WW Integrated Infrastructure and Platform Revenue Increases 19% in 4Q14 – IDC

At $2.7 billion, as demand outpaces traditional systems

This is a Press Release edited by StorageNewsletter.com on March 27, 2015 at 2:37 pmAccording to the International Data Corporation‘s Worldwide Quarterly Integrated Infrastructure and Platform Tracker, vendor revenue for the worldwide integrated infrastructure and platforms market increased 19.4% year over year to $2.7 billion in 4Q14.

The market generated 1.2EB of new capacity during the year, which was up 42.2% compared to same period a year ago.

For the full year 2014, worldwide integrated systems revenues increased 28.9% year over year to $9.4 billion, while new storage capacity shipments grew 52.8% to 3.5EB.

“The integrated systems market continued to exhibit strong momentum throughout 2014 and represents a growth opportunity for IT vendors,” said Jed Scaramella, research director, enterprise servers. “The industry saw competitive dynamics shift in 2014 with major vendors completing company privatization and acquisitions, as well as many forming new partnerships. These actions are sure to set a new competitive landscape for 2015.”

“An expanding number of organizations around the world are turning to integrated systems as a way to address longstanding and difficult infrastructure challenges,” said Eric Sheppard, research director, storage. “This drove $2.1 billion of net-new spending in 2014 and makes these solutions an increasingly rare source of high growth within the broader infrastructure marketplace.”

Integrated Platforms Vs. Integrated Infrastructure

IDC distinguishes between two market segments: integrated platforms and integrated infrastructure. Integrated platforms are integrated systems that are sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools. Integrated infrastructure systems are designed for general-purpose, distributed workloads that are likely to have differing performance profiles. While integrated infrastructure is similar to integrated platforms in that it will leverage the same infrastructure building blocks, it is not optimized for a specific workload.

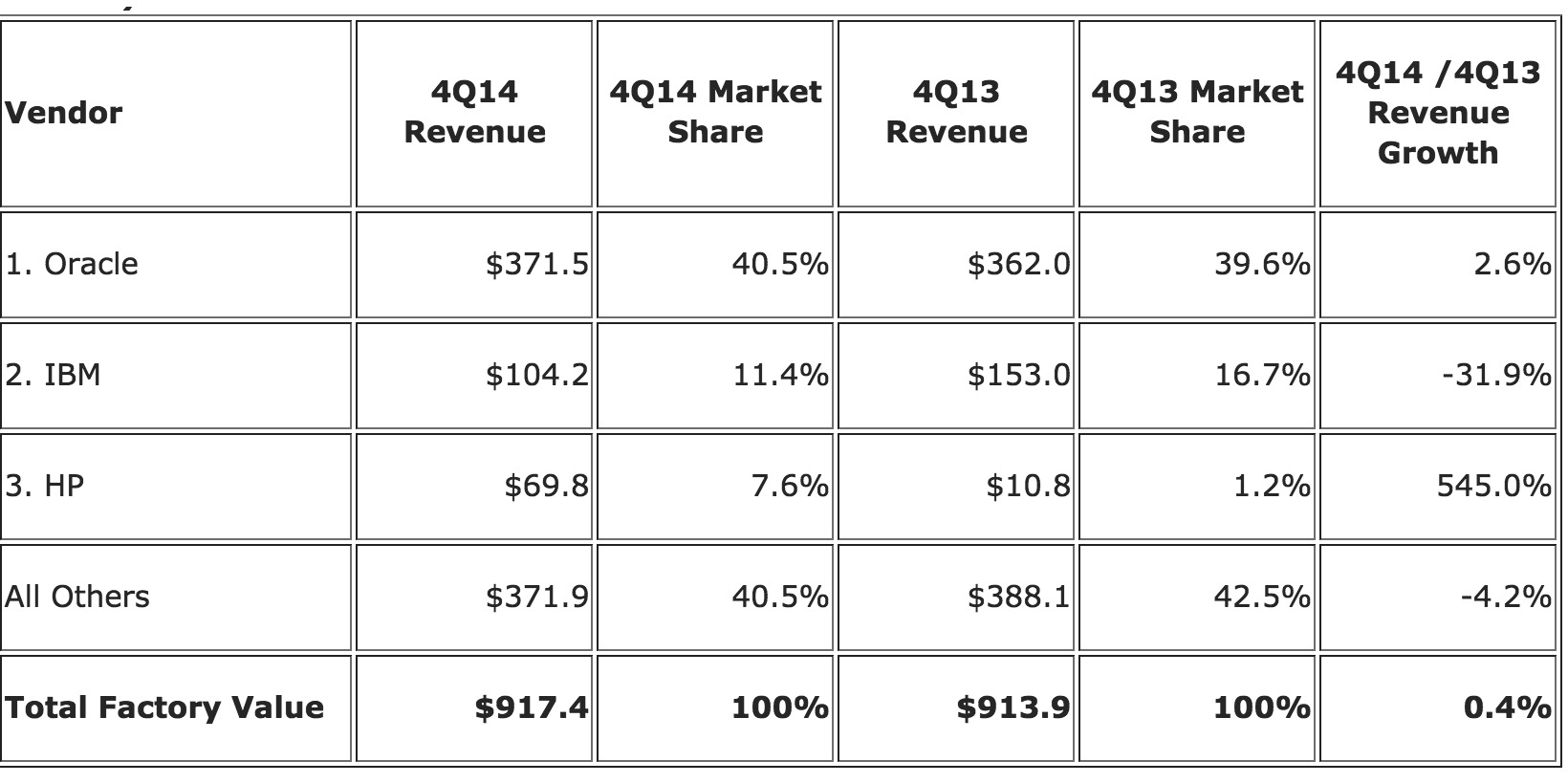

The integrated platforms market was essentially flat during the fourth quarter, generating $917 million in sales on 0.4% year-over-year growth rate. Oracle was the largest supplier of integrated platform systems with $371 million in sales, or 40.5% share of the market segment.

Top 3 Vendors, WW Integrated Platforms, 4Q14

(revenue in million)

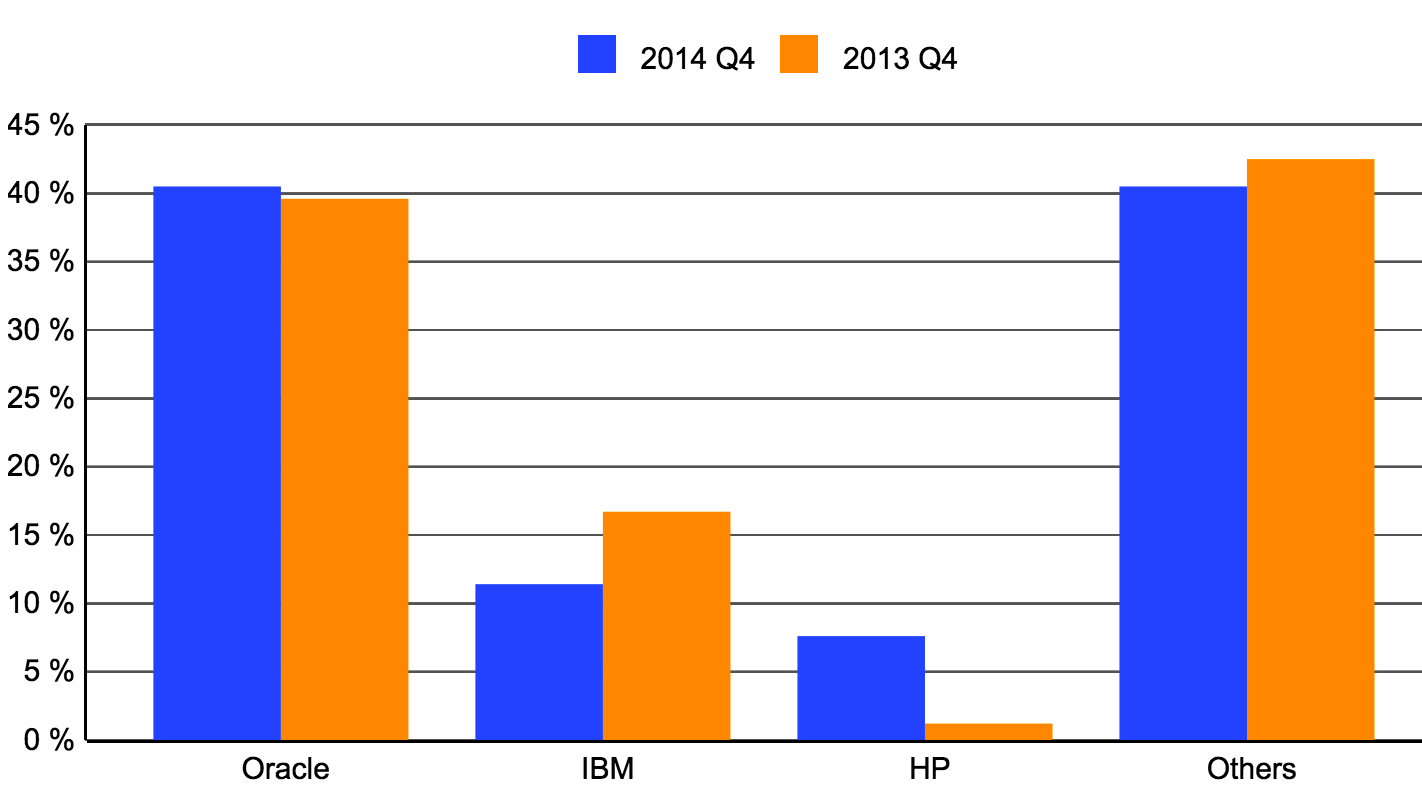

WW Integrated Platforms – Top 3 Vendor Market Share – 4Q14

(vendor revenue share)

(Source: IDC Worldwide Integrated Infrastructure & Platforms Tracker, March 26, 2015)

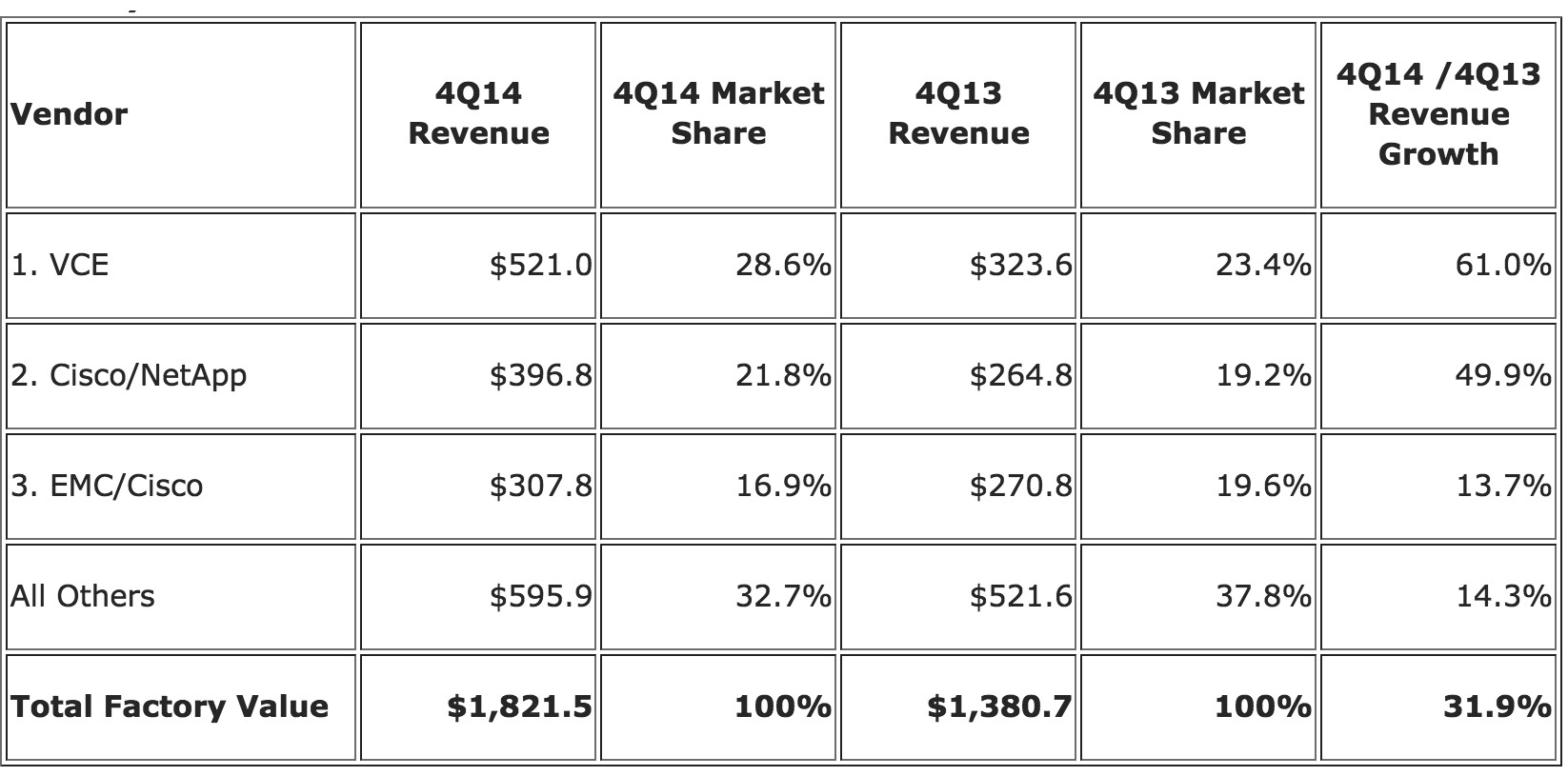

Integrated infrastructure sales grew 31.9% year over year during the fourth quarter 2014 to $1.8 billion in total sales. VCE was the top-ranked supplier of integrated infrastructure in the quarter, generating revenues of $521 million and capturing a 28.6% share of the market segment.

Top 3 Vendors, WW Integrated Infrastructure, 4Q14

(revenue in million)

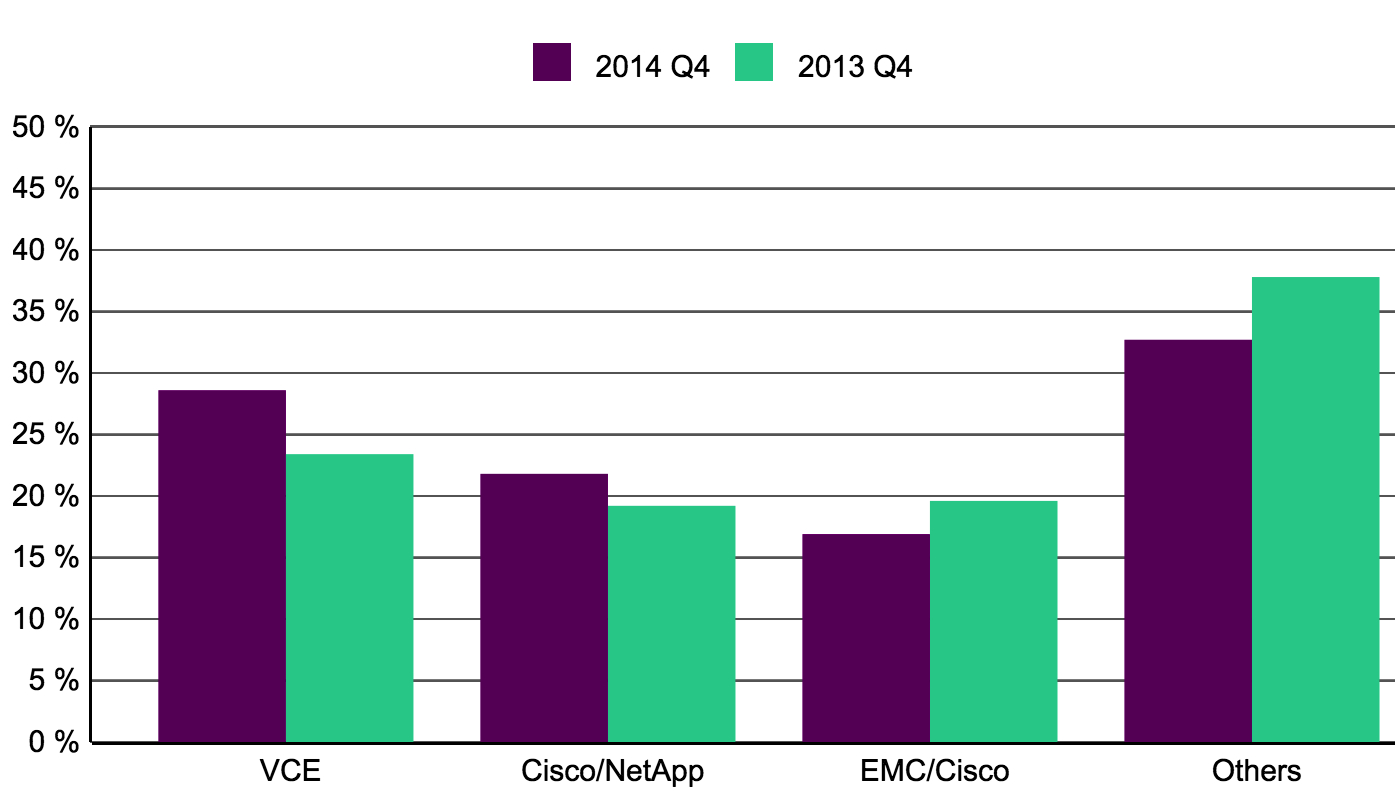

WW Integrated Infrastructure – Top 3 Vendor Market Share – 4Q14

(vendor revenue share)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter