SanDisk: Fiscal 2Q15 Financial Results

All but flashy: sales continuing to fall, down 24% Y/Y and 7% Q/Q

This is a Press Release edited by StorageNewsletter.com on July 24, 2015 at 3:18 pm| (in $ million) | 2Q14 | 2Q15 | 6 mo. 14 | 6 mo. 15 |

| Revenue | 1,634 | 1,237 | 3,146 | 2,569 |

| Growth | -24% | -18% | ||

| Net income (loss) | 274 | 81 | 543 | 120 |

SanDisk Corporation announced results for the second quarter ended June 28, 2015.

Second quarter revenue of $1.24 billion decreased 24% on a year-over-year basis and decreased 7% sequentially.

On a GAAP basis, second quarter net income was $81 million, or $0.38 per share, compared to net income of $274 million, or $1.14 per share, in the second quarter of 2014 and $39 million, or $0.17 per share, in the first quarter of 2015.

On a non-GAAP basis, second quarter net income was $136 million, or $0.66 per share, compared to net income of $329 million, or $1.41 per share, in the second quarter of 2014 and net income of $134 million, or $0.62 per share, in the first quarter of 2015.

“During the second quarter, we strengthened our portfolio with several new product launches in both the retail and commercial channels,” said Sanjay Mehrotra, president and CEO, SanDisk. “We are making steady progress on all operational fronts, and remain focused on enhancing our financial performance.”

News highlights

- Announced the availability of its new Fusion ioMemoryPCIe application accelerators which utilize SanDisk NAND and improve performance compared to the previous generation ioDrive2, enabling datacenter consolidation and lower TCO. These application accelerators also feature updated Virtual Storage Layer (VSL) data access acceleration software.

- Announced its new CloudSpeed Eco Gen. II enterprise SATA SSD for cloud service providers, with up to 2TB capacity, based on 15nm NAND flash. It delivers greater storage density with three times the streaming bandwidth versus HDDs.

- Announced the Extreme 500 and the Extreme 900 families of high-performance portable SSDs at capacities up to 480GB and 1.92TB respectively. These SSDs feature faster transfer speeds than a portable HDD.

- Introduced the new Z400s SSD, a cost-effective 15nm-based SSD designed to replace HDDs in computing platforms and embedded applications, such as digital signage, security surveillance, and point of sale or kiosk environments.

- Announced a third quarter 2015 dividend of $0.30 per share of common stock, payable on August 25, 2015 to stockholders of record as of the close of business on August 3, 2015.

Comments

SanDisk reported once again a poor quarter en 2Q15. Revenue decreased 24% Y/Y and 7% Q/Q, net income down 52% Y/Y but 108% Q/Q. But business is supposed be better next three-month period.

CFO Judy Bruner explains the reasons of the bad quarterly results:

- "Our client SSD revenue declined as expected, due to the end of life during Q1 of a program with a major customer (probably Apple. Editor), while our client SSD revenue with other OEM customers increased nicely from Q1 to Q2.

- "Our enterprise revenue also declined sequentially. Embedded revenue was down sequentially in Q2, due to the seasonality of certain embedded products, while our removable revenue increased sequentially driven by seasonality and share gains.

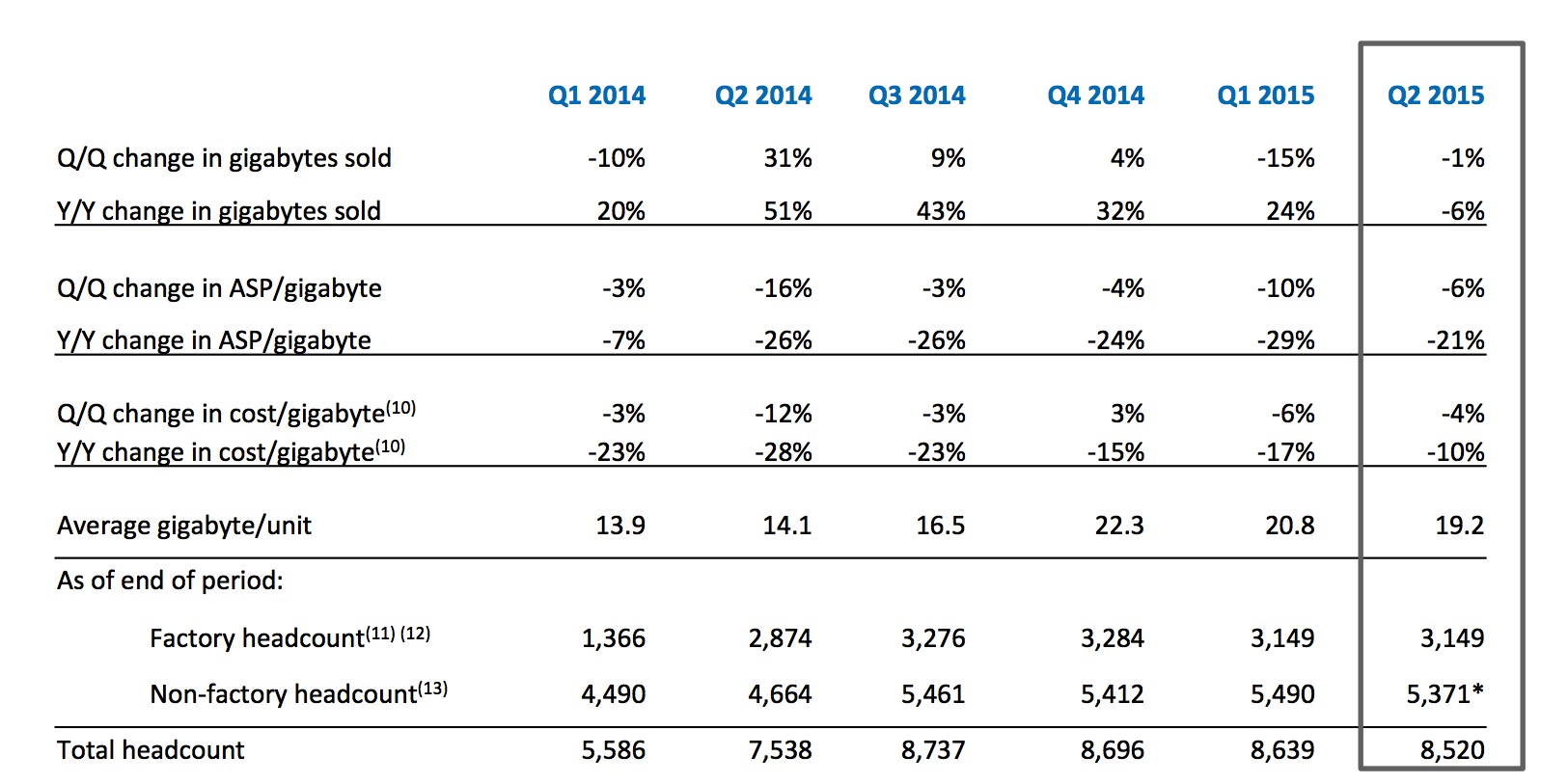

- "Our gigabytes sold were down sequentially by 1% and down year over year by 6%, with the year-over-year decline driven largely by rebuilding of our inventory levels, combined with the loss of the client SSD program at a major customer.

- "The decline in our blended ASP per gigabyte was more modest than in Q1, with a sequential decline of 6% and a year-over-year decline of 21%. Our all-in cost per gigabyte declined 4% sequentially and declined 10% year over year."

Furthermore, there is a decline in unit prices of 128GB and 256GB SSDs, but with the advantage to continue to reduce the gap with HDDs, with the 128GB drive approaching cost parity with low-capacity HDDs.

Nevertheless, president and CEO Sanjay Mehrotra, has some positive comments:

- "In enterprise SSDs, our Fusion-io revenue grew sequentially in Q2.

- "Our enterprise SAS SSDs sales performed well during the quarter, driven by better-than-expected demand for several of our products."

Future products

SanDisk plans to begin addressing the NVMe PCIe market opportunity with a new offering available for qualification in mid-2016. Furthermore, it expects to start sampling products based on next-generation 3D NAND memories in 2017. The company began equipment purchases to support the commencement of pilot production of 48-layer architecture in the second half of 2015.

Outlook

From a supply bit growth rate standpoint, the flash maker expects the industry's year-over-year supply bit growth to be somewhat above its previous estimate of approximately 40%, and also expects its captive bit growth to be in line with the industry. For 2016, the firm estimates is that both the industry and its own supply bit growth rates will be lower than in 2015.

For the third quarter, SanDisk expects revenue to be higher than in 2Q15, in the range of $1.35 billion to $1.45 billion or a sequential growth between 9% and 17%.

The firm expects the majority of sequential second-half revenue growth to come from mobile embedded products, with a significant portion of this revenue forecasted on the cusp between 3Q15 and 4Q15. The ramp timing of several mobile embedded products, along with the market success of company's customers' mobile products, are key variables in where SanDisk land in forecasted 2015 revenue range.

Current estimate for 2015 revenue remains within the range of $5.4 billion to $5.7 billion that the company provided last April, which means a huge decline from FY14: 14% to 19%.

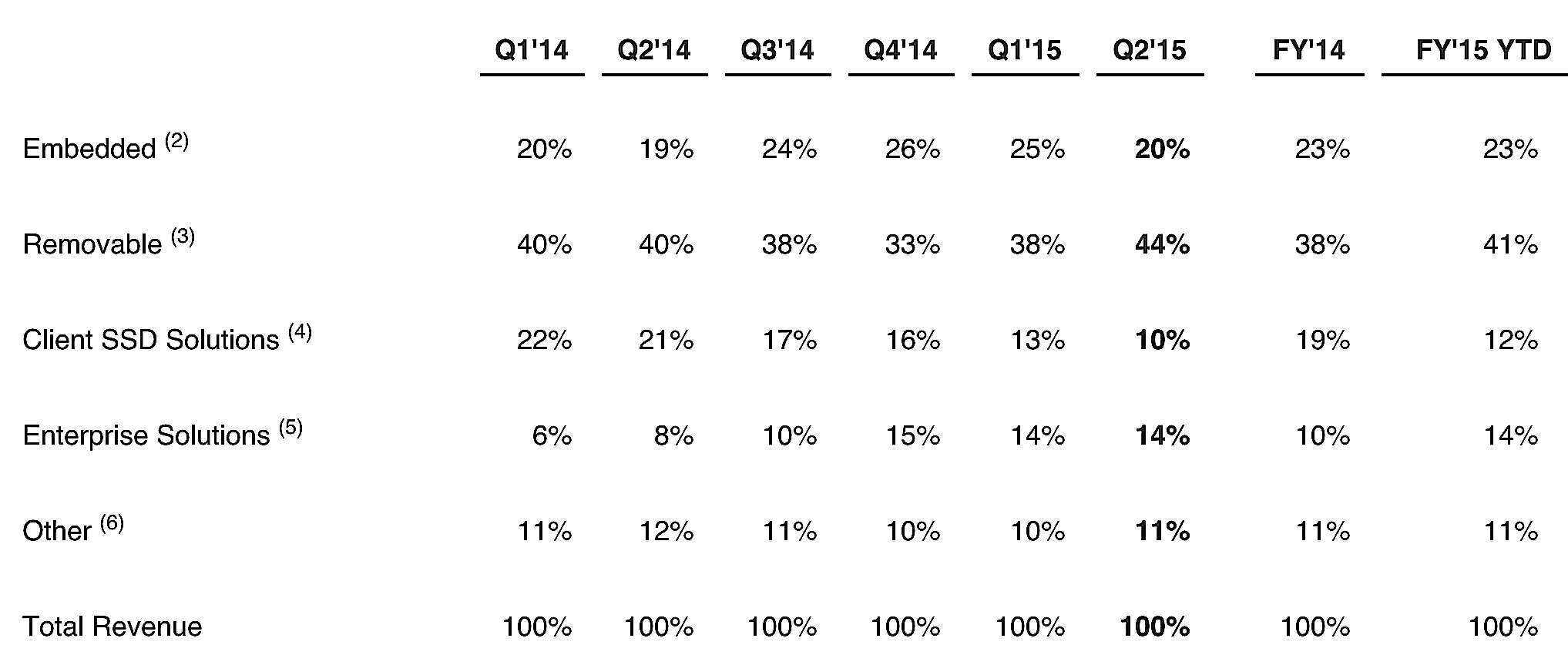

Revenue Mix by Category

(1) Revenue by category is estimated based on analysis of the information

the company collects in its sales reporting processes.

(2) Embedded includes products that attach to a host system board.

(3) Removable includes products such as cards, USB flash drives and audio/video players.

(4) Client SSD Solutions includes SSDs used in client devices and associated software.

(5) Enterprise Solutions includes SSDs, system solutions

and software used in data center applications.

(6) Other includes wafers, components, accessories and license and royalty.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter