SanDisk: Fiscal 3Q15 Financial Results

Revenue up 17% Q/Q and down 17% Y/Y

This is a Press Release edited by StorageNewsletter.com on October 23, 2015 at 3:07 pm| (in $ million) | 3Q14 | 3Q15 | 9 mo. 14 | 9 mo. 15 |

| Revenues | 1,747 | 1,453 | 4,892 | 4,022 |

| Growth | -17% | -18% | ||

| Net income (loss) | 263 | 133 | 806 | 253 |

SanDisk Corporation announced results for the third quarter ended September 27, 2015.

Third quarter revenue of $1.45 billion decreased 17% on a year-over-year basis and increased 17% sequentially.

On a GAAP basis, third quarter net income was $133 million, or $0.65 per share, compared to net income of $263 million, or $1.09 per share, in the third quarter of 2014 and $81 million, or $0.38 per share, in the second quarter of 2015.

On a non-GAAP basis, third quarter net income was $223 million, or $1.09 per share, compared to net income of $336 million, or $1.45 per share, in the third quarter of 2014 and net income of $136 million, or $0.66 per share, in the second quarter of 2015.

“SanDisk completed several important product qualifications in embedded and SSD solutions in the third quarter, contributing to our strong sequential revenue growth,” said Sanjay Mehrotra, president and CEO, SanDisk. “Our mix of 15nm, three-bit-per-cell (X3) technology helped drive substantial cost reduction in the quarter. We are making excellent progress in expanding our product portfolio and building our customer engagements.“

News highlights

- SanDisk and Toshiba announced the start of equipment installation in the New Fab 2 facility at Yokkaichi Operations and their entry into definitive agreements for joint manufacturing of 3D NAND and investment in New Fab 2. New Fab 2 is primarily intended to provide the clean room space necessary to transition a significant portion of the current Yokkaichi 2D NAND capacity to 3D NAND.

- SanDisk announced a long-term partnership with HP to collaborate on a new technology within the Storage Class Memory category and create enterprise-wide solutions for Memory-driven Computing. The partnership will center around SanDisk’s ReRAM technology and manufacturing and design expertise and HP’s Memristor technology. SanDisk and HP will also partner to enhance data center solutions with SSDs.

- SanDisk announced the first 256Gb, 3-bit-per-cell (X3), 48-layer 3D NAND chip and began 3D NAND pilot line operations in Yokkaichi, Japan. 256Gb X3 3D NAND chip is designed for wide applicability in consumer, client, mobile and enterprise products and is expected to begin shipping in SanDisk products in 2016.

- SanDisk entered into several agreements with SK Hynix, Inc. including an expanded and extended IP licensing agreement, a multi-year commercial relationship under which SK Hynix will supply its DRAM products to SanDisk and a settlement of the trade secret misappropriation suit filed by SanDisk in 2014.

- SanDisk introduced its iNAND 7232, a high-performance embedded mobile storage solution optimized for imaging performance in mobile devices. The iNAND 7232 leverages SanDisk’s 15nm X3 NAND flash storage and features second-generation SmartSLC technology architecture that quickly and intelligently responds to mobile users’ changing needs.

- SanDisk introduced three new reference architectures for VMware Virtual SAN 6 utilizing SSDs and Fusion ioMemory PCIe application accelerators. These reference architectures help customers gain performance on VMware’s Virtual SAN software-defined storage infrastructure.

- SanDisk shipped its 2 billionth microSD card since beginning commercial shipments ten years ago. The introduction of the microSD card by SanDisk in 2004 reduced the size of removable memory cards, helping to propel the growth of the smartphone market.

- As a result of SanDisk’s pending acquisition by Western Digital Corporation, SanDisk’s capital return program, consisting of quarterly cash dividend and share repurchases, is suspended effective at the start of the fourth quarter of 2015.

Comments

Like Western Digital, SanDisk announced its quarterly financial results at about the same time of their $19 billion mega merger.

3Q15 revenue of $1.45 billion was at the top of the anticipated range by SanDisk that was in the range of $1.35 billion to $1.45 billion.

On a sequential basis, the largest driver of the 17% growth was embedded products utilizing 15nm X3 memory. Furthermore cost/GB improvement exceeded price/GB decline.

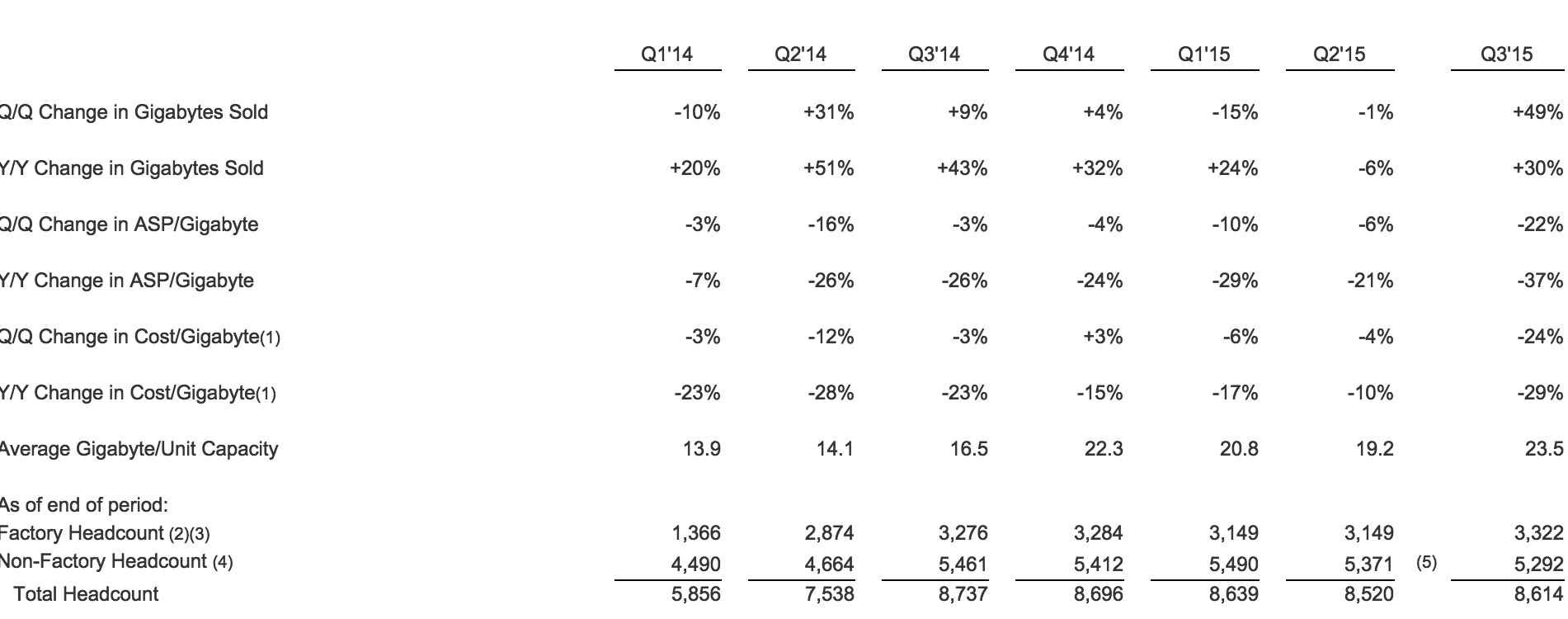

In the last three-month period, gigabytes sold increased 49% Q/Q and 30% Y/Y, reflecting sequential growth in units sold as well as an increase in average capacity, which was up 23% Q/Q and 43% Y/Y.

Blended price/GB and cost/GB declined at a faster rate than in the last several quarters, with both metrics influenced by product mix.

Q3 blended ASP/GB declined 22% sequentially and 37% year-over-year.

Sales declined slightly sequentially in both removable products and enterprise products. Within enterprise, the flash company experienced growth in PCIe and SATA offset by a decline in SAS revenue.

SanDisk estimates next quarter revenue to be between $1.4 billion to $1.475 billion compared to $1,453 billion this three-month period.

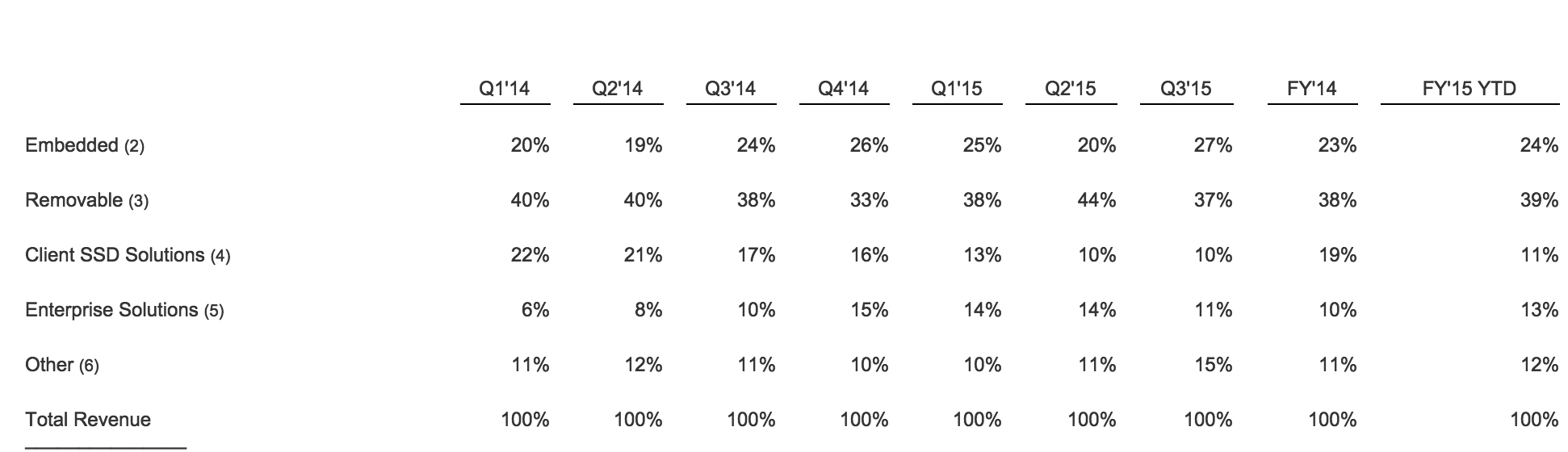

Revenue Mix by Category (1) Revenue is estimated based on analysis of the information the company collects in its sales reporting processes.

(1) Revenue is estimated based on analysis of the information the company collects in its sales reporting processes.

(2) Embedded includes products that attach to a host system board.

(3) Removable includes products such as cards, USB flash drives and audio/video players.

(4) Client SSD Solutions includes SSDs used in client devices and associated software.

(5) Enterprise Solutions includes SSDs, system solutions and software used in data center applications.

(6) Other includes wafers, components, accessories, and license and royalty.

Abstracts of Prepared Remarks on Third Fiscal Quarter 2015 Results

Sanjay Mehrotra, president & CEO

"In Q3, 15nm products constituted the majority of our bits sold and we also began pilot line operations with our partner Toshiba for the upcoming 3D NAND conversion.

"We expect our new MCP products containing SK Hynix DRAM to become available in the first half of 2016.

"We have also extended the term of our first 300mm joint venture [with Toshiba], Flash Partners, from 2019 to 2029.

"Moving to third quarter results, in embedded, we completed qualification of several new products, including a custom embedded X3 mobile solution, a custom embedded solution for a customer's SSD application and iNAND X3 solutions for the broader mobile market. Revenue shipments of all of these solutions began in the third quarter and contributed to a 57% sequential growth in overall embedded revenue.

"Complementing the strength in our Fusionio PCIe products, we are pleased to be gaining momentum in our enterprise SATA offerings and expect revenue from these products to grow sequentially in the fourth quarter.

"On the SAS front, we are making steady progress developing our 15nm, 12Gb SAS products for introduction in 2016. Development is also going well on our previously described converged platform enterprise solutions, which are targeted for 2017 introduction.

"Specifically, we continue to estimate that nearly 40% of all corporate laptops will be shipping with client SSDs by the end of 2015 and expect to see a 60% attach rate before the end of 2016.

"During the third quarter, we began 3D NAND pilot line operations using our 48-layer, 256-gigabit X3 chip and we expect to use initial output for internal product development and validation before commercializing it beginning in 2016.

"For 2016, we expect the industry supply bit growth to be in the mid-30% range as 2D NAND scaling reaches its limits and as we expect 3D NAND to be no more than 20% of industry wafer capacity exiting the year."

Judy Bruner, CFO:

"We expect sequential growth in our enterprise sales driven primarily by increasing momentum with hyperscale customers, and we also expect sequential growth in retail sales due to seasonality. However, (...) we were able to land more of our second half mobile revenue in Q3, and we anticipate continued demand softness in the mobile market and pockets of continued pricing pressure."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter