

The company expects flat revenue next quarter, in the range of $3.3 billion to $3.4 billion, to be compared to $3.4 billion for former three-month period.

| WD's HDDs (units in million) |

Enterprise | Desktop | Notebook | CE | Branded | Total HDDs | HDD share | Exabyte Shipped |

Average GB/drive |

ASP |

| 4Q13 | 7.9 | 16.2 | 24.0 | 6.5 | 5.3 | 59.9 | 44.9% | 47.7 | 797 | $60 |

| 1Q14 | 7.8 | 17.3 | 22.9 | 8.5 | 6.1 | 62.6 | 62644.7% | 50.8 | 811 | $58 |

| 2Q14 | 7.8 | 16.8 | 22.7 | 8.8 | 7.0 | 63.1 | 44.4% | 55.1 | 874 | $60 |

| 3Q14 | 7.1 | 16.6 | 21.8 | 8.6 | 6.3 | 60.4 | 43.8% | 53.6 | 888 | $58 |

| 4Q14 | 7.1 | 16.2 | 22.9 | 10.9 | 6.0 | 63.1 | 45.7% | 55.2 | 875 | $56 |

| 1Q15 | 7.8 | 16.3 | 23.4 | 10.5 | 6.8 | 64.7 | 44.0% | 64.9 | 1,002 | $58 |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 61.0 | 43.4% | 66.4 | 1,087 | $60 |

| 3Q15 | 7.5 | 13.5 | 18.8 | 8.6 | 6.1 | 54.5 | 43.6% | 61.3 | 1,123 | $61 |

| 4Q15 | 7.2 | 11.6 | 15.5 | 9.1 | 5.2 | 48.5 | 43.7% | 56.2 | 1,159 | $60 |

| 1Q16 | 7.2 | 11.7 | 15.8 | 11.5 | 5.6 | 51.7 | 43.6% | 63.5 | 1,228 | $60 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter