TLC to Account for Half of Total NAND Flash Output in 4Q15 – DRAMeXchange

Excess supply for 1H15

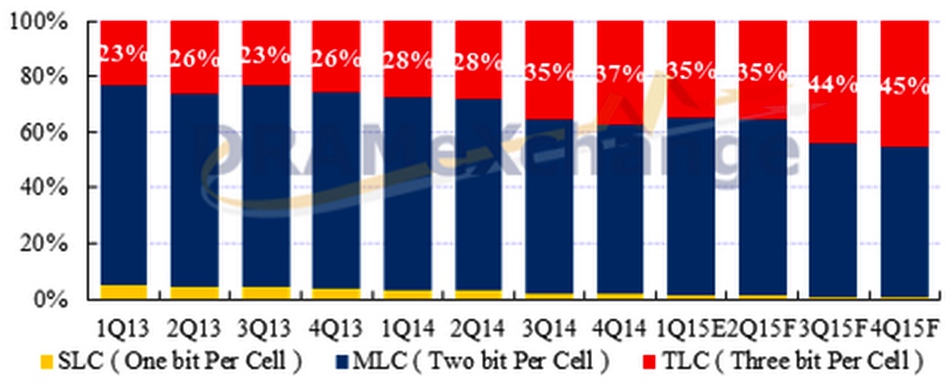

This is a Press Release edited by StorageNewsletter.com on March 26, 2015 at 2:50 pmA report from DRAMeXchange, a division of TrendForce, indicates that TLC NAND flash will account for nearly half of the total NAND flash output in 4Q15.

With TLC NAND applications shifting from memory card and USB drive to OEM storage devices such as eMMC/eMCP and SSD, manufacturers will in turn launch their TLC-based storage solutions this year. The ratio of TLC NAND flash output will therefore continue to grow.

DRAMeXchange’s assistant VP Sean Yang said in the past TLC NAND flash was widely used in memory cards, USB drives, and external devices because of its cost advantage, but that has changed.

“Samsung has actively introduce TLC into the eMMC/eCMP and client SSD markets since 2013,” Yang explained. “And with its recent market share gains in 2014, Samsung managed to push its competitors to develop TLC-based embedded products as well.“

Moreover, the shares of TLC NAND flash in applications such as cell phones, tablets, and other consumer electronics have steadily increased due to the maturation of controller chip technology (that makes NAND flash more powerful) and the low price of TLC itself (around 80% to 85% of MLC type).

The most crucial point in development of TLC NAND flash came in 2014, when it was used in iPhone6/6 Plus. From then on, TLC-based products for mobile devices have moved from the mid-level to upscale market.

Apple’s decision to equip Macbook Pro/Air series with SSDs after 2013 also set an important example in the PC vendors.

The advancements in controller chips have resolved TLC’s prior problems such as performance issues and slow R/W speed, making TLC-based SSD products more popular in the market.

Besides flash module makers rolling out TLC-SSDs, other NAND flash makers are also introducing TLC-based client-SSDs. With the price difference between TLC-SSD and conventional HDD dwindling rapidly, many PC vendors will opt to increase the number of their products carrying SSDs this year in order to stay competitive in an industry environment that is becoming more challenging.

DRAMeXchange hence forecasts that the client-SSD will see its growth soaring very quickly.

1Q13-4Q15 NAND Flash Production by Type

(Source: DRAMeXchange, March 2015)

As for the NAND flash market, Yang expects that excess supply will be the trend for the first half of 2015. This is because seasonal effects have hurt shipments of smartphones, tablets, and notebooks in the first quarter. Compared with 4Q15, the shipments of these products in 1Q15 respectively declined between 10% to above 15%. The lack of noticeable demands at the user end will also affect the NAND flash market in the second quarter.

However, demands will start to pick up by the start of the third quarter because Apple is scheduled to release its newest iPhone and iPad towards the end of the quarter. Flagship models of other smartphone vendors will come out at the same time as well. Thus, the entire NAND flash market will return to a healthy state of supply-demand by then.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter