128GB SSD Breaks $50 Barrier, Soon $40

HDDs to become irrelevant in sub-256GB markets, said SanDisk

This is a Press Release edited by StorageNewsletter.com on September 3, 2015 at 2:26 pmfRene Hartner, VP of corporate business development, is the author of an interesting article published on SanDisk Corp.‘s blog on June 30, 015:

The Truth About SSDs That HDD Vendors Do Not Want You To Know

Bigger is not better, in other words: only better is better.

For years, the golden rule when it came to building or buying computers has been “bigger the better.” A laptop with a larger HDD was, by that urban legend, better. The more DRAM inside of a PC, the better overall experience it would deliver.

Those assumptions, though, are fast becoming a myth. In many segments, you can now get better performance, and better price to performance ratio, out of laptop (or even a desktop) built with an SSD and less DRAM rather than a model with a larger HDD and more DRAM. Bigger is not better, in other words: “only better is better.”

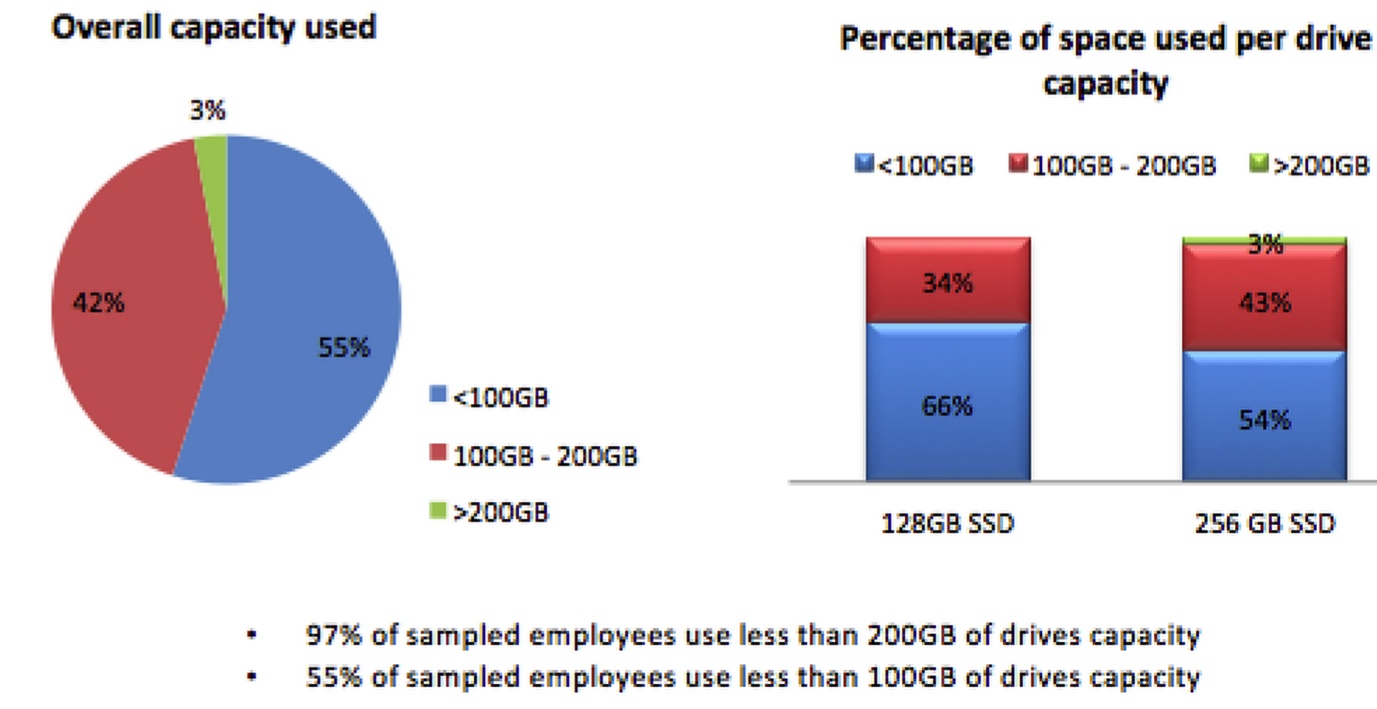

Take a look at the notebook for a typical business user. A recent SanDisk study shows that less than 3% of corporate users store more than 200GB of data on their 1TB notebooks.

Figure 1: Example of Corporate laptop capacity utilization

Similarly, Gartner noted that SSDs are replacing HDDs in an increasing number of notebooks because of the affordability of SSDs in the 180GB to 256GB range. The firm further added that, although 128GB would be sufficient for many, most users would be better off with at least 180GB of capacity. (Gartner: Recommended Configurations for Notebooks and Desktop PCs, 2015).

Thus, while a 256GB drive may not be suitable for video editors, gamers or design engineers, it fits the bill for a large number of use cases in 2015.

Many computer manufacturers and the HDD industry, however, respond to this market scenario with notebooks sporting 1TB drives and 8GB of memory. That’s overkill on two counts:

- First, the extra drive capacity introduces an unnecessary penalty to both the OEM and the target customer segment.

- Second, you don’t need that much DRAM. The reason computer manufacturers load up their system with 8GB and 16GB of DRAM to buffer the comparatively slow speed of HDDs. No spinning, disks, no need for excess DRAM.

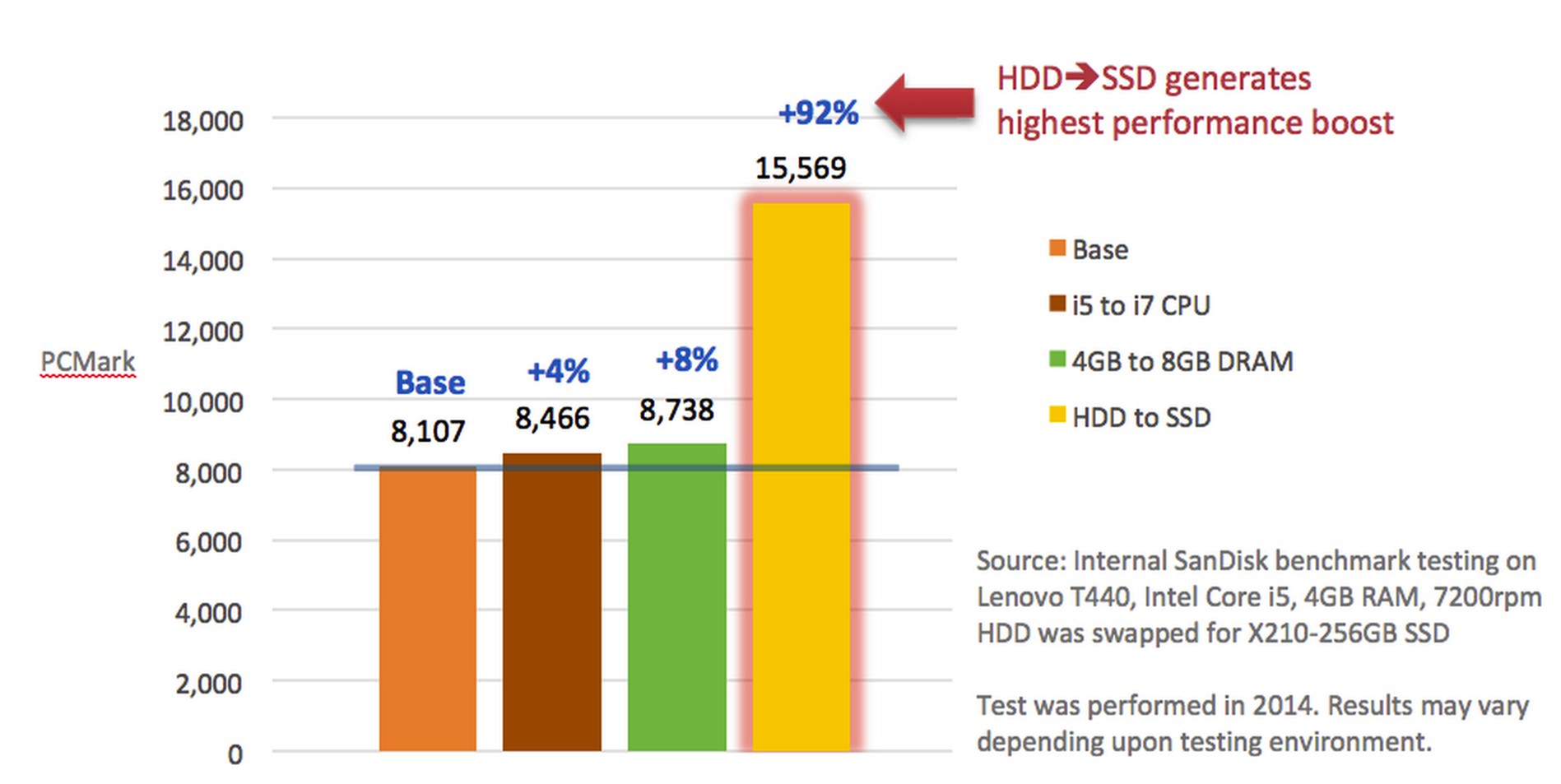

You could build a system with a 256GB SSD and 4GB of DRAM. Reducing DRAM from 8GB to 4GB could save anywhere between $40 and $60. More importantly, manufacturers and users would get more and better performance for every dollar spent on storage technology. As shown in Figure 2, doubling DRAM results in a marginal performance improvement on PCMark Vantage Point: the shift to SSDs nearly doubles the results.

Figure 2: Performance improvement as a result of laptop component upgrade

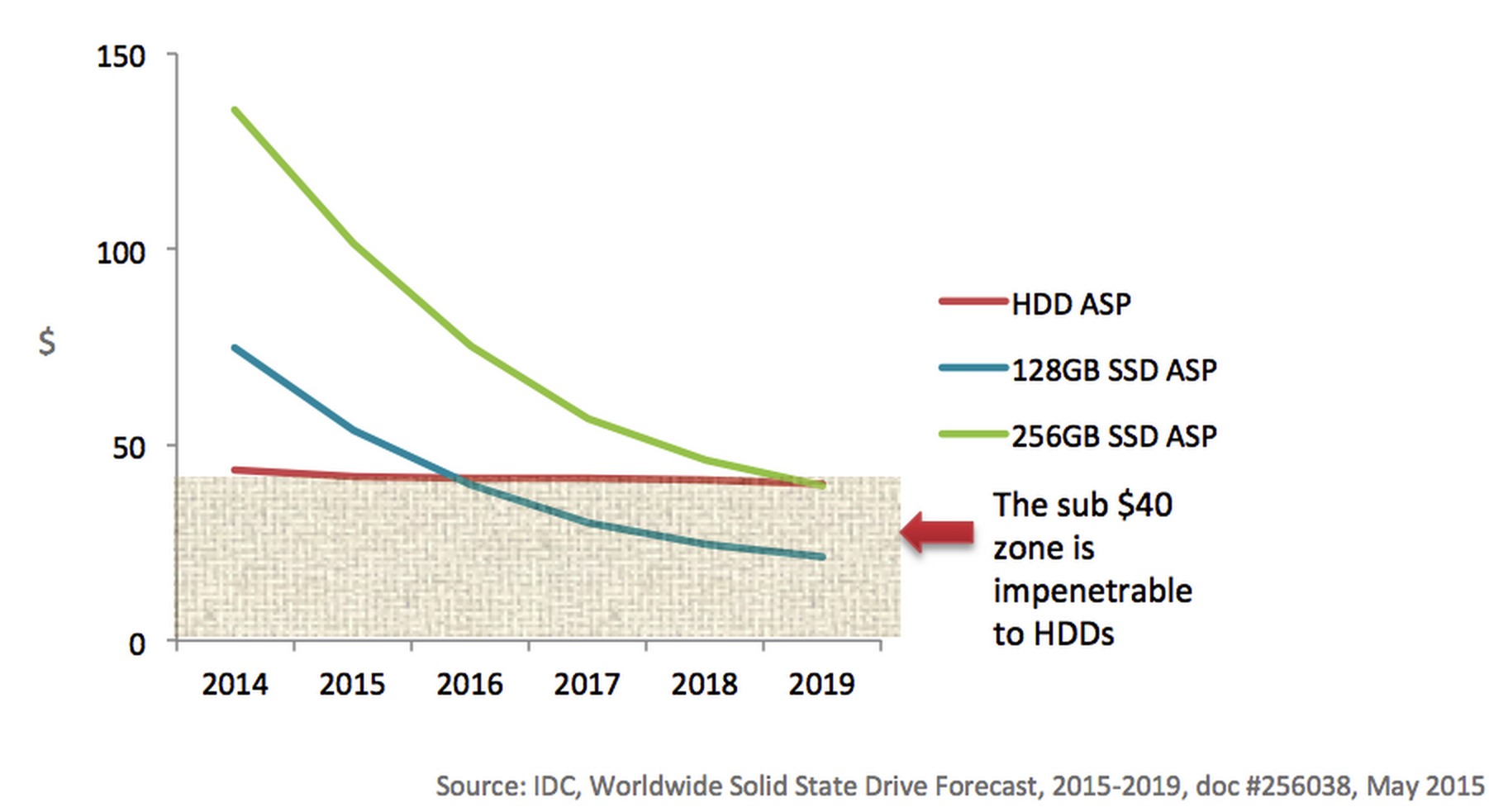

But wait, you say, can’t HDD manufacturers undercut the price/performance of drives by reducing their own capacities? Unfortunately for the HDD industry, HDD have price floor of approximately $40 because of the mechanical parts required to spin drives. (IDC: Worldwide 2014-2019 SSD Forecast, 2015). Even a one-gigabyte HDD would cost $40 to make. With SSDs, the money goes to storage, not motors.

128GB SSDs are going to break the $40 barrier in the next major PC refresh cycle, and remember the $40 barrier is their price floor, HDDs are selling for a higher average price today and HDD vendors will get into a price war to defend share, which will become a losing battle once SSDs are selling for a price below $40.

[Editor’s note: You can already find 128GB SSDs for under €50 Euro.]

Even more intriguing than a side-by-side comparison of storage is the fact that by changing the configuration from e.g. 500GB HDD and 8GB DRAM to 128GB SSD and 4GB of DRAM the price barrier is already broken and OEMs can build a lower cost system today.

No matter how much HDD vendors lower their price and sacrifice their margins to compete, the HDDs will become irrelevant in the sub-256GB markets.

Figure 3: Price curve for SSDs vs. HDDs

Because of flexible configurations, shifting to SSDs early and fast can buy an OEM the competitive advantage. An OEM, for instance, can stand out in entry-level notebook segments by creating an SSD SKU with an equivalent BOM but greater performance than its HDD/high DRAM counterparts. We have seen notebook OEMs ditch 500GB HDDs for 128GB SSDs. Others have used SSDs to expand share and margin in premium segments. In fact, a major OEM has been converting its flagship notebook product line to all-SSD design. The strategy helped this vendor gain market share, leaving others competing for a shrinking pie aggravated by fast declining notebook prices and diminishing margins.

For business laptops, upgrading from HDDs to SSDs can help CIOs reduce IT labor costs by extending laptop lifecycles while improving the user experience and employee productivity. A SanDisk whitepaper shows that for a 1,000 employee company, an SSD deployment could result in an overall cost reduction of up to $400 per laptop, or $400,000 as laptop purchases can be deferred for one year (Source: SanDisk’s STAR SSD Upgrade Program Reduces IT Labor Costs and TCO, 2015). A majority of the savings comes from a 33% increase in laptop lifecycles, thanks to SSDs’ outstanding reliability and low failure rate.

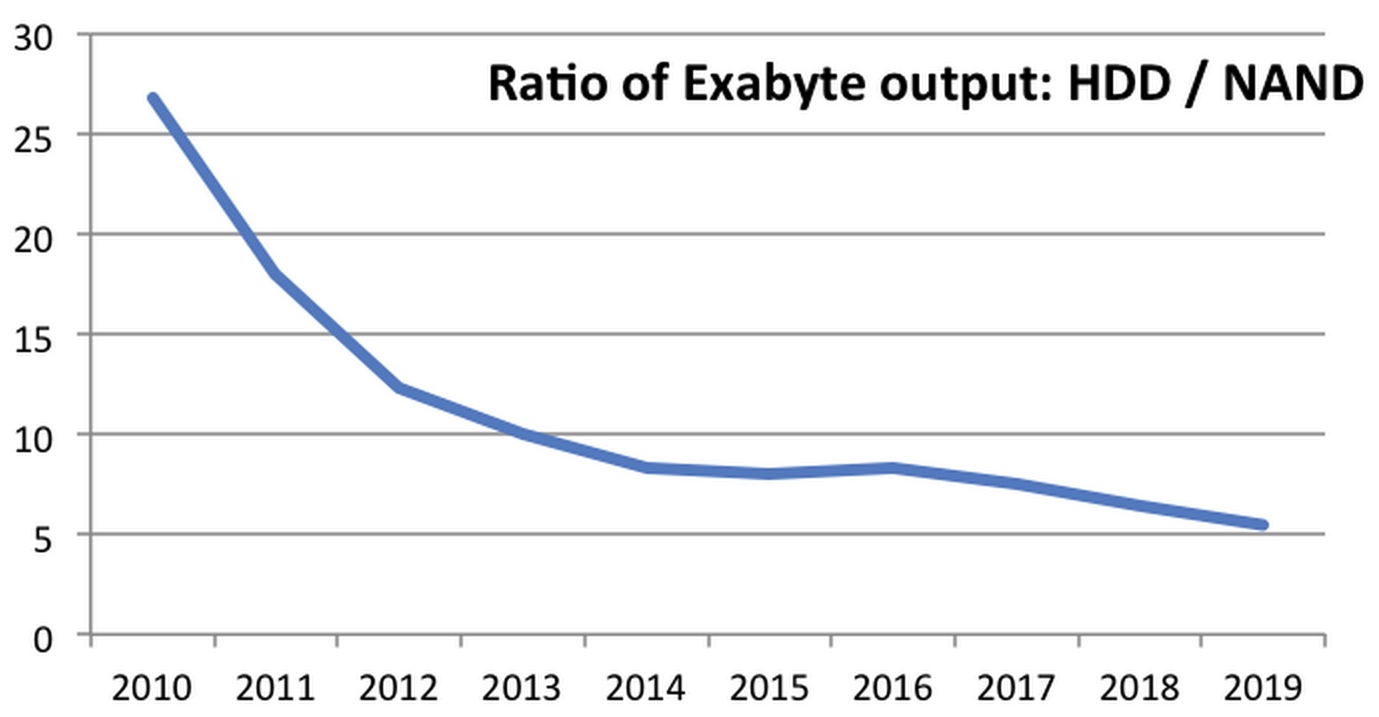

The ability of fewer SSD bits to displace more HDD ones suggests that we could see an accelerated collapse in HDDs. As Figure 4 shows, the HDD industry produced 27 times as many bits as the NAND flash industry in 2010. The bit ratio is approaching 8x this year and will further shrink to about 5x by 2019. The SSD adoption in notebooks could accelerate the fall-off of HDDs in the total storage bit mix by continuously replacing HDDs with SSDs in smaller capacity, potentially driving down the HDD-to-SSD bit ratio to as low as 3-4x by 2019.

Figure 4: Ratio of exabyte output: HDD/NAND

Consumers are voting with their wallets for laptop brands that are building differentiated solutions to win market share and SSDs are poised to make a big difference there. IT managers are also starting to upgrade fleets of laptops with SSDs to extend the laptop lifecycles thus saving millions of dollars and driving employee productivity to an unprecedented level. It is time for the notebook OEMs to hear the customer voice and create winning solutions with SSDs.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter