EMEA Personal and Entry-Level Storage Devices Down 1% Y/Y – IDC

29 million units shipped in 2014

This is a Press Release edited by StorageNewsletter.com on February 27, 2015 at 2:55 pmResearch from International Data Corporation shows that annual shipment units for the personal and entry-level storage (PELS) market inEMEA) were down 1.1% year over year with around 29 million units shipped in 2014, according to the IDC Worldwide Personal and Entry-Level Storage Tracker.

Shipment values were also down 2% from a year ago, to $2.3 million.

In the fourth quarter 2014, EMEA unit shipment declined 3.9% to 7.8 million units, showing the same pattern as the year as a whole, while 4Q14 shipment values were down 5.5% to $611.8 million.

In the personal storage segment, HDD vendors continued to gain market share and dominate the market.

Although there are threats of technologies such as public cloud and online streaming to the market, the bandwidth and security levels are still a major concern in Europe, which makes personal storage devices the main source for consumers to store and manage their data.

“The entry level segment, on the other hand, used to be dominated by mainstream non-HDD vendors. In 2014, however, mainstream non-HDD vendors lost 21.4% unit share to HDD vendors. The reduction in entry-level prices has stimulated SMBs and home offices to acquire products that could offer the relevant enterprise features they require as well as satisfy their storage needs,” said Jimena Sisa senior research analyst, European storage research.

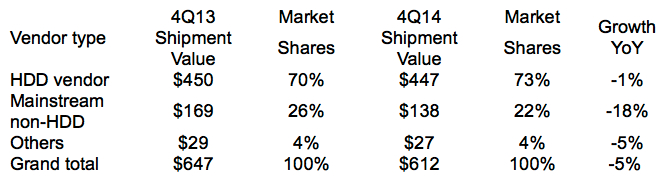

EMEA PELS Shipment Value, Market Share, and Y/Y Growth, 4Q14

(Shipment Value in $ Million)

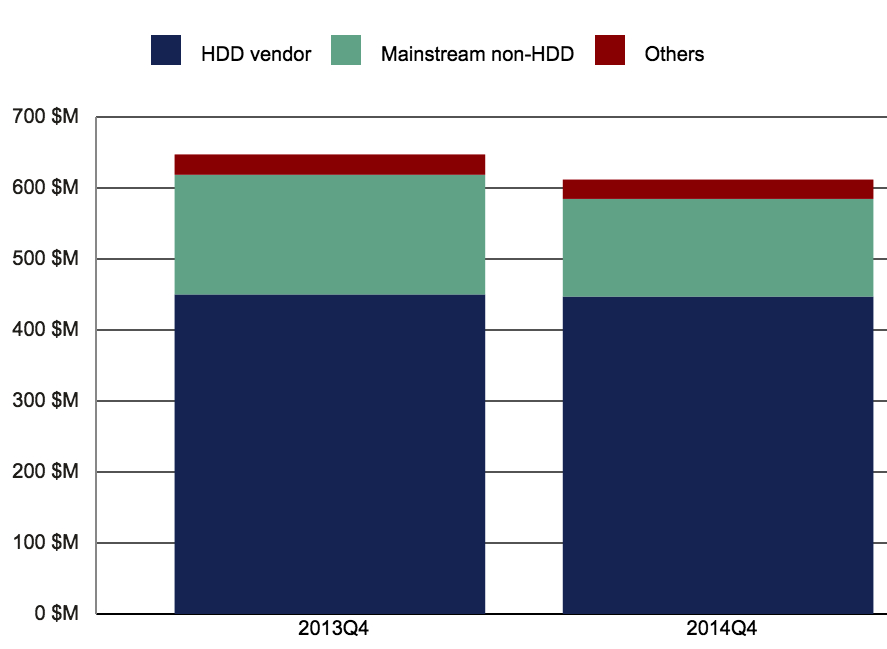

EMEA PELS Market by Vendor Type, 4Q14

(Revenue in $ Million)

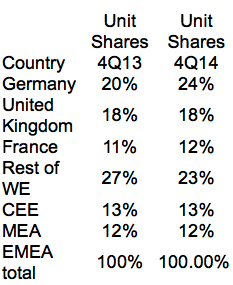

EMEA PELS Country Share, 4Q14

Notes:

- IDC defines personal storage as having 1-2 bays and entry-level storage as having 3-12 bays. HDD vendors are suppliers that manufacture their own HDD drives, in addition to branded external storage. IDC defines a mainstream non-HDD vendor as a major PELS vendor that does not manufacture its own HDD drives.

- Data for the PELS market is reported for calendar quarters. It includes vendor type, bays, capacity range, interface, and form factor.

- Major vendors covered in this IDC Tracker include Western Digital, Seagate, Toshiba, Buffalo Technology, D-Link, Netgear, and Lenovo/EMC (Iomega).

- EMEA PELS research covers 16 Western European countries: the Czech Republic, Poland, and the Rest of Central Eastern Europe, South Africa, Turkey, the United Arab Emirates and the Rest of Middle East and Africa.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter