18% of IT Budget Dedicated to Storage in Europe – IDC/HP

One-fifth of external storage spend on flash in 2014

This is a Press Release edited by StorageNewsletter.com on March 9, 2015 at 3:04 pmThis white paper, From Flash to Value – How External Solid State Arrays Become a Normality Among European Customers, was written in February 2015 by IDC Corp.‘s analysts Silvia Cossi and Giorgio Nebuloni, and sponsored by Hewlett-Packard Development Company, LP.

Over the past few years, IT environments have been gradually shifting towards what IDC defines as the 3rd Platform, a new way of consuming IT, shaped by mobile devices, cloud services and big data analytics, as opposed to the hardware-based environments companies used to rely on. Data will increasingly be stored in hybrid cloud environments, accessed as-a-service and eventually moved to the center of value creation through big data analytics. To get there, however, not only will more data need to be accessible to more users, but it will also need to be accessible faster to generate proven and sizeable business outcomes.

In this study we look at how Flash storage helps achieve some of those goals, and how it is growing in usage among European customers.

Key findings of this research include the following:

- Organizations across Europe have faced flat or shrinking IT budgets for some time. Around 26% of respondents saw an increase in their overall IT budget in 2014 compared with 2013, 21% recorded a decrease, and 47% experienced no change. Approximately 18% of the IT budget was dedicated to storage, which was virtually unchanged since 2013. The clash between stagnant budgets and increasing performance and capacity demands from next-generation applications has accelerated innovation in the datacenter, with Flash being one of the key emerging technologies.

- On average, Flash users interviewed by IDC for this study dedicated roughly one-fifth of their external storage spend on Flash in 2014. The largest proportion of them (around 47%) reported that Flash systems account for less than 10% of their storage spending in 2014. However, a significant 27% saw that proportion ranging between 10 and 50%, a sign that some of the early adopters are on an accelerated deployment path.

- Databases are the main workload supported on Flash arrays, and were mentioned by two-thirds of the respondents. In the mid-term, areas more directly related to data (database, analytics, big data) will remain the major driver for adoption of external Flash arrays in Europe. In 2015, however, more commonplace workloads will also be migrated to a faster Flash-enabled back-end.

- While speed remains the main benefit and driver for Flash storage implementations, IDC advises end users to start looking at other positives such as savings on storage, server CapEx and database or application licenses. As far as concrete implementation goes, we recommend integrating Flash blocks in the broader storage management ecosystem whenever possible, as this will save headaches in the long run.

In this white paper

This IDC white paper focuses on the benefits and inhibitors to the adoption of external storage arrays based on Flash media in European enterprises in 2014. This document analyzes how Flash-based storage is being implemented in the region and reports results from a survey run among European storage administrators highlighting the successes and possible challenges in the journey. Finally, this IDC White Paper provides an overview of HP’s latest Flash storage solutions, highlighting their characteristics and positioning them in the broader portfolio of the vendor.

Situation preview

The external storage spending in Western Europe grew modestly (1% YoY) in the first half of 2014, totaling $2.7 billion. This followed similarly slow growth (3% YoY in dollar terms) in 2013. Overall, the market has been slowing since the turn of the decade. Although spending has returned to 2008 levels, the architectures in use, the shift to mid-range systems, and the influx of cloud present a landscape completely different to what it was at the time. The world of storage is moving and businesses are required to move with it to remain competitive in the European and global market.

In the next sections we’ll focus on the following topics:

- The changing dynamics of storage spending

- The challenges to running storage

- Using Flash to overcome storage pain points

IDC conducted primary research to gain fresh insight into these themes. Between September and October 2014, IDC surveyed 304 IT organizations in five European geographies (France, Germany, Italy, the Nordics, and the UK). All of the survey data reported here stems from that specific study, unless otherwise stated.

Budget Shifts Equal Mindset Change

Organizations have faced shrinking IT budgets for some time, all the while being expected to provide increased levels of service and to manage exponential data growth. Around 26% of respondents saw an increase in their overall IT budget in 2014 compared to 2013, 21% recorded a decrease, and 47% experienced no change. Approximately 18% of the IT budget was dedicated to storage, remaining virtually unchanged since 2013, and pushing organizations to stretch their storage purchases as budgets remain the same or reduced.

As is often the case when stagnant budgets are expected to meet increasing requirements, the market has started to undergo a structural change to adapt to the new pattern of demand. This situation at very least accelerated the next wave of innovation in the datacenter.

In particular, IT environments have been gradually shifting towards what IDC defines as the 3rd Platform, a new way of consuming IT, shaped by mobile devices, cloud services and big data analytics, as opposed to the hardware-based environments companies used to rely on. Data will increasingly be stored in hybrid cloud environments, accessed as-a-service and eventually moved to the center of value creation through big data analytics. To get there, however, not only will more data need to be accessible to more users, it will also need to be accessible faster to generate proven and sizeable business outcomes.

Capacity Growth is So … Last Year

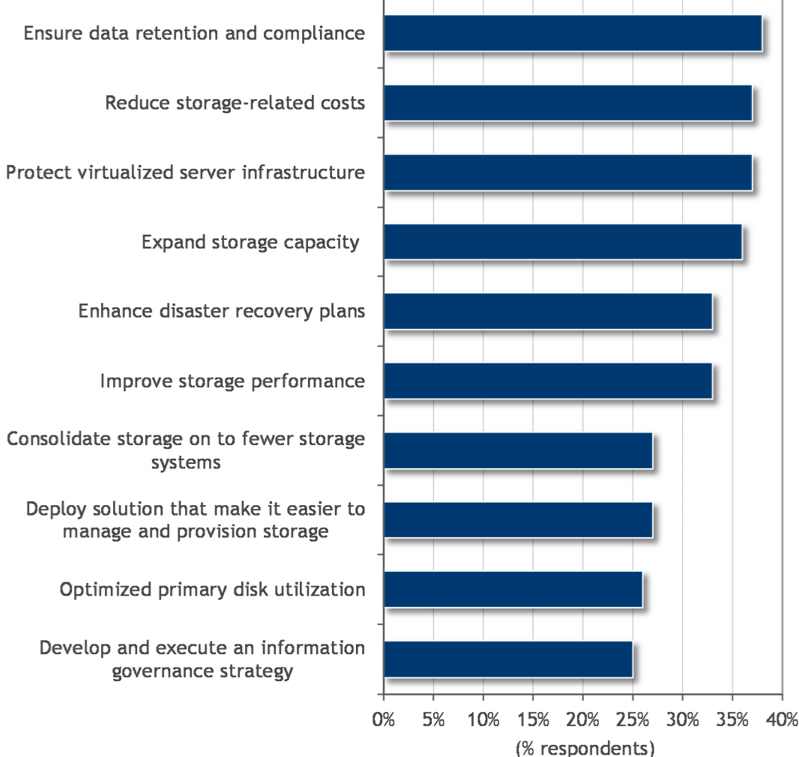

Exploding storage capacity is not a new challenge in European datacenters. IDC estimates that external storage terabyte volumes grew at an average of 40% over the past four quarters in EMEA, with a total of more than 10EBs of data shipped. In the annual IDC European Storage Survey, run at the beginning of 2014 with 500 respondents, “expanding storage capacity” was ranked as a high or essential priority by 36% of respondents. An additional 33% ranked “improving storage performance” as a similarly high priority. Compared to the previous year, we found that capacity requirements have remained comparatively stable, but performance requirements seem to have increased further. Figure 1 shows the results discussed above.

Figure 1: Top 10 Priorities in Storage for European Organizations, 2014

Q. How much of a priority are each of the following factors in your organization’s storage

requirements for the next 12 months?

Note: N= 500; % respondents that marked High Priority or Essential

(Source: IDC European Storage Survey, January 2014)

Such findings are backed up by the results of the survey discussed in this paper.

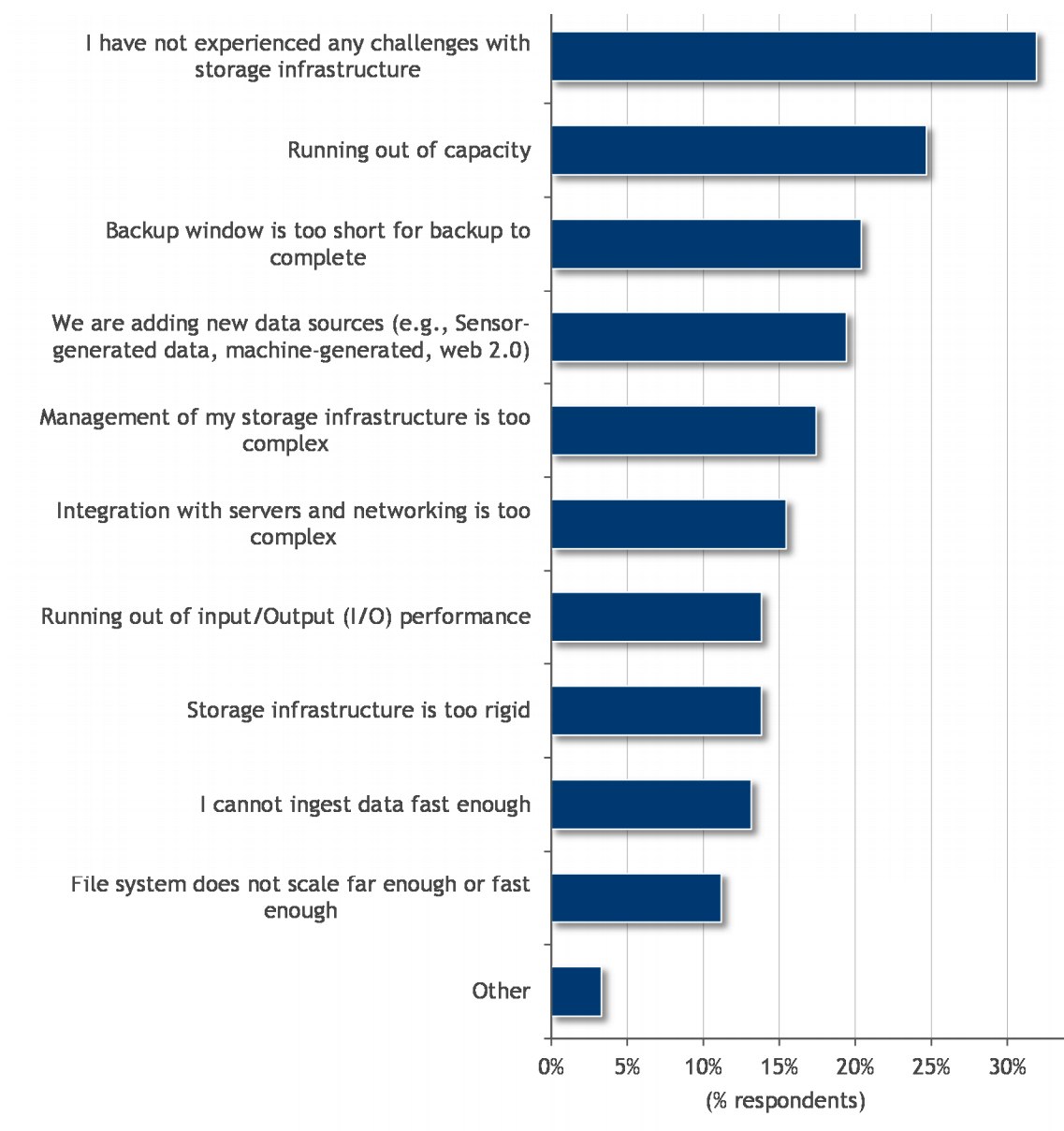

Figure 2 shows the main storage challenges identified by respondents of the Flash survey in discussion. While capacity emerges as the main challenge (alongside backup windows and infrastructure management), I/O capacity starts to appear as a problematic area. A large number of companies are coming to grips with new, large, and unstructured data sources generated by their end customers via Web or social media interactions, by sensors dispersed in their supply chain, and so on. Businesses that embrace this 3rd Platform scenario successfully do not limit their response to a passive absorption of these new data volumes.

Figure 2: Main Storage Challenges in European Organizations

Q. What are the main storage challenges your company faces?

(Source: IDC, 2014)

On the contrary, business users in those companies visualize, consume, and act upon this new data tide, which increases the pressure on increased performance for traditional storage media. Some 15% of the IT staff surveyed realize this and say they are running out of I/O bandwidth, but IDC believes that many other storage administrators will come to grasp it in the most painful way, by suffering a data crash or, worse, raising the white flag towards their own business units, therefore losing credibility as enablers of business growth.

Flash Adoption in European Companies

The request for speed combined with capacity is being met by increasingly broad support from technologies that dramatically accelerate data access. Some of these advancements happen on the software side, but the real game changer is the booming availability of Flash as a new storage medium.

Almost a decade ago, alternative technologies based on NAND Flash began trickling into the market. Mass storage devices based on silicon had traditionally been used in commercial electronics (factory automation, medical, military, etc.), but the adoption of NAND Flash has since skyrocketed with the ascent of the 3rd Platform. Initially finding its way into consumer devices such as MP3 players, NAND Flash usage has since extended to PCs and smartphones and finally to servers and external storage devices.

Highly durable SSDs are in use in the external storage space, combined with controllers and software that ensure reliability for enterprise workloads.

In this space, users have a choice between:

- All-Flash Array (AFA) – external arrays built for and including only silicon media.

- Hybrid Flash Array (HFA) – traditional disk arrays that are fit to support some minor volumes of Flash as a caching or accelerator element, alongside HDDs for cheaper capacity.

While there are several ways for a system vendor to implement NAND Flash capacity at a component level (SSD versus PCIe cards, different types of cell density, different types of controllers), the overarching benefits that the new medium brings about are as follows:

Performance boost of almost any application due to faster read and write speeds. In NAND Flash, there is no need for parts that move and “look for data,” as happens on a rotational HDD. Also, the fragmentation of files doesn’t impact the performance of flash-based storage, which is not the case with traditional HDDs.

Potentially large savings in several adjacent areas including server hardware, cooling, electricity, floor rent, and application software licenses.

Potential and current users of Flash are focused mainly on the first aspect, since the presence of Flash in many datacenters has not yet reached critical mass for the CAPEX savings to impact the bottom line for companies. Once this second aspect becomes more tangible, we expect a widening deployment of the technology, especially in large environments.

Market adoption of Flash looks to be ramping up:

- In a recently published report, IDC estimated that Flash media has already contributed more than 10% of the total external storage revenues in Western Europe in the first half of 2014, with year-on-year growth well above 200%, which compares starkly with the single-digit pace of the market.

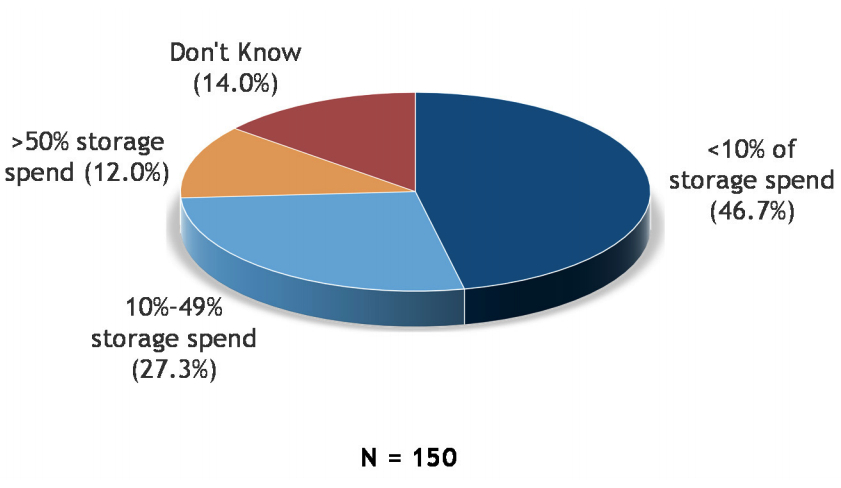

- The largest portion of Flash users interviewed (around 47%) reported that Flash systems account for less than 10% of their storage spending in 2014. However, a significant 27% saw that proportion ranging between 10 and 50%, a sign that some of the early adopters are on an accelerated deployment path (see Figure below). On average, Flash users dedicated roughly one-fifth of their external storage spend to Flash in 2014.

Figure 3: Expected Proportion of Storage Budget for Flash, 2014

Q. What percentage of the storage budget will be allocated to new Flash systems acquisition in 2014?

Note: Flash users only

(Source: IDC, 2014)

These numbers indicate a market that is by no means confined to early adopters anymore, but it is becoming mainstream, enabling not only all the typical sharing applications such as database and emails, but also the ones envisioned by the 3rd Platform paradigm such as cloud and VDI.

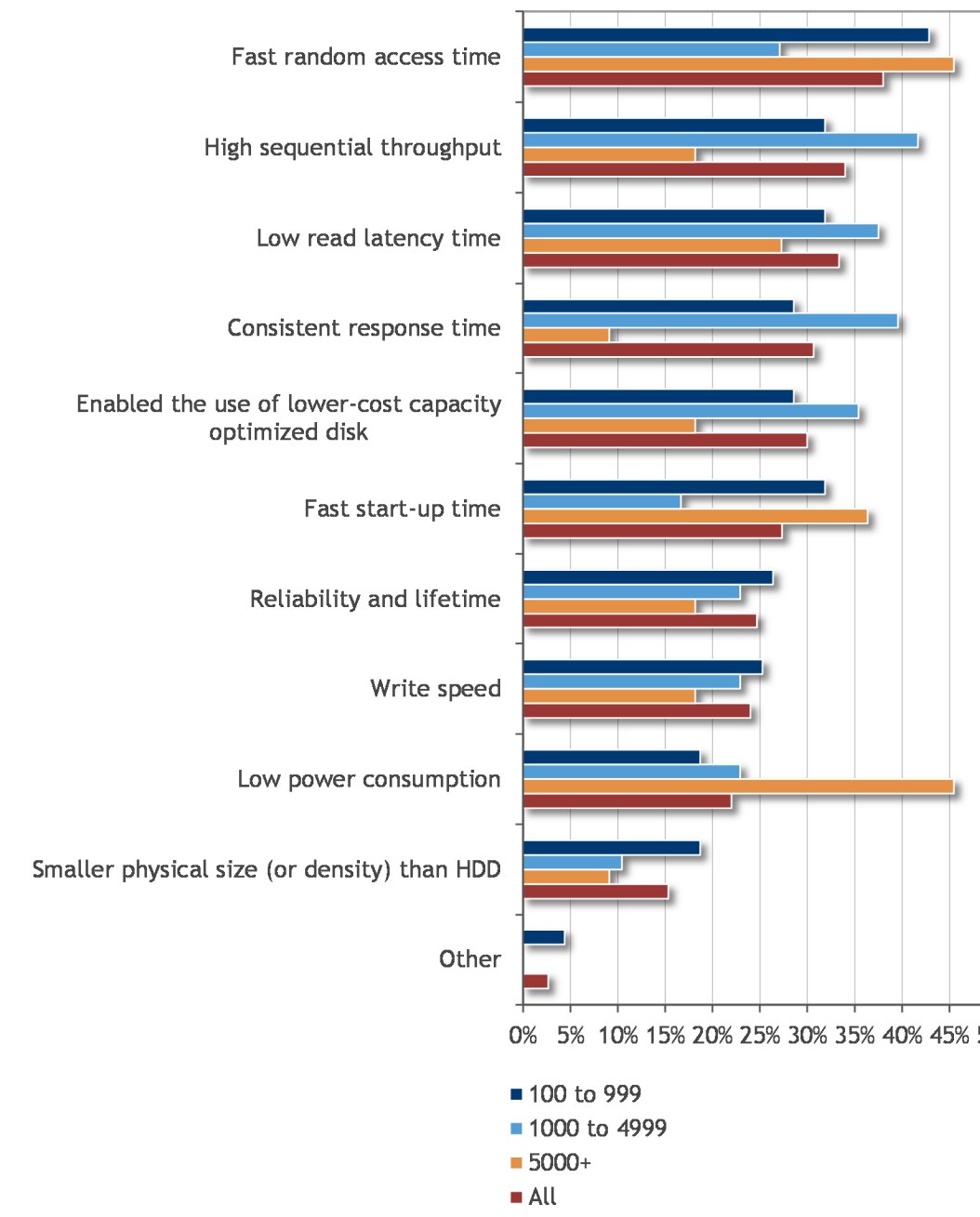

Speed and More

The key benefits of Flash technology have been identified as faster random access time, followed by higher sequential throughput and lower read latency times (see figure below). The majority of respondents see Flash mainly as a performance enabler; i.e., a way to speed up information access time and thus business processes, while cost-related issues such as power consumption and usage of low-cost optimized disks appeared to play a secondary role when deciding on the introduction of Flash arrays, according to the respondents flash storage does actually bring several of those potential benefits to bear, but those are not judged as important as performance by the users yet. This will require some education from the supplier community going forward.

IDC has also found that cost plays a more significant role for the largest organizations (over 5,000 employees) where due to the larger size of the hardware installed base energy bills are way more impactful, while smaller businesses value the smaller physical size and higher density of Flash arrays so that they can also be fitted into branch or office environments and small server rooms.

Figure 4: Key Benefits of Flash, by Company Size

Q. What have been the key benefits of deploying Flash in your organization?

Note: N = 150; Flash users only

(Source: IDC, 2014)

Looking at the main drivers of Flash adoption, 46% of respondents believe that increasing performance requirements could prompt them to adopt Flash, while only 26% would introduce Flash to improve their TCO. Other motivations for adoption include increasing capacity, optimizing the cost-performance ratio and evolving from legacy technology.

Preferred Workloads and the Rapid “Normalization” of Flash

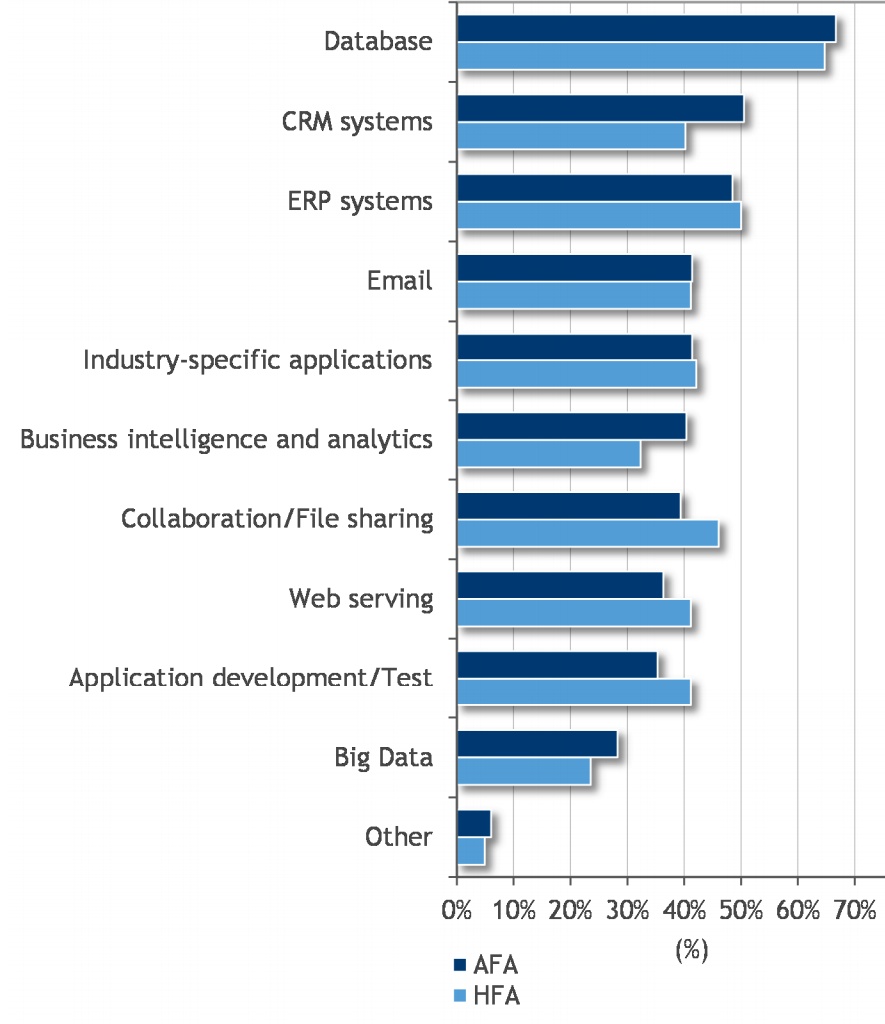

As illustrated in figure 5, databases are the key target workload for AFA and HFA systems, highlighted by almost 70% of the sample for both systems. No major differences in target workloads were noticed for the two approaches.

Big data analytics was only quoted by a quarter of respondents, but IDC believes that these workloads will contribute to the growth in Flash usage, as exponentially increasing data volumes need to be stored efficiently and flexibly at a reasonable cost.

Figure 5: Applications Supported on Flash Arrays

Q. Which of the following applications are you currently using, or do you plan to use on your Flash Arrays?

Note: Current/potential AFA users (N=99), current/potential HFA users (N=102)

(Source: IDC, 2014)

Overall, IDC believes that in the short-term workloads that are more directly related to data (database, analytics, big data) will continue to be the major driver for adoption of external Flash arrays in Europe. In 2015, more standard workloads will also be migrated to a faster back-end, on either HFA or AFA systems. Several early adopter customers that have worked with Flash arrays for some time are already supporting mixed workloads on Flash back-ends, effectively standardizing on the medium as the storage backbone. In the long-term, and as the raw $/GB differential between disk and Flash dissolves, IDC believes the preponderant majority of primary storage will reside on Flash-enabled systems.

A key proof point for this broadening of the appeal is provided by the demands of the users themselves. Over two-thirds of all respondents would like to see HA features combined with Flash arrays – this request can easily be explained by the fact that databases (primary workload) and the core business applications that they support need by definition to sit on highly-available infrastructure. However requests for “regular” storage features such as deduplication (55% of the respondents would like to see it in combination with Flash), snapshots (55%), encryption and thin provisioning (45% each) remark once more that Flash is on its way to becoming the new normal in external storage. This is why vendors are racing each other to make those features available to their customers and “normalize” the new medium.

Looking at the different architectures used for deploying SSD, the study has shown that over half (55%) of respondents use SSD in storage systems (i.e., hybrid Flash arrays) and half (49%) also use cache modules in disk storage systems. The most common level of storage for which Flash deployments are planned is RAID (47%), followed by tier 1 storage (41%). Other levels quoted by a third of respondents each are cache and tier 0 storage.

Challenges to Using Flash

Challenges to Flash adoption are varied, and can include the high cost per Gigabyte of Flash powered systems, IT budget constraints, lack of internal skills, and the complexities associated with managing Flash systems.

However, companies that are not using or planning to use Flash (118 respondents) listed reservations in the following order:

- The cost or price (62%)

- The belief that the type of data assets they have wouldn’t benefit (42%)

- The opinion that the technology is still immature (36%)

- The opinion that there is no perceived benefit for the price (32%)

All in all, three of those top four reservations are linked to a perception of value, and IDC is of the opinion that the powerful combination of peer adoption and extremely high price competitiveness in the market will sway that perception.

At the same time, popular misconceptions regarding Flash being far from cheap and limited to certain types of performance-intense workloads still need to be overcome in order to achieve more mainstream adoption and convince CIOs of the technology’s viability for replacing entire legacy store infrastructures.

HP’s Flash Storage Strategy

Flash start-ups began shipping storage systems re-engineered to be optimized for the use of Flash in 2012. Such systems represented a breakthrough in terms of raw performance compared to the traditional spinning media, but at times faced reliability problems and – more importantly – were equipped with basic management tools.

Incumbent players such as HP hit the market in a second wave, and at the beginning simply supported the use of the Flash medium in their existing arrays in a hybrid mode. However, they were soon able to leverage their expertise in sophisticated management tools to mitigate the issues the first generation systems were affected by.

HP decided to build its Flash portfolio on the principle of continuity with the existing offerings it had. Instead of buying technology from a third party provider, the vendor picked the architecture of its existing general purpose flagship platform (HP 3PAR) as the foundation for a new range of AFA systems able to tackle the issues of the first generation Flash arrays and to then achieve a widespread adoption of the technology.

IDC believes this move fits well with the broader product strategy that HP adopted in the past two years, whereby the vendor has consolidated its efforts around HP 3PAR as the core platform, with the addition of products in the software-defined space (HP StoreVirtual, StoreOnce VSA), backup area (HP StoreOnce), and archive space (HP StoreAll, HP StoreEver). is where HP is focusing several complimentary offerings, such as the recently announced HP 3PAR File Persona, around the 3PAR brand.

According to IDC EMEA Quarterly Storage Tracker, 2Q14, HP 3PAR was the largest platform by sales in EMEA in the midrange space for general purpose, tier 1 applications in 1H14. In this space (which IDC defines as the category of products sold at an ASP between $25,000 and $250,000), HP 3PAR accounted for about 12% of the revenue, which is well above the second ranked platform, and has improved by two%age points compared to the whole of 2013. HP, according to IDC’s EMEA Segment/Channel tracker, was also the largest supplier in the region for solutions sold to small businesses with fewer than 100 employees in that period.

HP’s External Flash Storage Product Range

The 3PAR range has shown positive momentum in the market thanks to a combination of technology features (e.g., efficient compression) and price affordability. Naturally, HP therefore decided to exploit its 3PAR flagship platform to build its two latest AFA arrays, the HP 3PAR StoreServ 7450, and the HP 3PAR StoreServ 7200.

The first product, the HP 3PAR StoreServ 7450, is aimed at enterprises and is a re-engineering effort of the platform first launched in 2013. The substantial re-engineering effort included hardware and firmware changes to make the product fully Flash-optimized. The latter product, launched in June 2014, is more focused on midmarket customers or branch offices, with a particularly accessible entry level price (<$35K) intended to appeal to first-time Flash users as well as small service providers that need to start with an initial low investment.

Both systems feature the same set of management tools that are available on 3PAR. Compared to other All-Flash Arrays in the market, these systems achieve lower cost and higher scalability through the use of the highly dense, cheaper cMLC coupled with advanced data compression features such as the recently introduced Express Indexing, which allows scalability to up to 1.3 PBs of usable capacity. With the latest firmware release, 3PAR offers deduplication for all SSD tiers across all models of the 3PAR StoreServ family. This feature helps provide more usable capacity from the physical hardware and therefore lowers customer investments without the need for any storage pools or post-processing. HP also offers in-line deduplication, which lowers flash costs by saving capacity up front without the need for any storage pools or post-processing.

From an HFA point of view, the 3PAR platform has been equipped with Flash since the beginning of 2014 in the HP 3PAR 7xxx family.

So, looking at the concerns that still remain around adopting Flash – as well as its required benefits – let’s see how HP Flash solutions have addressed them:

- Aggressive $/GB price point. The 7200 model features an entry-price level well below the market average ($60K-$200K) at $35K dollars. To achieve a very aggressive $/GB threshold, which HP sets at $2/GB, the vendor deployed its patented “Adaptive Sparing” technology that allows it to extract 20% more capacity from Flash disks than its competitors. This comes as a windfall for potential users that still perceive that Flash as too expensive for them. In fact, price concerns are inhibitors for 61% of customers not using Flash currently whom IDC interviewed, while an additional 32% believe there is no perceived benefit for the price.

- High scalability. Capacity is typically the highest storage concern due to fast data growth. However, Flash is typically seen as a performance booster, while capacity is not the first benefit that comes to mind when deciding to buy a Flash system (only 32% of respondents would expect to have this as a benefit from Flash). However, a more scalable AFA would allow users to address at least part of their capacity issues, in particular making systems able to handle metadata management. The HP 3PAR 7540 and 7200 AFA systems have been designed to be scalable up to 1.3 PBs of usable capacity, this result being achieved through the newly released Express Indexing technology which is able to lookup data based on their metadata to decide whether allocating it to a new memory block or not.

Bringing Flash to technological maturity. A misconception hindering adoption is the still widespread belief that Flash technology is too new and immature (36% of non-users interviewed), while an additional 18% of the respondents still claim Flash suffers limited endurance. On this ground, HP has applied its long heritage in data compression to its systems, which feature the same compaction technology tools that have differentiated 3PAR in the market, enhanced by the new Express Indexing. Also, as highlighted in the above section, HA was top of the list in the requirements of Flash users, and HP has worked to address that. In a further effort to dispel any lingering doubts around the reliability and physical durability of the medium, HP in June 2014 offered on 3PAR the “Get 6-Nines” Guarantee, which commits to 99.9999% of storage uptime, as well as a five-year warranty on the original SSDs included in the HP 3PAR StoreServ package. - Innovation delivered on a well-tested platform. 21% of the non-users interviewed fear that Flash would add too much complexity on the management side, while 17% of them perceive it is too complex to integrate. In this case, leveraging the same architecture for Flash systems pays out. Being HP’s Flash portfolio built on the 3PAR architecture, data migration and federation within HP’s portfolio is easy to implement and the system integration is more automatic. At the same time, the fact that Flash capabilities are embedded in the roadmap for HP’s core architecture means the system is more guaranteed to be future-proof.

HP’s vision is to bring Flash over a scalability and price point threshold to allow companies of any size to run mainstream applications on it rather than (or in addition to) spinning media.

Since the acquisition of 3PAR was completed, HP has built a deeper understanding of the typical needs of midsized companies, as well as of managing general purpose workloads. In this sense, IDC believes its vision to make Flash available to its main market segment (tier 1 solutions especially for SMB) is a natural extension of its strategy.

From the end users’ point of view, especially for those that have already implemented 3PAR, opting for an HP Flash system gives them the reliability they’ve been used to from their legacy enterprise systems, without most of the constraints with which Flash is normally associated. This is also reflected in the survey results among Flash users that have chosen the HP platform.

Although that subset is too small a sample to draw definitive conclusions, a couple of points can be made:

- Respondents that have implemented HP in their datacenter seemed to have a higher satisfaction rate for their Flash systems, with two-thirds of them being completely or moderately satisfied, versus an average of around half for other Flash suppliers.

- The key advantage identified by HP Flash users was in the improvement in write speed, which ranked higher compared to the overall Flash user sample. This might be attributed to the special software optimization tools deployed by HP such as the 3PAR Adaptive Read and Write technology, as well as the newly introduced Express Writes tool, which can further squeeze write times.

Challenges/Opportunities

Apart from the broader challenges described above – which impact all suppliers – IDC believes that HP specifically will have to overcome the following hurdles to maximize the market penetration of its Flash solutions:

- Low brand awareness among business unit owners. Several of the largest deployments of external AFA that IDC is aware of have been triggered by (and at times even paid for by) stakeholders such as database administrators, leaders of digital initiatives, and others who sit outside of the traditional sphere of influence of HP’s storage sales. HP needs to enter discussions with those decision makers earlier, while keeping the storage leads in the customer organization engaged through the process.

- Later than start-ups in product marketing push. HP should strengthen the message to end users and use the channel to maximize market awareness. The vendor is attacking a market where start-ups have been active for at least two years. Start-ups are very “vocal” in pushing their models: aggressive marketing is a must to help resellers in their “hard talk” with clients. Also, end users would benefit from increased knowledge of the market offer, especially HP users, who could reap the highest benefit in implementing HP flash systems due to easy integration with the existing HP environment.

- Uphill battle to educate less savvy customers. Focusing on the mainstream customer is a good strategy in terms of market size, and IDC believes the timing is now right. As highlighted in the current study, however, customers, especially in the midmarket space, do not always grasp the benefits of AFA and HFA, and tend to underestimate savings and ROI impact. HP sales and pre-sales will have to spend more time making prospects aware of this, which might lengthen sales cycles.

On the positive side, IDC is of the opinion that HP can leverage following opportunities for growth:

- Harness massive midmarket opportunity. The high $/GB and limited scalability of the first generation AFA systems have confined Flash adoption to single workloads for most of the initial adopters. As we discussed above, so far AFA systems have been predominantly used as a “single-point solution” for performance-hungry applications such as databases, datawarehouses, and so on, and typically those that could justify the initial investment and provide a quick ROI. In its effort to “democratize” the technology, HP has a vast market opportunity in the several SMB customers that it already serves and would benefit from the high predictability and low latency that Flash can offer for a number of different workloads.

- Help fulfill customer demand with financing options. Several of the new players are active in offering pay-per-use models for their AFA arrays, in some cases risking financial viability. HP is one of a handful of vendors that can leverage a long-standing, integrated financing arm to allow cash-flow constrained verticals (e.g., retail), as well as service providers with unpredictable revenue streams to acquire the technology in a more modular fashion.

- Meet the customer demand for a more “normal” Flash. This current research proves that several users are open to the idea of platforms delivering better performance, but demand that basically all of the standard features they are used to for “regular” storage work with Flash arrays. By quickly filling this gap with its core platform, HP has the chance to establish itself in the existing (and growing) 3PAR customer base.

Conclusion

The research conducted by IDC with end users and suppliers in the past few months shows that Flash arrays are here to stay. Early adopters with deep pockets are being joined by fast moving companies in the midmarket and even public sector, and both HFA and AFA are poised to enjoy strong double-digit growth rates in dollars spent in 2015 in Europe, beyond the considerable impact they already had in external storage in 2014.

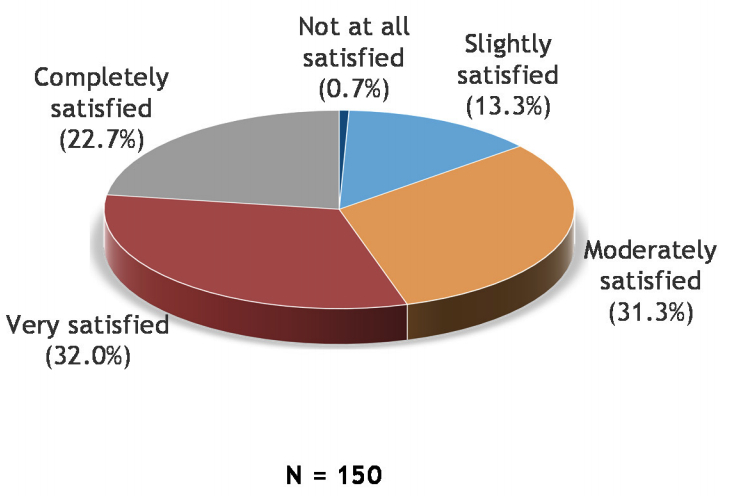

- On top of this, the initial wave of customers seems to have had good successes so far:

- 55% of Flash users are highly satisfied with Flash storage delivering the benefits planned for, 31% are moderately satisfied while only less than 1% are not satisfied at all.

- 83% of Flash users would repeat their Flash purchase. Satisfaction levels were comparable between AFA and HFA users.

Figure 6: Satisfaction Levels of Flash Users

Q. How satisfied are you with the flash storage producing the benefits you had planned for?

Note: N = 150; Flash users only

(Source: IDC, 2014)

Finally, IDC has the following advice for storage managers in organizations looking to use external Flash arrays:

- Raise expectations beyond speed. Speed in write and read were listed as a “must have” for Flash arrays by 50% of the respondents, but only 25% thought CapEx savings on storage or server hardware were a “must have” and 30% did not expect any at all. IDC believes this is a strategic mistake as all production implementations of AFA/HFA done right should yield at least some benefits on server CapEx and, more importantly, on database or application licenses.

- Set a plan for ROI before starting. Less than 40% of the Flash users interviewed had any idea about the ROI of their implementation. Without that piece of information it is hard to be relevant in internal discussions or justify further investment.

- Demand no less than what you are used to in terms of features. In these times and at the level of maturity reached by the technology, it is not acceptable for external AFA or HFA to still require compromises for traditional, well-accepted features in terms of HA and management. Make sure you extensively benchmark Flash platforms in that respect before shortlisting them for purchase.

- Integrate, don’t isolate. Point solutions for specific workloads can be justified in the midterm, as an “emergency button,” but whenever possible look to integrate Flash blocks in the broader storage management ecosystem as it will save you headaches in the long run.

- Proactively engage your internal customers. On many occasions, IDC has seen business leaders or application leaders in midsize or large companies bypass their traditional storage organization, preferring to directly contract a storage vendor for a quick solution to their speed demands, leaving the storage owners to fulfill the implementation. Continuous dialogue should help avoid that and keep you in control of your infrastructure.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter