Nimble Storage: Fiscal 2Q16 Financial Results

Revenue and loss increasing, as usual

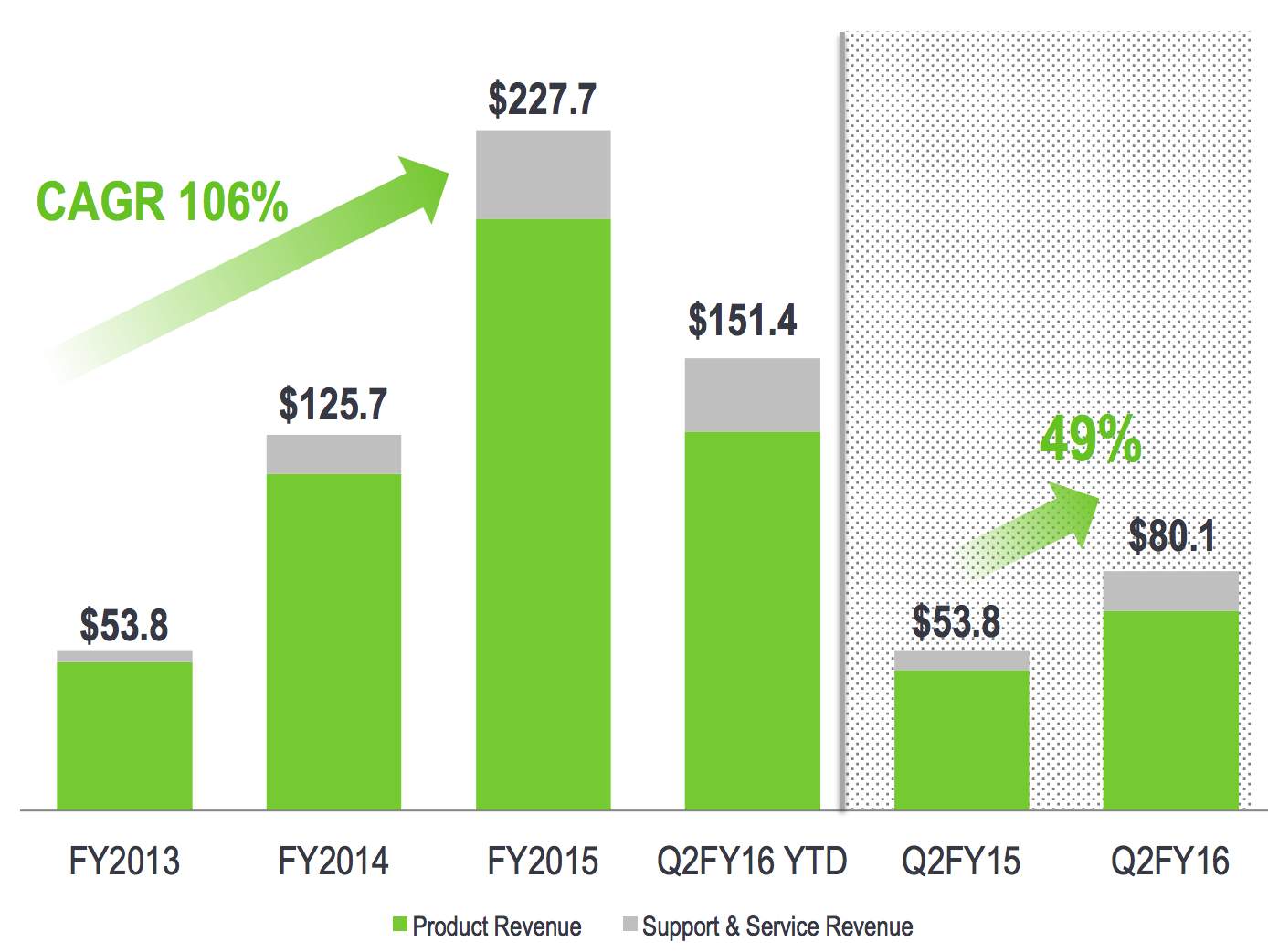

This is a Press Release edited by StorageNewsletter.com on August 26, 2015 at 2:40 pm| (in $ million) | 2Q15 | 2Q16 | 6 mo. 15 | 6 mo. 16 |

| Revenue | 53.8 | 80.1 | 100.3 | 151.4 |

| Growth | 49% | 51% | ||

| Net income (loss) | (26.1) | (30.1) | (45.7) | (59.1) |

Highlights:

- Second Quarter Revenue Up 49% Y/Y to $80.1 million

- Record Non-GAAP Gross Margins of 67.8%

- Record Cash Flow from Operations of $14.9 million and Free Cash Flow of $9.0 million

- Record Customer Growth with 690 new customers totaling 6,211

- Number of Deals > $100,000 at Record High

Nimble Storage, Inc. reported financial results for the fiscal second quarter 2016.

“As the storage industry continues to experience disruption from architectural shifts, our core belief that only the Adaptive Flash Platform can consolidate and dynamically optimize every enterprise application running across the data center remains our guiding principle,” said Suresh Vasudevan, CEO. “Q2 provided clear evidence of our continuing momentum. We added 690 new customers, a new quarterly record, delivered a broad range of enterprise-grade capabilities with Nimble OS 2.3, and were recognized with two prestigious awards, an industry award for the most innovative flash memory technology and an IT professional innovation leader award for hybrid HDD/SSD arrays.”

“Q2 was another quarter of strong financial execution. Our industry leading gross margins reached another record high at 67.8%. We continued to drive improvement in our operating leverage, as operating margins improved by 11%age points compared to Q2 FY2015, while generating record cash flow from operations which was 19% of revenue this quarter,” said Anup Singh, CFO.

Financial Highlights:

- Total revenue increased 49% to $80.1 million, up from $53.8 million in the second quarter of fiscal 2015.

- Excluding fluctuations in foreign currency, revenue would have been $82.8 million representing a 54% increase over the second quarter of fiscal 2015.

- Non-GAAP gross margin for the second quarter of fiscal 2016 was 67.8% compared to 67.4% in the second quarter of fiscal 2015.

- Non-GAAP operating loss was $7.2 million or negative 9% of revenue for the second quarter of fiscal 2016, compared to a loss of $10.7 million or negative 20% of revenue in the second quarter of fiscal 2015.

- GAAP net loss for the second quarter of fiscal 2016 was $30.1 million, or $0.38 per basic and diluted share, compared with a net loss of $26.1 million, or $0.37 per basic and diluted share in the second quarter of fiscal 2015.

- Non-GAAP net loss for the second quarter of fiscal 2016 was $7.8 million, or $0.10 per basic and diluted share, compared with a net loss of $10.9 million, or $0.15 per basic and diluted share in the second quarter of fiscal 2015.

- Cash flow from operations was $14.9 million or 19% of revenue for the second quarter of fiscal 2016, compared to $2.8 million or 5% of revenue in the second quarter of fiscal 2015. Free cash flow was $9.0 million or 11% of revenue for the second quarter of fiscal 2016, compared to negative $1.3 million or negative 2% of revenue in the second quarter of fiscal 2015.

Forward Outlook for 3FQ16

- Total revenue in the range of $86.0 to $88.0 million

- Non-GAAP operating loss in the range of $5.0 to $6.0 million

- Non-GAAP net loss per basic and diluted share in the range of $0.08 to $0.09 based on weighted average shares outstanding of approximately 80.0 million

Business Highlights

- Executive Appointments Fortify Leadership Bench Strength. Leonard Iventosch joined the company’s leadership team as VP of WW channels. The company also announced the return of Mike Munoz who will serve as VP of WW alliances.

- Nimble Delivers Full Benefits of Storage Consolidation with Enterprise-grade Enhancements to the Adaptive Flash Platform.

- All-Flash Service Level Provides Dynamic Performance and Capacity. The all-flash service level meets the most stringent latency demands – its responsiveness is ideal for transaction processing, data warehouse/business intelligence, and VDI deployments. And unlike flash-only arrays, service levels can be dynamically changed on the fly from operation in one service level to a different service level as workload demands fluctuate over time.

- A Single Platform for Optimizing Enterprise-wide Applications. Additional capabilities introduced include software-based encryption and a REST API-based extensibility framework, which complement existing enterprise functionality, including VM-level monitoring and reporting and integrated data protection.

- Obtained Federal Information Processing Standard Certification. Nimble completed a Federal Information Processing Standard (FIPS) 140-2 certification from the U.S. government’s National Institute of Standards and Technology (NIST) for its OpenSSL FIPS Object Module, Nimble Storage SmartSecure. Nimble can now fully address the stringent security mandates of federal customers and partners with the Adaptive Flash platform.

- Named Most Innovative Flash Memory Technology. The Flash Memory Summit Awards Committee named Nimble a Best of Show winner in the Most Innovative Flash Memory Technology category.

- Recognized by IT Professionals as Technology Innovator. IT professionals voted Nimble as the 2015 Innovation Leader for Hybrid HDD/SSD Array in IT Brand Pulse’s most recent brand leader survey.

Comments

Revenue growth

Abstracts of the earnings call transcript:

Suresh Vasudevan, CEO:

"We now have over 6,200 customers within our installed base. Our channel continues to play a stellar role in helping us drive customer acquisitions. We have over 1,000 unique channel sales reps that close deals during Q2.

"Our bookings over the last 12 months within the Global 5000 and cloud service provider segment compared to the previous 12-month period were up by more than 80% in each segment. In just the Global 500, we now have 70 customers as part of our installed base.

"During Q2, we more than doubled the number of SmartStack customers compared to Q2 of last year. One of the largest deals this quarter was a 2.5 petabyte deployment at MD Anderson Cancer Center, which was a joint engagement with Cisco in a SmartStack deployment. As part of our systematic expansion of our global footprint, our international revenue grew at 99% compared to Q2 of last year. Excluding currency fluctuations, international revenue growth would have been 133%. We now have customers in over 50 countries globally."

Anup Singh, CFO:

"During Q2, our cash increased over $12 million to end at approximately $214 million."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter