WW Tape Cartridge Market Never Stopped to Decrease – SCCG

Since half dozen of years without interruption

This is a Press Release edited by StorageNewsletter.com on April 3, 2015 at 3:10 pmThe Santa Clara Consulting Group has published Backup Tape Tracker ($2,850) for 4Q14.

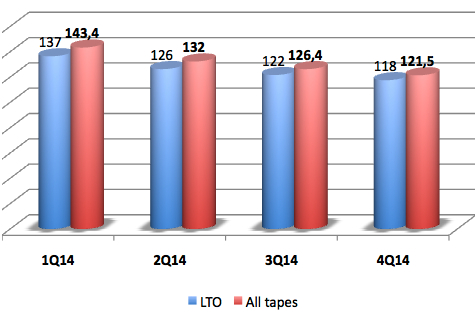

Backup tape cartridge sales amounted to $121.50 million. LTO accounted for 96.78% of total with sales of $117.59 million.

The media market is expected to be $117.42 million in the next quarter.

Total LTO volume was slightly off at 4.7 million units in Q4. LTO-6 continued its expansion in the quarter accounting for 22% of units and 36% of dollars. LTO-5 was slightly down from the previous quarter. It accounted for 41% of unit sales and 33% of dollars. LTO-4 was significantly down. It represented 28% of units and 23% of dollars. LTO-3 sales were also significantly down. They accounted for 8% of volume and 7% of dollars. LTO-1 and LTO-2 were off -21% and -14% respectively from narrow bases.

Combined, they accounted for 2% of units and 2% of dollars. HP led the LTO market with a 30% share. Fuji was the second largest supplier and IBM was third. Q1 LTO unit sales are expected to be steady with Q4 levels. They will be supported by growth of LTO-6.

The DDS/DAT cartridge volume was slightly down at .2 million units in Q4. DAT-72 accounted for 39% of unit sales and 41% of the value of the segment. DAT-160 accounted for 35% of the value of the segment and DAT-320 sold 2%. HP led the DDS/DAT market with a 73% share. Segment dollar sales amounted to $2.69 million.

DLT-S cartridge sales amounted to .01 million units. H-P led the segment. It was followed by Quantum and Maxell. DLT-S dollar sales are expected to be off to $0.43 million in Q1. DLT-V sales were up at .005 million units. Their value was $0.23 million. DLT-4 cartridges accounted for 59% of units. Quantum led the segment with a 58% share. H-P was second at 25%. Sales of DLT-V are expected to be lower in Q1.

AIT media supports its respective installed bases of drives. Total AIT cartridge volume in the quarter amounted to .004 million units. Sony was their sole supplier.

Shipments of QIC cartridges in the quarter totaled .003 million units. Their value was $.26 million. Imation dominates the segment with a market share of 97%.

The 8mm metal particle cartridge amounted to .00001 million units worth $0.0001 million. Sony was the only supplier.

Comments

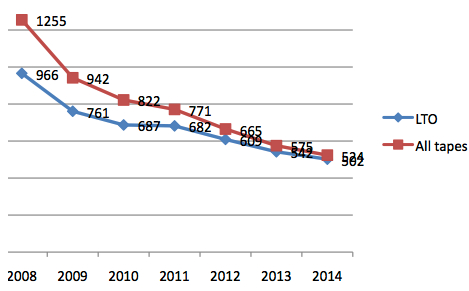

Since half dozen of years, the trends in the worldwide tape cartridge market - not including proprietary high-end formats from IBM and Sun/StorageTek - are always the same:

- 1/ Revenue is decreasing each year without interruption.

- 2/ LTO is more and more dominating, from 77% in 2008 to 96% in 2014

- 3/ LTO market is also going down each year, just at a lower level than the entire market.

- 4/ All other tape formats are dead or dying.

Below are figures and graphs based on figures from SCCG and compiled by StorageNewsletter.com.

Tape cartridges revenue in $ million

| Year | LTO | Y/Y growth | All tapes | Y/Y growth | % for LTO |

| 2008 | 966 | NA | 1,255 | -2,7% | 77,0% |

| 2009 | 761 | -21,2% | 942 | -24,9% | 80,8% |

| 2010 | 687 | -9,7% | 822 | -12,7% | 83,6% |

| 2011 | 682 | -0,7% | 771 | -6,2% | 88,5% |

| 2012 | 609 | -10,7% | 665 | -13,7% | 91,6% |

| 2013 | 542 | -11,0% | 575 | -13,5% | 94,3% |

| 2014 | 502 | -7,4% | 524 | -8,9% | 95,8% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter